- XRP is showing signs of a possible breakout, with analysts predicting a big rise.

- On-chain data shows declining active addresses, raising questions about the strength of the bullish trend.

Ripple [XRP] was trading at $0.5842 at the time of writing, up 1.8% and continuing the steady recovery of recent weeks. In the past seven days alone, XRP has risen 7.3%, sparking optimism among investors and analysts.

This recovery comes amid a period of general market volatility, in which XRP’s performance has been relatively muted compared to some other major cryptocurrencies.

Analysts point to a seven-year compression pattern

Renowned crypto analyst CrediBull commented on XRP’s recent price movements, highlighting the asset’s long-term compression for nearly seven years.

He described this as “the mother of all bull flags” and highlighted its uniqueness in the crypto space.

Source: CrediBull on X

CrediBull commented:

“There is literally nothing like it in this space, partly because most of the coins here haven’t even existed in seven years lol. When the old guard wakes up, it will become legendary.”

Another analyst, MoonLambo, expressed a similar sentiment, which states: “As I have said many times, XRP cannot and will not stay in this range against the dollar forever,” indicating that XRP will eventually reach a new all-time high.

XRP’s On-Chain and Market Data: Assessing Bullish Signals

To determine if XRP is truly ready for a bullish wave, it looks at its on-chain metrics. Despite the optimistic technical outlook, data about the chain provides a more nuanced picture.

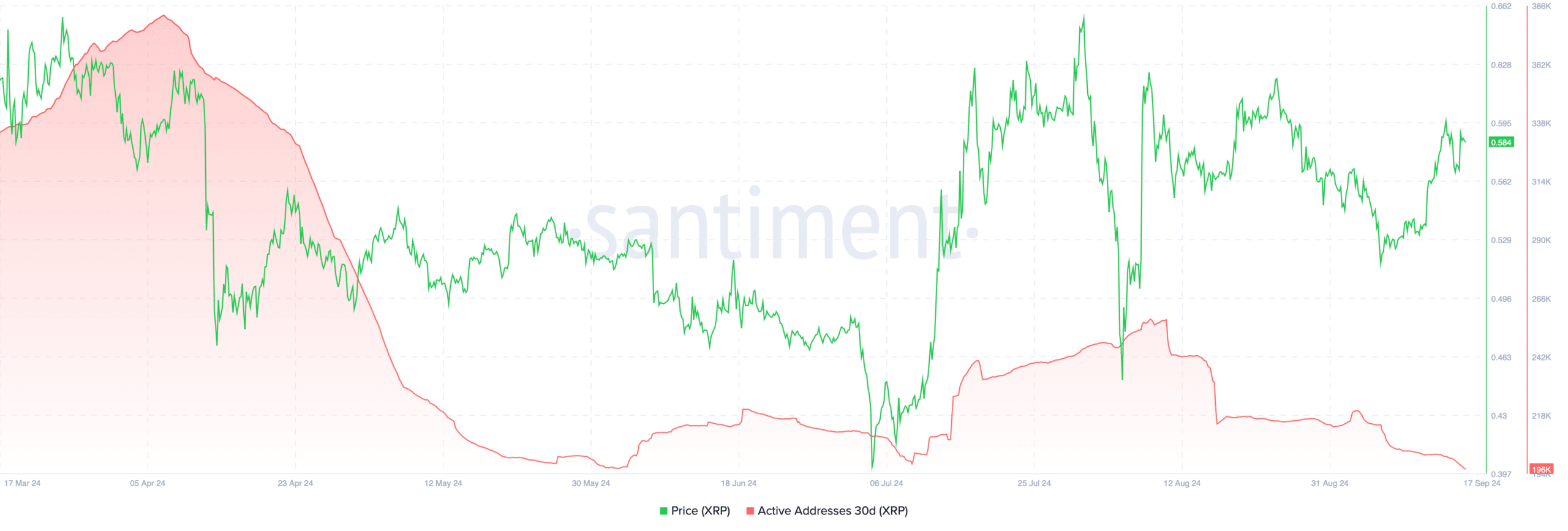

According to Santimentthe number of active XRP addresses has fallen significantly in recent months.

Source: Santiment

This figure has fallen from a peak of 382,000 in April to around 196,000 currently. A reduction in the number of active addresses often indicates declining user engagement and reduced transaction activity on the network.

This decline could signal caution for the near future, as lower active addresses could limit upward momentum and indicate that the rally could be short-lived without a renewed influx of participants.

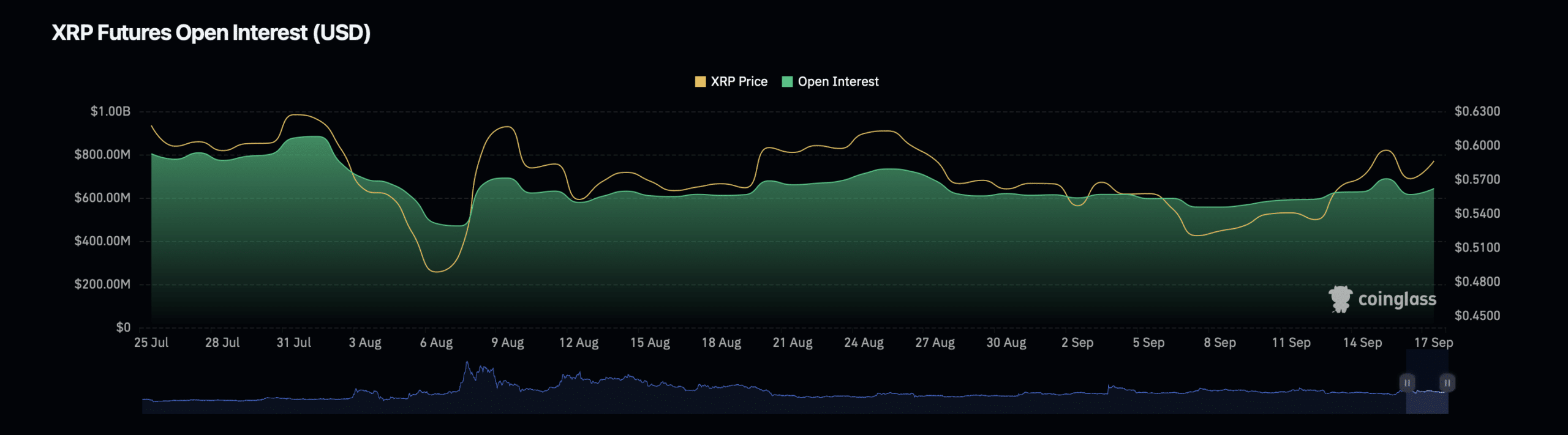

Further facts from Coinglass revealed that XRP open interest has increased by 4.32% to reach a current valuation of $650.26 million. Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not yet been settled.

Source: Coinglass

An increase in open interest indicates increased trading activity, due to growing speculation about the price direction of XRP. Furthermore, the asset’s trading volume has seen a slight increase of 0.15%, amounting to $1.32 billion.

Read XRP’s 2024-2025 Price Prediction

A simultaneous increase in both open interest and volume could indicate a strengthening trend, with traders taking positions in anticipation of a potential price move.

However, it also introduces the possibility of increased volatility, as higher open interest can lead to sharp market reactions to news or price movements.