- Bitcoin dominance probably needs to be between 62% and 70% for an altcoin season to begin.

- However, there are also additional issues related to various metrics that require serious attention.

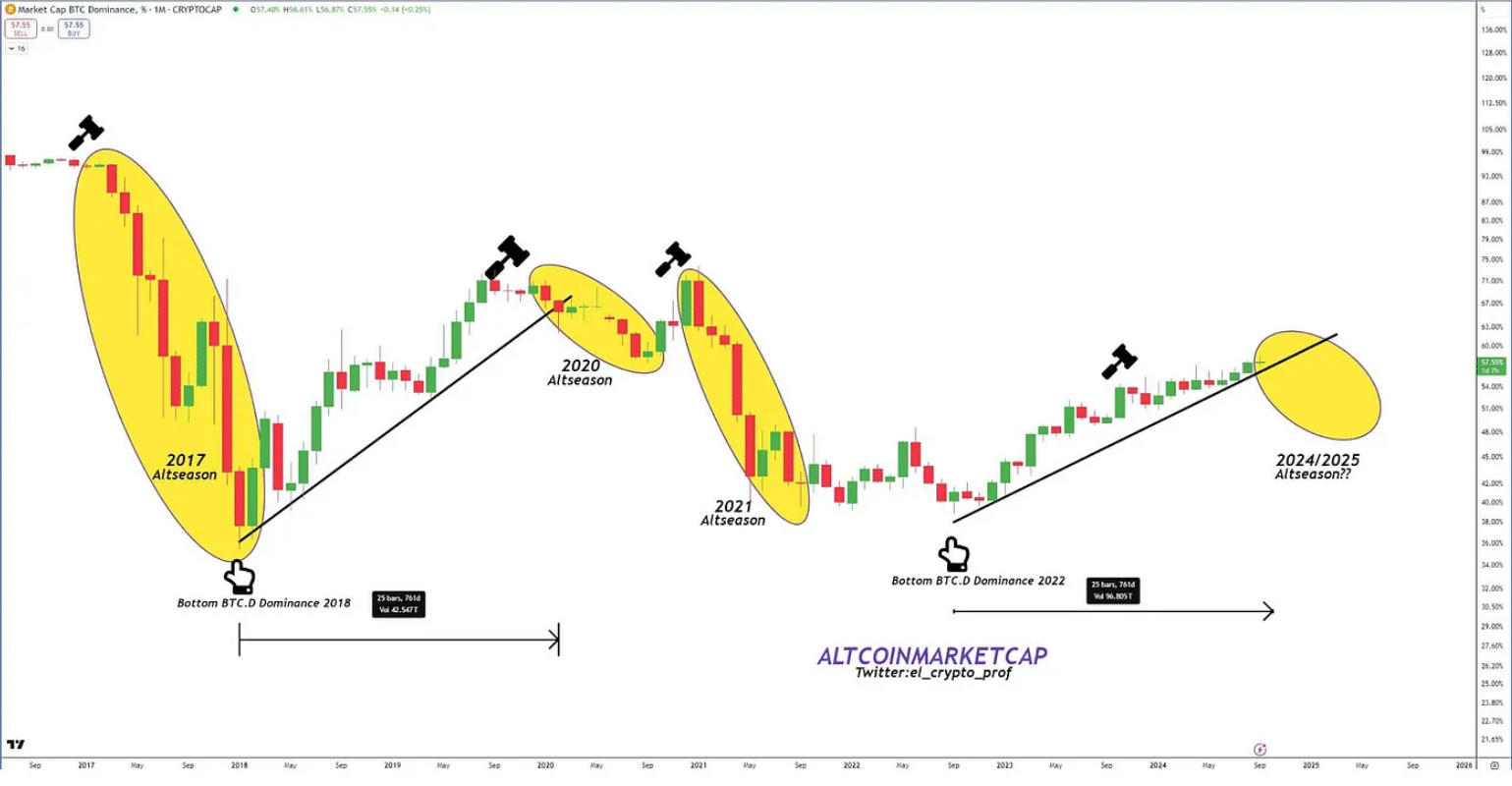

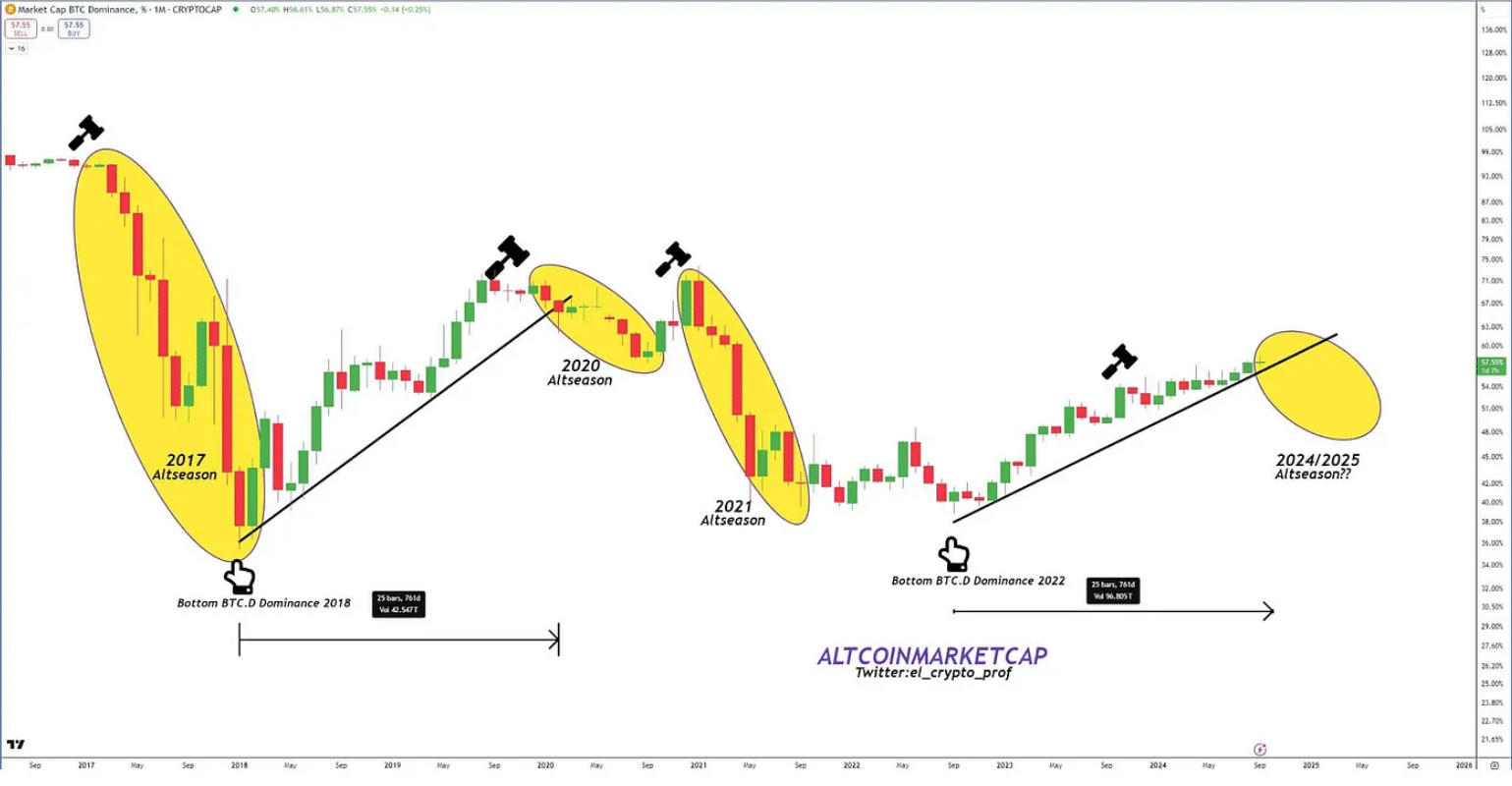

Market sentiment was generally bearish for altcoins in the third quarter, with Bitcoin [BTC] dominance rises to about 57%, a new all-time high. The Altcoin Season Index is currently at 35, after reaching its lowest point in mid-August.

Typically, altcoins perform well after Bitcoin’s dominance peaks. Because Bitcoin captures market share early in a cycle, capital often shifts to altcoins once BTC’s dominance begins to fade. This cycle benefits altcoins as investors look for higher risk, higher reward assets.

From a statistical perspective, Bitcoin’s market cap would need to grow by about $280 billion to fall into the 62%-70% range for an altcoin season to kick off. This growth will likely occur when BTC reaches $80,000, among several other metrics.

High Bitcoin dominance is crucial

Over time, Bitcoin’s dominance has declined significantly, from 90% in 2013 – when the market was in its infancy – to a low of 39% in 2021, as altcoins began to gain popularity.

Source:

Notably, each altcoin season is driven by specific catalysts, such as the launch of new cryptocurrencies, technological innovations such as ERC-20 tokens, and broader trends such as DeFi and NFTs.

This suggests that in addition to Bitcoin’s market share, individual contributions from altcoins will also play a crucial role in fueling the next altcoin season.

Currently, altcoin market holdings are too limited to ride a season independently, as altcoin losses often depend on Bitcoin returns for stability. For a shift to occur, Bitcoin would likely have to lead the way with an initial surge.

This trend suggests that Bitcoin’s price may need to exceed $80,000 to achieve a BTC dominance of over 65%, which could trigger significant capital inflows into the altcoin market.

Need for a high risk appetite

In a recent one reportAMBCrypto highlighted an emerging shift in the altcoin market and called for strategic actions from Ethereum developers to combat growing competition.

Internally, this requires careful assessment, while externally, Bitcoin’s appeal suffers from a larger risk deficit, indirectly hindering altcoins from gaining their due momentum.

Source: xe.com

With gold prices reaching new highs driven by interest rate cuts and geopolitical tensions, Bitcoin’s stagnant performance underlines the limited market risk appetite for crypto.

Historically, an upward trend in the BTC/Gold ratio has aligned with altcoin season. Therefore, the current decline in risk appetite is negatively impacting altcoin performance, suggesting that a rising BTC/Gold ratio could serve as a signal of more favorable conditions in the future.

In short, as BTC undergoes a pullback, the declining BTC/Gold ratio reflects an investor shift towards perceived safe-haven assets, undermining Bitcoin’s appeal as a long-term store of value.

This migration underlines the importance of market confidence in BTC’s role as ‘digital gold’ to support a broader altcoin rally – one that will likely stabilize once BTC approaches the $80,000 mark.

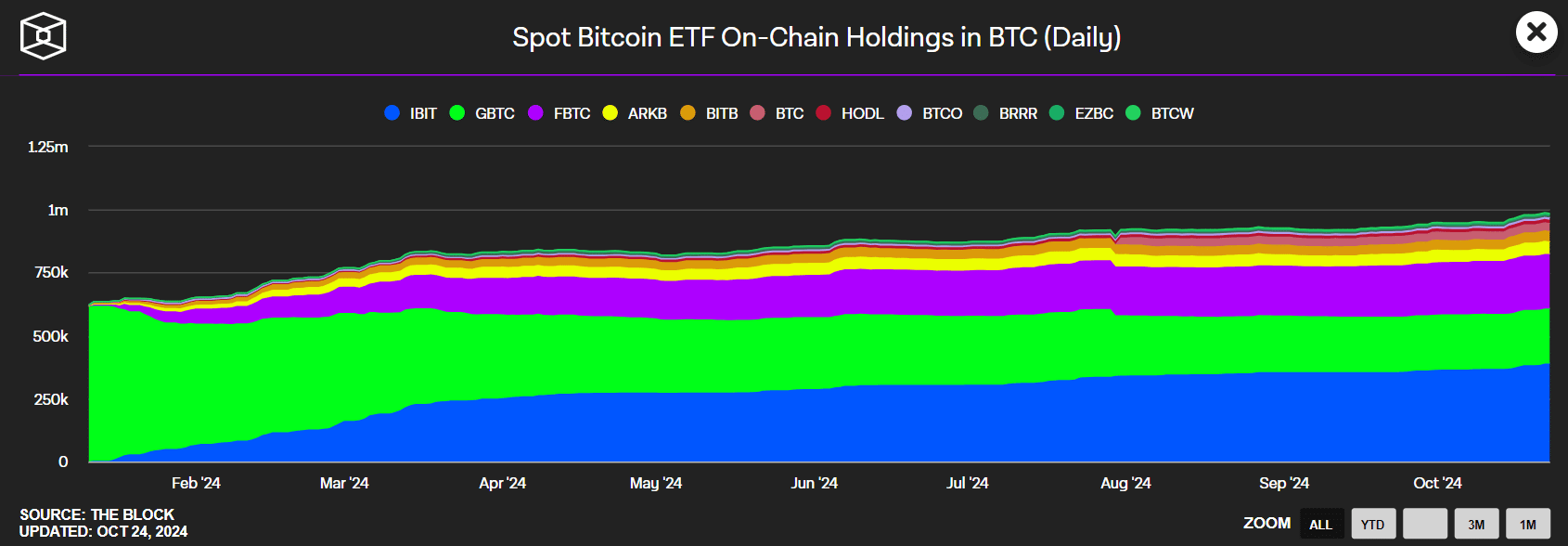

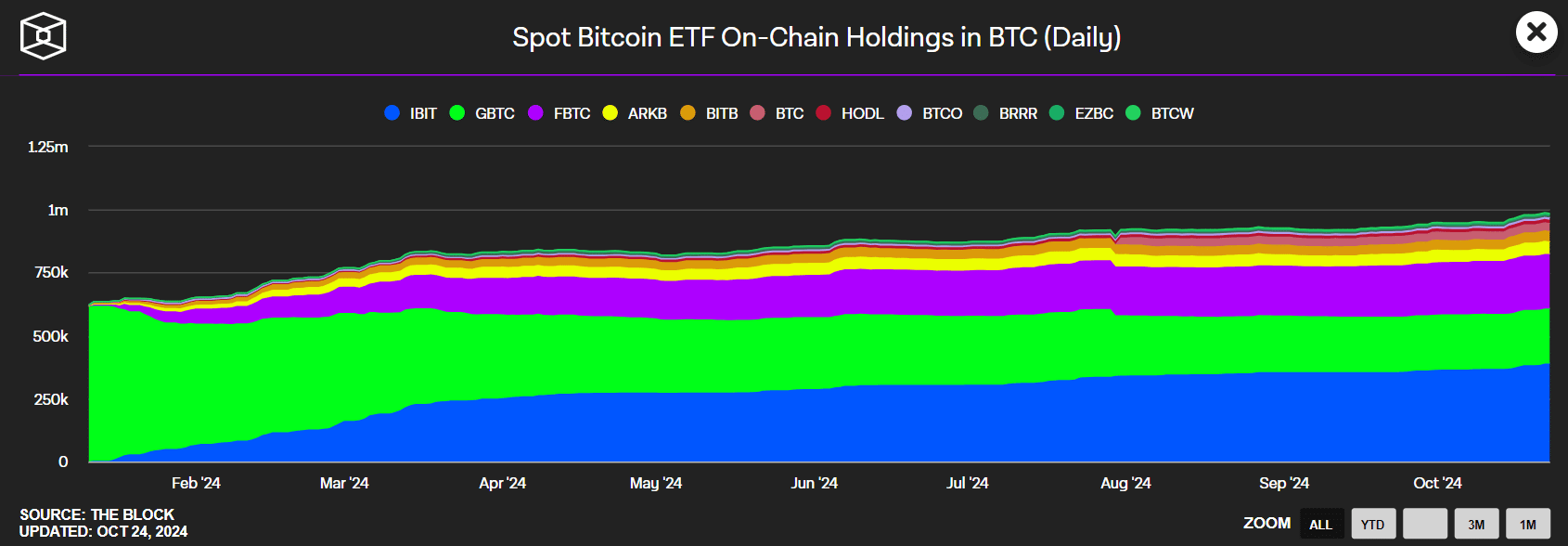

Less ETF-driven momentum

Another factor is the relationship between the price increase of Bitcoin and ETFs. While ETF-driven rallies are generally positive, the impact on altcoins can vary. The ETF market has experienced significant growth in 2024.

Source: Het Blok

However, when ETFs lead the market momentum, funds tend to stay within Bitcoin or Ether rather than turning into altcoins, as regular investors often have limited direct access to them. Instead, capital will likely flow into crypto-related stocks.

Read Bitcoin’s [BTC] Price forecast 2024-25

As a result, a combination of internal and external factors continues to delay the start of the altcoin season, which remains closely tied to Bitcoin’s price performance.

To make altcoin season a reality, Bitcoin would likely need to cross $80,000, a threshold that could be challenging to reach by the end of the fourth quarter given current dynamics.