- Algorand’s TVL rose 300% in a month, with Folks Finance driving DeFi growth.

- ALGO’s price maintains bullish momentum, supported by rising network activity.

Algorand [ALGO] has seen a notable increase in Total Value Locked (TVL) over the past month. Fueled by protocols like Folks Finance, this growth reflects a renewed interest in Algorand’s ecosystem.

Despite minor retracements, ALGO’s bullish price performance and rising network activity highlight continued momentum.

DeFi is driving the Algorand wave

Algorand has experienced an impressive increase in Total Value Locked (TVL), with growth of over 300% in the last 30 days, according to DeFiLlama.

On December 3, the blockchain’s TVL reached $244.74 million, the second highest level in history.

However, at the time of writing, TVL has paid approximately $184.5 million, reflecting a slight retracement but maintaining an upward trajectory.

Source: DefiLlama

TVL growth was significantly boosted by Folks Finance, which saw a 289% increase last month, with more than $284 million in locked assets.

This makes it the leading protocol powering the expansion of Algorand’s DeFi ecosystem. Other DeFi protocols on Algorand have also seen a steady increase in activity, indicating renewed interest in its ecosystem.

Price development: the bullish momentum continues

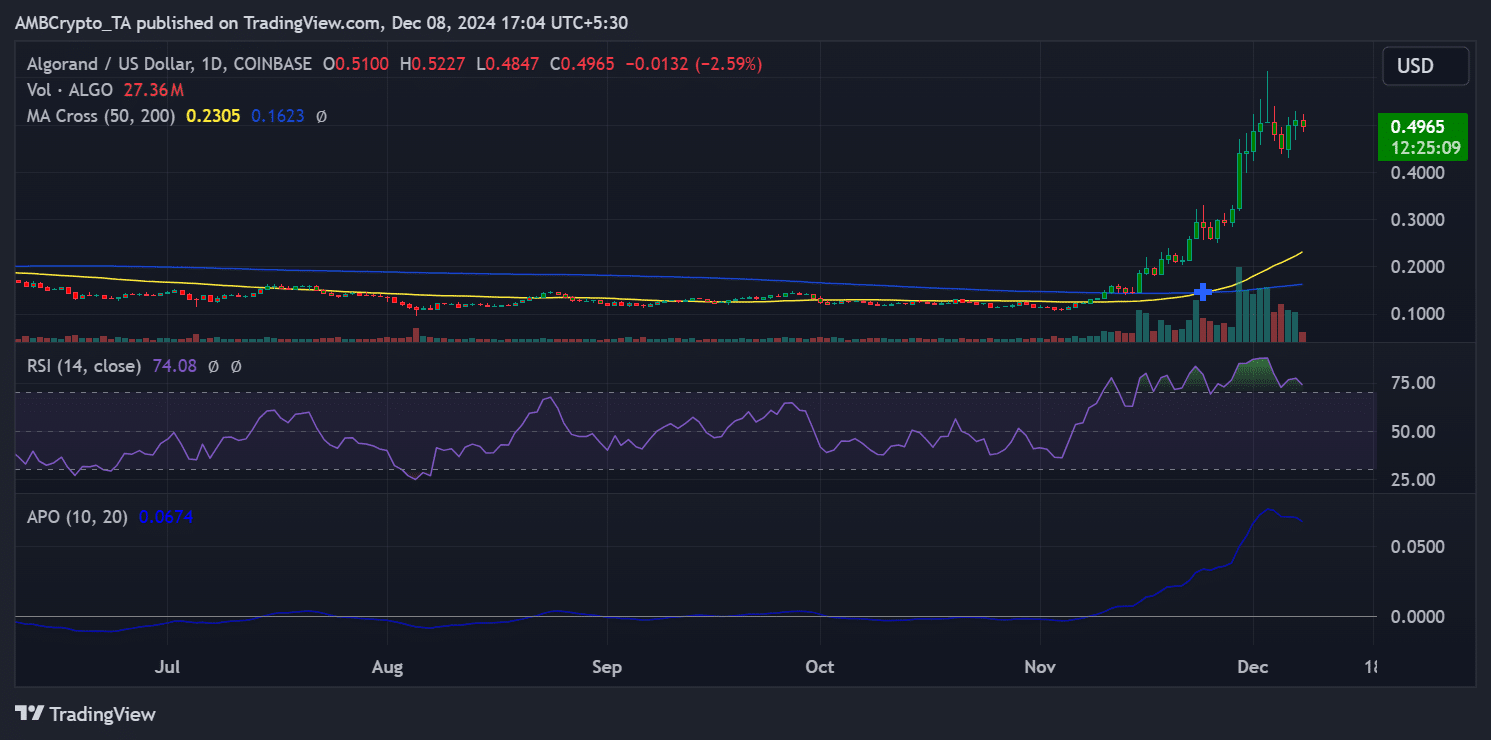

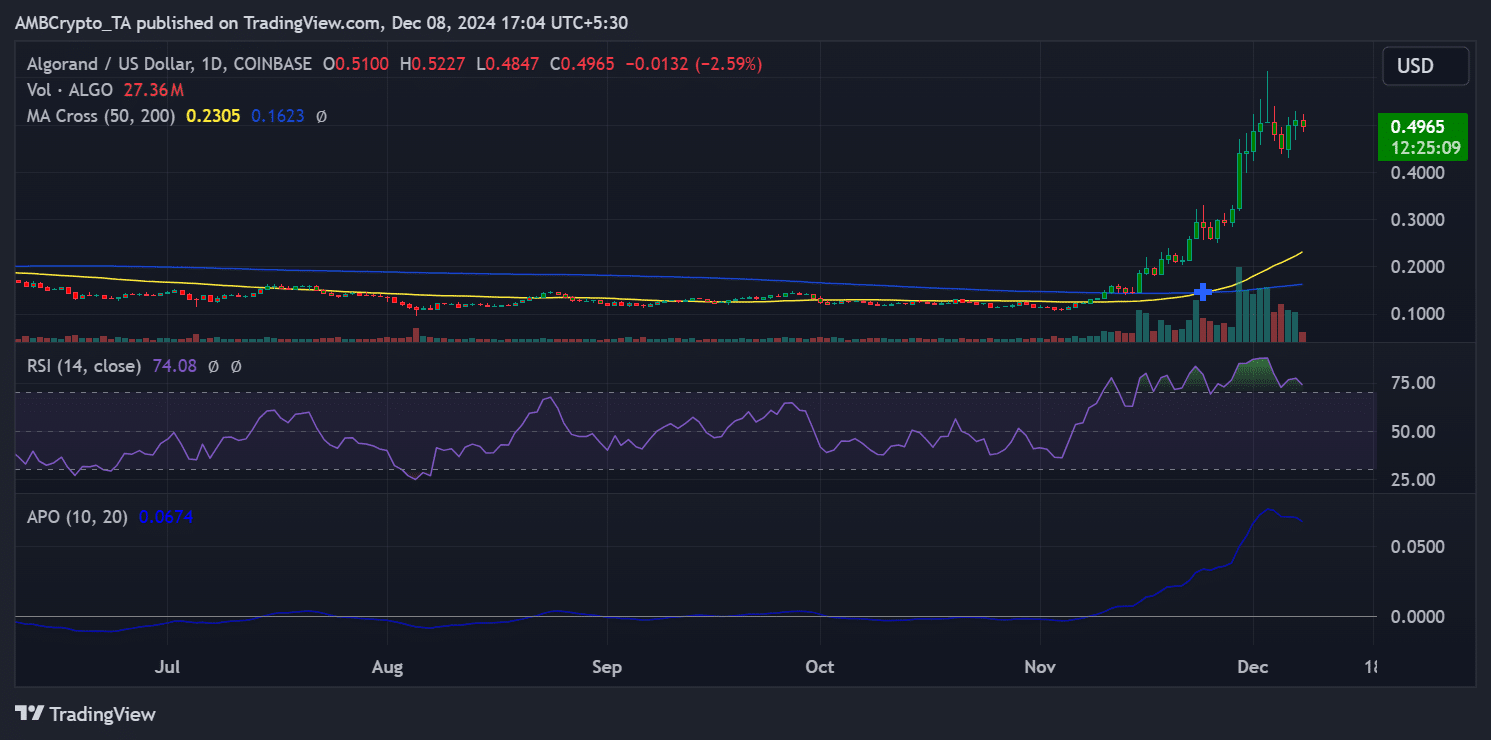

Algorand’s native token, ALGO, has mirrored positive on-chain metrics with significant price gains.

ALGO was trading at $0.4965, reflecting a slight decline from recent highs but maintaining a strong overall uptrend. The token broke above its 200-day moving average, indicating a bullish outlook.

Source: TradingView

The Relative Strength Index (RSI) of 74.08 suggests that ALGO is currently in overbought territory, indicating potential consolidation or profit-taking.

However, the Average Price Oscillator (APO) continues to show upward momentum, underscoring continued bullish sentiment.

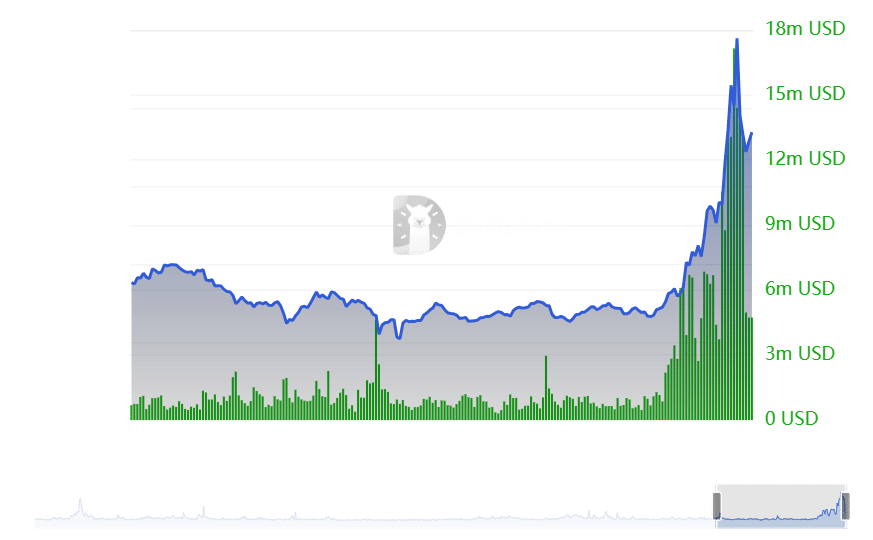

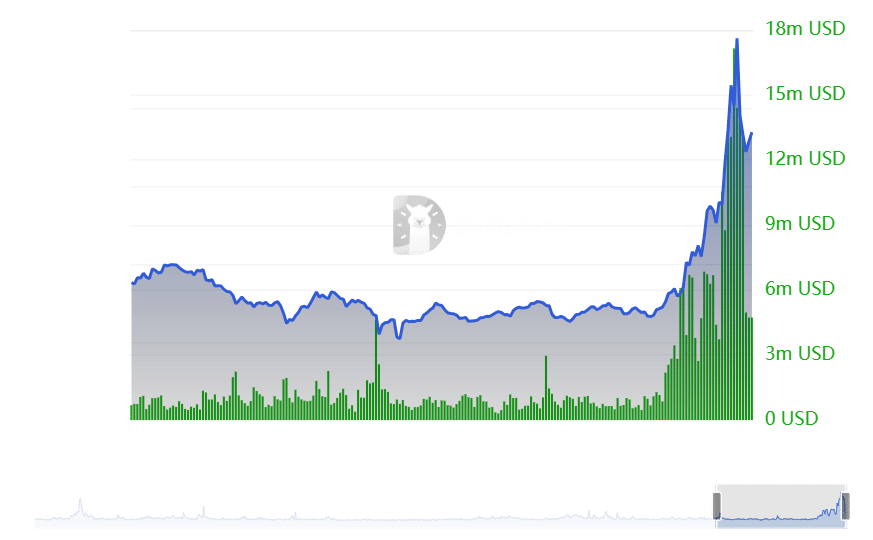

Volume analysis: peak in network and market activity

The recent performance of Algorand’s Total Value Locked (TVL) is strongly supported by strong volume activity. Trading volume on the network rose sharply, reaching 27.36 million on December 8.

Data from DefiLlama shows a significant spike in Algorand’s network volume, peaking at 2.33 billion ALGO at the end of November.

Source: DefiLlama

Although it has since dropped to approximately 788.44 million ALGOs, the increased levels still indicate increased activity on the network.

This matches the explosive TVL growth recorded on platforms like Folks Finance. The growth indicates greater network involvement.

Additionally, Santiment data shows a significant spike in ALGO volume, peaking at $2.33 billion ALGO in late November.

Although it has since fallen to approximately $788.44 million, the increased levels still indicate increased activity on the network.

Source: Santiment

Is your portfolio green? View the ALGO Profit Calculator

The interplay between network and trading volumes paints a picture of increased utility and interest in Algorand.

However, with both metrics pulling back from their recent highs, it remains to be seen whether the network can maintain its recent momentum or if a correction is imminent.