- A Pepe whale transferred 2.1 trillion tokens worth $52 million after 600 days of rest.

- Pepe has shown a moderate recovery on the price charts, with an increase of 3.78%.

Since reaching $0.00002836, Pepe [PEPE] is struggling to maintain upward momentum. As such, the memecoin has bounced back, hitting a local low of $0.00002164. However, since then the memecoin has tried to recover on its price charts.

At the time of writing, Pepe was trading at $0.00002423, up 3.78% on the daily charts.

Pepe’s continued revival has led to an increase in whale activity. Some whales are trying to take advantage of the recent rally, while others are constantly accumulating, hoping for more profits.

Pepe Whale offloads 2.1 trillion tokens

According to Look at chainA Pepe whale that had been inactive for 600 days transferred all 2.1 trillion tokens worth $52 million to a new address.

This whale, an early Pepe holder, spent just 0.0135 ETH worth $27 to purchase these tokens. Since then, this whale has held the assets until now.

This transaction could have two important consequences. First, if the transfers result in the total amount being sent to exchanges in preparation for sales, this could result in increased selling pressure. Second, if this whale reorganizes to move into safer cold storage, that’s a bullish signal.

Impact on price charts

Overall, PEPE experienced bearish sentiment from both whales and retail traders in the short term.

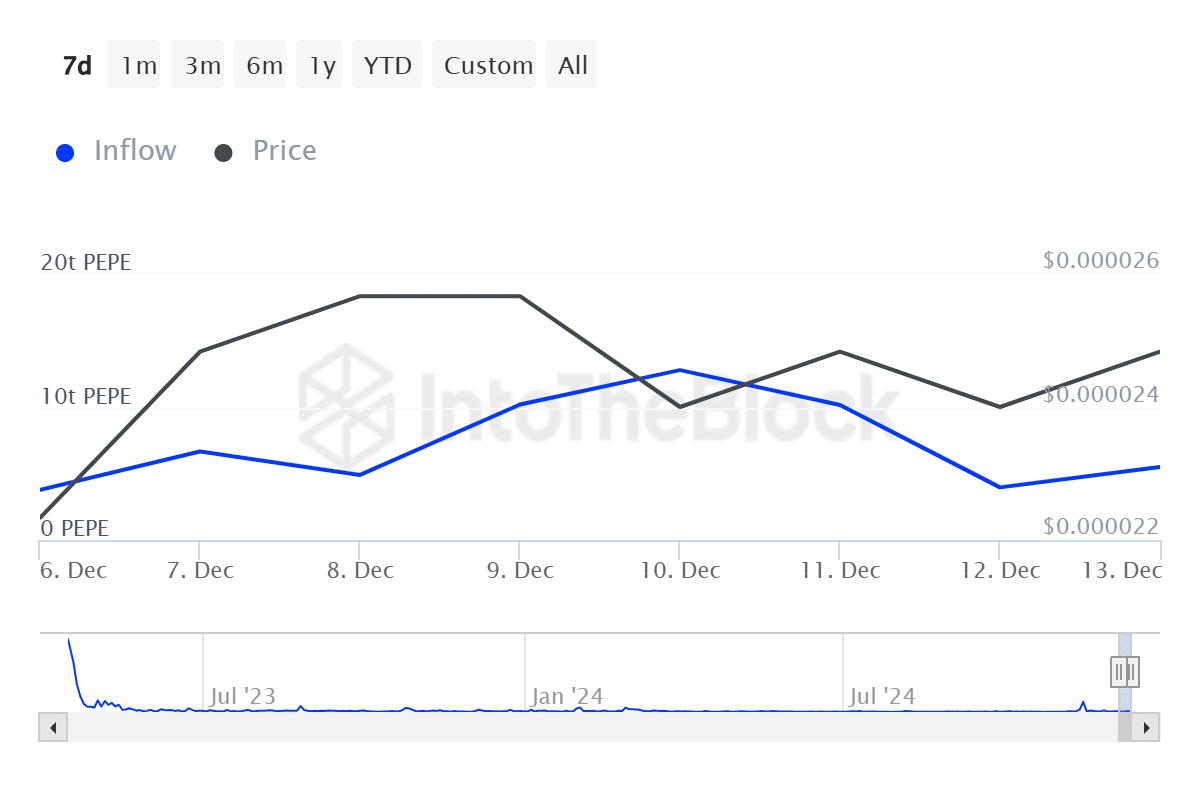

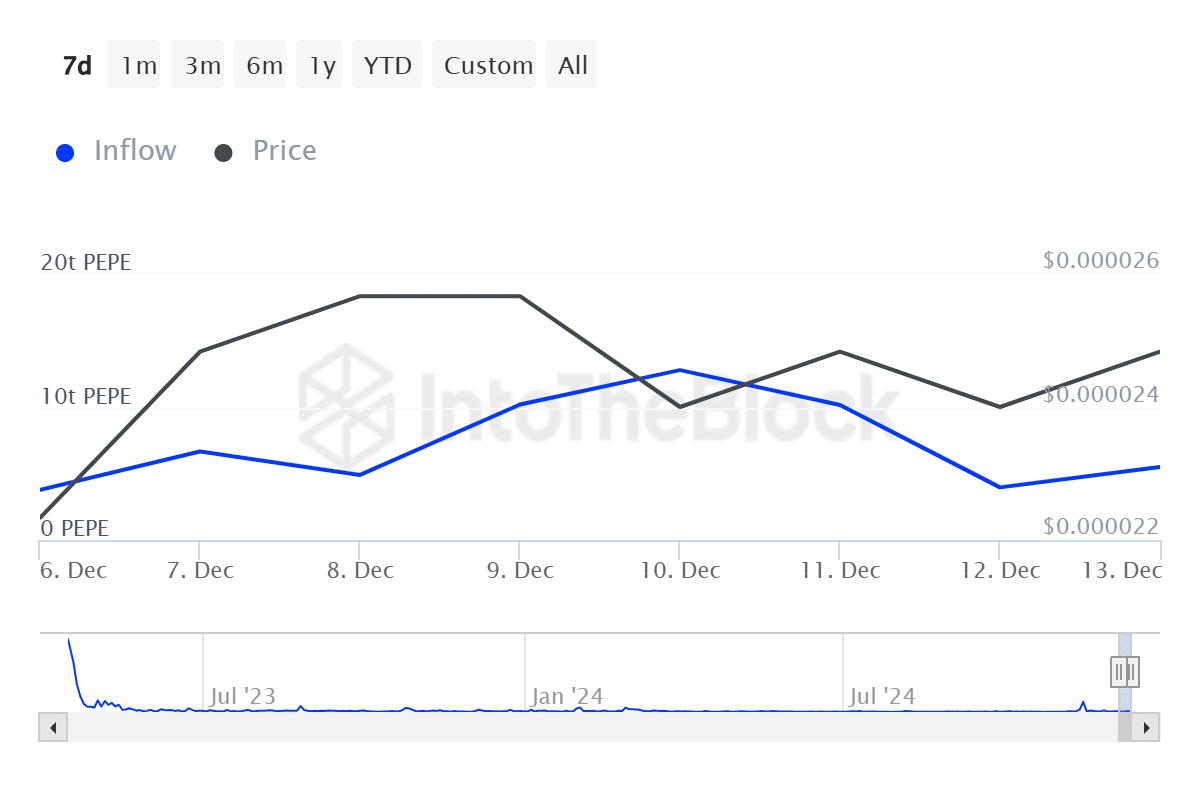

Source: IntoTheBlock

For example, Pepe’s big farmer inflows have declined from 12.78 trillion to 5.48 trillion in the past week. This suggests that whales are reducing their capital inflows into the memecoin. When large investors reduce the inflow of their money, it indicates a lack of market confidence.

Source: TradingView

Moreover, this bearish trend was reflected in a decline in the Relative Strength Index (RSI). The memecoin’s RSI has fallen, implying reduced buying pressure as the market corrects after the recent rally.

At 58, the RSI indicates that both sellers and buyers are still vying for market control.

What next with the memecoin?

According to AMBCrypto’s analysis, the memecoin experienced a market correction after a rally, resulting in bearish sentiment in the short term. However, fundamentals are strengthening and bearish sentiments may be short-lived.

Source: Santiment

Despite the short-term price weakness, the memecoin’s Adjusted Price DAA Divergence remained positive over the past week. This indicates that fundamental metrics such as network activity are improving. Therefore, this difference indicates potential price growth in the short term.

Read Pepe’s [PEPE] Price forecast 2024–2025

Given the long-term bullish sentiment, Pepe could book more gains and regain the $0.0000256 resistance level in the short term.

However, if bearish forces prevail, the price could drop to $0.00002319.