Bitcoin has been on an upward trajectory for some time, witnessing a significant rally within the broader crypto market, hitting the $64,000 threshold on Sunday, as analysts identified trends that could determine the asset’s next direction.

Bitcoin is poised to witness a rally or dip in the near term

Cryptocurrency analyst and trader Ali Martinez has joined social media platform X (formerly Twitter). part his insights on Bitcoin’s short-term price action with the crypto community.

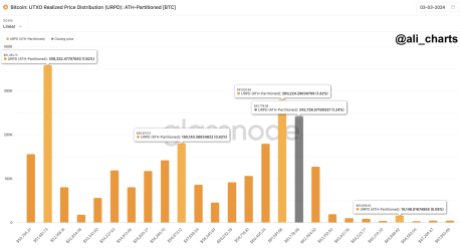

Martinez has noticed an area that could lead to an upturn or a correction. Ali Martinez highlighted that more than half a million Bitcoins have been traded within a range of $61,100 to $61,800, and as a result, the crypto asset has formed a “substantial support area.”

According to the analyst BTC is expected to rise to $65,900 if it manages to stay above this level. However, the experts expect this to happen given the lack of obstacles ahead.

Furthermore, Martinez also pointed out the potential for Bitcoin to undergo a correction if it moves below the support level. The crypto analyst stated that if this happens, BTC could drop to “$56,970 or even deeper to $51,500.”

The message read:

More than 500,000 BTC have traded in a range of $61,100 to $61,800, creating a substantial support area. If Bitcoin stays above this threshold, it could rise to $65,900 given the minimum resistance ahead. Conversely, if BTC falls below the support, a correction could take the price to $56,970 or even $51,500.

Ali Martinez’s predictions came in light of the broader crypto market experiencing a significant rally. Currently, the entire crypto market is seeing a substantial increase capital inflow not registered for more than 2 years.

Martinez noted in another X post that approximately $48.54 billion is entering the crypto market, indicating an increase in investor interest in crypto. He further underlined that the development marks the “largest capital inflow since October 2021.”

So far, experts predict that there will be greater financial inflows in the coming months due to clearer cryptocurrency regulatory frameworks.

BTC ETFs to Control 10% of the Crypto Asset Supply

Bitcoin Spot Exchange-Traded Funds (ETFs) continue to gain popularity while BTC maintains its position upward momentum. As a result, SkyBridge founder Anthony Scaramucci has done just that predicted that the products “could take control of 10% of BTC’s supply.”

Scaramucci noted that many BTCs have been “lost since the inception of the ETFs.” Consequently, ETFs now hold approximately 776,000 BTC since the products began trading.

However, he expects that the products will adopt the aforementioned percentage “when the time comes”. reaches 1.7 million BTC.” Anthony Scaramucci is convinced that when this happens, the price of Bitcoin will rise quickly.

Currently, Bitcoin’s price is trading at $65,184, showing an increase of over 5% in the past 24 hours. Meanwhile, the market cap and trading volume have both increased by 5% and 79% respectively in the past day.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.