Bitcoin Ordinals have emerged as a new way to improve the functionality and usage of Bitcoin, the original cryptocurrency. By leveraging Bitcoin’s blockchain in a new and innovative way, Ordinals brings unique value propositions and helps revitalize the Bitcoin developer community.

What are Bitcoin Ordinal Numbers?

Simply put, Bitcoin Ordinals are digital collectibles created by writing content such as art or media onto individual satoshis on the Bitcoin blockchain. Each enrolled sat is one of a kind and can be owned, collected and traded as a non-fungible token (NFT).

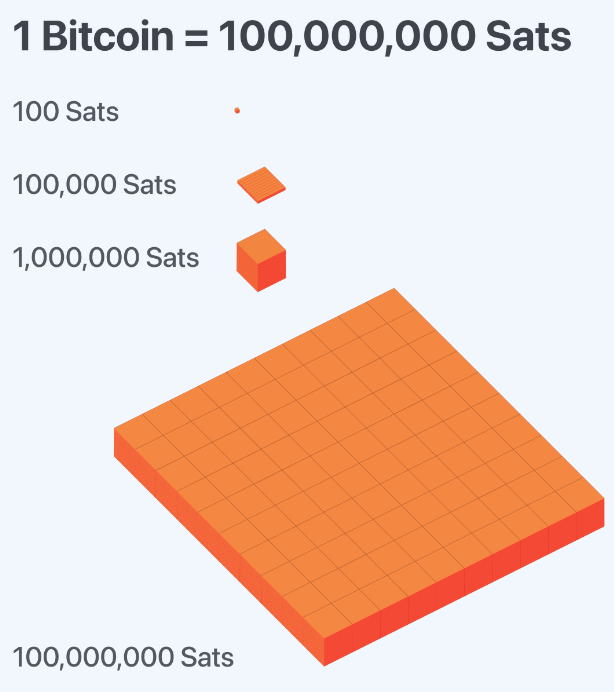

Ordinal numbers allow the assignment of a unique number to each individual satoshi (sat), the smallest unit of Bitcoin, equal to 0.00000001 BTC.

This numbering system allows identifying and tracking specific sats. Once you can identify and track specific sats, you can ‘subscribe’ data such as images, videos or text to individual sats. The inscribed data becomes a unique digital artifact associated with that specific satellite. Bitcoin Ordinals are based on the ‘Ordinal Theory’, which proposed a methodology to give individual identities to sats and enable tracking of their ownership and transfer on the Bitcoin network.

The backstory of the Bitcoin ordinal theory

The concept of Bitcoin Ordinals was introduced by programmer and artist Casey Rodarmor in something he called ‘Ordinal Theory’. Ordinal Theory proposes a logical ordering system to assign unique “ordinal numbers” to individual satoshis based on the order in which they were created on the blockchain. This gives each satoshi an individual identity.

The main idea is that by numbering satoshis, users can ‘subscribe’ arbitrary data such as images, videos, etc. to specific satoshis by linking this data to their ordinal numbers. This inscribed data essentially becomes a unique digital artifact or NFT on the Bitcoin blockchain.

Casey Rodarmor first published the white paper Ordinal Theory in January 2023, which laid out the technical details. He then launched the Ordinals protocol on Bitcoin’s mainnet on January 21, 2023, minting the very first Ordinal inscription.

The launch was made possible by previous Bitcoin upgrades such as Segwit in 2017 and Taproot in 2021, which increased the block size and the capacity to store arbitrary data on-chain. This paved the way for larger data loads, such as images, to be directly inscribed into Bitcoin transactions.

How Bitcoin Ordinal Numbers Work

Bitcoin Ordinals work by embedding additional data into Bitcoin transactions. This data includes the ordinal number, a unique identifier assigned to each satoshi. A satoshi is assigned a sequence number based on the order in which they were mined on the Bitcoin blockchain. For example, the first satoshi ever mined is assigned Ordinal #1, the second satoshi is #2, and so on. This numbering system allows each satoshi to be tracked and transferred uniquely, making them non-fungible.

Once satoshis are numbered, users can inscribe data such as images, videos, text, etc. onto specific satoshis by linking this data to their assigned ordinal numbers within a Bitcoin transaction. The inscribed data becomes a unique digital artifact, or NFT, linked to that specific numbered satoshi on the Bitcoin blockchain.

The technical process of inscription includes several steps:

- Data preparation: The data to be written is converted into hexadecimal format, interpretable as a Taproot script.

- Create taproot script: The hexadecimal data is wrapped in a Taproot script, a type of smart contract that can be executed on the Bitcoin blockchain. Taproot scripts enable complex conditions and operations.

-

Create transaction: Two transactions are created:

- Record transaction: This transaction contains a hash reference to the Taproot script (without revealing the entire script) and creates a Taproot output whose spending conditions are defined by the script.

- Reveal transaction: This transaction spends the output of the commit transaction by revealing the entire Taproot script, effectively writing the data into the satoshi.

- Broadcast transactions: The commit and reveal transactions are broadcast to the Bitcoin network’s mempool, awaiting confirmation from miners.

- Mining and confirmation: Once the transactions are mined and included in a block, the inscription becomes a permanent part of the Bitcoin blockchain, and the inscribed satoshi is now considered an Ordinal.

Important factors for this process are Segwit (Segregated Witness) and Taproot. Introduced in 2017, Segwit increased the block size limit from 1MB to 4MB and separated signature data from transaction data, allowing more transactions per block and discounting the weight of witness data for fee calculations. Taproot was activated in 2021 and removed the size limit for witness data, allowing more complex scripts to be included in transactions and introducing new scripting capabilities such as Schnorr signatures and Merkle tree abstractions.

Comparison with NFTs on Ethereum

Agreements

Uniqueness: Both Bitcoin Ordinals and Ethereum NFTs are designed to represent unique digital assets, so that each token is different and non-interchangeable.

Traceability: Both systems offer transparent ownership histories and transactions, allowing users to track the provenance and transfer of each unique digital asset on their respective blockchains.

Metadata: Both Bitcoin Ordinals and Ethereum NFTs can have associated metadata. These metadata increase their usefulness and value by providing additional information about the digital asset, such as descriptions, attributes, and links to off-chain data.

Differences

Complexity: Creating and managing NFTs on Ethereum is easier thanks to the blockchain’s built-in support for smart contracts and a well-developed ecosystem of tools and platforms. Bitcoin Ordinals, on the other hand, work directly on the Bitcoin base protocol and involve a more complex process of subscribing data to satoshis.

Storage method: Bitcoin Ordinal data (such as images or videos) is inscribed directly onto individual satoshis and permanently stored on the Bitcoin blockchain. This ensures that the data is immutable and completely decentralized. Ethereum NFTs typically store a credential or metadata on-chain, while the actual asset data is usually hosted off-chain on decentralized storage systems such as IPFS or centralized servers. This approach reduces on-chain storage requirements but relies on external data storage solutions.

Smart contract options: Ordinals work directly on the Bitcoin protocol without additional smart contract layers. This method lacks the programmability and flexibility of smart contracts, limiting the ability to implement features such as royalties or on-chain metadata updates, and integration with decentralized finance (defi) protocols.

Positives of Bitcoin Ordinal Numbers

Onchain data storage: Unlike traditional NFTs that store data off-chain, Ordinals record data directly and permanently on the Bitcoin blockchain, ensuring greater immutability and reducing reliance on external links or storage.

Security: By leveraging the robust security model of the Bitcoin network, the Ordinals are secure and resistant to tampering.

Compatibility with Bitcoin infrastructure: Ordinals are more easily compatible with existing Bitcoin wallets, exchanges and infrastructure, making them easier to manage and trade, ensuring liquidity.

Innovation: The development of Ordinals drives innovation within the Bitcoin ecosystem, potentially leading to new applications and use cases.

Negatives of Bitcoin ordinal numbers

Scalability issues: Bitcoin’s blockchain is not optimized for high-frequency transactions, which could limit Ordinals’ scalability. Increased interest and adoption of Ordinals could lead to congestion on the Bitcoin network, potentially increasing transaction fees and processing times.

Size restrictions: The Bitcoin blockchain has size limitations, limiting the amount and complexity of data that can be inscribed as ordinal numbers, potentially limiting their use cases.

Simple functionality: Unlike Ethereum NFTs, Ordinals do not support smart contracts, limiting their functionality in areas such as automatic royalty payments or advanced interactions.

Environmental problems: Like all Bitcoin transactions, creating and trading Ordinals requires energy-intensive mining, which adds to the environmental impact associated with proof-of-work blockchains.

High cost: The process of creating and transferring Bitcoin Ordinal NFTs can be costly due to the transaction fees associated with the Bitcoin network, making them inaccessible to some users.

What do you think of Bitcoin Ordinals? Share your thoughts and opinions on this topic in the comments below.