According to several crypto analysts, altcoins are showing a remarkable breakthrough, indicating a possible shift towards an altcoin-dominated market phase.

Analysts noted that the overall market capitalization of altcoins is rising, breaking long-standing downward trends. Technical and chain analyst Ali Martinez noted that while it is uncertain whether a full-fledged altcoin season has arrived, current developments represent a promising start.

Analyst Caleb Franzen shared insights that measured altcoins through TradingView indexes such as TOTAL.3 and OTHERS surpassed significant moving averages, especially the 100-day and 200-day exponential moving averages (EMAs). Franzen emphasized that the last such outbreak occurred in July 2023, during which altcoins used these EMAs as dynamic support to reach higher highs. He emphasized the importance of monitoring daily closures to confirm this trend.

Nine-tropical too pointed out the cyclical nature of the crypto market, which suggests that altcoins typically follow Bitcoin’s bullish momentum, often entering a powerful phase once Bitcoin breaks its all-time high and enters uncharted territory. The analysis indicates that after several instances since May where Bitcoin boomed without causing an altcoin season, current indicators are showing a simultaneous rebound in both the Bitcoin and altcoin markets.

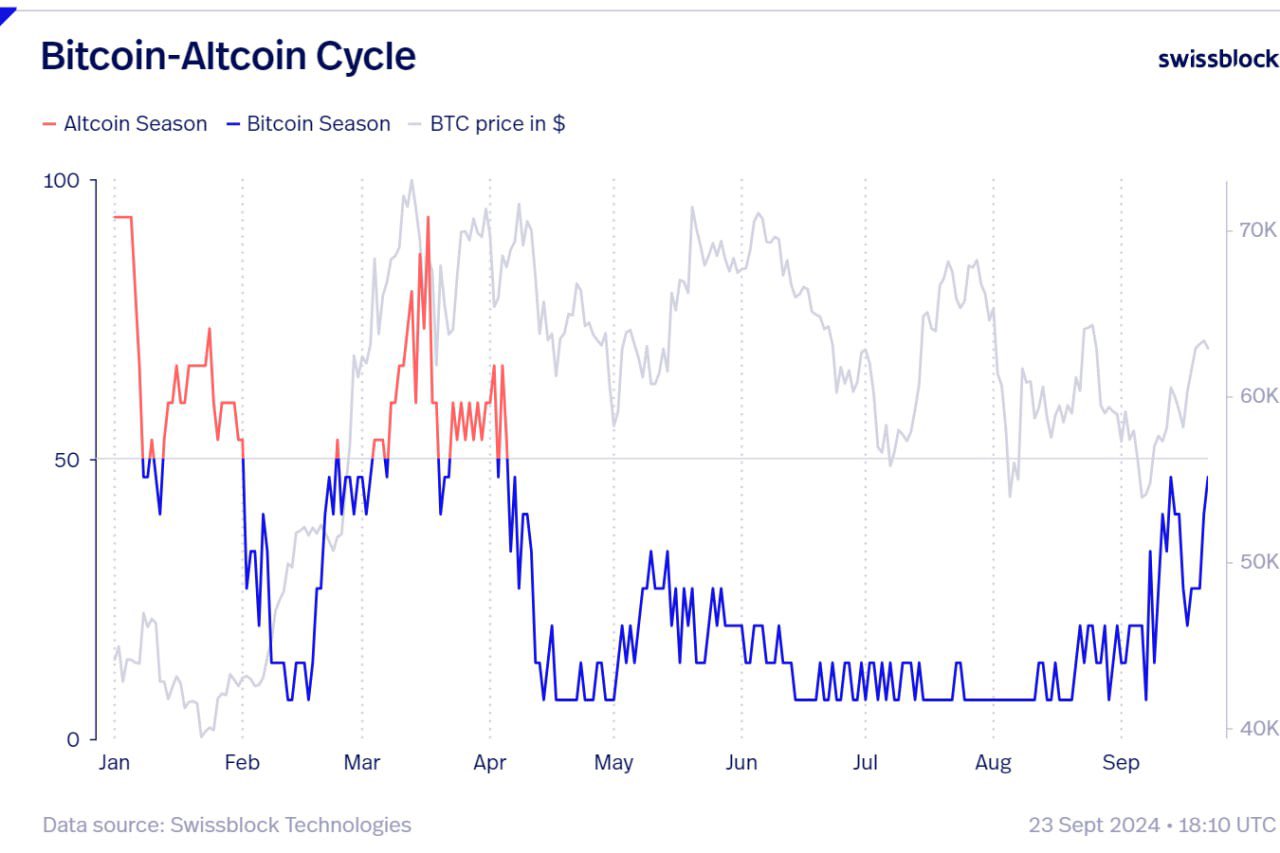

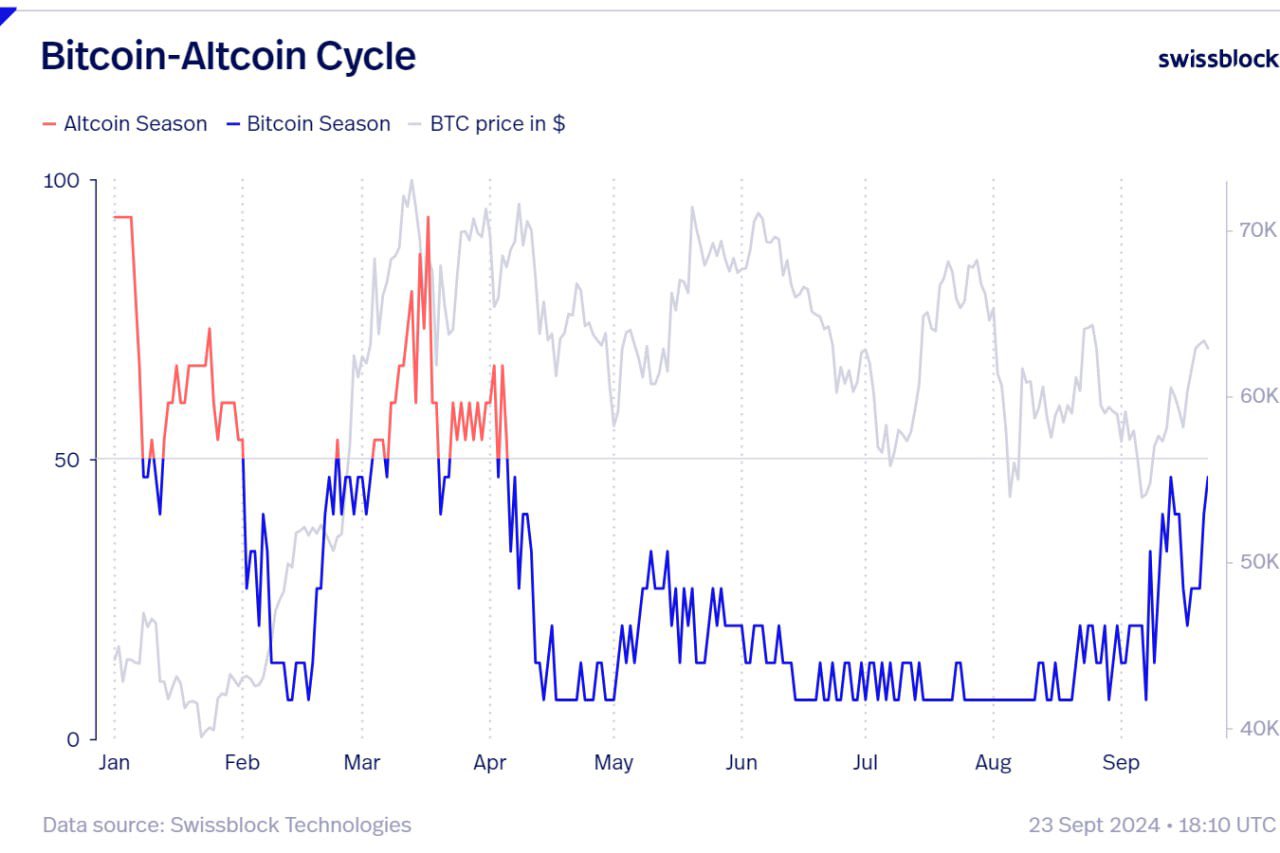

The Bitcoin-Altcoin Cycle chart from Swissblock Technologies illustrates this relationship. The chart shows the inverse dynamics between Bitcoin and altcoin seasons throughout the year. When the Altcoin Season Index is high, Bitcoin dominance tends to be lower, and vice versa. Currently, the index suggests that altcoins are gaining strength alongside Bitcoin rather than lagging behind as in previous cycles.

The Bitcoin season has so far been in the shadow of the altcoins in 2024

Despite these positive signs, it is important to take the broader market context into account. Over the past nine months, altcoins have generally underperformed Bitcoin in terms of price recovery and proximity to their all-time highs. Bitcoin is trading around $64,334, about 12.77% below the ATH of $73,750 reached in March 2024. Many altcoins, on the other hand, remain significantly below their peak prices. For example, Dogecoin is about 86.12% below its ATH, Cardano is down 89.22%, and Polkadot is down 92.49% from its high.

This disparity suggests that while Bitcoin has regained much of its value, altcoins have struggled to recover to the same extent. Factors contributing to this performance gap include increased regulatory scrutiny impacting smaller cryptocurrencies, the maturity of Bitcoin’s market providing resilience during volatility, and increased institutional interest that primarily benefits Bitcoin.

The current breakout in the altcoin markets could signal a change in this trend. If altcoins continue to build on this momentum, it could lead to a more balanced recovery in the broader crypto market.

Currently, Bitcoin’s dominance stands at 57%, down slightly from 58.6% on September 19. It reached its lowest level on September 10, 2022 at 38.9%, and has risen steadily over the past two years. Over the past five years, the highest rate reached was 72% at the top of the 2019 and 2021 bull runs.

Top tier 1 crypto assets

Top tier 1 crypto assets