A decentralized exchange (DEX) built on Arbitrum (ARB) burned its investors and made off with $3 million worth of crypto, according to blockchain security firm PeckShield.

Swaprum (SAPR) bills itself as “a next-generation decentralized exchange with a suite of trading tools and potential earnings of up to 100% APY.”

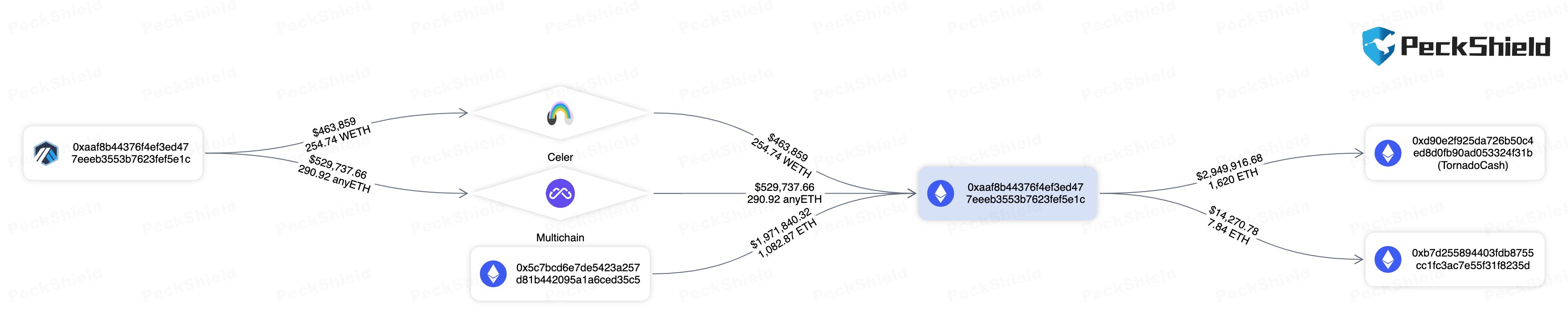

PeckShield noteshowever, that the DEX appears to have run a back pull scam this week, laundering 1,620 Ethereum (ETH) to the crypto mixer Tornado Cash and shutting down its social media accounts.

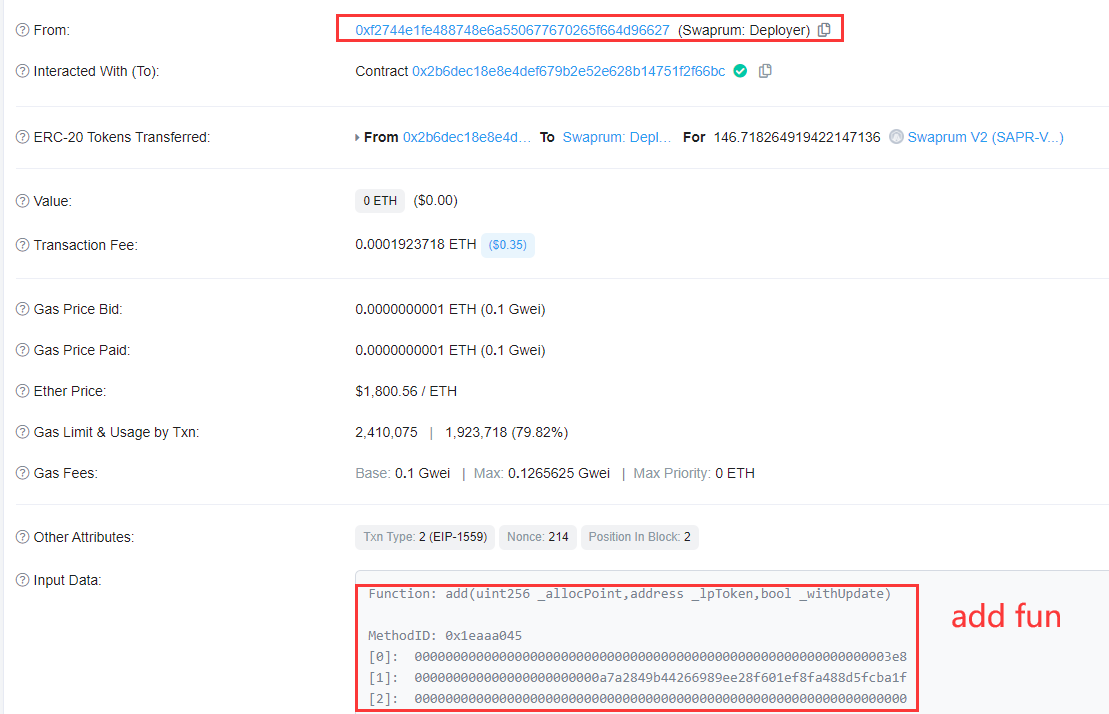

Meanwhile, blockchain security company Beosin reveals that the operator of the Swaprum smart contract has added a backdoor feature to loot liquidity pool tokens deployed by users. According to Beosin, the operator used the “add()” backdoor function to siphon crypto from the liquidity pool for their profit.

Back pulls generally refer to events where developers promote a new cryptocurrency project to investors and sell affiliate tokens, then take the money raised during the token sale and disappear.

The total value locked (TVL) on Swaprum fell from $3.148 million on Thursday to just over $9,000 on Friday, according to crypto tracker DeFi Llama.

A blockchain’s TVL represents the total capital held within its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

Don’t Miss Out – Subscribe to receive crypto email alerts delivered straight to your inbox

Check price action

follow us on TwitterFacebook and Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey

Featured image: Shutterstock/Sensvector