This article is available in Spanish.

US institutions are causing ripples in the cryptocurrency market as they have invested a whopping $13 billion in spot Bitcoin ETF shares since its inception in January 2024. Many people are surprised by this move, as traditional financial institutions were initially hesitant to enter the world of digital technology. assets.

Related reading

According to Ki Young Ju, CEO of CryptoQuant, 1,179 institutions currently own a total of 193,064 BTC, indicating a major shift in opinion towards crypto investments.

Institutional adoption is growing

The adoption of Bitcoin ETFs by the US Securities and Exchange Commission (SEC) has contributed significantly to the spike in institutional interest. This regulatory approval has created new opportunities for financial institutions to offer cryptocurrency investments, allowing them to tap into more revenue streams.

US Institutional Ownership #Bitcoin Spot ETFs are around 20%, with asset managers holding 193,000 BTC (according to Form 13F filings). pic.twitter.com/9YTOEH3G5w

— Ki Young Ju (@ki_young_ju) October 22, 2024

Big piece of the pie

Interestingly, major players such as Millennium Management and Jane Street now control more than 20% of the total market through various channels Bitcoin ETFs worth approximately 961,645 BTC. This rapid absorption immediately shows that the money concerns associated with digital currencies were short-lived.

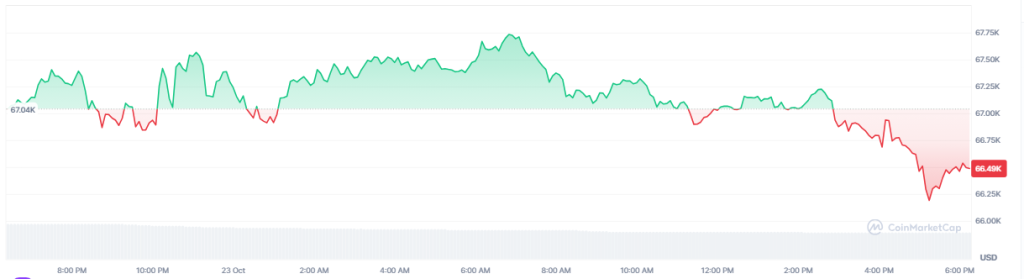

Analysts believe that the more companies engage in Bitcoin ETF, the price will continue to rise. Still, Bitcoin’s current price is around $67,000 and will likely rise to $100,000 by early 2025 based on past trends, but more importantly how people’s thinking is changing towards embracing Bitcoin as a legitimate investment category.

Options trading approved

Another major turning point came when the SEC recently approved options trading for spot Bitcoin ETFs on NYSE American LLC and CBOE. This implies that institutional investors can now effectively reduce their debt using conventional financial instruments Bitcoin exposure.

There has been a big change for institutional buyers as they can now trade options on these ETFs. Not only does it make Bitcoin easier to use, but it also makes it more like regular banking. Now that options trading is possible, experts believe more institutional buyers will enter the Bitcoin market.

The ability of institutional investors to trade ETF options is turning point. Bitcoin is becoming increasingly accessible and integrated into standard banking. Now that options trading is possible, experts expect more institutional investors to join Bitcoin.

Related reading

A bright future ahead

Bitcoin and its ETFs appear to have a promising future. Institutions’ continued involvement in this asset class is expected to have a beneficial impact on other digital assets. The SEC’s regulatory system provides a layer of protection that many investors appreciate. This clarity could lead to greater participation from traditional financial institutions, strengthening Bitcoin’s position in the investment world.

Overall, the combination of institutional demand and government support suggests that Bitcoin is more than a passing fad; it is becoming an essential part of the modern financial world. As time goes on, it will be interesting to see how this changing landscape affects both the digital currency market and broader economic trends.

Featured image of StormGain, chart from TradingView