- Solana outperformed Bitcoin and Ethereum and was the major highlight of the past quarter.

- OP and MKR had their highlights as there was more to look forward to in the fourth quarter.

The third quarter of 2023 (Q3) was full of twists and turns for the crypto market led by Bitcoin [BTC]. At one point, market participants had a lot to celebrate. Other times, the belief that the market would be favorable or maintain a good level of stability was tempered.

Read Bitcoins [BTC] Price prediction 2023-2024

Unlinking crypto assets from others

Interestingly, 21Shares has released an in-depth report report of what has happened at all levels in the sector. For starters, the largest set of Exchange Traded Products (ETPs) reported that macroeconomic factors remained in limbo despite the Fed raising rates to 25 basis points (bps).

However, interest rates did not rise in September, leaving the possibility of an interest rate increase in the final months open. Quarterly (QoQ) Bitcoin fell by 11.52% while Ethereum [ETH] decreased by 13.60%. The S&P 500, which at one point had a strong correlation with BTC and ETH, moved in the opposite direction, leading 21Share to conclude that:

“Crypto has historically been negatively correlated with this index, indicating that investors view it as a risky asset class. However, as crypto expands across use cases, we see increasing decorrelation within the asset class itself.”

Solana beats Bitcoin and Ethereum

But there was Solana [SOL], which has faced numerous challenges and FUD lately, outperformed both Bitcoin and Ethereum. One of the main reasons for the token’s impressive performance was its partnership with payment platform Visa.

Around September, the credit card giant announced that it had added support for the Solana blockchain Circle [USDC] transactions. According to Visa, the decision to integrate Solana was because of blockchain efficiency to process as many as 2,000 transactions per second (TPS).

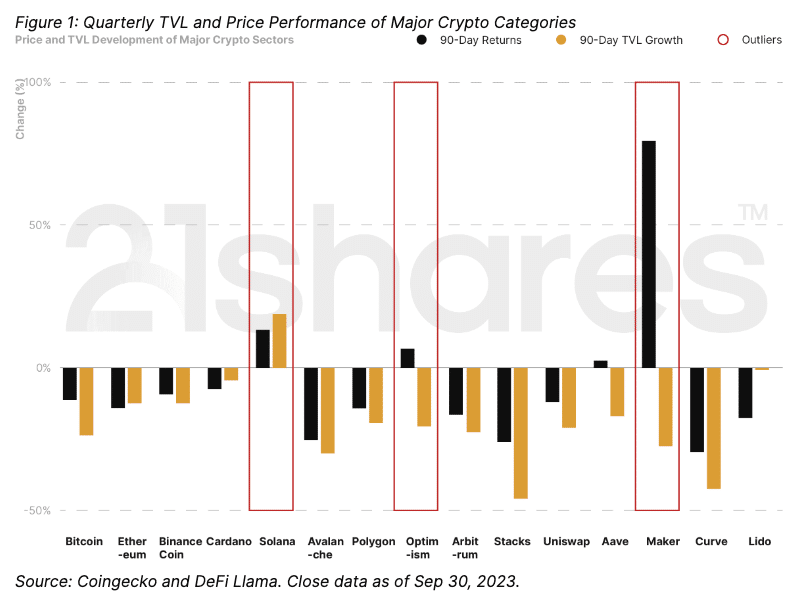

Consequently, the SOL price was the only part of the ecosystem that was positively affected. According to data shared by 21Shares, Solana’s Total Value Locked (TVL) also registered a notable increase in the quarter.

Source: Coingecko and Defi Llama via 21Shares

The TVL measures the unique deposits of assets locked or staked in a protocol. When the TVL increases, it implies an increase in liquidity deposits in dApps under a protocol.

Conversely, a decline indicates a lack of liquidity. In Solana’s casethe increase means that market participants regained confidence in the project.

OP and MKR had their time

It also appeared that only Solana recorded a 90-day increase in TVL from the top project. However, two projects could not be ignored for the entire quarter MakerDAO [MKR] And Optimism [OP].

For Optimism, the native token was able to maintain an increase of 7.43% over the past 90 days. This increase can be associated with various developments within the blockchain. For example, there has been a huge increase in the adoption of the OP Stack, among other things.

MKR, on the other hand, could boast a 79% increase in the third quarter, thanks to year-over-year sales growth and interest from Maker’s involvement with Real World Assets (RWAs). Ethereum has also made some notable progress this quarter, especially when it comes to staking and scaling solutions on the blockchain.

Ethereum and Chainlink Days

For example, to counter the centralization of the blockchain, Ethereum used the Distributed Validator Technology (DVT). The DVT allows multiple node operators to run a single validator. This is done to reduce the risk of compromises associated with the validators without affecting the blockchain.

Furthermore, the liquid staking sector continues to dominate blockchain activity. According to the report, liquid staking accounted for 42.8% of all activity Lido Finance [LDO] lead the cohort.

Source: Dune Analytics

Meanwhile, Ethereum has also postponed its next major upgrade, the Dencun upgrade, until next year. According to scalability on the blockchain, Eclipse, a customizable rollup provider, has introduced a modular scaling solution. Interestingly enough this development brought Solana and Ethereum together.

21Shares noted that,

“In the context of Eclipse, the L2 architecture will use Ethereum for settlement, while Solana will be deployed for execution thanks to its parallel processing capabilities for high performance.”

Another project that saw major development in the quarter was Chain link [LINK]. But this time it introduced a study explaining how tokenization of global assets on the blockchain can improve adoption.

Source: IMF

As shown above, Chainlink explained that the Cross Chain Interoperability Protocol (CCIP) could help with the infrastructure for stable dollar coins, noting that:

“The initiative is built around three pillars: educational content to facilitate understanding of the ecosystem, developing best practices and sector recommendations to promote a compliant industry, and actively working to build an -chain infrastructure that can be adapted to the needs of all stakeholders.”

Q4 could bring more

As we head into the fourth quarter (Q4), there seems to be a lot to look forward to. An example is the integration of the Bitcoin Lightning Network on Coinbase. This is intended to ensure faster and more effective BTC transactions and cross-border payments.

However, on-chain data from TheBlock showed that activity with the Bitcoin scaling solution decreased at some point. But the recent resurgence means that market players’ trust in the Lightning Network has increased and may continue to do so.

Source: Het Blok

Realistic or not, here it is The market cap of SOL in ETH terms

Another aspect to take into account is the possible revival of Solana. It is not news that the blockchain’s response to the FTX collapse was very poor. However, with some key developments in the third quarter, it is possible to see an increase in Solana adoption. In this regard, 21Shares noted that:

“Solana is seeing a surge in ultra-cheap NFT mining thanks to a new protocol called Bubblegum, which compresses the mining process. For reference, a collection of 86,000 can be dropped to users for around $100 using Solana, compared to almost $200,000 on Ethereum.”