- AERO is up +1200 over the past year.

- Base growth has been the main driver – will this trend continue?

Crypto from the airport [AERO] has experienced tremendous growth thanks to the wild expansion of Base, an Ethereum [ETH] L2.

Aerodrome is a strategic central liquidity provider in the Base ecosystem, operating as a decentralized exchange (DEX) and automatic market maker (AMM).

The growth of the L2 has been a huge catalyst for the protocol. In 2024, Base’s TVL (total value locked) increased 6x (from $500 million to almost $3 billion).

During the same period, Aerodrome Finance’s TVL increased from $100 million to over $1.3 billion (13x).

The original token, AERO, has perhaps been the most notable beneficiary. Year-over-year, AERO rose +1200%. Given the expected additional growth for Base, should you include this in your watchlist?

The potential of AERO

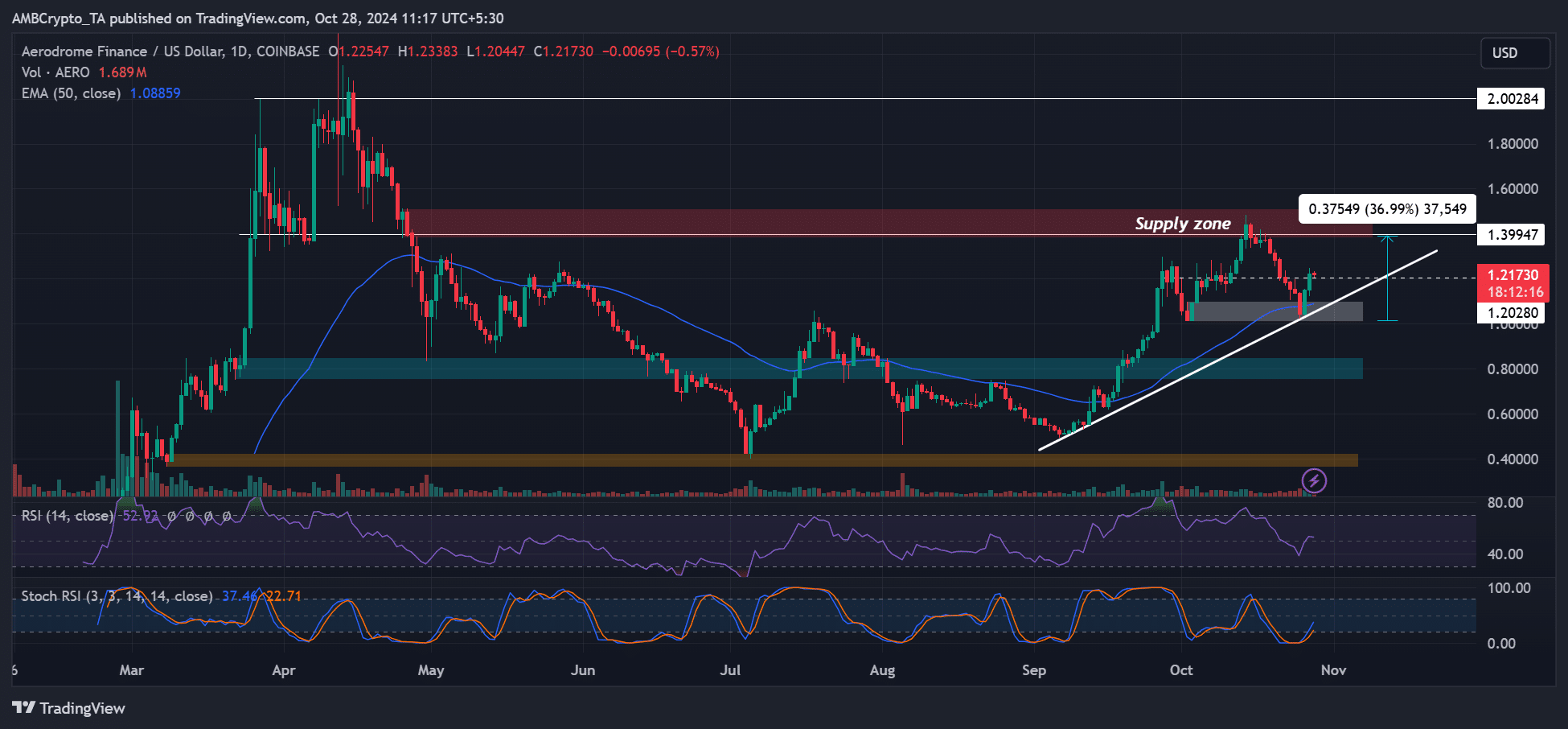

Source: AEROUSD, TradingView

AERO posted a recovery gain of more than 140% during the broader market recovery in September. However, it faced a price rejection of $1.3 – $1.5 (red, supply zone).

However, the pullback was halted when short-term demand neared $1.2, making it a crucial level to watch.

An extended uptrend to $1.5 could trigger a 36% recovery. A more aggressive push to $2 could yield a potential gain of almost 100%.

The major technical chart indicators showed plenty of room for growth as they were far from overbought.

However, market uncertainty and volatility could erupt as US elections take place in a few days. A breach of less than $1.2 could still offer a discounted bid of $0.8.

Ask about weekend spots

Source: Coinglass

Read Airport Finance [AERO] Price prediction 2024-2025

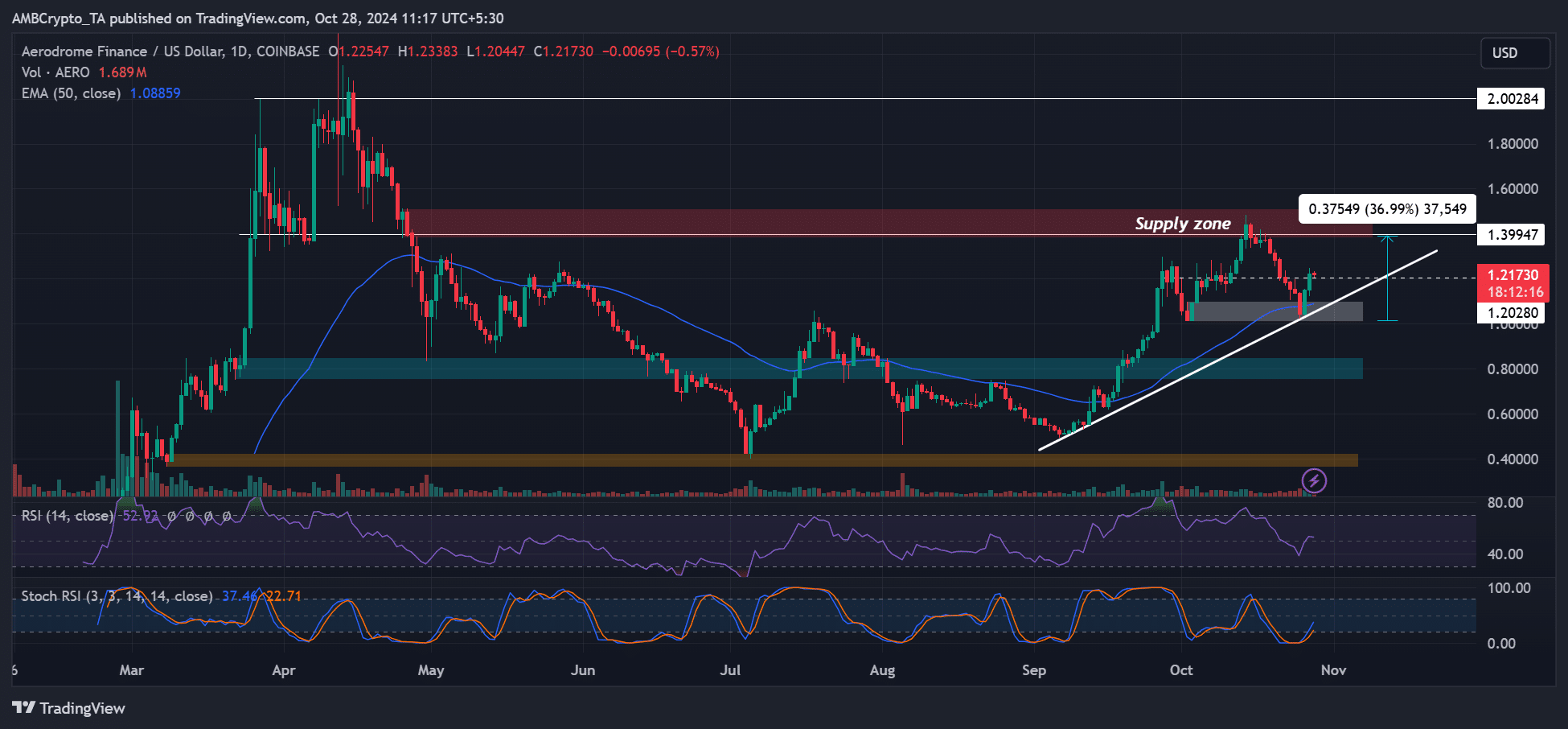

The latest increase of 18% over the weekend was mainly driven by spot market demand, as evidenced by a spike in spot CVD (Cumulative Volume Delta).

The statistic keeps track of the difference between the buying and selling volume. The peak meant more buying volume and therefore bullish sentiment.

However, interest in the futures market waned somewhat, as evidenced by a drop in open interest (OI) of almost 1 million AERO. Should the decline continue, a move to $1.5 could be postponed.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer