- Aptos’ 3.70 million daily transactions highlighted Aptos’ growing ecosystem but faced social visibility challenges.

- Technical indicators showed mixed signals, with bearish trends and oversold conditions creating uncertainty.

Aptus [APT] has achieved an extraordinary milestone by recording 3.70 million daily transactions with an average throughput of 3700 TPS and a minimum fee of $0.00005.

This performance is supported by a Total Value Locked (TVL) of over $1 billion and a market capitalization of $5.35 billion.

These impressive numbers position Aptos among the top contenders in the blockchain industry.

However, at the time of writing, APT is trading at $8.99, reflecting a decline of 6.58% over the past day, pointing to potential headwinds that Aptos may need to overcome.

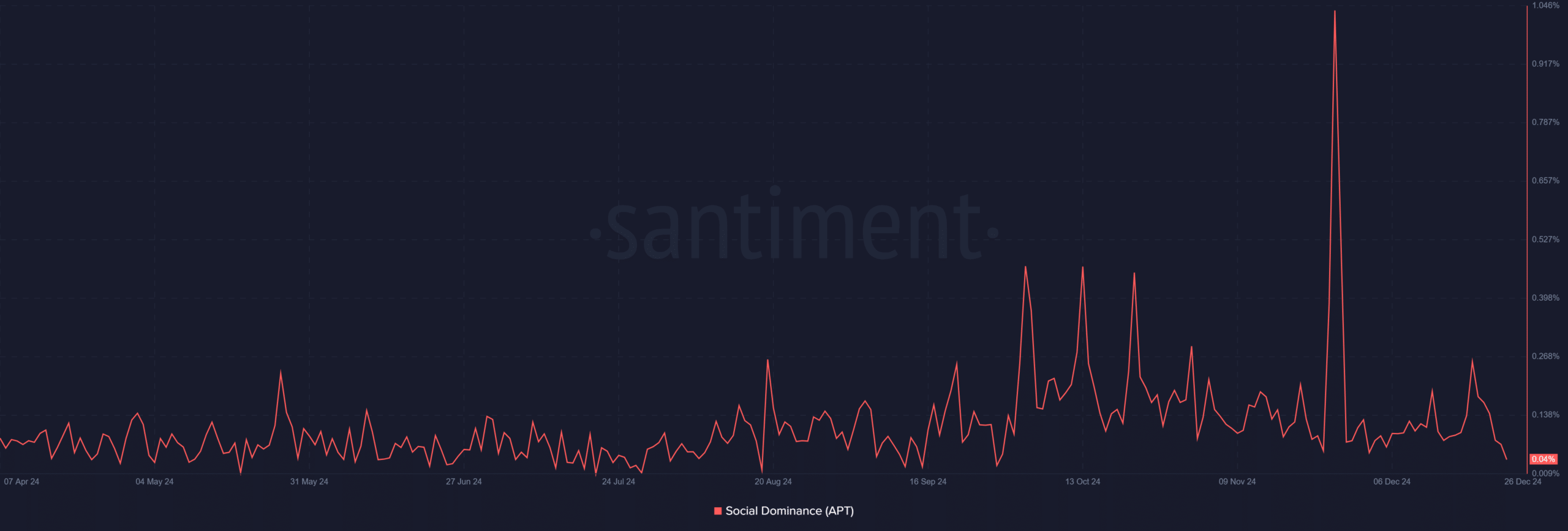

Social dominance struggles despite ecosystem success

Despite its significant achievements, Aptos faces challenges in social engagement.

Social dominance stood at just 0.04% at press time, significantly lower than the sporadic spikes seen earlier this year, such as November’s brief surge above 1%.

This indicates limited visibility and involvement within the broader crypto community. However, this challenge presents an opportunity for Aptos to ramp up its marketing and community building initiatives.

Source: Santiment

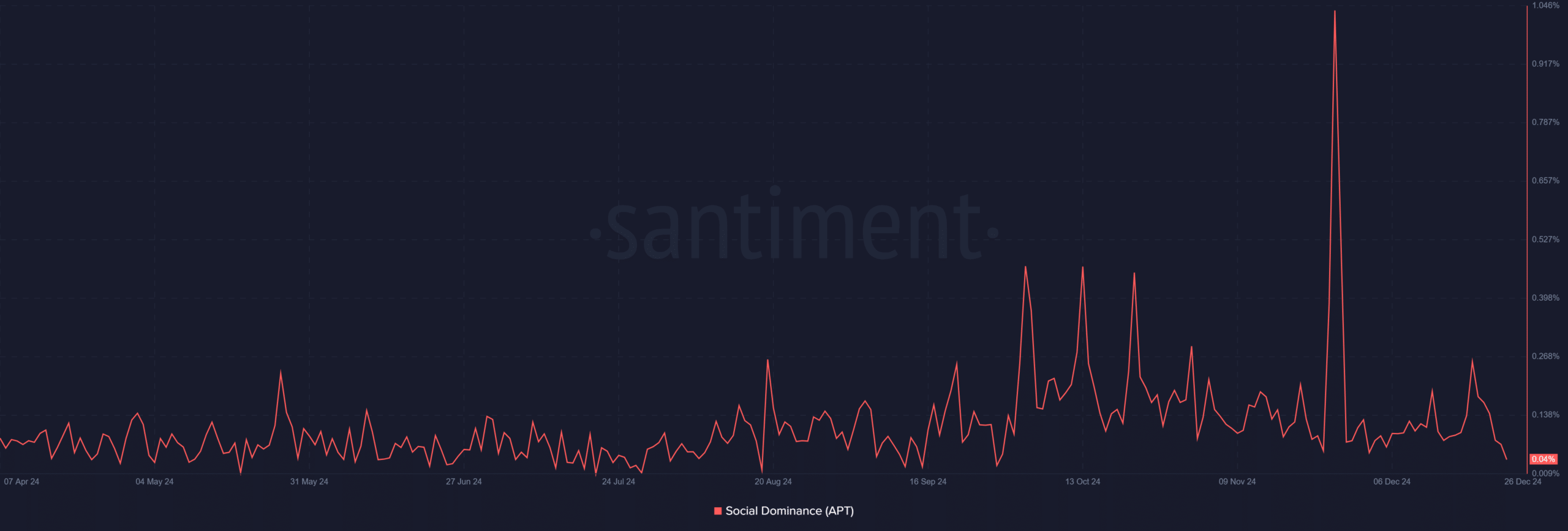

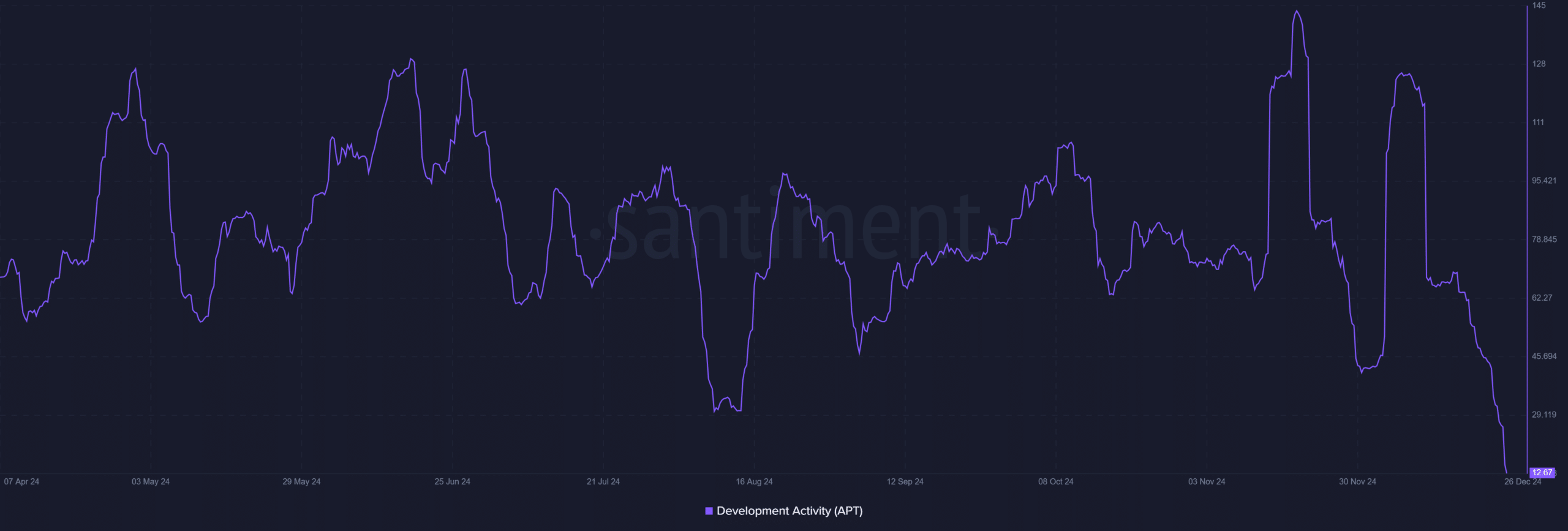

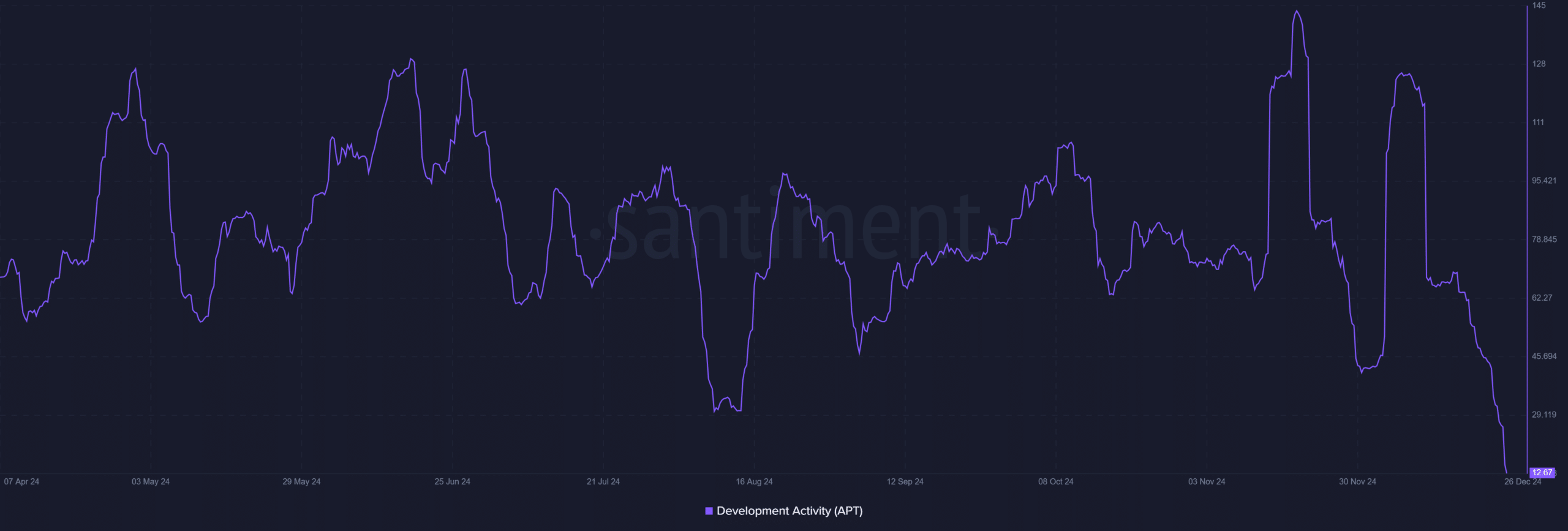

Development activity is falling to a worrying low

Development activity on Aptos has seen a sharp decline, with recent numbers falling to just 12.67 from highs above 95 earlier this year. This decline raises concerns about the pace of innovation and ecosystem expansion.

Therefore, prioritizing development initiatives is essential to retain developer interest and attract new projects.

Furthermore, consistent updates and feature rollouts can strengthen Aptos’ reputation as a technologically advanced blockchain.

Source: Santiment

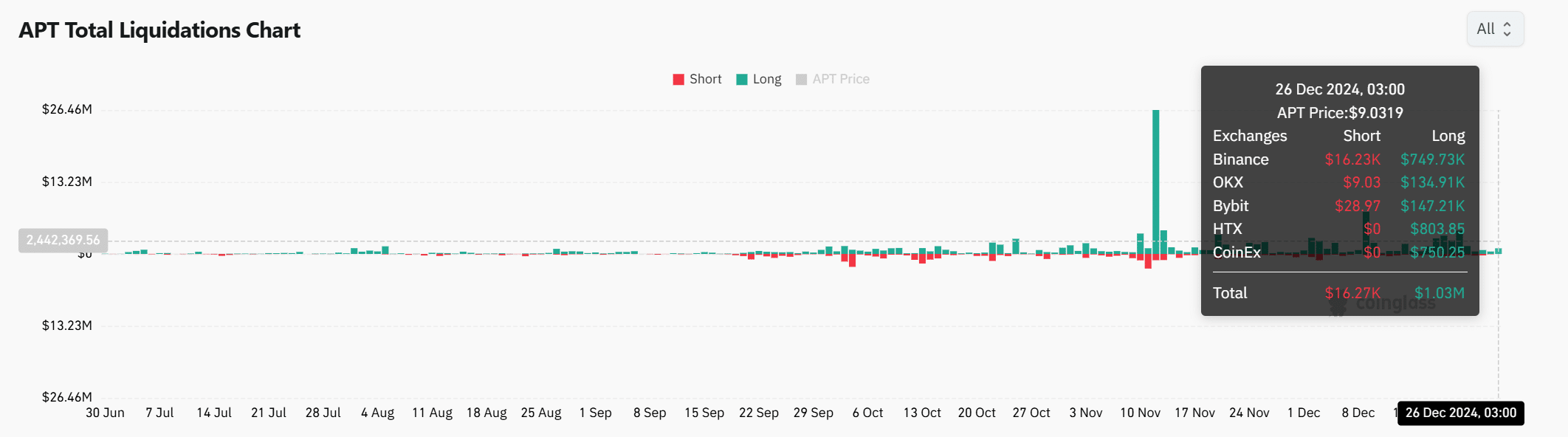

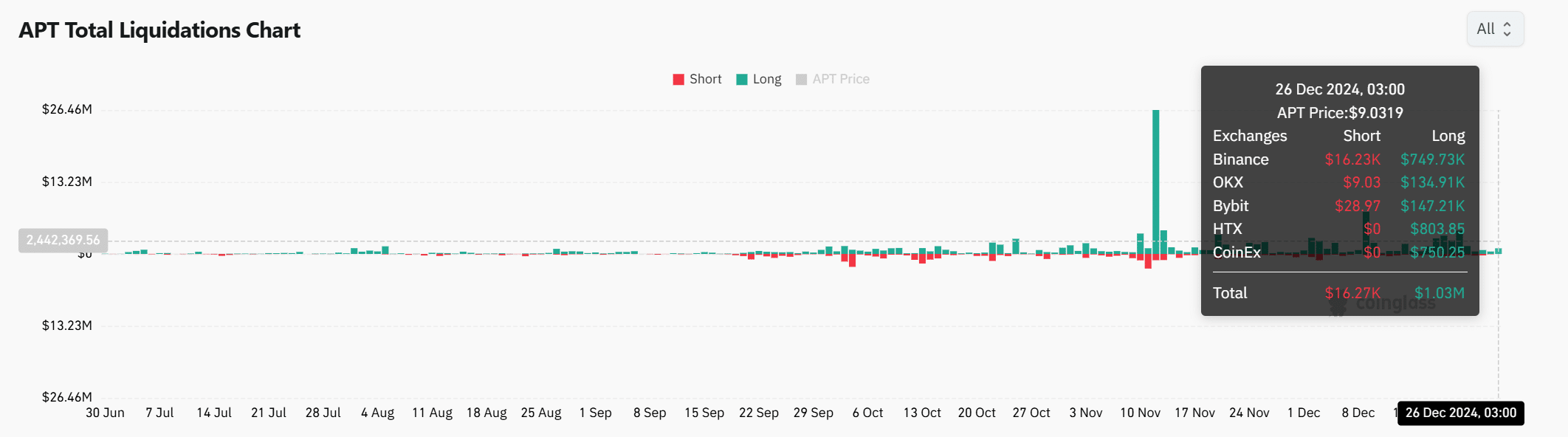

APT market liquidations emphasize volatility

Recent liquidation data reflects growing uncertainty in the Aptos market, with more than $1.03 million in long positions liquidated, mainly on Binance.

This liquidation trend highlights cautious sentiment among investors as Aptos trades near key support levels.

However, such market behavior also indicates the increased volatility that traders can exploit for potential profits.

As Aptos continues to develop, stabilizing price performance will play a crucial role in maintaining investor confidence.

Source: Coinglass

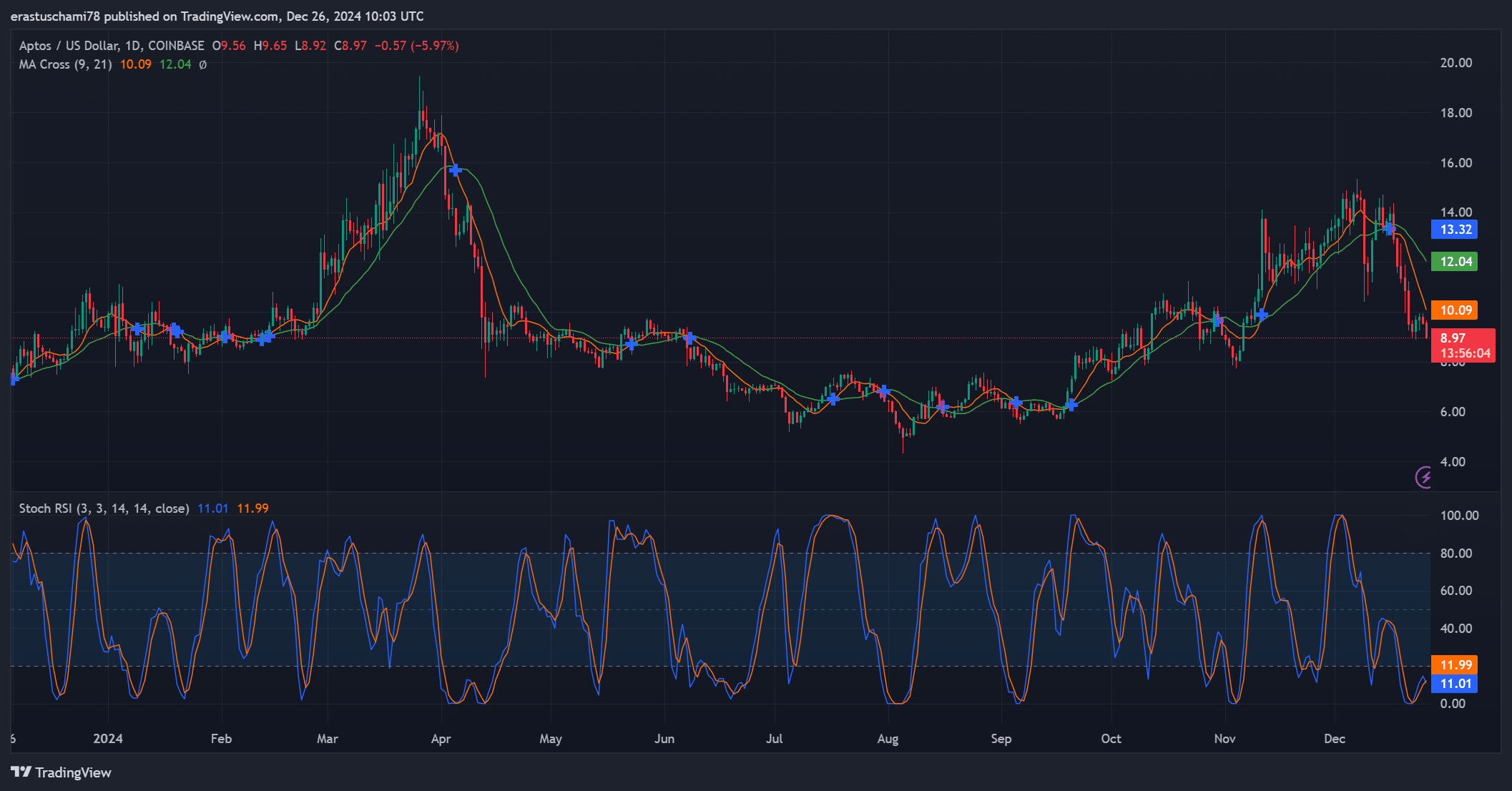

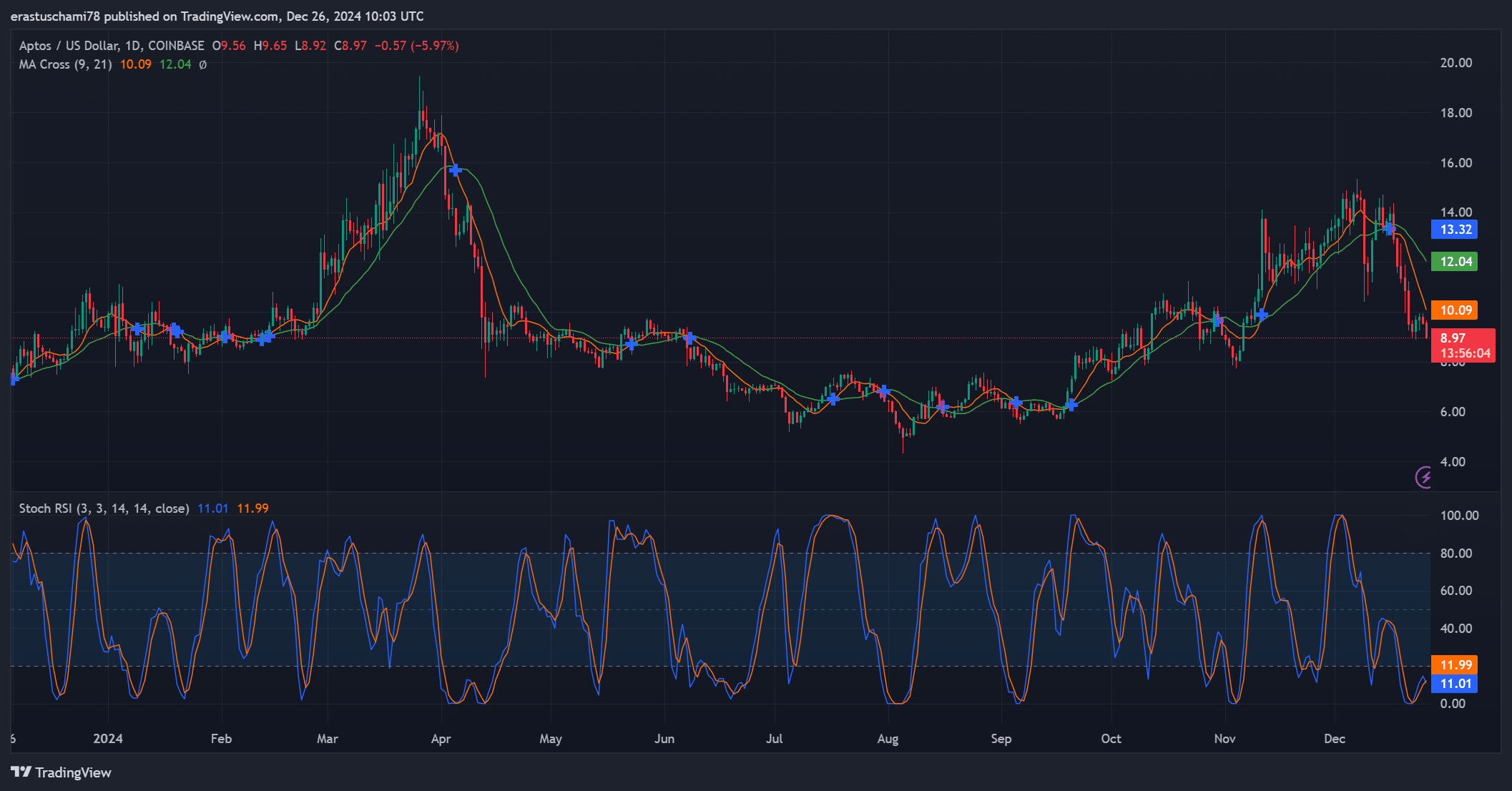

Technical indicators offer conflicting insights

The technical outlook for APT remains mixed, with both bullish and bearish signals. The Stochastic RSI shows oversold conditions, with readings at 11.01 and 11.99, indicating a potential recovery.

However, the cross on the moving average (MA) paints a bearish picture, with the 9-day MA below the 21-day MA.

Consequently, traders are likely to remain cautious and wait for clearer signals before taking decisive action.

Source: TradingView

Read Aptos’ [APT] Price forecast 2024–2025

Conclusion: Can Aptos maintain its momentum?

APT has demonstrated remarkable progress in transaction volume and ecosystem value. However, to sustain this growth, low social dominance, declining development activity and market volatility must be addressed.

Thus, while Aptos is promising, its long-term success depends on consistent innovation, stronger community involvement and effective price stabilization strategies.