- Bitcoin-Walvissen make huge movements, including a BTC purchase of $ 200 million and a return of 8 years

- Walvisposition Sentiment signals potential bearish prospects, suggesting a possible bitcoin prize correction

Bitcoin [BTC] Whale stirring the market again, with sleeping portfolios waking up again and massive transactions that reform the dynamics on the chain.

One whale recently built up $ 200 million in BTC, while another, inactive for eight years, moved to Bitcoin for more than $ 250 million.

While the price of BTC is reflected, the whale feeling appears to be divided – some double on accumulation, others who indicate potential short positions.

The result? A market full of uncertainty, where each big step could dictate the next trend.

A Bitcoin accumulation of $ 200 million

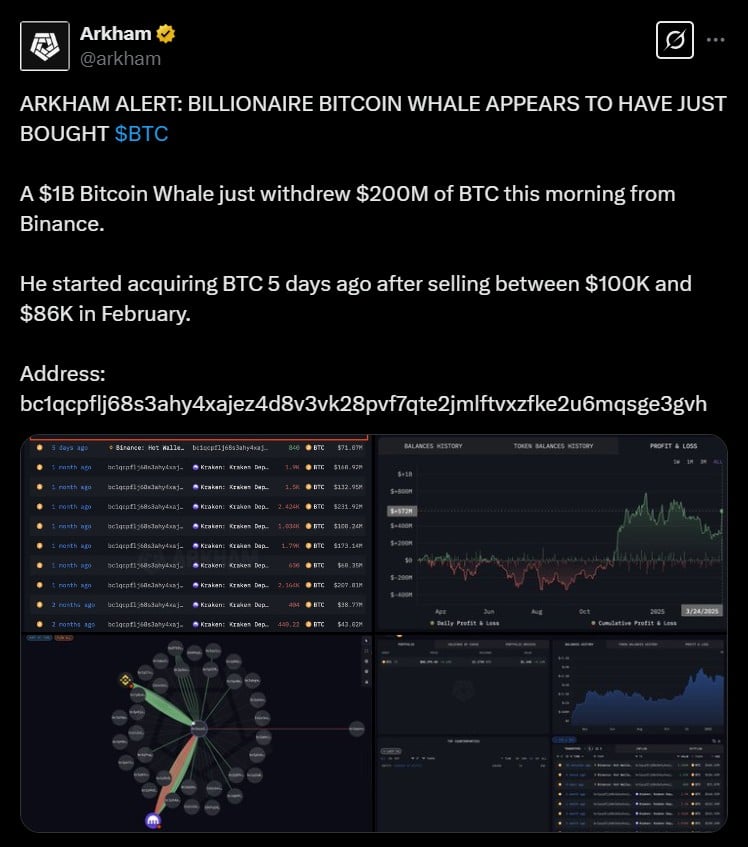

One of the most important whale movements in recent weeks came on March 24, when a Bitcoin -Walvis withdrew 2,400 BTC – more than $ 200 million – from Binance, according to Blockchain Analytics Firm Arkham Intelligence.

This purchase follows months of strategic sale, whereby the whale has unloaded 11,400 BTC before the market was re -submitted.

Source: X

Despite the cropping of his companies in February, when Bitcoin fluctuated between $ 100,000 and $ 86,000, the whale has now increased its position to more than 15,000 BTC, with a value of around $ 1.3 billion.

The timing of this accumulation corresponds to Bitcoin’s price rebound, which BTC has traded between $ 81,000 and $ 88,000 in the past week.

An eight -year -old sleeping whale arouses again

While some whales are actively accumulating, others appear again after years of rest.

On March 22, an address that had remained untouched for more than eight years suddenly 3,000 BTC – worth around $ 250 million – in a single transaction.

Source: X

Arkham Intelligence noticed That the whale initially acquired his BTC stack when he was only worth $ 3 million at the beginning of 2017, making it an astronomical profit.

Is this an early sign of long -term holders who cash in, or does it indicate a shift in whale strategy? Anyway, the return of sleeping portfolios adds a new layer of intrigues to an already volatile Bitcoin market.

Whales betting against Bitcoin on $ 88k?

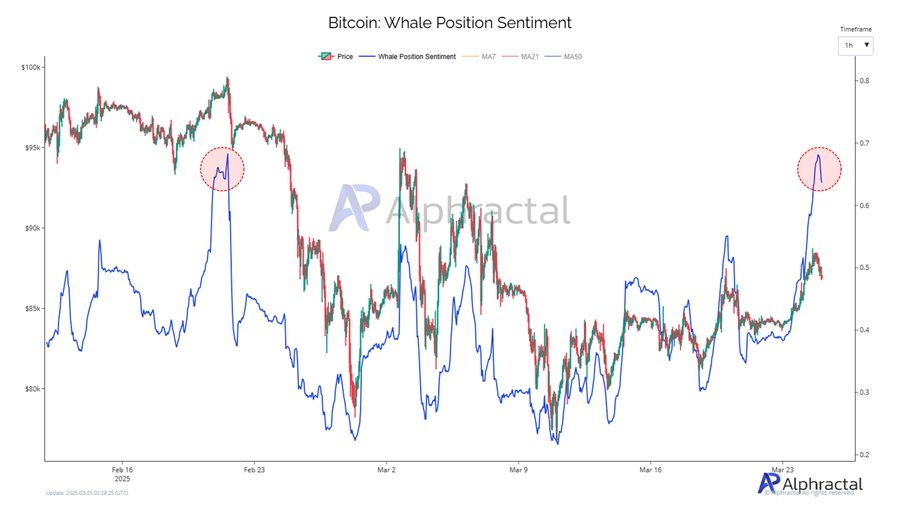

The last Whale Position sentiment Data reveals that large holders may change Bearish despite the recent rebound of Bitcoin.

The metric shows a sharp decrease after peak – historically a sign that whales go into short positions.

Source: Alfractaal

A similar pattern arose in February when the sentiment dropped, despite the fact that BTC pushed to $ 95k, which led to a steep correction.

With Bitcoin around $ 88k, a decrease in sentiment suggests that whales may prepare for a recession. If history repeats itself, volatility could follow.

Although BTC remains resilient, a threatening correction in whale event can fall further.