- The ALGO token has lost 36% of its value since the beginning of the year.

- A price breakout above the 200-day EMA paves the way for traders to take long positions.

Algorand [ALGO] is back in the spotlight as the price recovery brings a crucial resistance zone around $0.15 into view. The slightly renewed strength of midweek market action in the form of consecutive daily green candles over the past seven days follows a period of price weakness in the last week of August.

ALGO portfolios show accelerated growth amid price battles

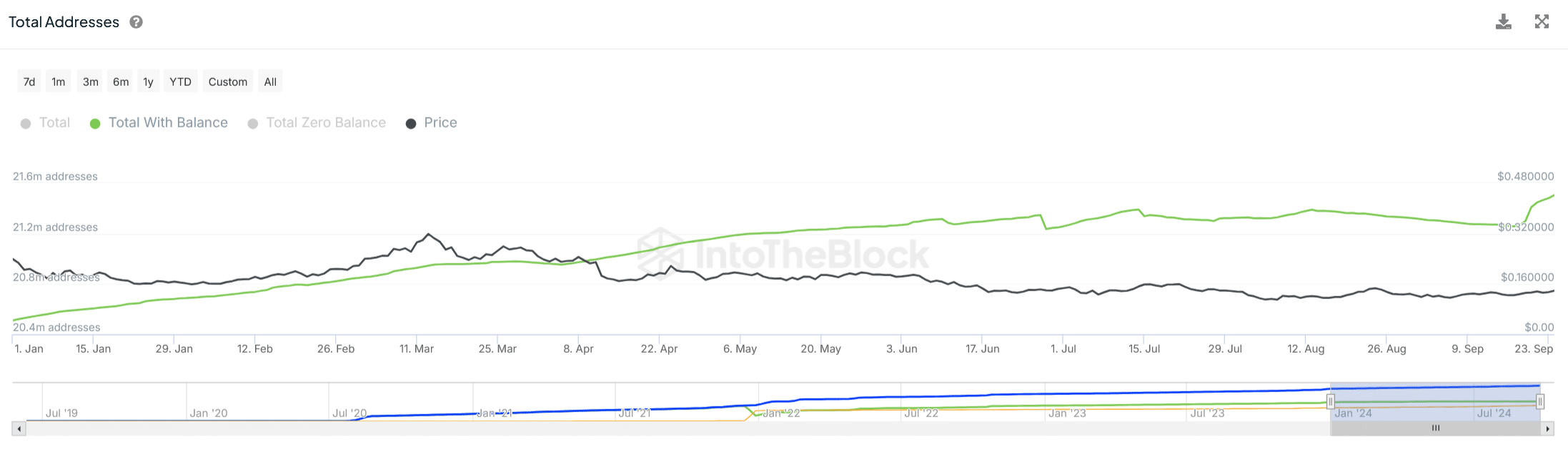

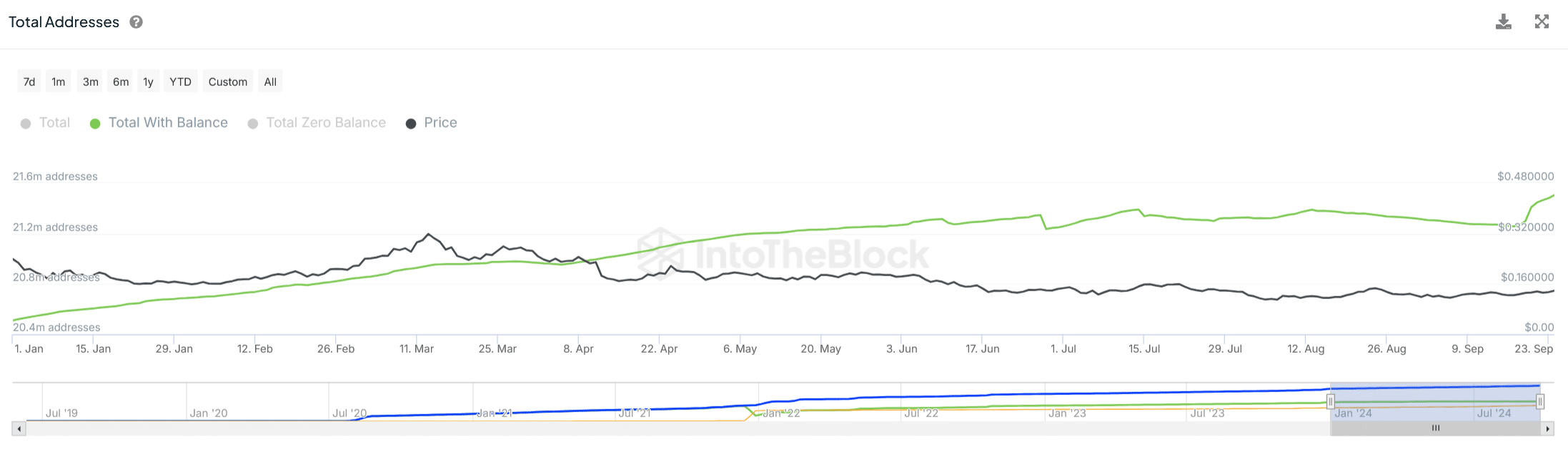

Despite the suppressed market action, Algorand has maintained a near-steady increase in the number of wallets this year.

ALGO addresses with a balance have grown by 990K this year according to data from IntoTheBlock. The network has seen accelerated growth in particular over the past seven days, with the total number of addresses with a balance increasing from 21.26 million on September 17 to 21.51 million at the time of writing.

Source: IntoTheBlock

This growing adoption of ALGO signals increasing interest in the blockchain ecosystem, despite an overwhelming majority of token holders making losses. IntoTheBlocks facts shows that only 1.87 million addresses are making a profit, which represents 9.01% of holders.

ALGO technical outlook

Algorand (ALGO) was trading at $0.14 at the time of writing, facing downside pressure below the 200-day exponential moving average (EMA).

From a technical analysis perspective, ALGO/USD is approaching a critical resistance zone between $0.149 and $0.152, which coincides with the 200 EMA. This range has proven to be a major hurdle over the past three months, after ALGO price fell below the moving average on June 7.

Source: TradingView

For ALGO/USD to confirm bullish momentum, the pair should ideally break above this trendline. The pair unsuccessfully challenged the zone in early July, before briefly overcoming it between July 14 and July 22.

In the most recent attempt, ALGO’s bullish momentum was thwarted at its high on August 26.

The zone also represents a barrier that traders keep a close eye on, as a successful break above it would yield nearly 140,000 addresses in profit.

These addresses, which are currently underwater, contain a cumulative volume of 743.62 million ALGO per IntoTheBlock data. Clearing this zone would provide much-needed relief for ALGO bulls, potentially paving the way for further gains above $0.160.

Improved market capital for stablecoins

According to the latest Algo Insights report, Algorand has tracked significant growth in stablecoin market capitalization in August. The total market capital for on-chain stablecoins, denominated in USD, increased from 85.53 million to 109.90 million, translating into a 28.5% increase.

Total USDC transactions too increased from 557K to 690K in the same period.

This is notable considering that Binance announced the addition of cross and margin USDC pairs for ALGO on August 30. Nearly all of Algorand’s stablecoin market capital has shifted to USDC in light of Tether stop support for its USD₮ on the blockchain.

Is your portfolio green? Check out the Algorand Profit Calculator

The transparency of Tether website shows that $119.2 billion in USDT is currently circulating on various chains, the vast majority of which are on Ethereum and Tron.

The net circulation of USDT in Algorand is $2 million. The stablecoin issuer said it will freeze all remaining USD₮ on Algorand by September 2025.