- Altcoin could have the potential to reach the $0.46 level if bullish sentiment remains unchanged

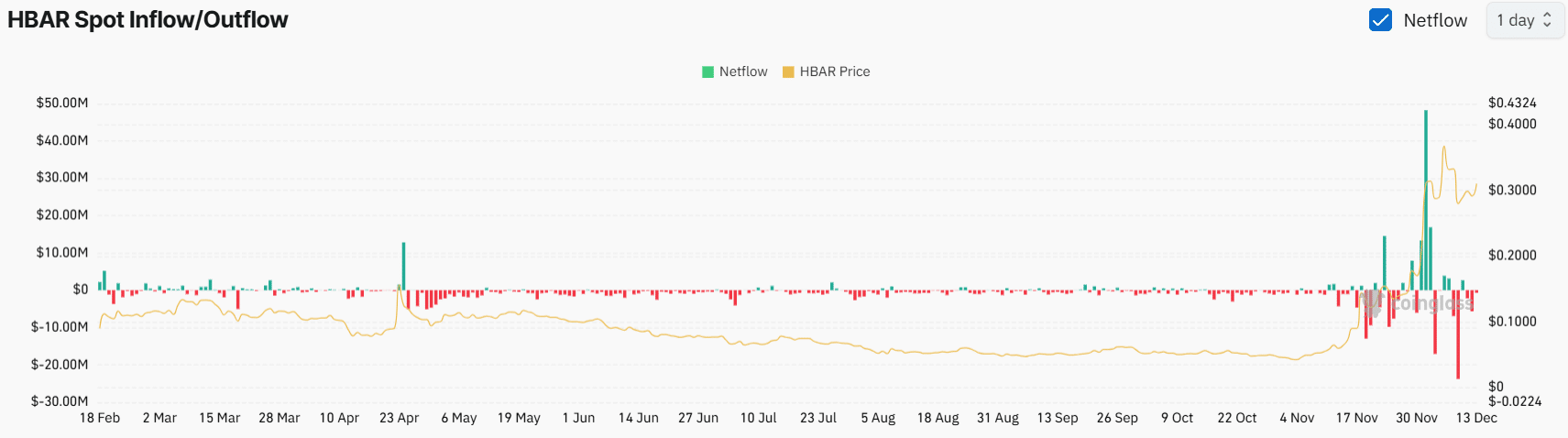

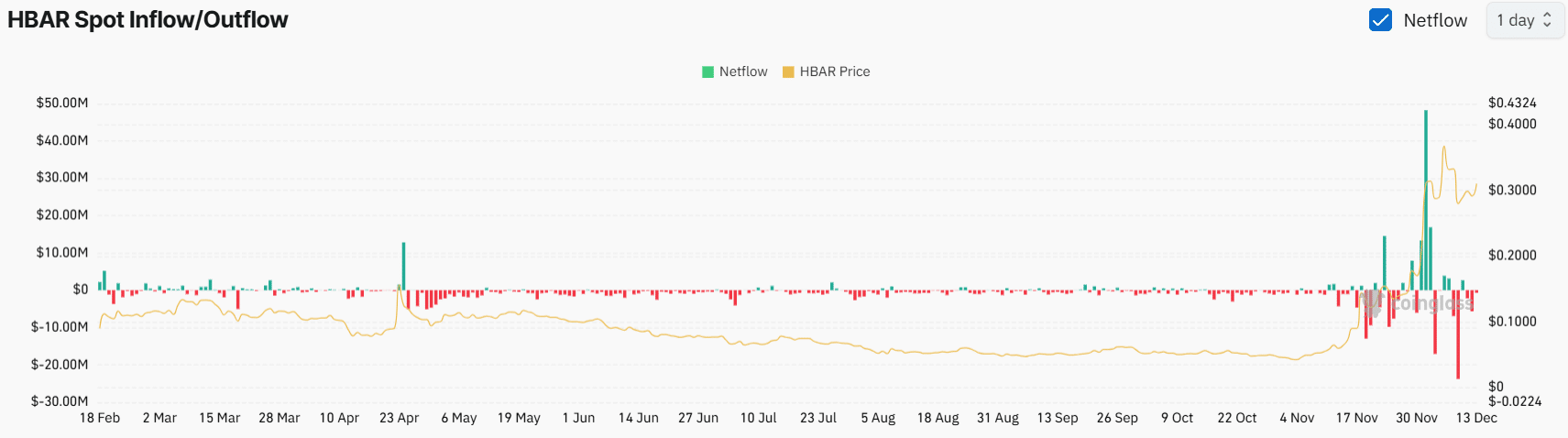

- HBAR’s spot inflows/outflows showed that the exchanges have seen outflows worth $11 million

HBAR, the utility token of the Hedera Network, could be poised for notable upside momentum as it neared a bullish break on the charts.

In recent days, HBAR has attracted the attention of many crypto enthusiasts due to its impressive performance. Meanwhile, the recent price action suggested that this upward rally is also likely to continue.

HBAR technical analysis and key levels

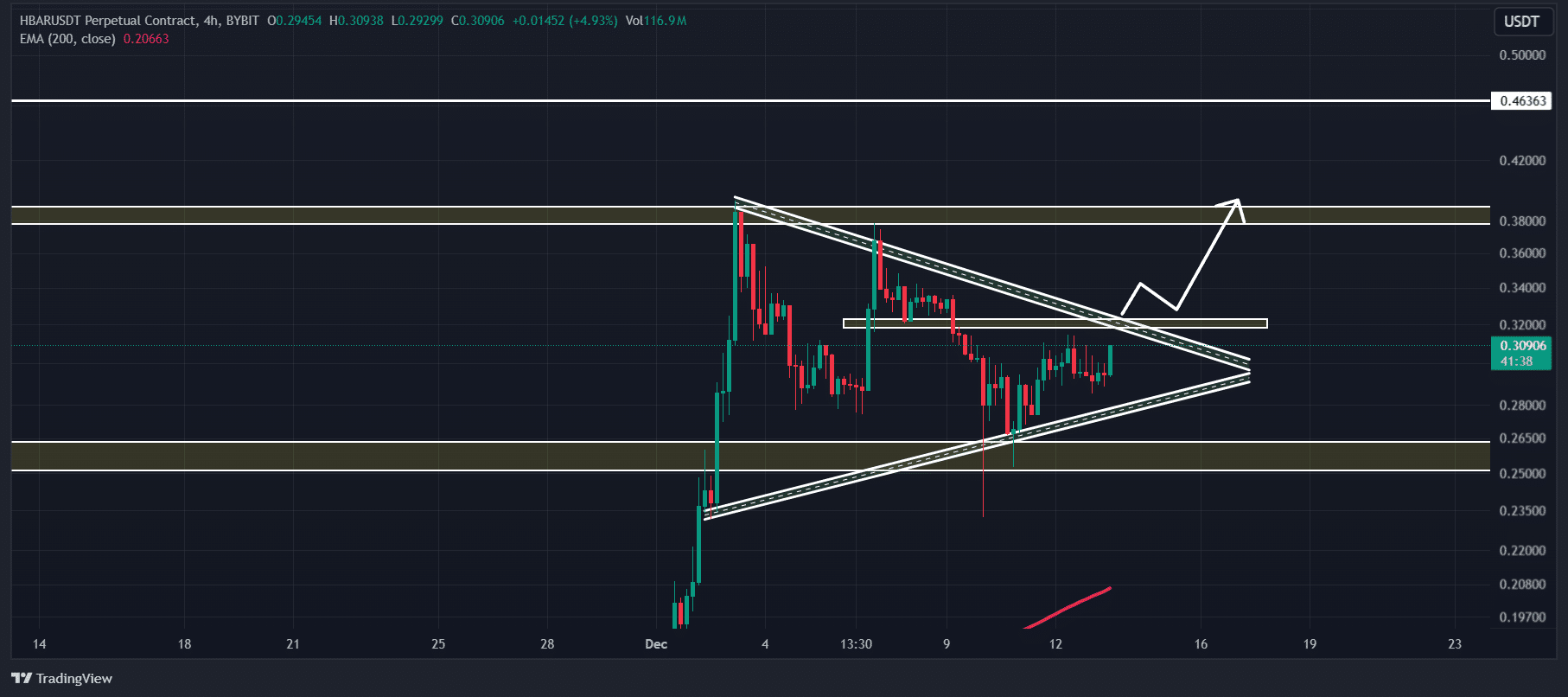

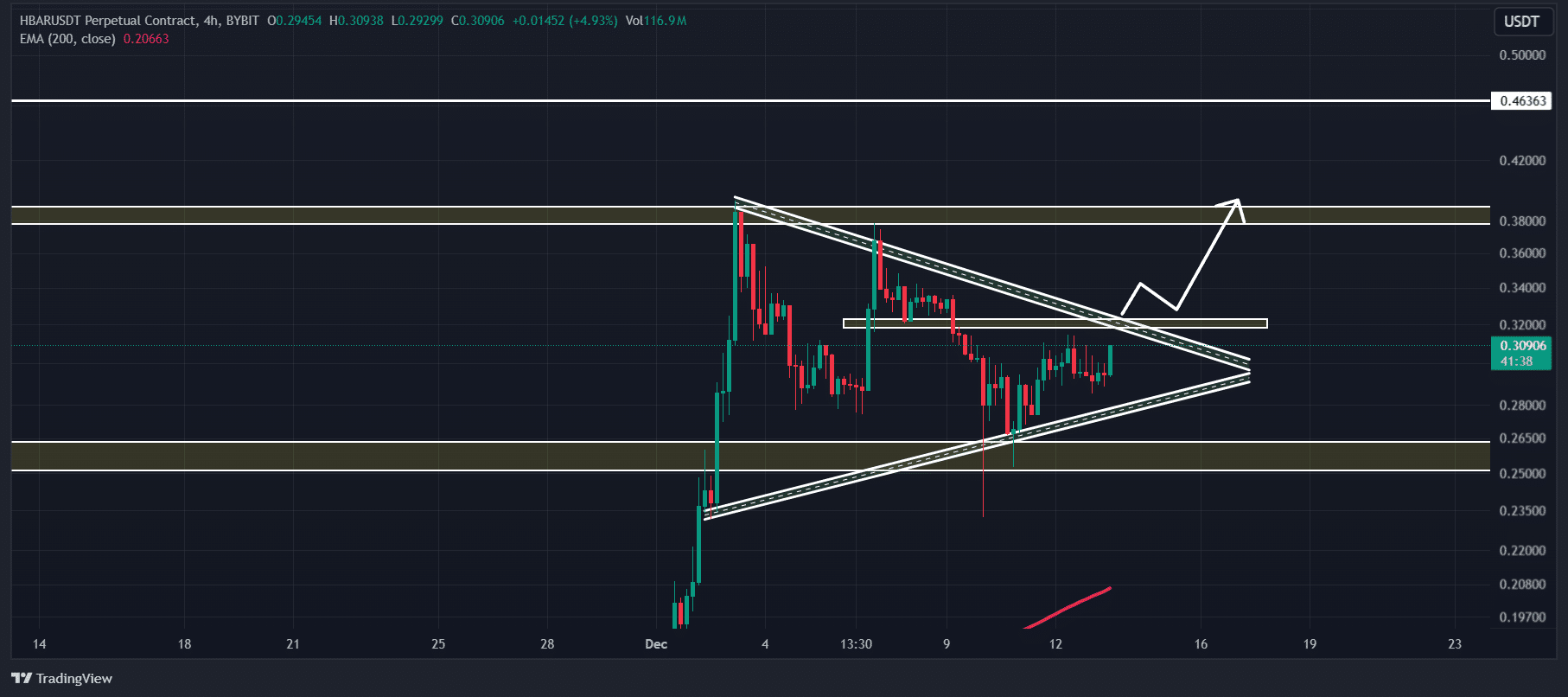

According to AMBCrypto’s technical analysis, HBAR appeared to be on the verge of breaking out of the symmetrical triangular price action pattern over the four-hour time frame.

Although the altcoin was trying to break this pattern at the time of writing, it also seemed to be struggling.

Source: TradingView

Based on the recent price action, if HBAR successfully breaks out and closes a four-hour candle above $0.328, there is a high chance that the price could rise 20% to reach the $0.40 level in the near future.

Moreover, if the market sentiment of the altcoin remains unchanged, there is a high chance that the altcoin could rise further by 20% to reach the $0.46 level.

On the upside, HBAR’s Relative Strength Index (RSI) recorded a reading of 57, below the overbought zone. This indicated that the asset still has significant potential to rise in the coming days.

Bullish statistics in the chain

This bullish technical analysis on a smaller time frame appeared to have piqued the interest of long-term holders in HBAR, according to on-chain analytics firm Coinglass. Spot inflow/outflow data from HBAR shows that the exchanges have seen significant outflows of $11 million.

Source: Coinglass

On the contrary, on-chain metrics suggested that long-term holders have remained neutral despite Tuesday’s sharp price drop. In fact, they seemed to be collecting tokens.

In addition to long-term holders, traders also seem interested in the altcoin, Coinglass shows. HBAR’s long/short ratio stood at 1.005 at the time of writing, underscoring strong bullish sentiment among traders.

When these on-chain metrics were combined with technical analysis, it was found that bulls have strongly dominated the asset. This could help HBAR overcome the hurdles in its path.