- Trump’s Executive Order introduces a federal task force to regulate and promote innovation on cryptocurrency markets

- Bitcoin responded with volatile price movements, which reflected optimism and uncertainty about the impact of the order

President Donald Trump made a flying start by signing various executive orders during his first three days as president. On January 23, President Trump, after a long wait, finally signed an Executive Order on Cryptocurrency. It is not necessary to argue that this step has led to speculation about what the future could be for this investment category.

Main highlights of the Executive Order on Cryptocurrency

The executive order of Trump on Cryptocurrency, called “Strengthening American leadership in the field of digital financial technology”is a milestone decision that lays the foundation for a more structured approach to the adoption of digital assets. One of the most important objectives of the order is the following:

- Set up a federal task force that supervises the regulations for crypto currency, whereby the protection of the consumer is guaranteed and at the same time stimulated innovation.

- Promotes the development of Stablecoins supported by the US Dollar as a counterbalance for other digital assets, which indicates the intention of the country to maintain the dominance in the global financial markets.

- Prohibit the introduction of a digital currency of the US Central Bank (CBDC), thereby referring to risks for monetary sovereignty.

- Investigate a reserve system for cryptocurrencies obtained through enforcement actions, which signaled an openness for the integration of digital assets in financial government systems.

These provisions emphasize a nuanced approach, in which support for innovation is combined with a cautious view of risks such as fraud and market volatility.

How the market responded to the executive order about cryptocurrency

The Implementation Decree on Cryptocurrency provided a mix of excitement and caution in the markets. Bitcoin (BTC), in terms of market capitalization the largest cryptocurrency, had immediate volatility after the announcement. While some investors saw this step as a positive step towards clarity in the field of regulations, others hesitated because of persistent uncertainties about the implementation.

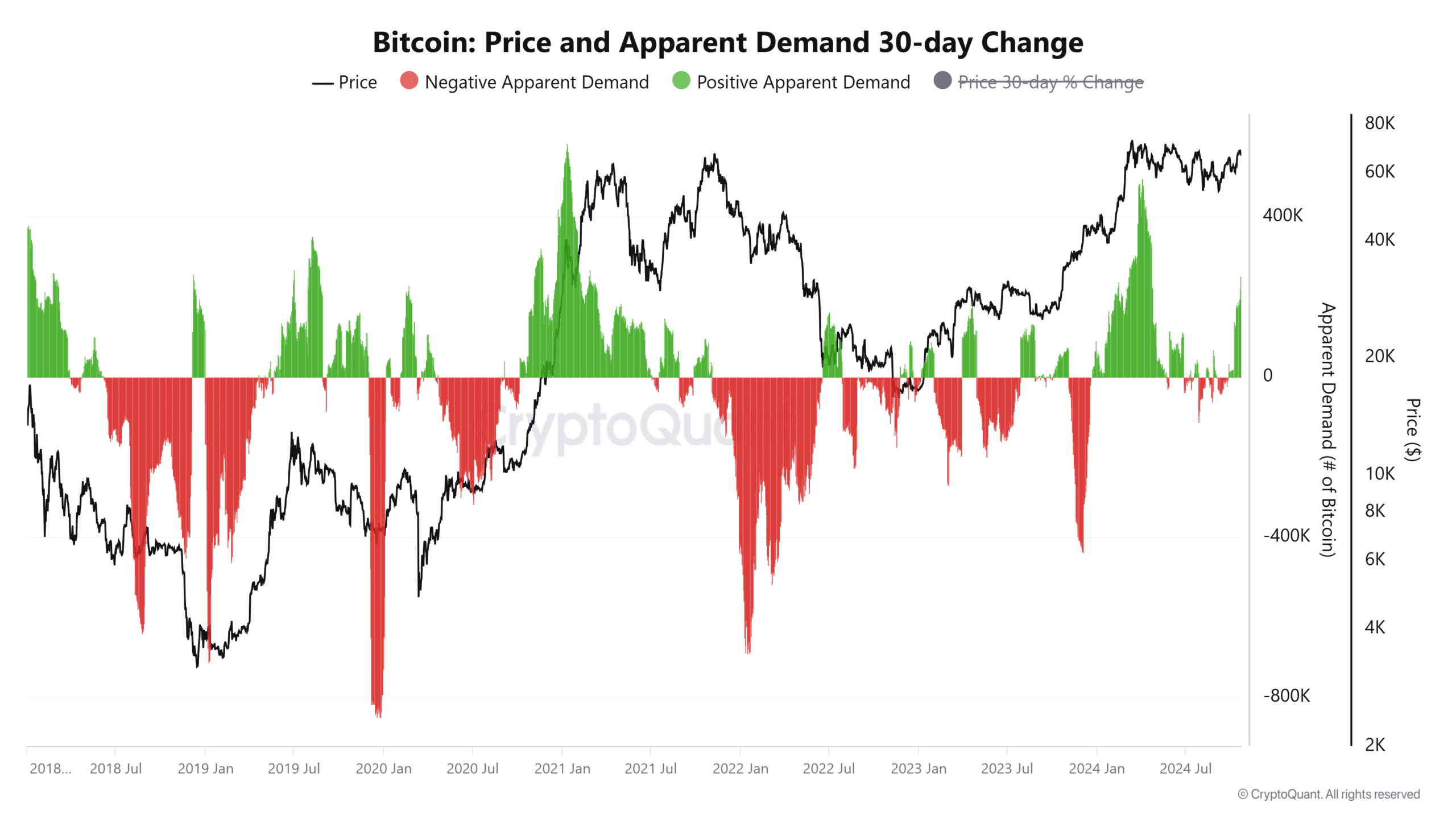

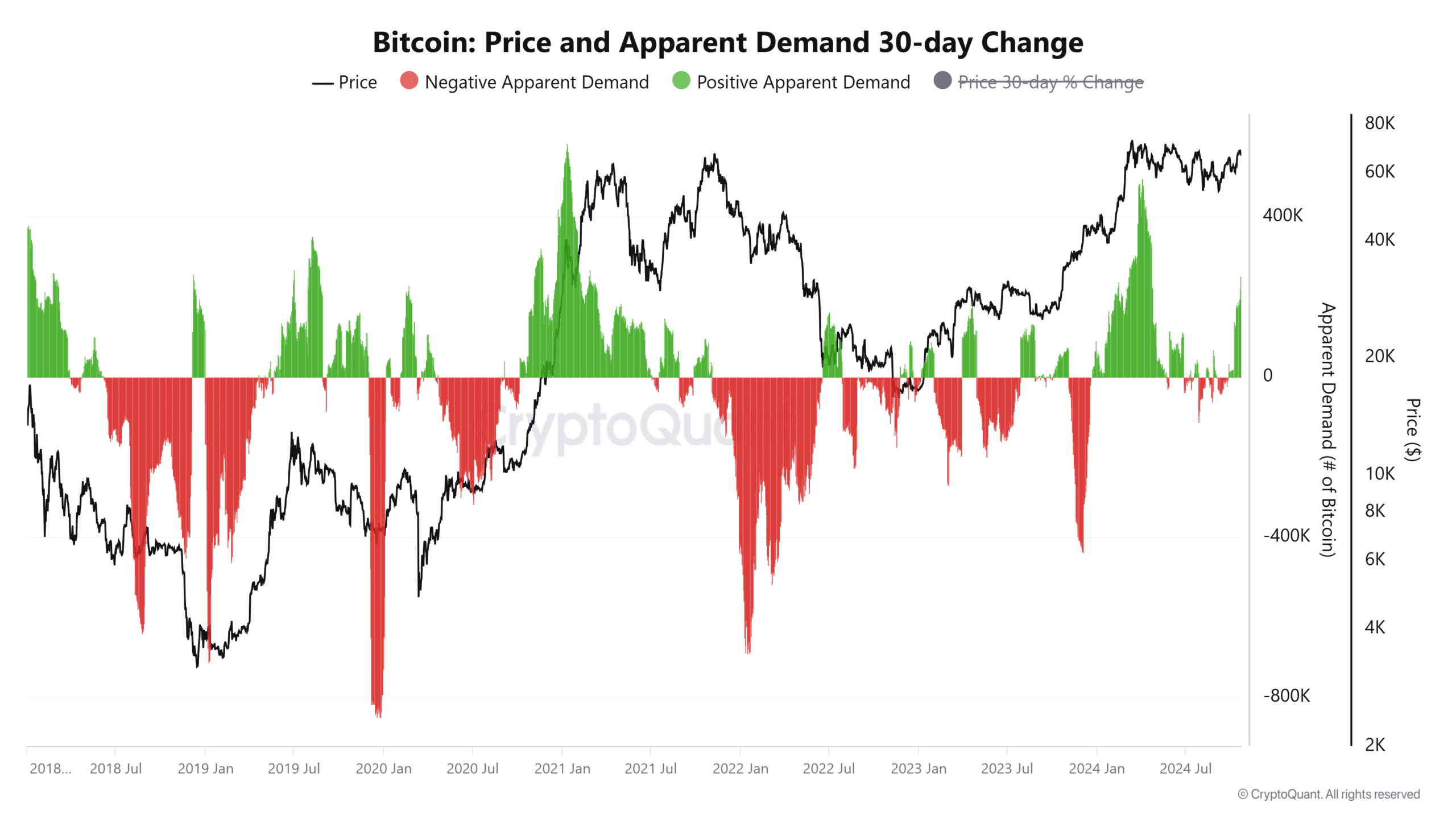

Ambcrypto analyzed the price and apparent changes in Bitcoin’s demand to better understand the market reaction, as visualized in the accompanying graph.

Bitcoin’s price and apparent question: a detailed overview

The graphic illustrated Bitcoin’s price process in addition to 30-day changes in the apparent demand. During the days around the Executive Order, the price of Bitcoin had an increased volatility.

The first announcement caused a slight increase, which reflected market optimism. However, the price returned when traders digested the long -term implications of potentially regulatory supervision.

Source: Cryptuquant

At the same time, a sharp rise in the positive apparent demand coincided with the release of the order. This trend indicated a greater interest in buying behavior, probably driven by renewed trust among investors that clearer regulations could attract institutional capital.

The graph, however, also showed periods of a negative apparent question, as a result of profits and uncertainty among private investors. These fluctuations emphasized the delicate balance between optimism about the clarity of the regulations and the fear of stricter checks.

Implications for the cryptocurrency ecosystem

Trump’s Executive Order on Cryptocurrency could mean a crucial shift for the sector. By giving priority to the development of Stablecoins and resisting CBDCs, the order tries to protect the economic interests of the US and at the same time make blockchain innovation possible. However, the mixed reaction of the market indicates the need for more detailed implementation plans to remove the concerns of investors.

For Bitcoin, the Executive Order strengthens its role as a barometer of the market sentiment. The price movements and demand dynamics underlined the sensitivity of the cryptocurrency to policy changes, and underlined the importance of predictability of regulations for promoting long -term growth.