- SEC approval could come at a good time for Bitcoin

- Markets are anticipating significant movements in BTC price charts

If you are an avid follower of the crypto market, chances are you have heard of Bitcoin [BTC] spot ETF in recent days.

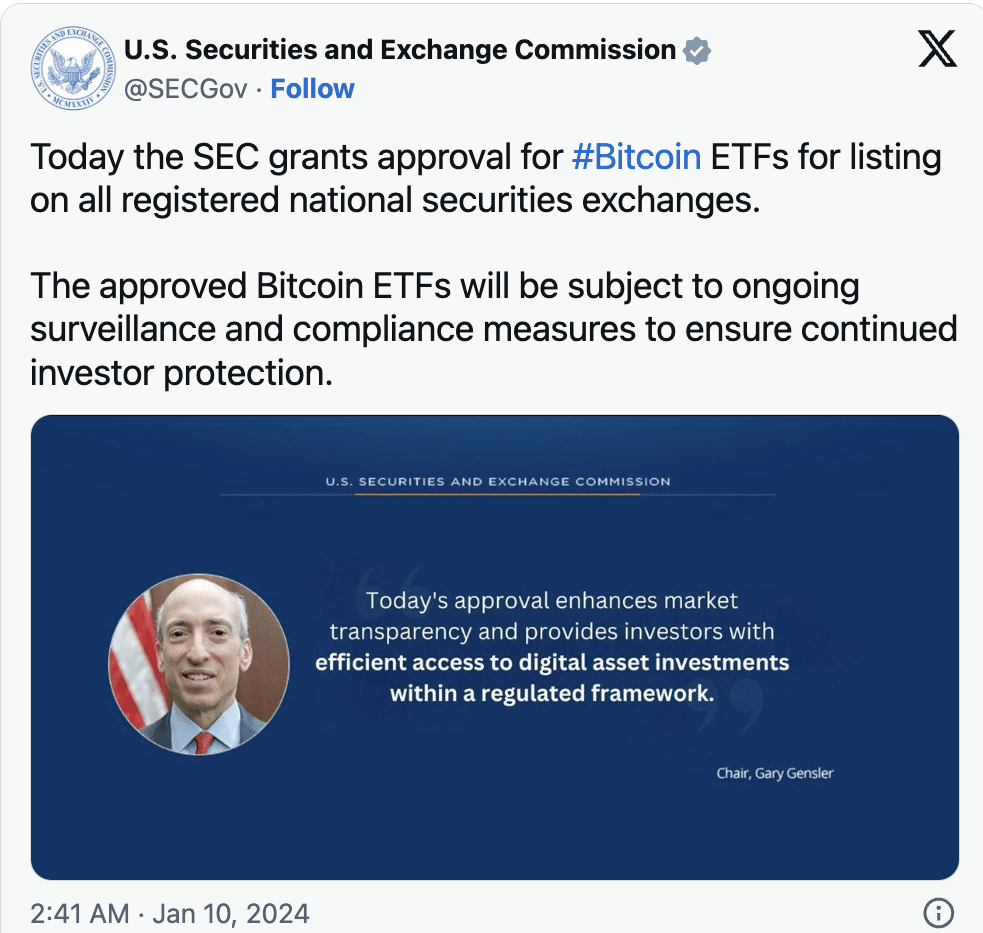

Do you already know the interesting part? You are not alone, as AMBCrypto noticed that many market participants were on the edge of their seats waiting for the resolution of the long-standing issue. In fact, the extent of the market’s suspicions is so great that someone actually hacked into the SEC’s official Twitter account to push out fake approval news. This was later refuted by SEC Chairman Gary Gensler.

Crypto analysis tool Santiment also shared a similar view via its post on X. According to Santiment, players are excited that the US SEC would say “yes” to the numerous applications.

As a result, the discussion surrounding Bitcoin ETFs rose to its highest point since October 17, 2023.

The potential #BitcoinETF approval is seemingly at all #crypto the spirit of community as $BTC has risen above $46.1K for the first time since April 2022. The broad expectations assume that #ETF applications will be approved simultaneously, which would happen immediately

(Continued)

pic.twitter.com/60fc77UUp8

— Santiment (@santimentfeed) January 8, 2024

HODLers are making more profits, are more on the way?

Besides the chatter about the development on many platforms, participants are also keeping a close eye on the price of BTC. At the time of writing, Bitcoin was changing hands at $46,540 on the charts.

The price of the coin briefly exceeded $47,000 a while ago, after many reports emerged that several spot ETFs would receive approval from the SEC.

However, despite the price increase, there is talk in some quarters that Bitcoin is not priced in yet. Some comments on social media also noted that the announcement, if ultimately made, would move mountains for Bitcoin’s price.

The movement also influenced the Realized Cap. The Realized Cap measures the cost of acquiring Bitcoin from the last time it was traded on-chain.

According to e.g Glass junctionBitcoin’s realized limit rose to $436 billion and was 7% away from the All-Time High ATH.

Source: Glassnode

The Realized Cap move, along with the price of BTC, helped Bitcoin holders’ gains. In fact, based on data from IntoTheBlock, more than 90% of Bitcoin addresses were profitable at the time of writing.

Should Bitcoin reach $50,000, as some analysts predict post-ETF, this percentage could rise to 95%.

With Bitcoin quickly moving past $46,000, more than 90% of all BTC addresses are now profitable. pic.twitter.com/GGchdT0yOl

— IntoTheBlock (@intotheblock) January 9, 2024

Pay attention to the spot volume and OI

AMBCrypto continued to assess trader sentiment regarding the potential approval of the spot ETF. At the time of writing, the funding rate was 0.01%, according to on-chain data from Santiment.

The Financing rate is the cost of maintaining an open position on the derivatives market.

Since the metric was positive, it means that the perp price recorded a premium compared to the spot price.

Furthermore, while BTC’s price stalled, the positive funding rate indicated that long positions were aggressive. However, they have not yet been rewarded for their positions.

Source: Santiment

The reasonable inference here is that Bitcoin had turned bearish and could contribute to the backlash. But the tides can change for the price depending on the Open Interest (OI) and spot volume.

Read Bitcoin’s [BTC] Price forecast 2024-2025

If OI and spot volume increase and there is approval from the SEC, Bitcoin will exit its bearish position.

In this case, the potential price increase of up to $50,000 could become a reality.