- Adventure Gold cryptocurrency trading volume increases by 4105.82%, indicating increasing interest from traders.

- Technical analysis pointed to resistance at $1.77, with potential targets at $3.39 and $7.78.

Adventure gold [AGLD] recorded a 24-hour trading volume of $1.58 billion, representing a staggering 4105.82% increase in the past 24 hours.

This sharp increase in activity indicated growing interest from traders and increased participation in the market.

Adventure Gold traded at $1.62 at the time of writing, reflecting a drop of 31.36% in the last 24 hours, despite a rise of 21% in the last seven days.

However, the combination of rising volume and price indicated strong demand and increased attention from both retail and institutional traders.

Important price levels to monitor

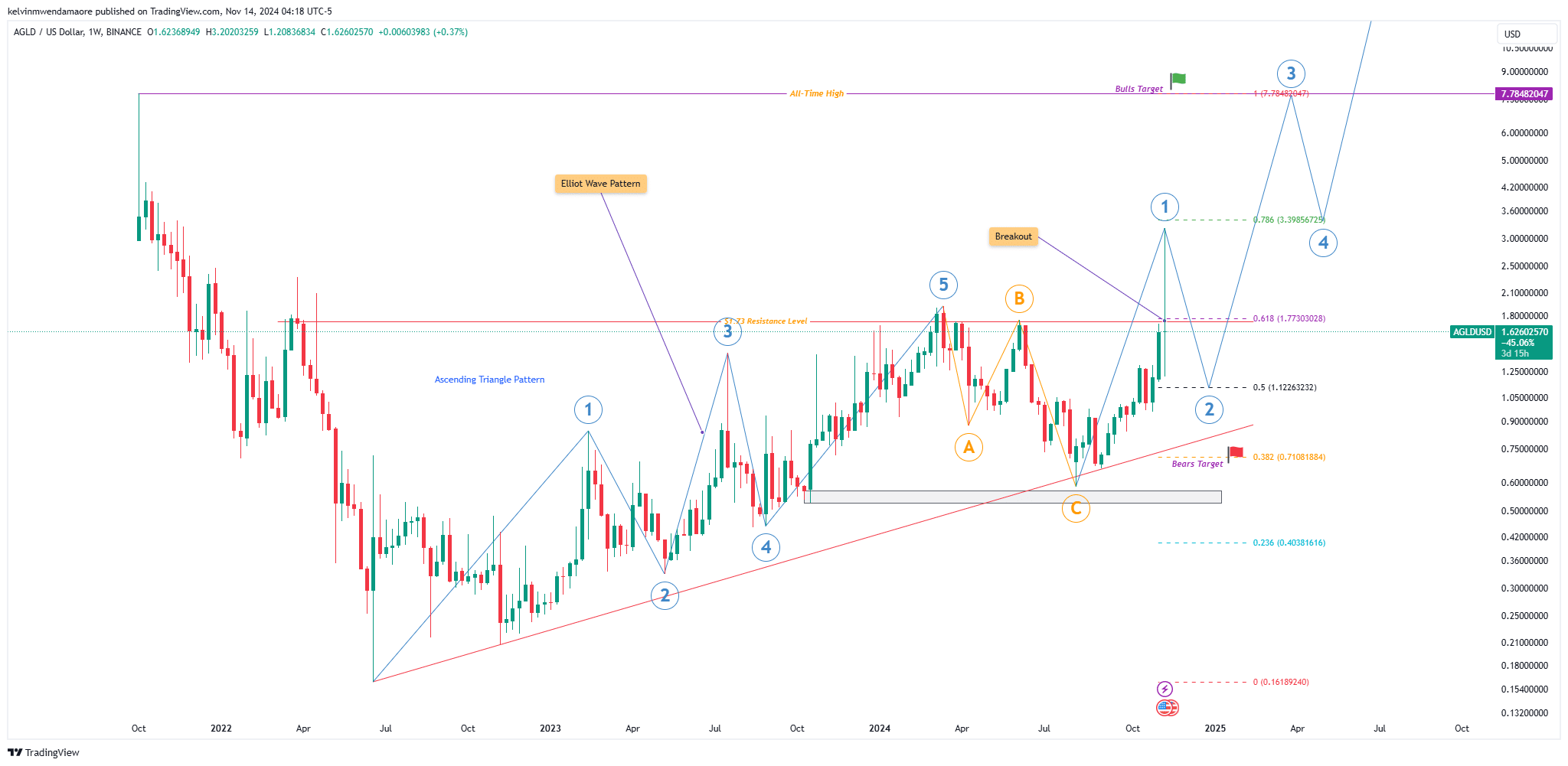

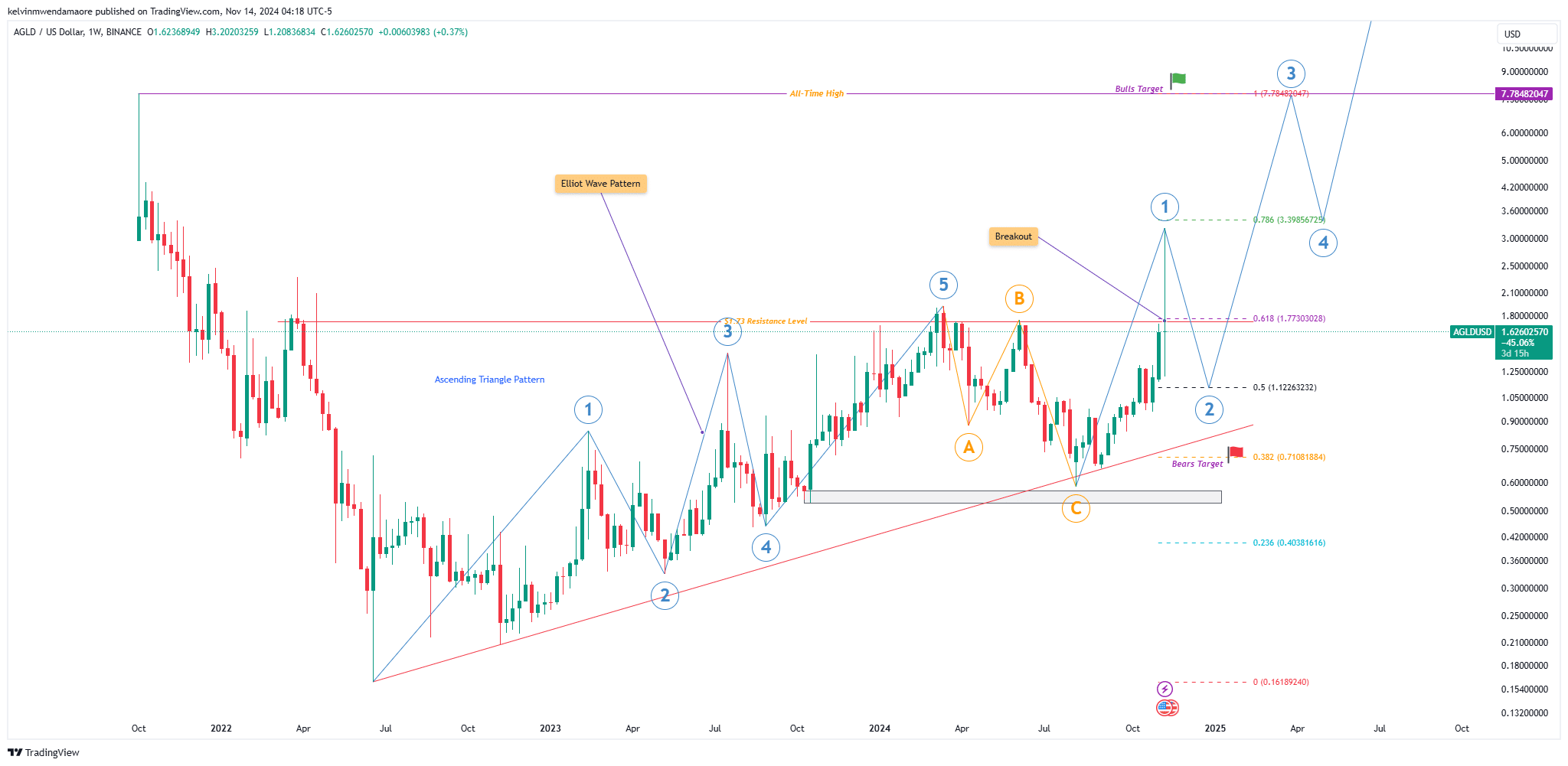

From a technical perspective, AGLD recently broke above an ascending triangle pattern and faced resistance at $1.77 (Fib 0.618).

If the token reaches this level, potential targets are at $3.39 (Fib 0.786) and $7.78, with the latter in line with historical price highs.

Source: TradingView

Support levels to watch include $1.12 (Fib 0.5) and $0.71 (Fib 0.382). A breakdown below that could signal further downtrend, with the next major support between $0.40-$0.50.

Price movements within these levels will be crucial in determining the token’s next direction.

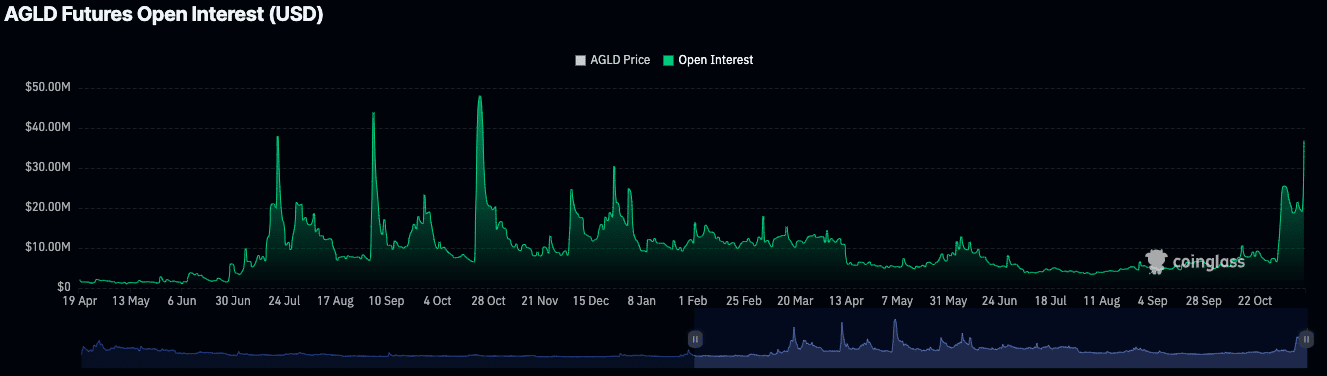

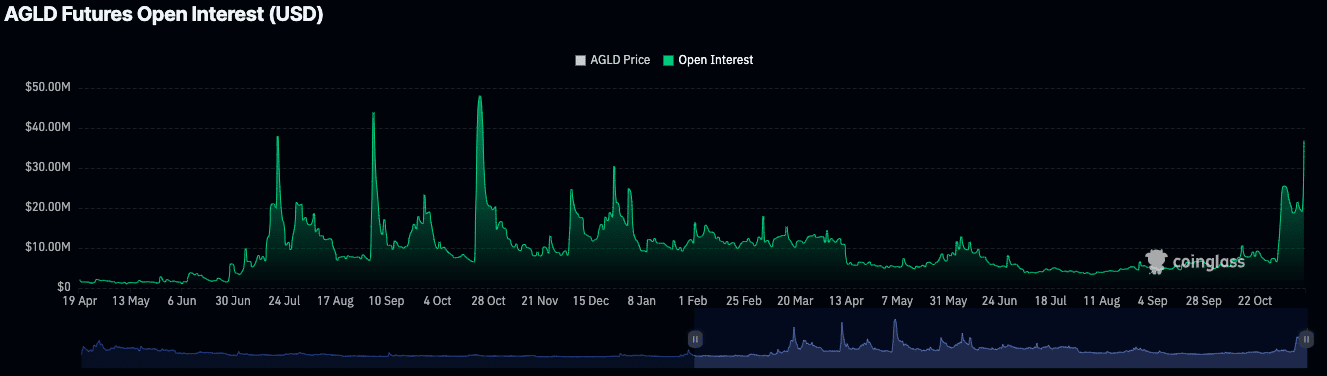

Futures data shows increasing speculation

Futures market data indicated a sharp increase in trading activity. AGLD’s Futures volume rose 2716.14% to $2.40 billion, while Open Interest rose 74.09% to $33.27 million.

These numbers suggest traders are positioning themselves for further volatility.

Rising open interest often indicated an influx of new positions, indicating that both long and short traders expect significant price movements in the near term.

Source: Coinglass

Adventure Gold crypto shows growing interest from users

Data from the chain showed a sharp increase in user activity. The number of new addresses grew by 4,633.33% last week, while active addresses increased by 1,563.16%.

Meanwhile, zero-balance addresses rose 3,689.66%, signaling a surge in wallet creation.

Source: IntoTheBlock

This rapid expansion of user engagement indicated increased adoption and activity within the AGLD ecosystem. A growing user base is often a sign of increasing interest, which could support the token’s current momentum.

Possible cooldown ahead?

Despite the recent rally, technical indicators pointed to a possible consolidation. The RSI has retreated to 59.48, leaving the overbought area.

Moreover, the Chaikin Money Flow (CMF) was -0.23, indicating net capital outflow and selling pressure.

Source: TradingView

Read Gold’s Adventure [AGLD] Price forecast 2024–2025

The MACD remained in bullish territory at the time of writing, but shrinking histogram bars suggested momentum may be slowing.

While AGLD’s outlook remains positive, traders should remain cautious as the market could see a short-term decline before seeing further upward movement.