- BTC and ETH’s long contracts were much more than shorts, but the expiration of these positions could be the highest in months.

- The Put Call Ratio of both assets remained positive despite increasing concerns.

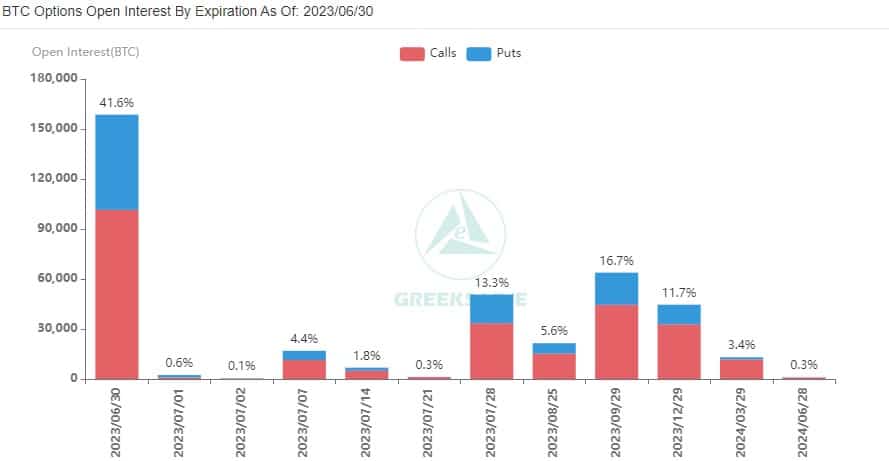

With the cryptocurrency market bustling with increased activity, approximately $7.2 billion has come in Bitcoin [BTC] And Ethereum [ETH] option contracts can expire. According to Greeks.liveETH accounted for $2.3 billion of value, while BTC’s share was $4.9 billion by monthly open contracts.

Is your wallet green? Check the Bitcoin Profit Calculator

Calls peg Put back

Over the past 30 days, Bitcoin’s price is up 12.31% cumulatively. The coin’s rise above $30,000 enhanced traders’ enthusiasm for the price action. As a result, the Put Call Ratio (PCR) has been kept at 0.56.

Source: Greeks.live

For context, the Put Call Ratio helps traders understand the sentiment of the options market based on the open options contracts and trading volume.

Also, a call option corresponds to a coin purchase at an agreed price at the expiration of the contract. On the other hand, a put option gives the right to sell an asset under the same conditions.

So if the PCR is less than 1, it means there are more Call options than Puts. This means that traders are betting on the market to be bullish.

Conversely, when the PCR is significantly higher than 1, it means there are more Put options than Calls. Here, the broader market sentiment could be termed bearish. Meanwhile, directional bias is neutral only when the PCR is slightly above 1.

In addition, ETH’s PCR was similar to BTC at 0.57. And like the king coin, the altcoin had an income of more than $1,800 thanks to the bullish sentiment.

Source: Greeks.live

Increasing volatility between fall and rise

As Greeks.live mentioned, BTC volatility increased. And based on the Bollinger Bands (BB), volatility has remained extreme. The BB showed that BTC had left overbought territory since the price stopped touched the top band.

However, the Relative Strength Index (RSI) was 67.04. If the RSI reaches the overbought 70 levels, BTC may pull back. If that happens and BTC drops below $30,000, Puts would benefit and bears could gain some control.

![Bitcoin [BTC] Price action](https://statics.ambcrypto.com/wp-content/uploads/2023/06/BTCUSD_2023-06-30_08-29-55.png)

Source: TradingView

But if BTC maintains solid buying momentum and enters the $31,000 region, it will favor Calls.

ETH’s Bollinger Bands situation was similar to Bitcoin’s. And like BTC, despite the high volatility, it was neither overbought nor oversold.

But despite a bullish crossover, the Awesome Oscillator (AO) showed that ETH shorts could win. This was due to the sequentially stripe of four red bars. Usually this is a sell signal.

![Ethereum [ETH] Price action](https://statics.ambcrypto.com/wp-content/uploads/2023/06/ETHUSD_2023-06-30_08-43-16.png)

Source: TradingView

Read Ethereum [ETH] Price prediction 2023-2024

However, given the broader market sentiment, there’s no guarantee that shorts will rule profits for long.

If bulls fend off the bearish appearance, Calls profits would run into the millions. On the other hand, if bears extend their dominance, then puts would dampen Calls’ expectations.