- According to analyst charts, ARB is now trading within a falling wedge pattern, indicating the potential for an upside rally.

- However, other metrics give mixed signals about what to expect from ARB in the coming days.

Over the past month, Arbitrum [ARB] posted a solid gain of 23.13% in an attempt to regain balance after a notable decline. Still, the country has struggled to maintain its momentum over the past 24 hours, posting only a modest 1.37% gain.

There is some optimism in the market as a positive pattern emerges. But will ARB follow the bullish path? AMBCrypto is investigating this further.

Falling wedge positions ARB for a rally

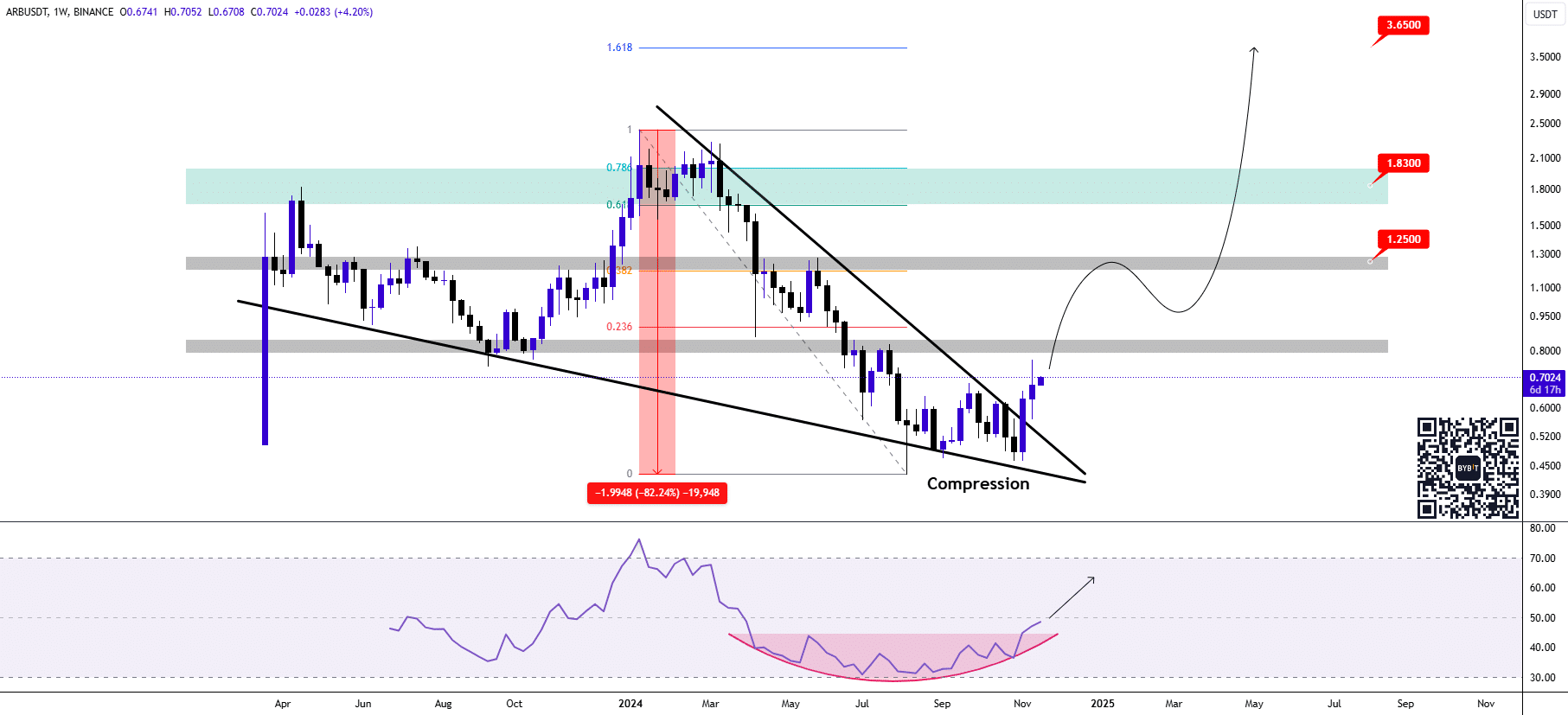

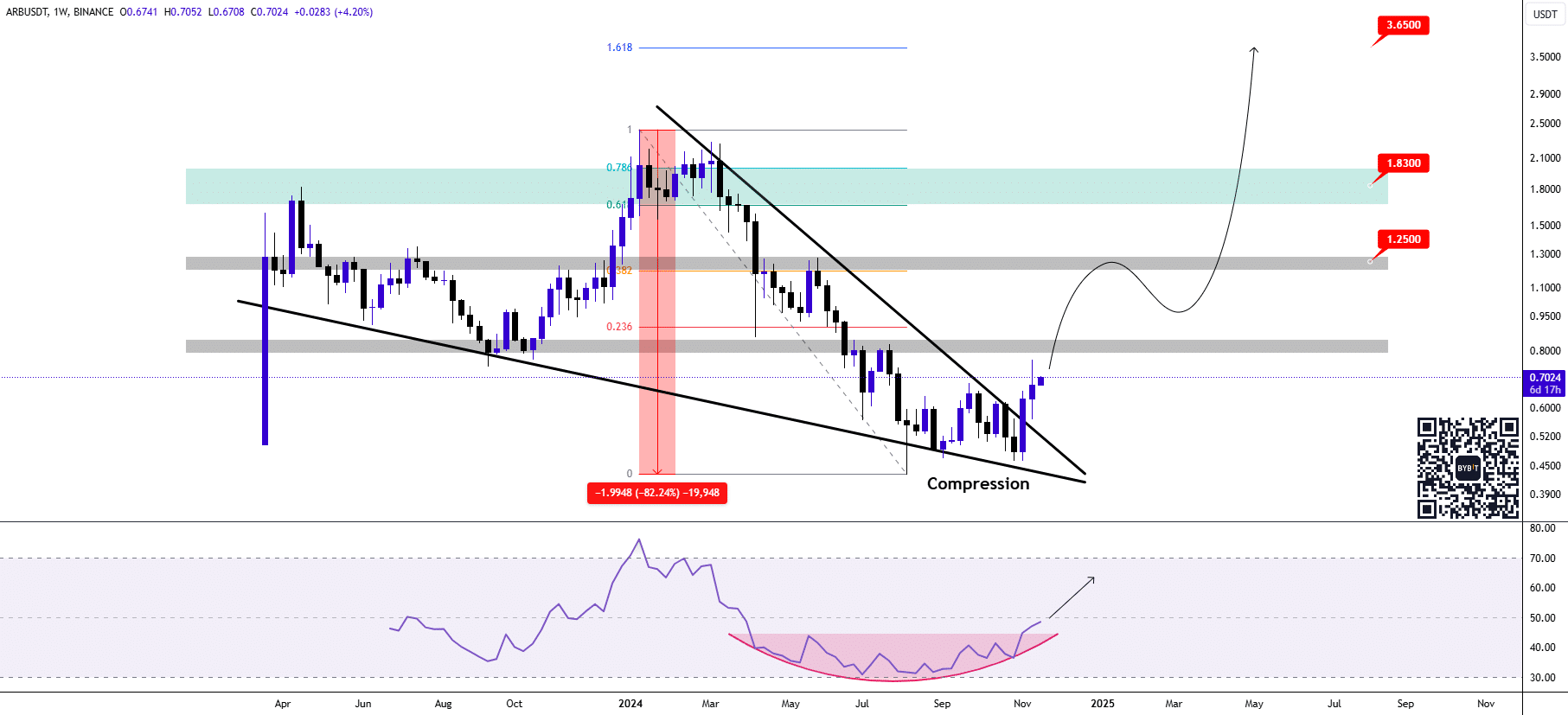

Crypto analyst Alex Clay has done just that identified a falling wedge pattern in ARB price action – a classic bullish formation where prices consolidate to the downside before an upside breakout occurs. Historically, this pattern has produced gains of up to 82.24%.

ARB recently broke this pattern, signaling potential for further upside. Clay’s chart highlights three key targets: $1,250, $1,830, and $3,650.

Supporting this outlook, the Relative Strength Index (RSI) is forming a rounding bottom as it moves into positive territory. This suggests that ARB is entering a favorable zone for further gains.

Source:

Clay expressed optimism about ARB’s prospects, saying:

“As $ETH recovers, I’m looking for the leading Layer 2 projects [like ARB] also rise.”

How ETH Recovery Could Boost Arbitrum’s Price Rise

Ethereum’s price recovery will likely have a significant impact on Layer 2 tokens like ARB, which are dependent on Ethereum’s growth performance.

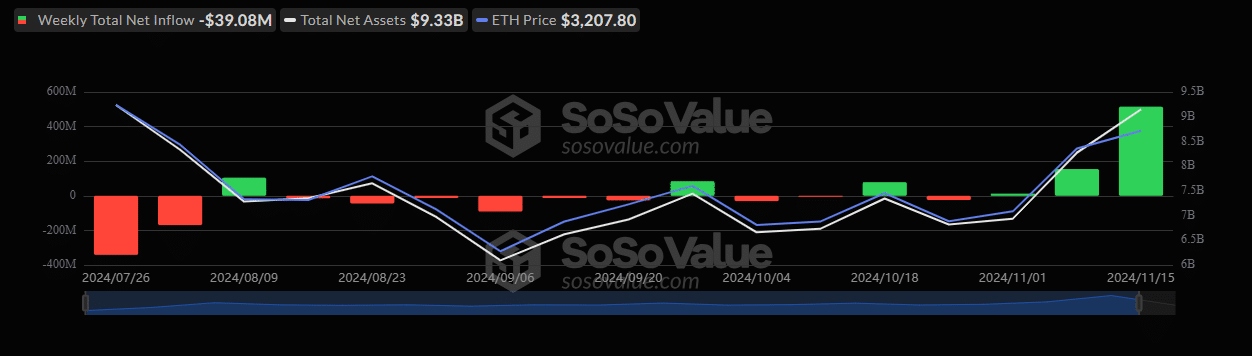

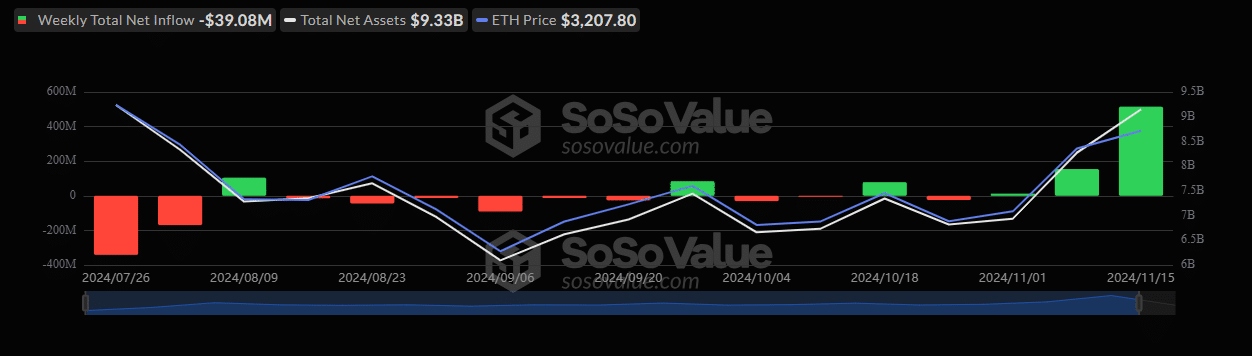

Over the past week, ETH has begun its recovery, attracting renewed interest from traditional investors. Data from Soso value reveals that ETH spot ETF saw its largest inflows in a single week, totaling $515.17 million – a clear indication that investors are accumulating the assets.

Source: Sosowaarde

If ETH continues this upward trajectory, the positive momentum is expected to extend to Ethereum-dependent assets such as ARB. This would not only improve market sentiment but also serve as a strong catalyst for ARB’s price appreciation.

Conflicts between on-chain trading activities

A notable conflict arises in the on-chain trading activities for ARB. On the one hand, the Funding Rate, which tracks the market cohort that manages the disparity between spot and futures prices, indicates that buyers (long positions) are driving the market.

At the time of writing, the funding rate stands at 0.0192%, reflecting bullish sentiment that suggests the market is likely to maintain its upward momentum.

Read Arbitrums [ARB] Price forecast 2024–2025

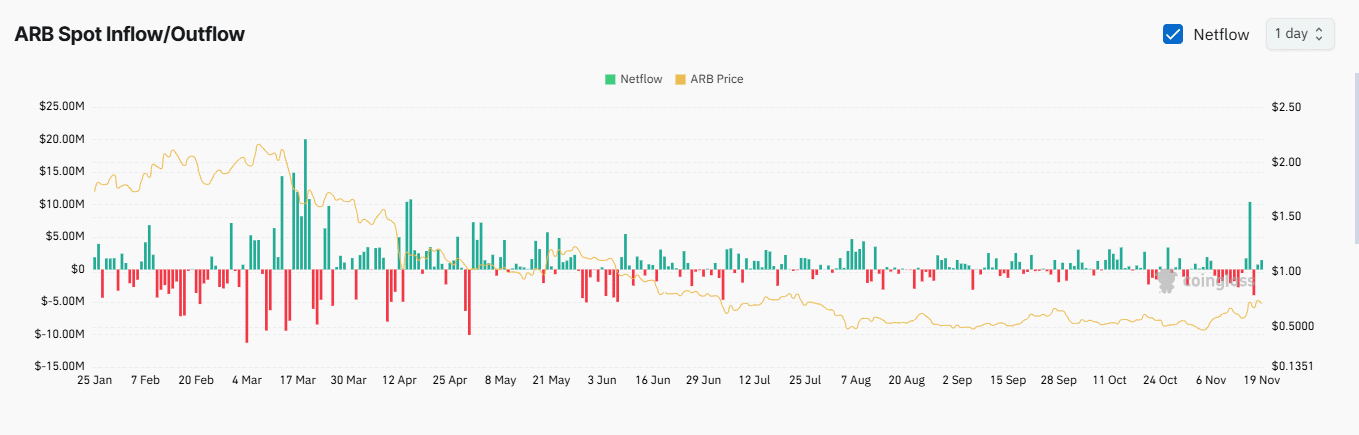

However, significant positive ARB exchange net flow has been observed in both the daily and weekly time frames, indicating market participants are transferring their holdings to exchanges – typically a precursor to selling.

Source: Coinglass

$1.95 million worth of ARB moved to exchanges in the past week, with $1.44 million transferred in the last 24 hours. If this trend continues, it could put significant downward pressure on assets, countering the current bullish outlook.