Bloomberg analyst Eric Balchunas has done just that reduced the odds of the SEC rejecting a Bitcoin ETF are just 5%, with fellow Bloomberg reporter James Seyffart indicating only black swan interventions from Gary Gensler or the Biden administration are possible routes to denial.

Interestingly, over the weekend when traditional markets were closed, crypto continued to trade as usual, with Bitcoin trading sideways and the rest of the market recording a significant sell-off. Bitcoin traded between $43,500 and $44,400, with a swing of just 2%. At the time of writing, the largest digital asset by market capitalization is in the middle of this range, at $44,000 per month. CryptoSlate facts.

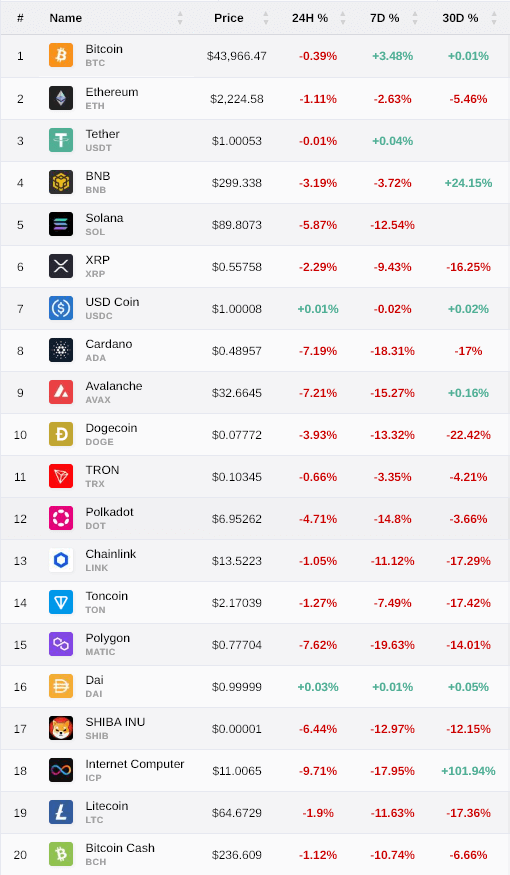

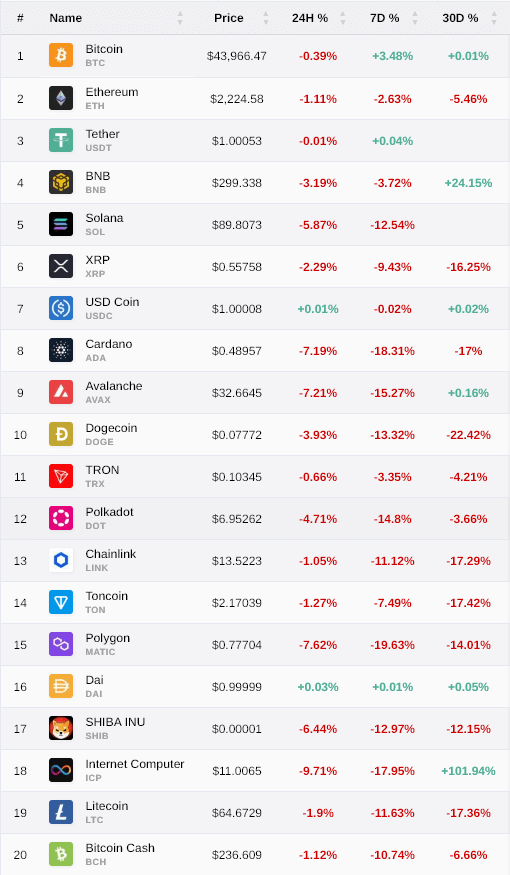

However, altcoins such as BNB, Solana, Cardano, Avalanche, Dogecoin, Polkadot, Polygon, Shiba Inu and ICP are all down at least 3% and as much as 9.7% at the time of writing.

The most resilient altcoins appear to be Ethereum,

Since Saturday, January 6, Bitcoin’s dominance has increased by 1.5%, reaching a peak of 54% before rebounding slightly this morning. This signals the leading digital asset is strengthening its position in the market ahead of a potential milestone approval this week.

One of the biggest losers of the weekend, Solana, fell as much as 13% against Bitcoin this weekend and is still down around 9%. Solana peaked at $126 on December 26, 2023, but has fallen 28% in the 13 days since to trade at $90 at the time of writing.

Bitcoin has recovered from its cycle low of 38% dominance in the crypto market in mid-2023, to claw back to 54% on the hype of a potential spot Bitcoin ETF. This 39% increase puts its dominance at the highest level since April 2021, wiping out all the ground the rest of the altcoin market built up on the asset during the last bull run.

Since Ethereum’s launch in 2015, Bitcoin’s dominance peaked at 75% in early 2021 before falling dramatically during the bull market, eventually trading within the 39% to 48% range for about 760 days. However, over the past two Bitcoin halves, BTC’s dominance has consistently declined, dropping 64% and 38% respectively, marking a low after about 510 days.

Most interestingly, as shown by the indicator at the bottom of the chart above, Bitcoin’s dominance has had a near-perfect correlation with Bitcoin’s price since early 2023, the longest period of correlation since Ethereum entered the market.

This week will be one of the biggest ever for Bitcoin as all eyes are on the Bitcoin ETF approval process. Either way, a decision will certainly have an effect on the entire market, with volatility expected across the board.