Popular Bitcoin analyst Willy Woo says BTC is facing a major obstacle that could hinder the king cryptocurrency’s potential for future growth.

Wow shares a graph with his 1 million followers on the social media platform

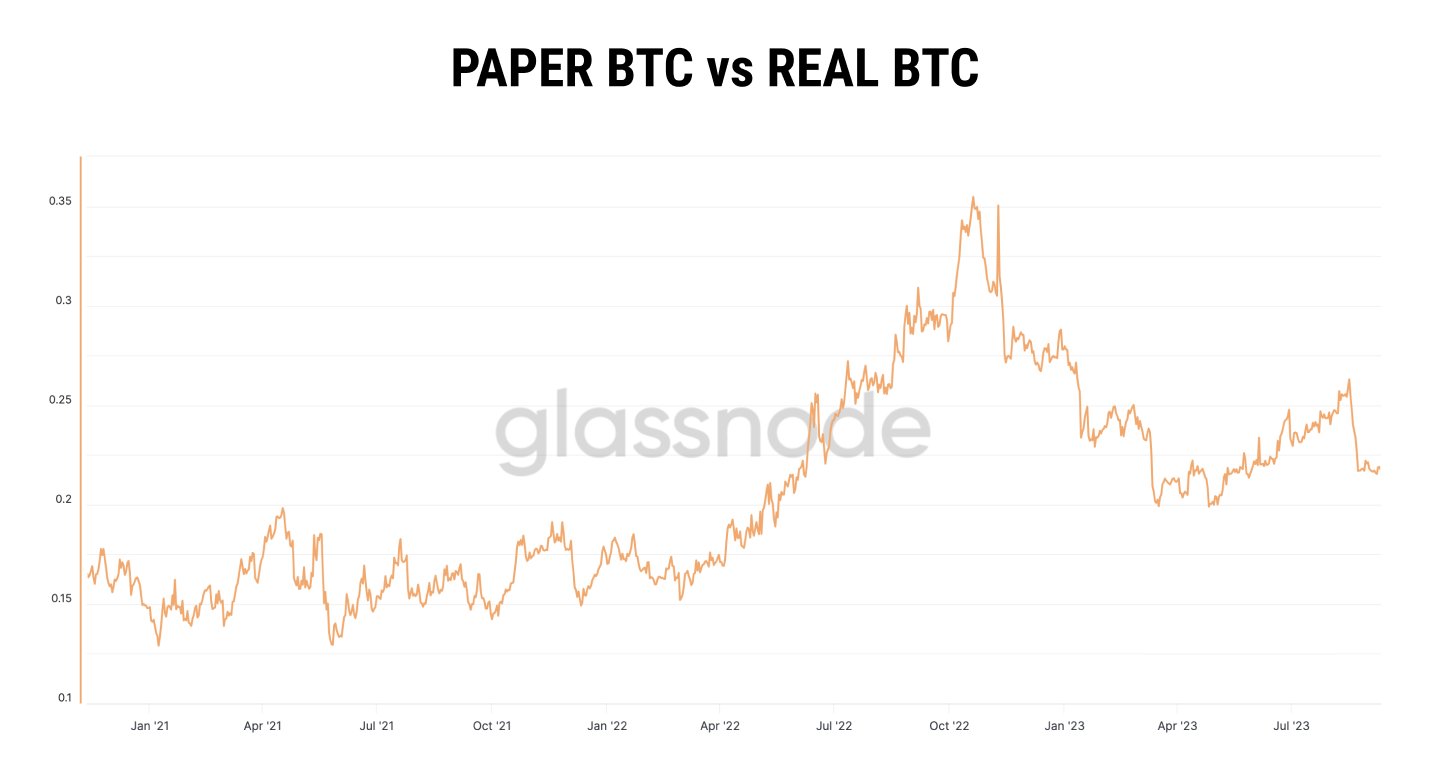

“This is a slide from my TOKEN2049 talk. It is the ratio of ‘paper BTC’ (combined open value of futures) being traded versus the real BTC which is highly liquid and traded. We are now in a regime where 20-30% more BTC is being traded. This counteracts a bullish supply shock.”

According to Woo, the rise of Bitcoin derivatives strips BTC of liquidity, allowing price manipulation and weaker rallies.

The analyst say that since US dollars (USD) are much more plentiful and readily available to investors than BTC, the futures and derivatives markets allow big players to take large chunks of capital and use it to put inorganic selling pressure on Bitcoin. Wow say the prominence of such markets is Bitcoin’s ‘enemy’ and the reason why BTC has seen less dramatic rallies in recent years than in its early days.

“In the long term, institutions that don’t have BTC can sell it without restrictions, as long as they have a lot of USD. See how the exponential reflexive bull runs ended when the futures markets came online.”

Woo says in a separate one after,

“All you need to check is the daily volumes traded on futures. It reduces liquidity in the spot markets. As long as this is the case, the spot markets revolve around the gravity of the futures markets, and not the other way around.

That’s why you see an agenda set to delay a spot exchange-traded fund (ETF). For seven years, spot liquidity remained limited while the futures markets flourished and easily outgrew the spot market.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney