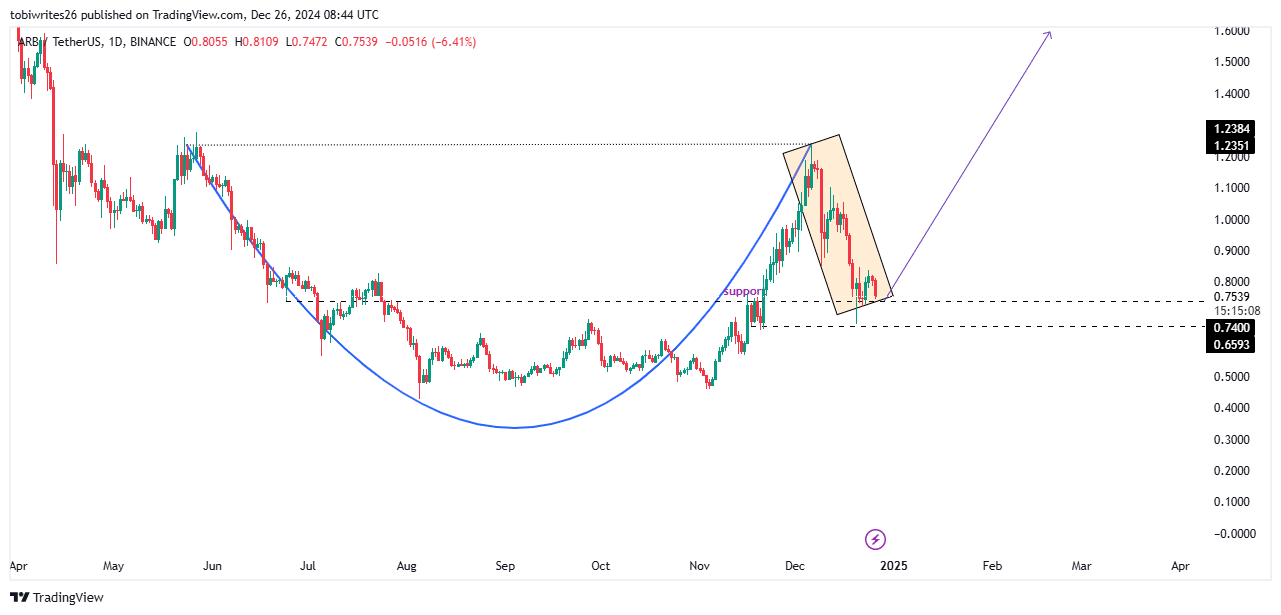

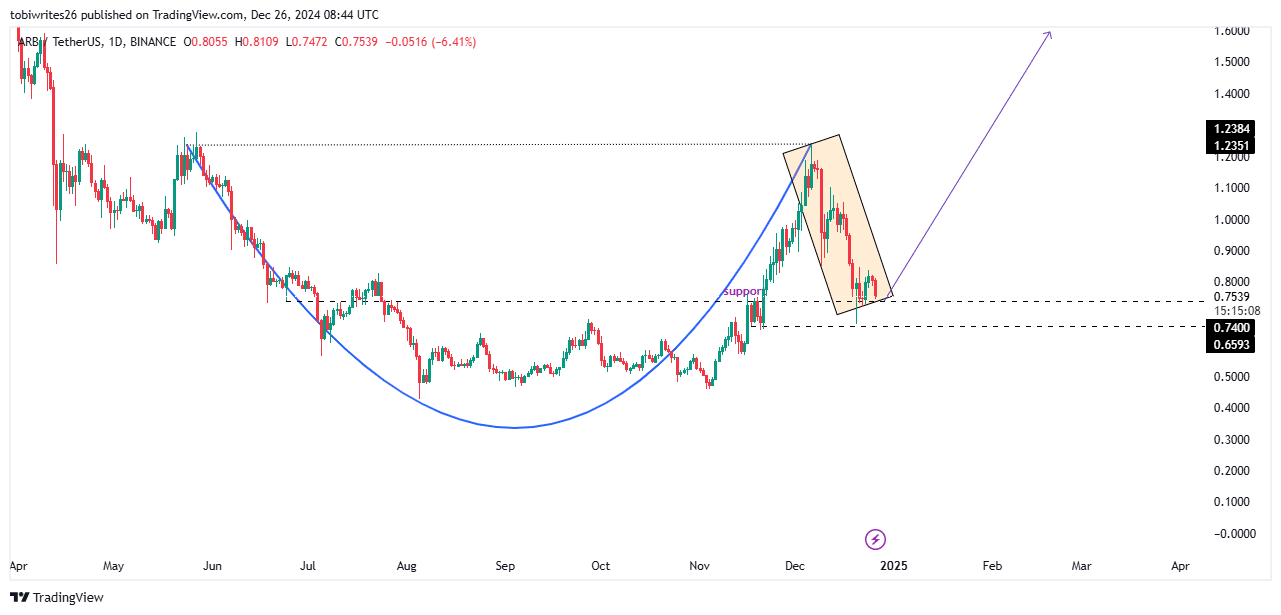

- At the time of writing, ARB appeared to be trading within a cup-and-handle pattern – a bullish signal that often precedes a significant rebound

- The rally depends on ARB entering a key demand zone, and whales could play a role in driving this move

ARB has struggled to maintain its bullish momentum lately, with the altcoin already starting to fall on the charts. In fact, the altcoin has fallen 14.28% on the charts over the past month – a trend that has continued over the past week and also over the past 24 hours.

Although ARB may see further declines in the short term, it could quickly recover and resume its bullish trend, offering the potential for higher returns.

Bullish pattern shapes for ARB

ARB has started trading within a bullish cup and handle pattern, as shown on the chart with the highlighted lines. This pattern generally indicates upward movement for the asset, at least in the short term.

For ARB, the expected rally could push the price to at least $1.5 once the pattern fully develops.

Source: trading view

However, before the rally takes off, the ARB is likely to fall further as it looks for a demand zone with enough momentum between $0.74 and $0.659. Once this level is reached, the asset can be expected to trend higher.

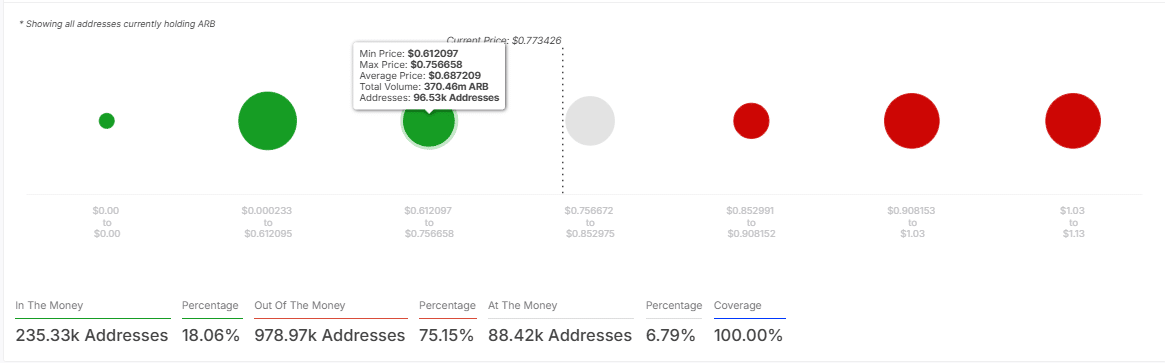

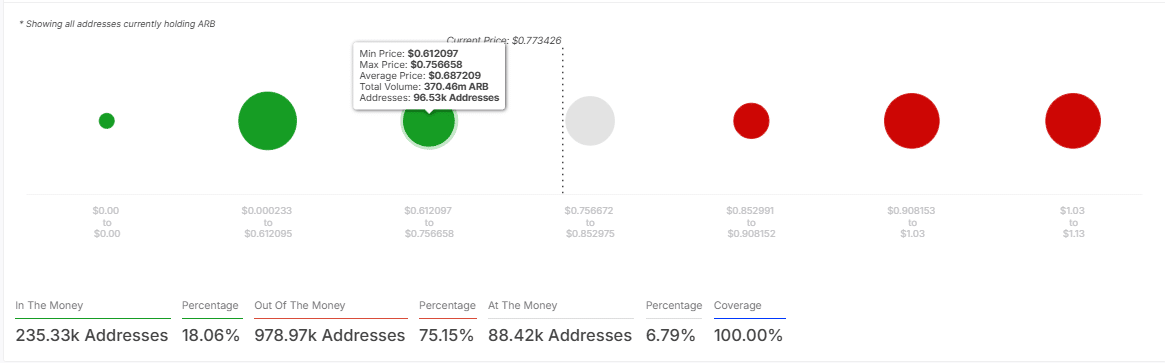

Purchase orders for ARB

AMBCrypto’s analysis found that the demand level on the chart could push ARB higher. According to IOMAP, this demand zone corresponds to the ‘In the Money’ region, where 13,200 addresses contain 320,000 ARB – marking this as a high-impact support level.

IOMAP, a tool used to identify key areas of support and resistance, revealed the distribution of addresses based on profitability. Here “In the Money” refers to addresses with profits, while “Out of the Money” means addresses with losses.

With ARB entering this ‘In the Money’ zone, it can be expected that the price will start its uptrend from this point.

Source: IntoTheBlock

The Bull-Bear ratio, which compares the number of bullish and bearish whales, revealed 39 bulls and 49 bears. This suggested that bearish whales are likely to push the ARB down, pushing it towards the demand zone, as they look for favorable prices in line with buying activity before re-entering.

Given this sentiment, ARB’s decline could extend further than the 5.06% drop recorded on the daily time frame.

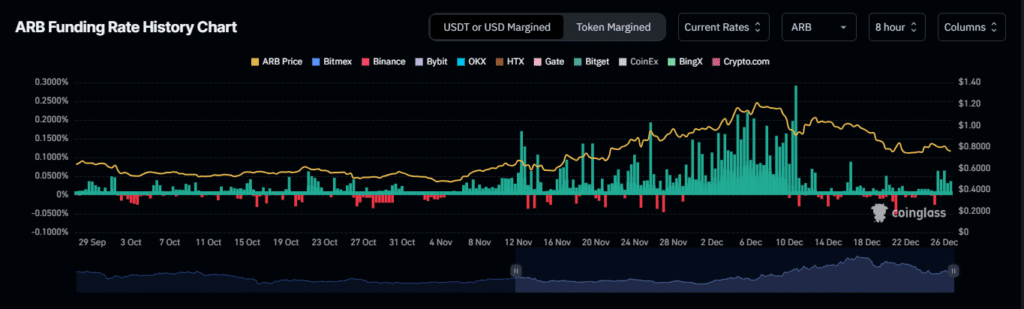

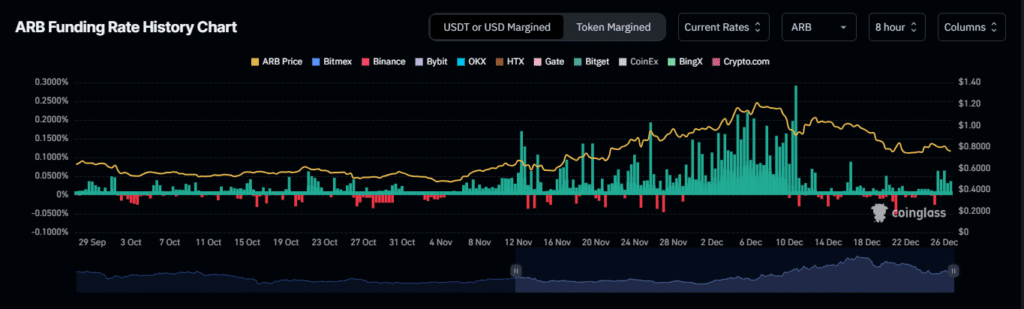

Derivatives traders enter the market

According to Coinglass, ARB’s funding rate has started to increase. The price rose and registered a value of 0.0097% in the last 24 hours, placing it in the positive zone.

A positive funding rate indicates that long derivatives traders, especially those who use leverage, dominate the market and help maintain price stability.

Source: Coinglass

Simply put, sentiment around ARB remains bullish, and its slight decline could be part of the necessary correction before an upward move.