- The last purchase signal of Cardano hinted at potential for a short -term rally, but the uncertainty continues to exist

- Despite the rise in market activity, the financing speed and the MVRV ratio emphasis emphasized

The TD sequential indicator is in the news today after it has recently generated a purchase signal for Cardano [ADA]With the Altcoin trade at $ 0.7100, a decrease of 0.98%, at the time of press. This technical signal has aroused interest among traders and showed the potential for a price rebound.

As the market is closely monitored, the demand will continue to be the start of a short-term rally, or will it just turn out to be another volatile peak?

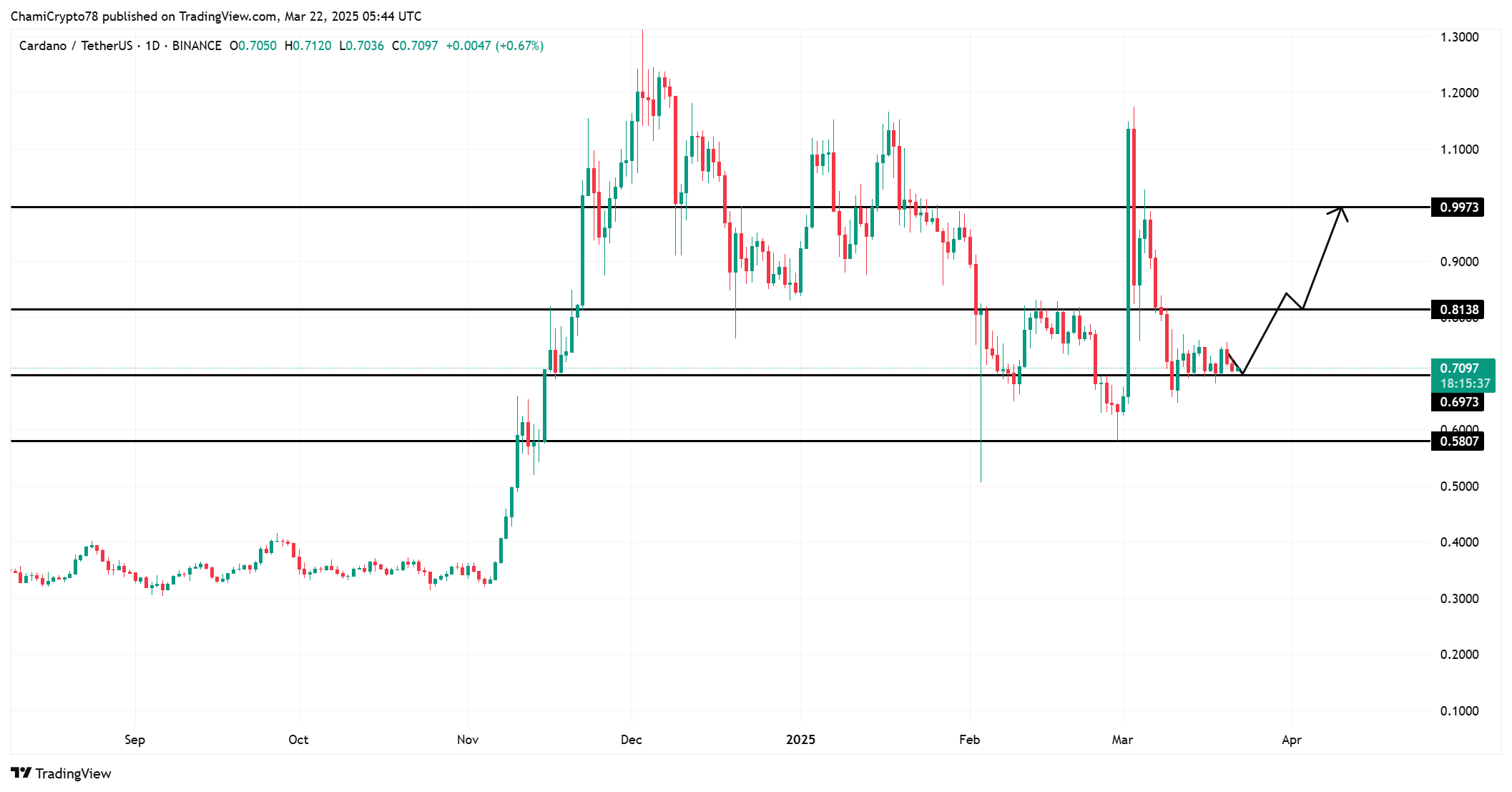

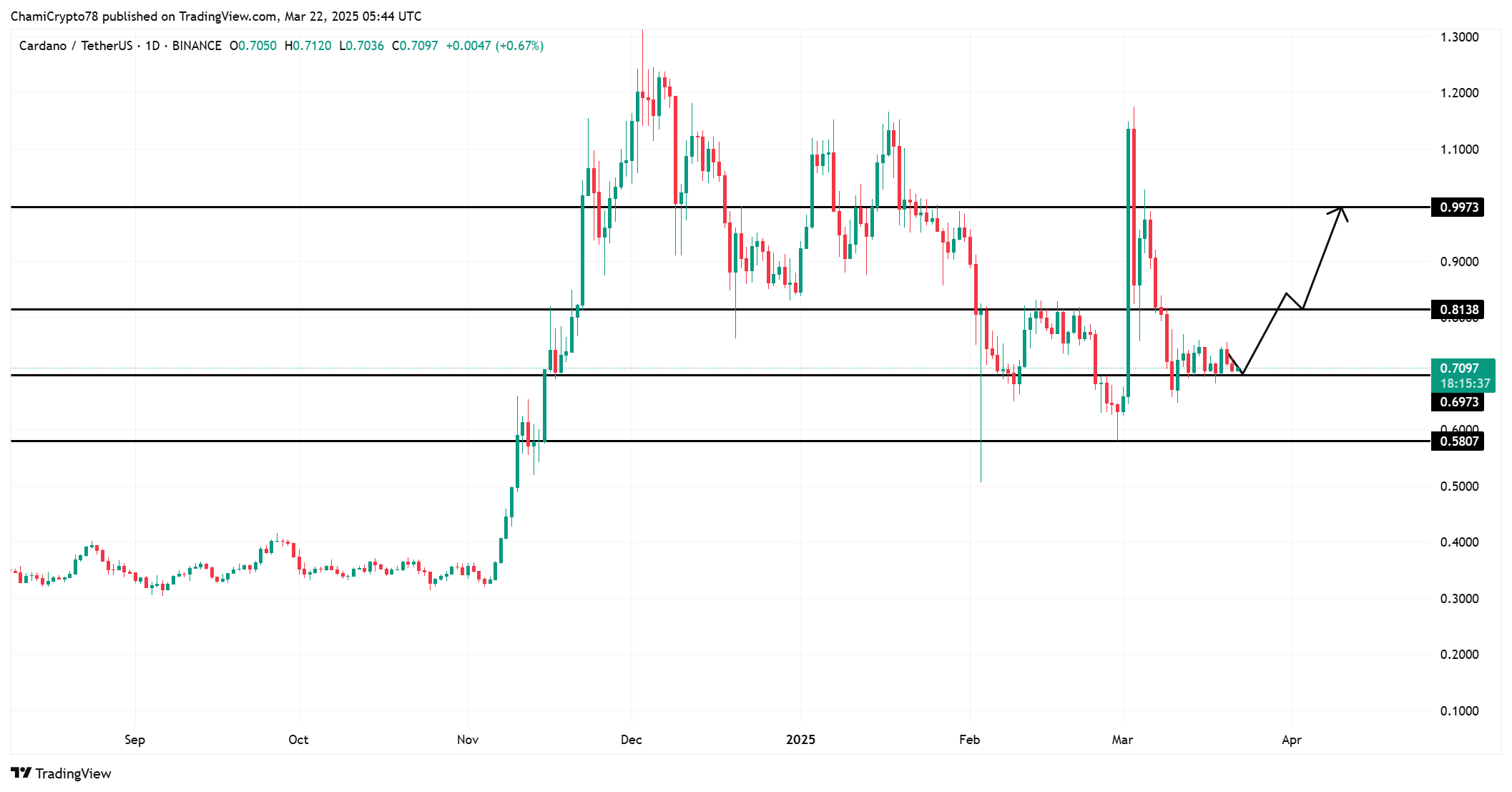

If we investigate the recent price promotion of Cardano, we can see clear consolidation after a period of volatility. In fact, the price has registered an attempt to break above the level of $ 0.8138, with support around the $ 0.6973 level.

If Ada can hold above this important level of support, this can be aimed at testing the next resistance around $ 0.8138. Simply put, the TD -sequential purchase signal offered a glimmer of hope for traders looking for a price rebound.

Source: TradingView

Binance Funding Figures Analysis – Is Sentiment Bullish or Bearish?

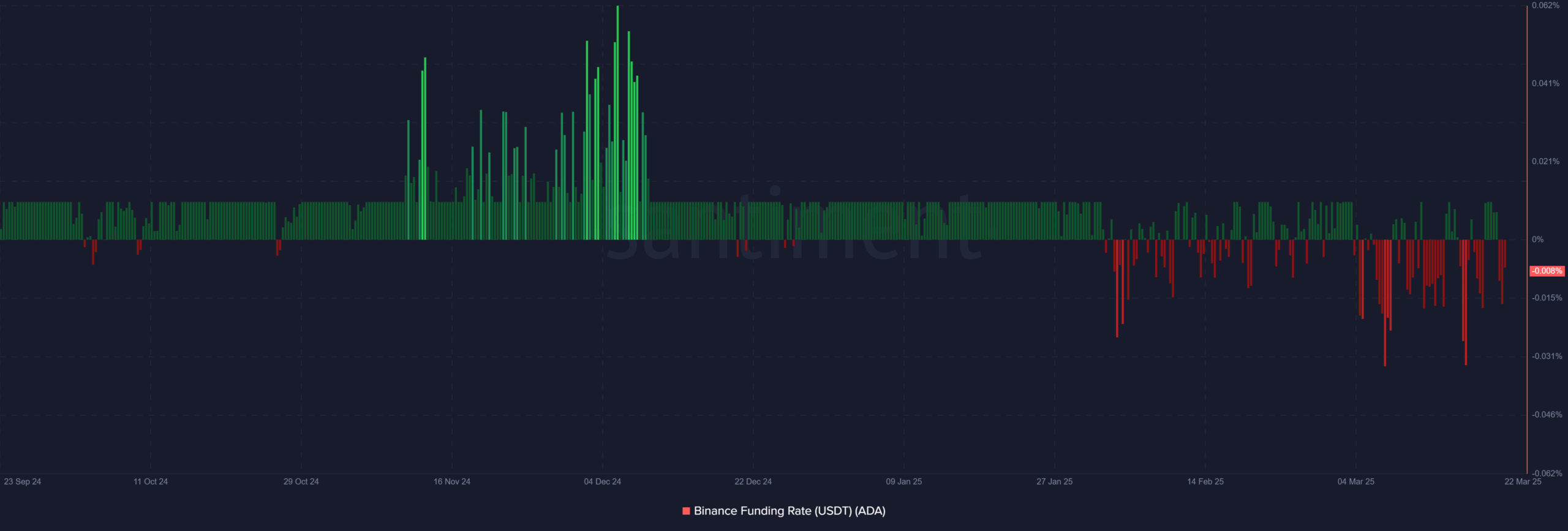

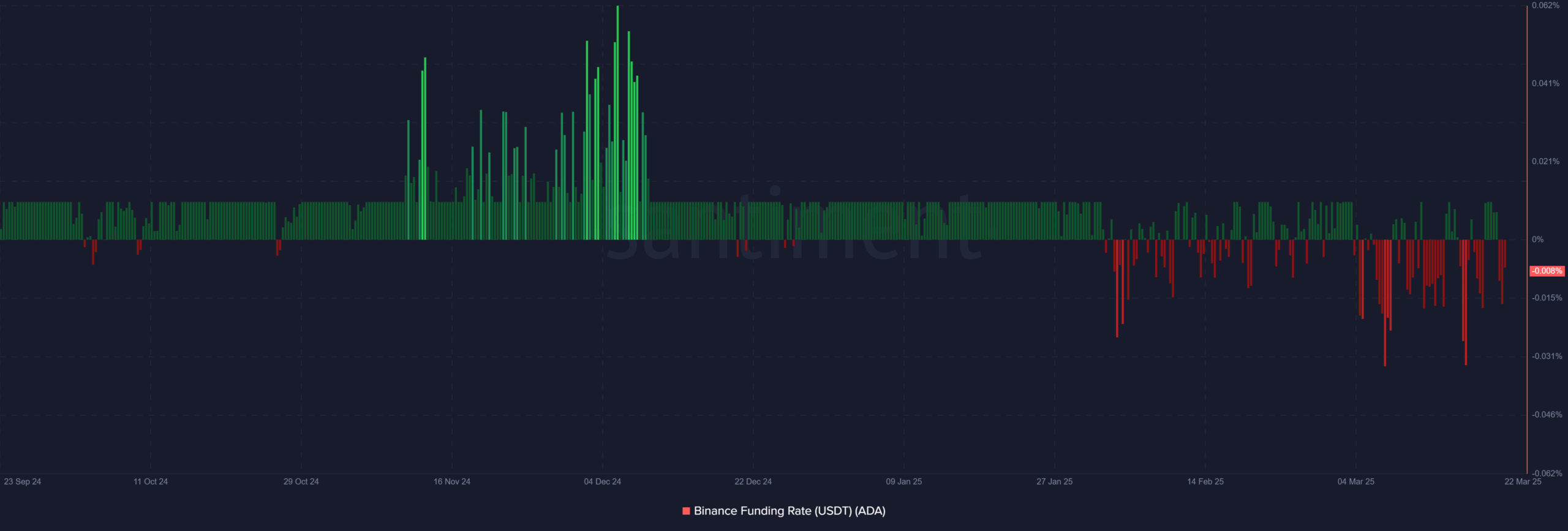

At the time of writing, the Binance financing percentage for Cardano had a value of -0.0084%. This negative rate suggested that more traders are taking short positions – a sign of Bearish sentiment on the market.

However, the mild fluctuations of the rate referred that the market remains relatively balanced, without extreme sentiment driving the price in both directions.

Moreover, this negative financing speed can lead to downward pressure if short positions continue to dominate.

Source: Santiment

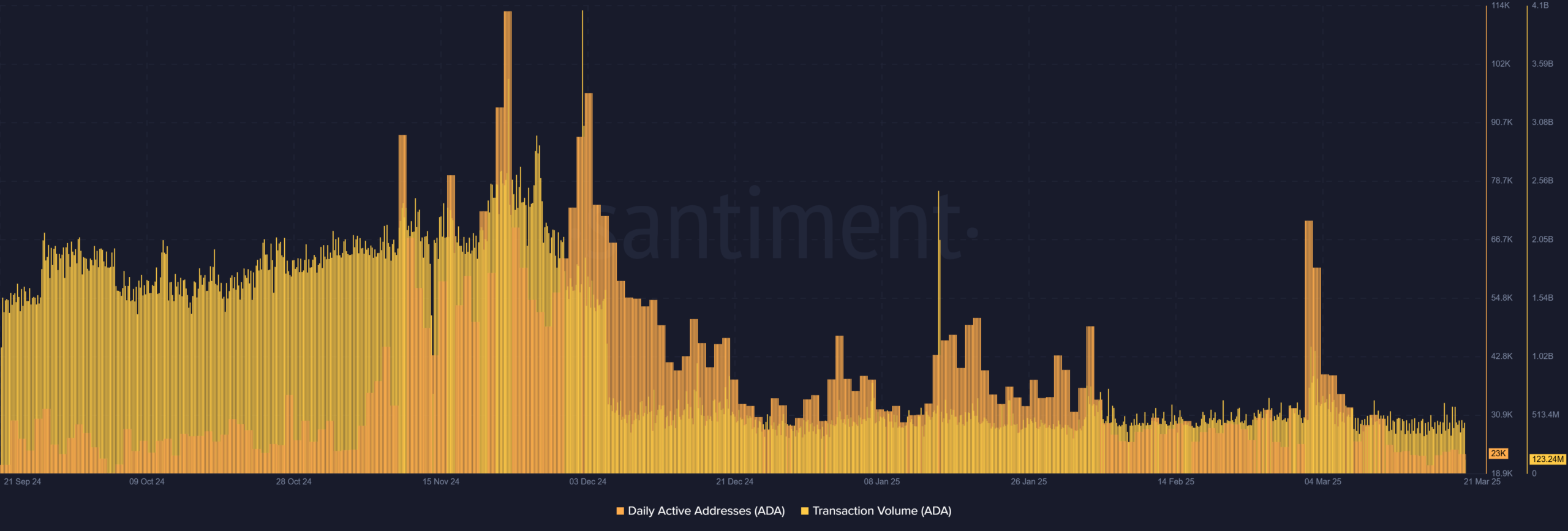

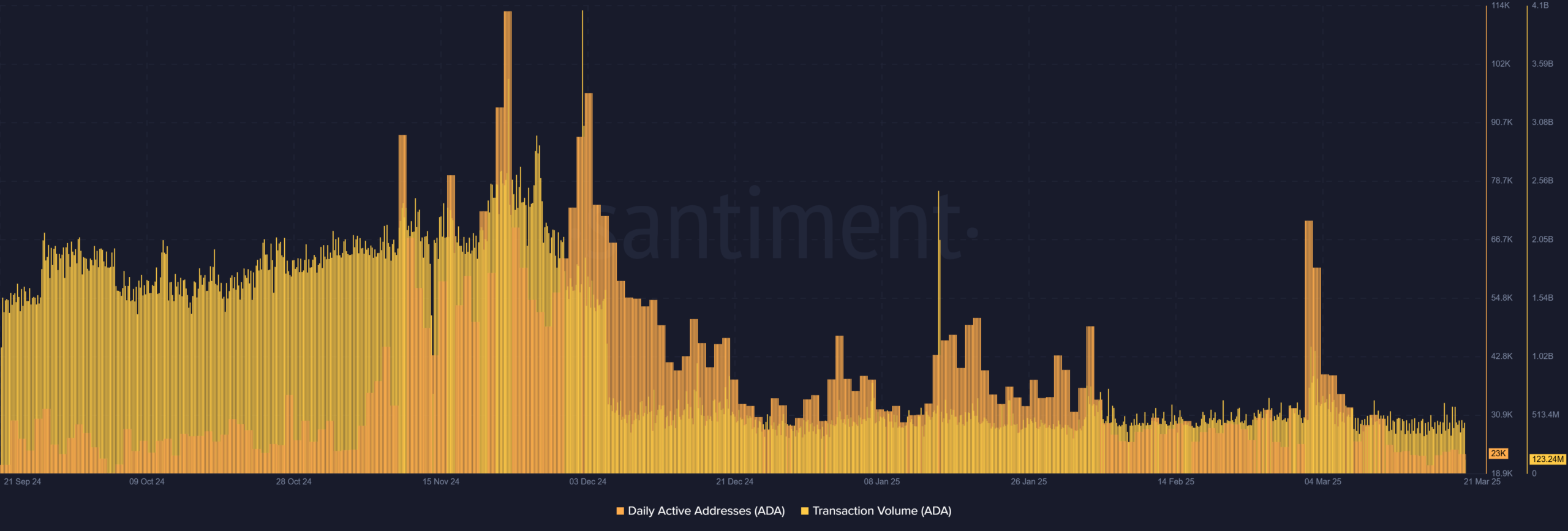

Daily active addresses and transaction volume -analysis

The daily active addresses of Cardano recently saw a noticeable increase, climb to 23.009 addresses. Moreover, the transaction volume rose to 123.24 million ADA, which indicates the growing interest in the asset.

This increase in the activity may indicate that more investors participate in the market, which may make a price increase in the short term.

Despite the growth of addresses and transactions, the market has been dubious. This can be a sign that the current trend may not be sustainable for the long term.

Source: Santiment

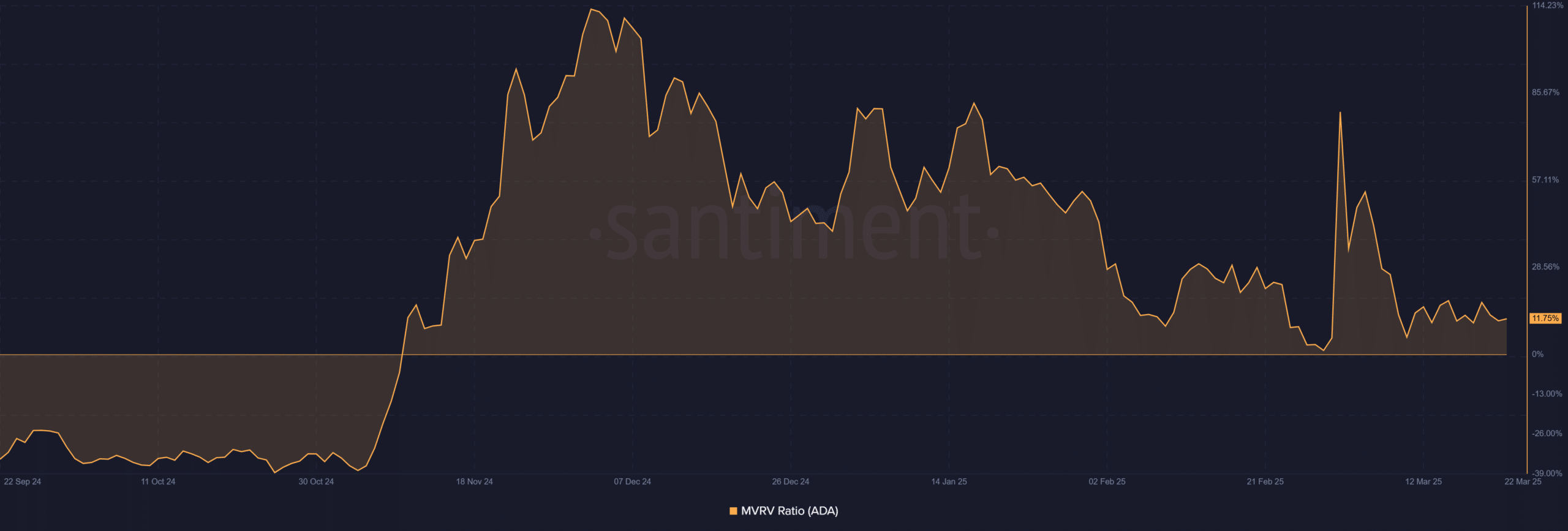

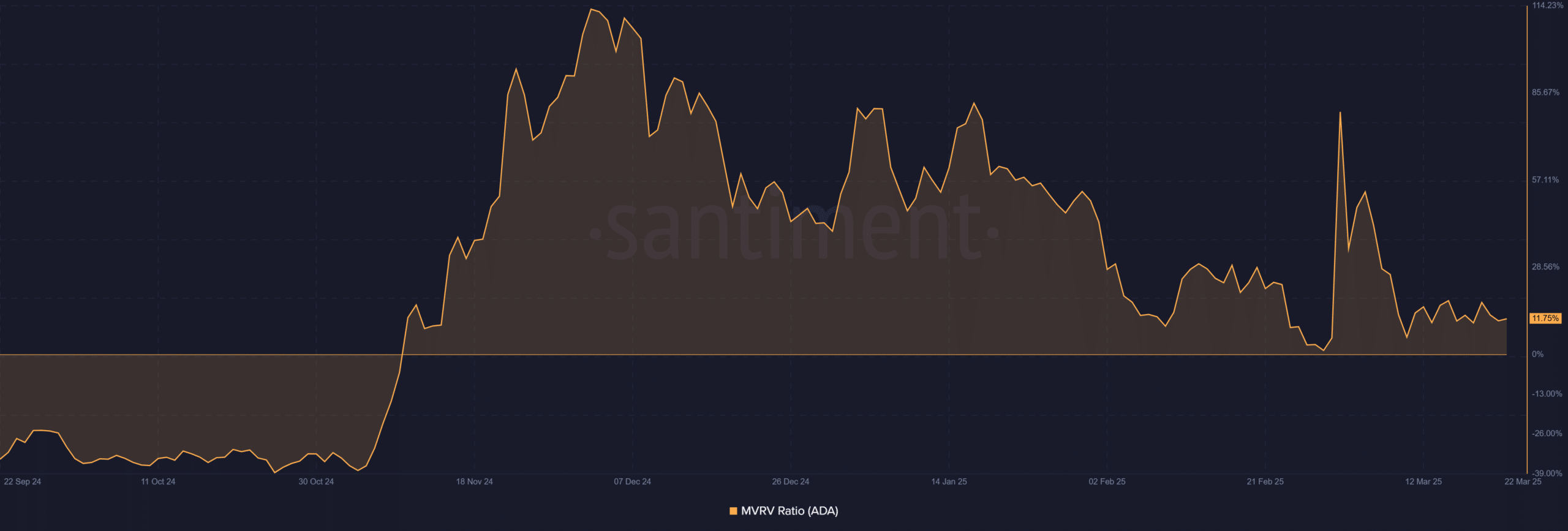

Ada MVRV ratio – Overvalued or undervalued?

The MVRV ratio of Cardano was 11.75% – a sign that it was somewhat overvalued in the short term. This ratio measures the difference between the market value of Cardano and its realized value, which indicates potential profit pressure.

Although the MVRV ratio hinted that Ada could experience some resistance at higher price levels, it also be a potential long-term bullish trend.

Simply put, despite the overvaluation in the short term, Cardano can still see growth potential in the future.

Source: Santiment

Will Cardano’s rebound hold or fade?

The newest buying signal and the walk in market activity for Cardano hinted during a potential short -term rally. The negative financing percentage and high MVRV ratio, however, pointed to caution among traders.

Cardano can see a temporary price bumpers based on the prevailing market conditions. However, the rally may not be sustainable in the long term. That is why the price of Cardano can see an upward movement, but it is unlikely that it will currently activate a permanent bull run.