Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of the crypto.news main article.

This year’s NFT.NYC was different. Since its launch in 2019, NFT enthusiasts and industry players have been gathering here to learn more about the latest trends and innovations in the space. The event is all about celebrating the impact and potential of NFTs with a clear mission to drive mainstream adoption. As such, the level of excitement and investment surrounding the event can be seen as a barometer for the state of the NFT landscape – and this year’s event was quiet.

You might also like: Casino Capitalism at NFT.NYC, and Are NFTs Really Dead? #rumors | Opinion

Much less capital was spent on activations and booths, and the show floor felt muted – even more so than the 2023 event, which itself was considerably quieter than 2022. There were still some interesting projects, but the energy was lacking and it felt very different from the excitement and conversations I’ve had at recent events like Token2049 Dubai and GDC.

Are NFTs dead?

In 2021, NFT.NYC was a remarkable spectacle that was dubbed the “Crypto Coachella” and “Super Bowl” of the NFT world. Driven by enormous excitement and anticipation, it captured the attention of all corners of the world with its dazzling celebrity endorsements, extravagant marketing campaigns and dazzling multi-million dollar art sales that lit up billboards in Times Square. The event reflected the booming market as trading volumes soared to $17.6 billion. That said, that era was also a reflection of speculation and blindly following profits, which led to many users being burned by the greed of bad actors and projects without substance.

Does this shift mean NFTs are dying? Not at all. This year’s event reflects a shift for the better within the crypto industry. NFTs have matured: no longer a speculative fad, they have been subsumed into the broader verticals of the crypto industry, negating the need for an NFT-focused event; people have gone on to discuss tokenization in gaming, finance, real estate and more. NFTs no longer need to set up their own infrastructure; instead, they can take advantage of the robust systems and scalability offered by established crypto ecosystems.

Changing tides

What has changed? The NFT market crashed during the crypto winter of 2022. Digital collectibles claimed the term “NFT” as a use case and became the sole application on everyone’s mind when they thought of “NFTs.” Their association with “expensive digital images of monkeys” and overpriced JPEGs gave the industry a bad name. Without the aggressive speculation driving them, digital collectibles are no longer as popular; the feverish buzz around collectible NFTs has subsided.

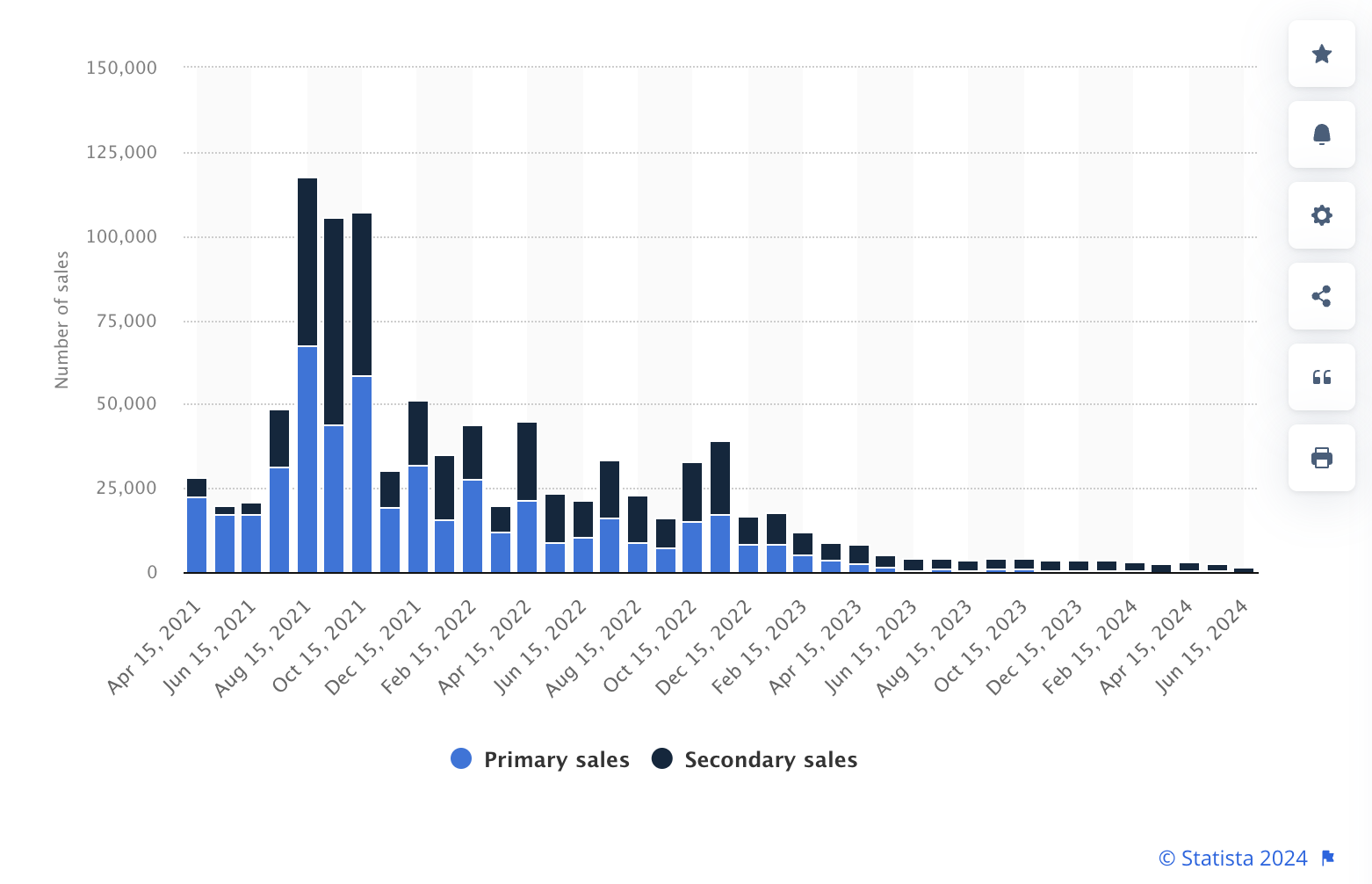

Total NFT sales in the art segment worldwide | Source: Statista

According to Statista, NFT sales volume in the art segment fell by more than 30% between April 2021 and April 2024. During the recession in October 2023, the NFT market experienced a significant decline, causing rock bottom prices to plummet, an 83% drop from the previous one. Highlight.

NFT market maturation

The purpose of NFTs has shifted and we need to reclaim the term from collectibles and move the conversation toward practical use cases.

One of the most exciting is the tokenization of financial and real assets. As of December 2023, the Total Value Locked (TVL) in tokenized RWAs exceeded $6.5 billion. The financial sector is leading the adoption of risk-weighted assets with the tokenization of financial instruments. This year we’ve seen players like Blackrock and Franklin Templeton flip the switch.

People are also excited about the prospect of asset tokenization to represent owned assets, including real estate, art, stocks and more. Consider dividing a property into tokens. Partial ownership of the property is now possible. For example, if 1,000 tokens each mean 1% ownership, investors can trade these tokens on blockchain platforms, improving liquidity and streamlining ownership transfer processes.

In gaming, NFTs have redefined digital ownership, allowing players to truly own virtual assets like characters and weapons. These NFTs can be bought, sold and traded on vibrant marketplaces, generating real value, especially when using ‘dynamic’ NFTs, which allow the gamer to upgrade their items as they are used in the game. Compatibility between platforms broadens the appeal and allows for seamless transfers between games (although there are other challenges to be solved in this area before it becomes mainstream).

The shift from hype and speculation to integration within the broader crypto space serves as clear evidence of the maturation of NFTs. This transformation brings enormous benefits, such as leveraging existing infrastructure and scalability, and fostering collaboration and innovation. As NFTs continue to diversify and find new applications, their role within the crypto space will grow stronger. The future of NFTs is promising as their continued growth and integration paves the way for a thriving ecosystem.

Read more: Tokenization of Art, Gaming and the Future of NFTs | Opinion

Alun Evans

Dr. Alun Evans is co-founder of LAOS Network. With over 20 years of experience leading and designing games and technology companies, Alun is well-versed in creating innovative products that address experience and developer challenges. In addition to his stewardship of LAOS Network, he is the CEO and co-founder of the company building LAOS, Freeverse, which focuses on building scalable blockchain infrastructure. Alun also led Shar3d.io, a pioneering company enabling collaborative 3D web applications, and was CTO of Bodypal.com, a virtual clothing services company. He has a Ph.D. in medical physics from University College London.