- ETH staking grew, but Bitcoin’s performance was much less than Q1.

- Exchanges and NFT trading volume declined.

The second quarter of the year witnessed significant developments and fluctuations in the cryptocurrency landscape. In contrast to the first quarter, there were different results for the period April to June Bitcoin [BTC], Ethereum [ETH]the NFT sector and trading volumes on experienced exchanges.

Read From Bitcoin [BTC] Price prediction 2023-2024

For starters, a key event at the start of the quarter was the Ethereum Shapella upgrade. And this was highlighted in CoinGecko’s crypto industry report. The upgrade, the blockchain’s first major upgrade after the Merge, took place on April 12.

Deployed Ether was not short

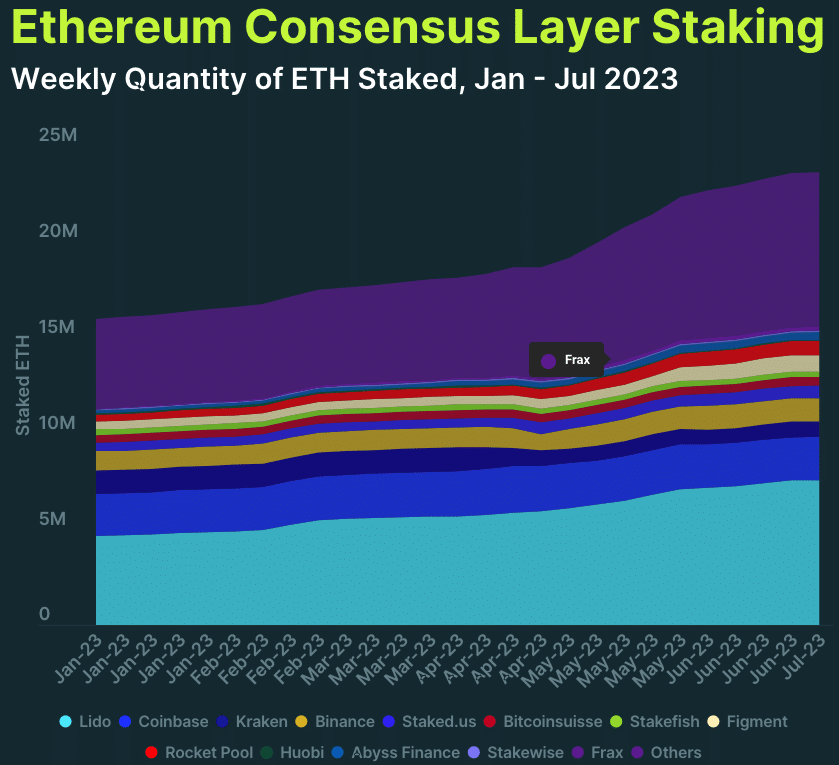

And this allowed validators to disconnect the ETH deposited in the network if they wanted to. According to CoinGecko report, ETH staking grew 30.3% in Q2, with the usual suspect Lido Finance [LDO] dominates the ranking of the staking provider.

Source: CoinGecko

However, the report did not mention the decline of other staking providers, especially exchanges. And the main reason for this was the regulatory issues that Coinbase and Kraken faced with the US SEC. The report stated that,

Kraken’s dominance fell to 3.4% as it scaled down its staking product in the US following a settlement with the SEC. The exchange had a -36.2% decline in ETH QoQ wagered. Coinbase’s dominance also dropped -3.5% in the second quarter, ending the quarter with a market share of 9.6%.

BTC is stepping back as exchange volume fell

For Bitcoin, the massive growth in the first quarter cooled somewhat. Despite hitting a Year-To-Date (YTD) high of $30,694, pushing the crypto market cap to $1.24 trillion, BTC only managed a 6.9% QoQ (QoQ) increase ).

Source: CoinGecko

While Bitcoin’s average daily trading volume fell to $13.8 billion, stablecoins were also affected. The market capitalization of BinanceUSD [BUSD]And Circle [USDC] dropped. However, Tether [USDT] managed to hold on to its top position.

There was also a notable stablecoin in the spotlight — TrueUSD [TUSD]whose market capitalization grew by 50%.

Source: CoinGecko

On centralized exchanges (CEXs), spot trading fell by 42.3%. One of the factors responsible for this was the regulatory issues the world’s largest exchange that Binance faced.

With it appearing that the SEC wanted to prosecute and sue Binance, traders felt it was a wise decision to refrain from using the exchange. Exchanges including Bitget and Bybit, which sent Crypto.com and Huobi out of the top 10, benefited from this move.

Despite the caution in using CEXs, DEXs love Uniswap [UNI] did not record a substantial increase in volume compared to the previous quarter.

Is your wallet green? Check the Ethereum Profit Calculator

Although the rise of memecoins such as Pepe [PEPE] contributed to an increase in trading activity, the total volume nevertheless fell by 30.8%.

In the NFT sector, sales of Ethereum collections fell, but the blockchain still maintained its dominance. However, the growing interest in Bitcoin Ordinals dampened the effect. As a result, Ordinals accounted for 20.3% of total NFT volume in May.

Source: CoinGecko