- Bitcoin’s average number of daily transactions rose to 522,000 in September.

- The reserve risk indicator suggested that the price of BTC was at a market bottom.

Investors continued to monitor the situation closely Bitcoins [BTC] price, which one remained above the $26,000 mark at the time of writing. Additionally, on September 28, Messari posted an analysis highlighting the king coin’s performance on multiple fronts in recent weeks.

Check out our latest Bitcoin Brief on all things BTC, including the latest news on Runes, Grayscale and MicroStrategy. https://t.co/GucLHkmpPg

— Messari (@MessariCrypto) September 28, 2023

Read Bitcoins [BTC] Price prediction 2023-24

SEC and Bitcoin

Messari’s report started with highlights from the ETF and SEC episodes. For the uninitiated, a federal judge ordered the SEC to review Grayscale’s request for a spot Bitcoin ETF on August 29. This incident caused BTCThe price of Bitcoin will rise as the prospects for a Bitcoin spot ETF increase.

However, the price increase was transitory as the price fell back to previous levels in just two days.

While this was happening, MicroStrategy, one of the largest BTC holders, increased its accumulation. According to an SEC filing filed on September 25, MicroStrategy had nearly 5,445 Bitcoin stored for $147 million, increasing the company’s total BTC holdings to 158,245 BTC.

Bitcoin’s network activity is commendable

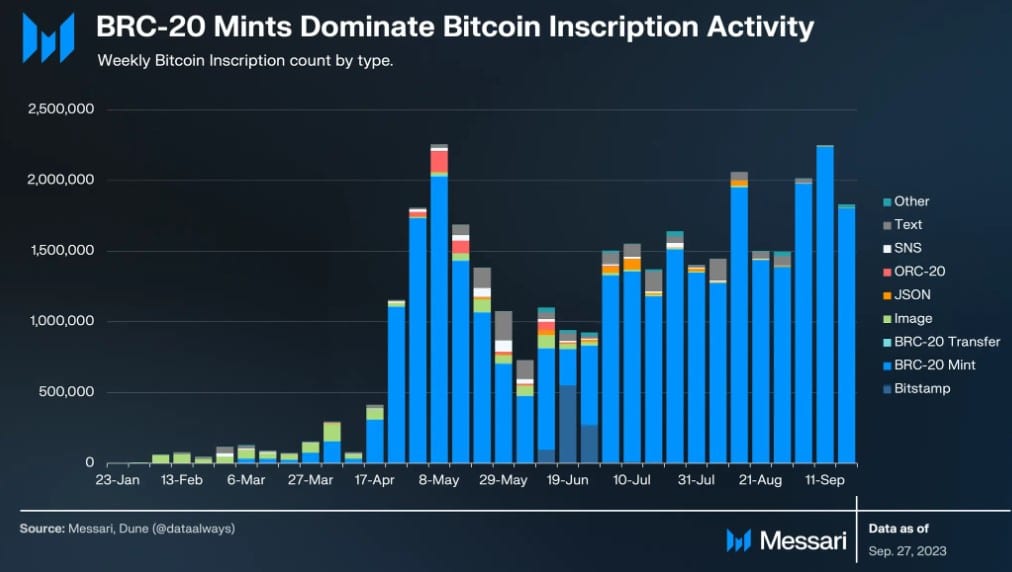

In addition to the aforementioned updates, Messari’s report also highlighted Bitcoin’s network activity. For example, BTC Ordinals, which gained a lot of popularity immediately after its creation, continued to show strong upward momentum.

Over the past month, there have been 7.7 million entries on Bitcoin, which is an increase of 20% from the previous month. In fact, Inscriptions also accounted for more than 20% of total bitcoin transaction fees in September, which looked encouraging.

Source: Messari

Messari’s analysis found that the number of Bitcoin transactions remained relatively stagnant between 2021 and 2022. However, this changed with the emergence of inscriptions in early 2023.

In September, the average number of daily transactions rose to 522,000, which was an increase of 12% compared to the previous month.

Furthermore, Bitcoin’s active addresses had a breakthrough in September, crossing the 1 million threshold. According to the report, the daily average number of active addresses reached 1.04 million, which was an increase of 9% compared to August.

Source: Messari

Should investors have high expectations for BTC?

While several metrics recorded increases over the past month, the king of cryptos’ price action remained relatively less volatile. From CoinMarketCapthe price of BTC has only increased by 1% over the past seven days.

At the time of writing, it was trading at $26,963.98 with a market cap of over $525 billion.

Messari’s analysis also included a look at BTCthe reserve risk. The reserve risk indicator measures the confidence of long-term holders towards the price of BTC.

At the time of writing, reserve risk remained near critical historical levels, previously in line with market bottoms.

Source: Glassnode

Is your portfolio green? look at the BTC profit calculator

Additionally, LunarCrush’s facts revealed that bullish sentiment around BTC has also increased by more than 6% over the past seven days.

Considering the numbers mentioned above and the price of BTC almost touching the $27,000 mark, investors could witness a bull rally in the coming days.