A widely followed crypto analyst says that the largest crypto assets by market capitalization will be in the first inning of the next bull market.

Pseudonymous crypto trader Rekt Capital tells their 345,800 Twitter followers that Bitcoin (BTC) is in the early stages of a bull run.

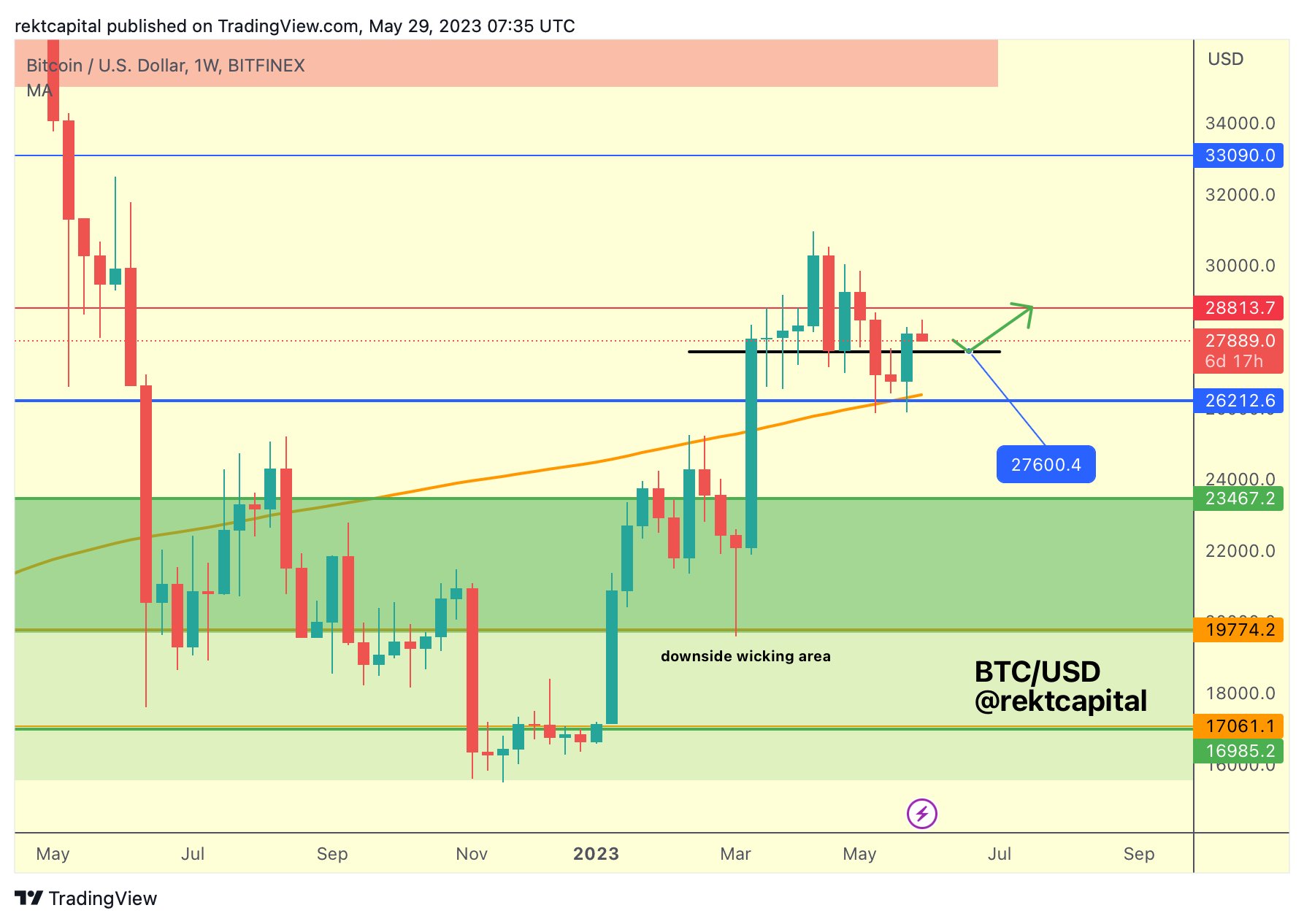

Further contextualizing their claim, Rekt offers a chart in which BTC breaks out of a falling wedge pattern and then retests the upper limit of the wedge to confirm the pattern.

“BTC has Weekly Closed right at the Falling Wedge resistance or just above it

Anyway, BTC can be set for a dip to retest the top of this Falling Wedge as support

Successful retest would confirm Falling Wedge outbreak.”

A falling wedge breakout is a technical analysis pattern used to identify potential bullish reversals in an asset’s price. The pattern is characterized by a series of lower highs and lower lows that form a wedge-shaped pattern on the chart. As the pattern progresses, the distance between the highs and lows narrows, indicating that selling pressure is easing. When price breaks out of the upper trendline of the wedge, it is traditionally considered bullish.

stretches capital too say that BTC had a “great” weekly close, with a candle closing just above the $27,000 level.

“That is a very good BTC Weekly Close

BTC lost ~$27,600 as support two weeks ago and has now positioned itself for a retest/recovery of the same level

A dip into the black would be healthy and a successful retest there could position BTC for a revisit of ~$28,800″

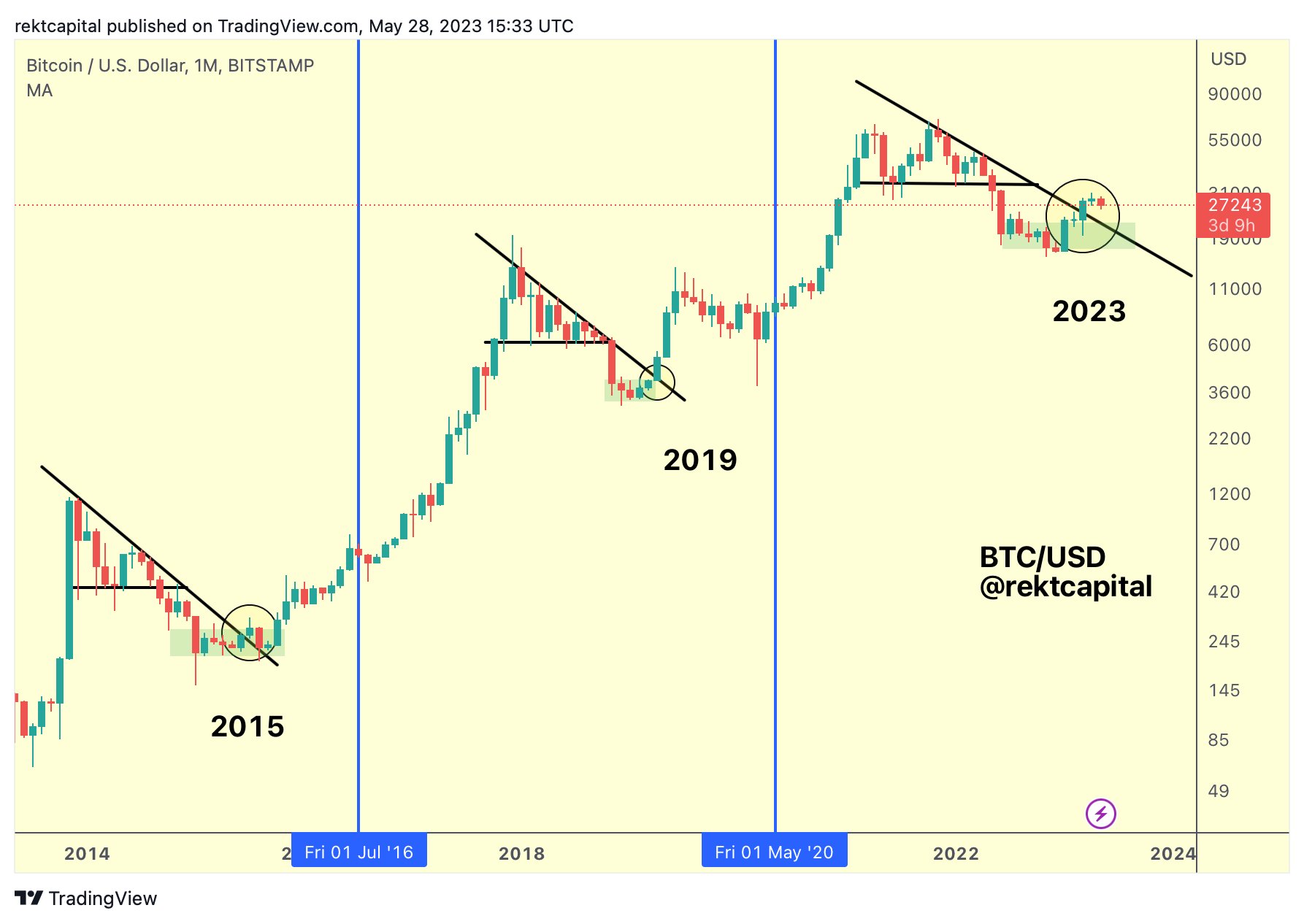

Zoom out, Rect say that in recent months BTC has breached a long-term downside resistance that emerged in late 2021. The analyst says that Bitcoin is now in a bullish trend, at least for the medium to long term.

“BTC’s Medium to Long Term Outlook Is Bullish”

BTC is worth $27,627 at the time of writing, down 0.6% in the past 24 hours.

Don’t Miss Out – Subscribe to receive crypto email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Featured image: Shutterstock/studiostoks/Boombastic