- BTC needs to break $66,000 for a bullish run.

- $5.64 billion in realized gains indicate strong market activity.

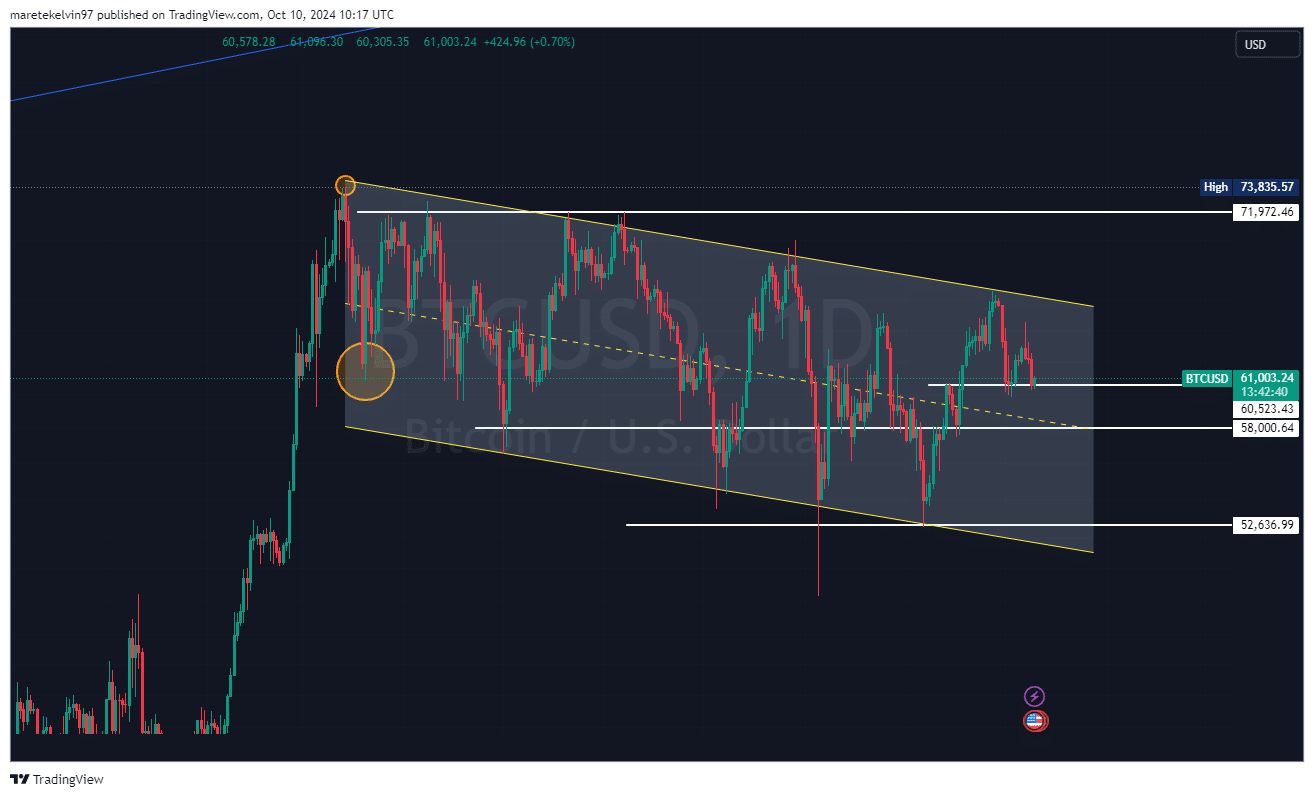

Bitcoin [BTC] continues to struggle within a descending parallel channel. From the optimism of a few days ago, it seems that there is no outbreak in sight.

After rejection at the upper limit, BTC could be headed for lower levels unless it hits one key price level.

THIS indicates a more bearish run

BTC’s last price encountered resistance and was rejected from the upper limit of the descending parallel channel at 66K.

The rejection at the upper limit brings into view the middle limit of the channel, which is at $58,000, or in the worst case even the lower limit at $52,000.

Source: TradingView

Market participants looking for a breakout in the direction of the bulls will need to see BTC close above $66,000 – a price resistance level that has proven to be formidable.

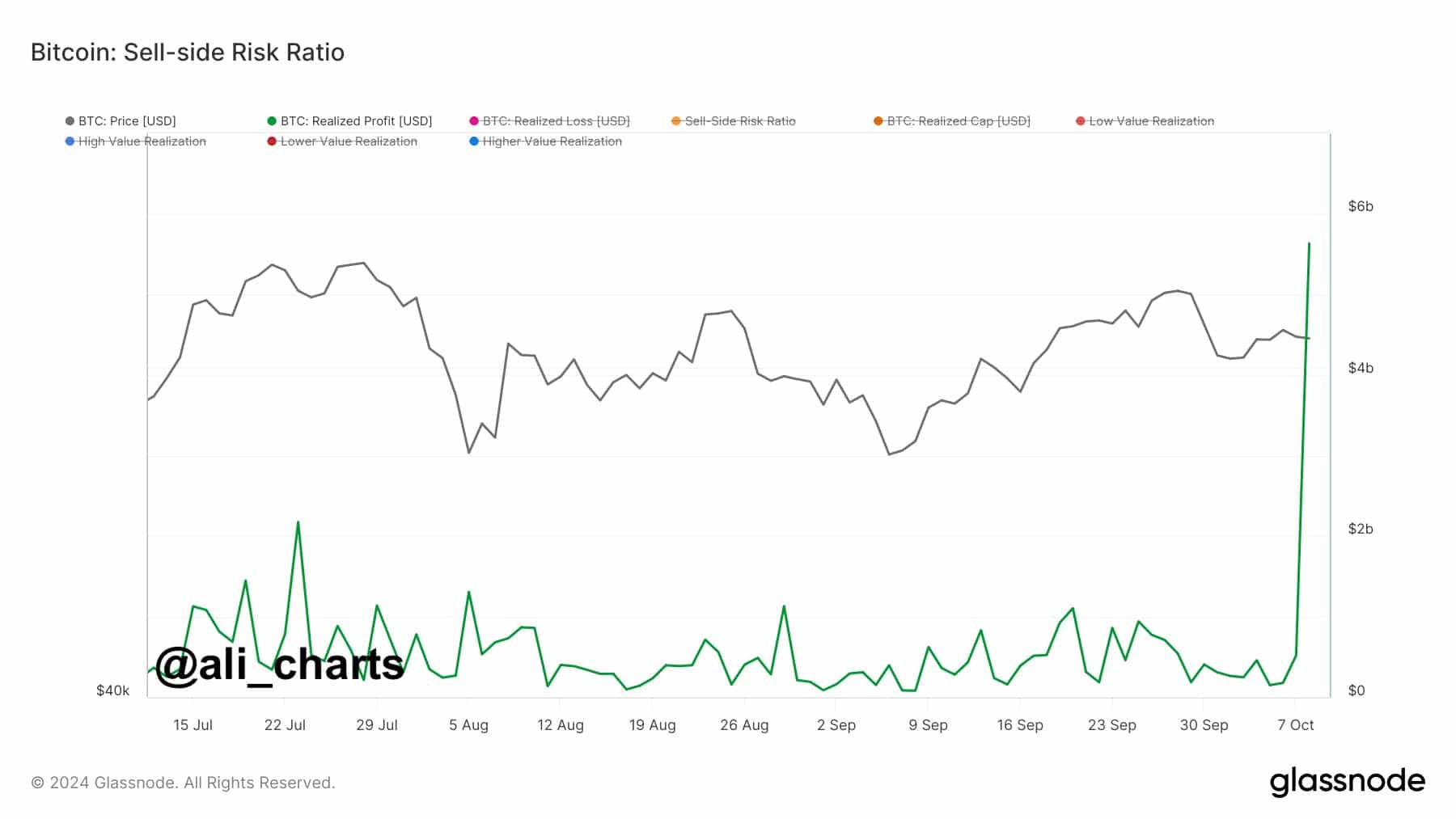

Realized profits stimulate market activity

The Bitcoin market is still so active. Based on the last 24 hours’ performance alone, the recorded profit of $5.64 billion was a key indicator of large-scale profit taking.

The rebound signals that investors are making money, which will likely create downward pressure in the near future.

Source:

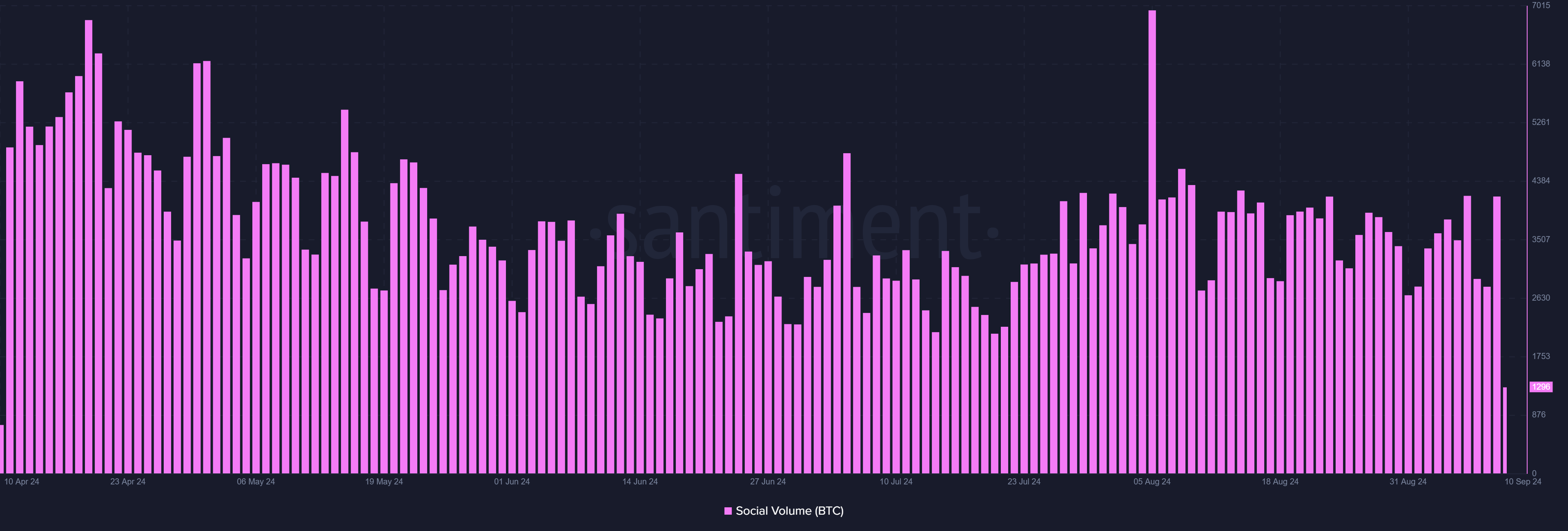

Bitcoin social sentiment is spiking

In addition to the aforementioned statistics, social sentiment surrounding BTC has also exploded in recent times, according to data from Santiment.

Much of the fuss could be due to new speculation about Satoshi Nakamoto, the mysterious creator of Bitcoin.

While a jump in Bitcoin’s social sentiment could fuel short-term volatility, the chances of sustaining a long-term price increase without first getting above $66,000 are minimal.

Source: Santiment

Read Bitcoin’s [BTC] Price forecast 2024–2025

While realized gains and social sentiment indicate a vibrant market, the technical outlook for BTC remains unclear. The $66,000 mark is the key level to watch for a breakout.

Until then, market participants should prepare for possible drops to $58,000 or even $52,000.