- ARB holders expected a breakout, with a potential price increase of 182.72% from current levels.

- Despite the slowdown in activity, ARB’s TVL of $2.47 billion indicated strong DeFi performance amid price uncertainty.

Arbitration [ARB] was trading at a crucial level at the time of writing, with analysts suggesting that a possible breakout could lead to a significant price increase.

The token has been trading in a descending channel for quite some time, consistently encountering resistance at the top of the channel and finding support at the bottom.

At the time of writing, ARB’s price was hovering around the upper limit of this channel, indicating a possible bullish reversal if the price moves above this critical level.

According to one recent analysisARB’s price could rise to around $1.50 if a breakout occurs. This projection meant a potential upside of 182.72% from the current value of $0.5082.

As the token continued to test the resistance level, traders are closely watching the next move to see if it will spark a significant rally.

Source:

Decline in ARB price and trading activity

Despite a potential breakout, ARB’s recent price action has been less favorable. ARB has seen it down -5.07% in the last 24 hours and down -1.11% in the last seven days.

With a circulating supply of 3.5 billion ARB tokens, the press time market capitalization was $1.77 billion.

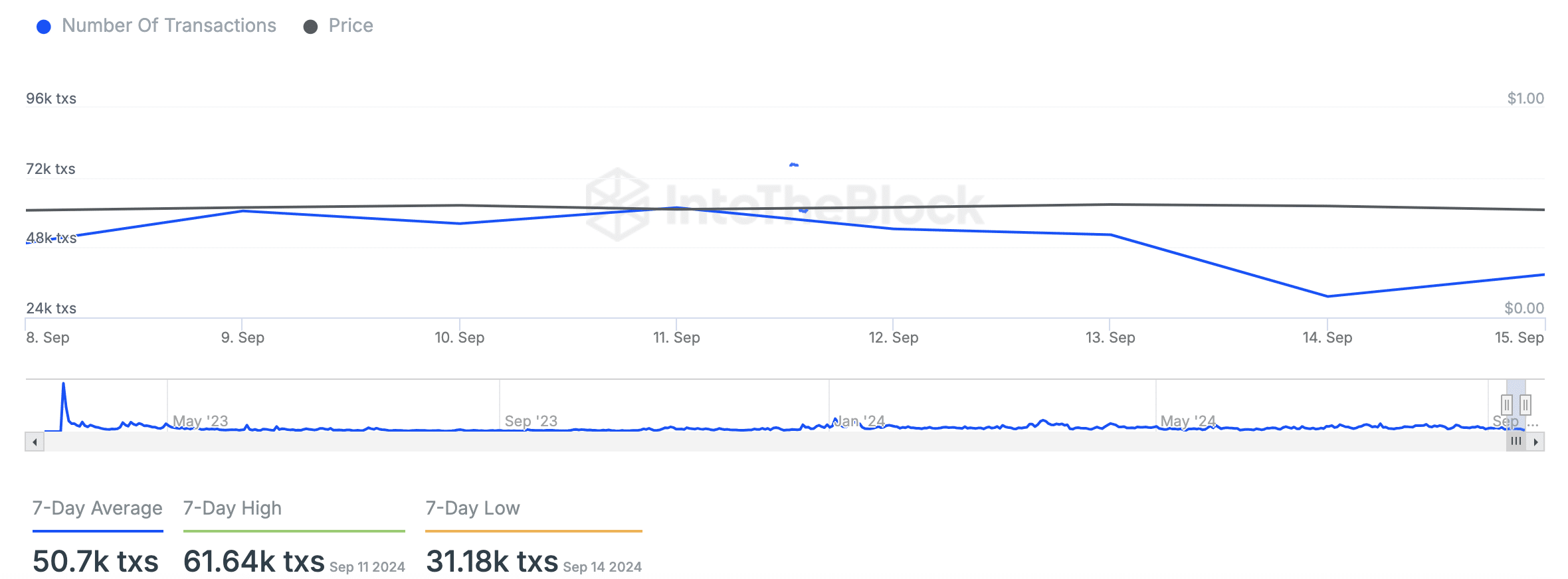

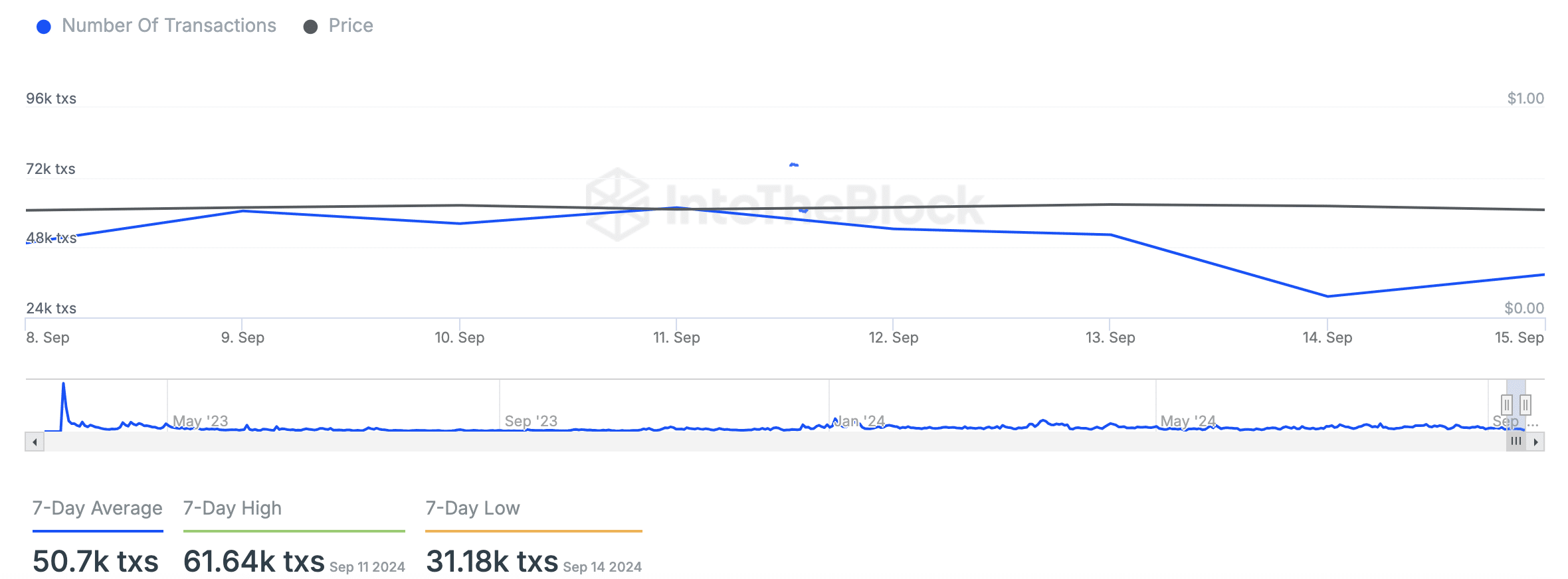

In addition to the price drop, activity in the chain has also decreased. Data shows that ARB’s transaction volume is trending downward, with a seven-day average of 50.7,000 transactions.

The highest transaction volume during this period was 61.64 thousand on September 11, while the lowest, 31.18 thousand, was recorded on September 14.

Source: IntoTheBlock

Furthermore, large transactions have also seen a decline, with only 51 recorded in the past 24 hours, down from a peak of 110 on September 10.

Despite this reduced activity, the price has remained stable around $0.50, raising questions about the potential for a breakout.

Statistics about the chain show mixed signals

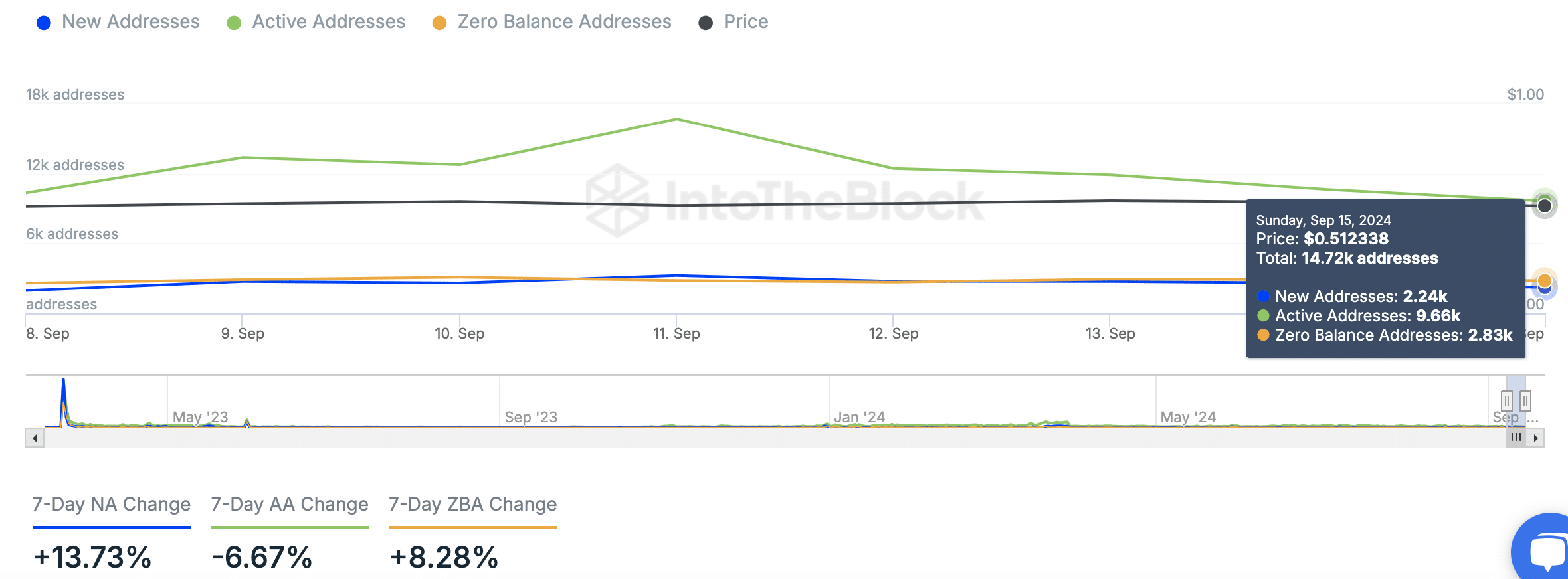

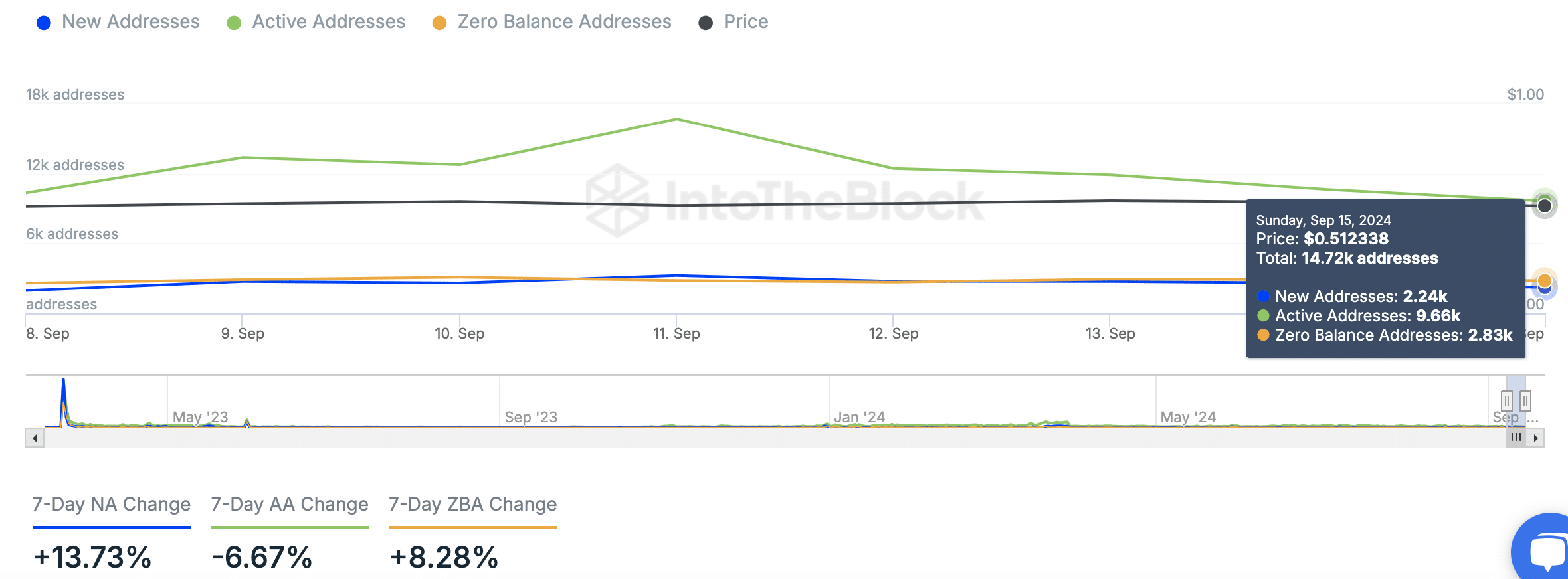

Recent data from InTheBlok highlighted both positive and negative trends in ARB’s on-chain metrics. The number of new addresses increased by 13.73% to 2.24k in the past week.

However, the number of active addresses has fallen by 6.67% to 9.66k. In contrast, the number of zero-balance addresses increased by 8.28%, indicating a higher number of dormant accounts.

Source: IntoTheBlock

Despite these figures, ARB’s Total Value Locked (TVL) remained robust and stood at $2.47 billion at the time of writing. DefiLlama.

Stablecoin’s market capitalization on the platform was $4.701 billion, with $11,118 in fees and $9,417 in revenue over the past 24 hours.

This strong performance in the DeFi space has yet to translate into a price recovery for ARB, although the possibility of a breakout could change that.

A recent report from AMBCrypto suggests that almost 100% of ARB holders are currently trading at a loss.

Read Arbitrums [ARB] Price forecast 2024–2025

This reflects the token’s long-term downward trend in recent months, even as the platform itself continues to perform well in terms of TVL and market share in the DeFi space.

The token’s decline has raised concerns among holders, especially as on-chain activity has slowed.