NFT

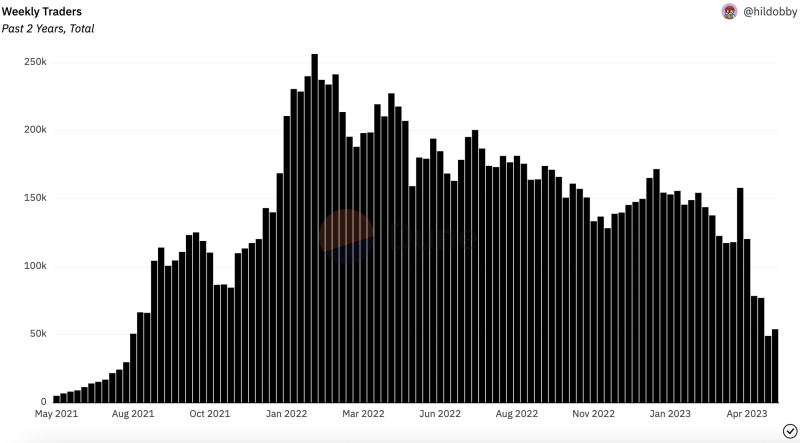

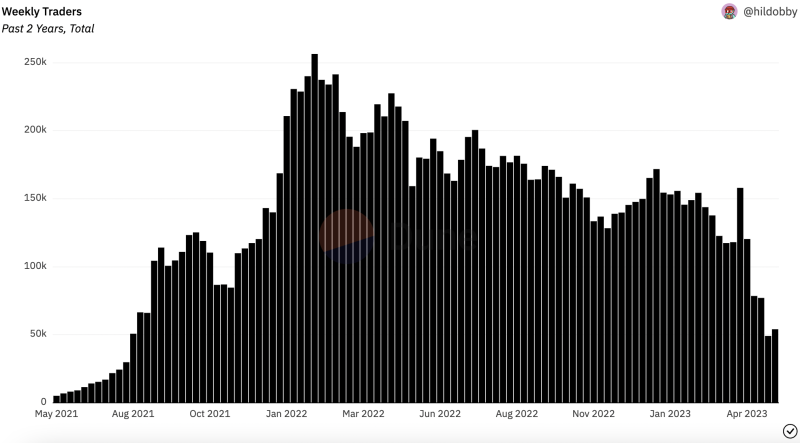

The number of weekly active NFT traders has dropped to its lowest level since August 2021, according to The Block Research.

Liquidity farming, driven by marketplace Blur’s ambitious stimulus program designed to drive traders away from OpenSea, the long-leading platform in NFT trading, has led to price erosion. The lower prices combined with general market volatility have subsequently had the knock-on effect of a reduction in the number of traders, said The Block Research Analyst Brad Kay.

“This bottom price erosion, combined with heightened market volatility, has tempered the usual buying drive, the ‘fear of missing out’ among mainstream traders,” he said. “This volatility, in turn, has had a discouraging effect on regular traders, leading to a decline in overall trading activity.”

Last week, the number of active traders buying and selling Ethereum NFTs dropped to around 49,000, according to data of Dune analysis. The total number of traders has not been this low since August 2021, the data shows.

Weekly number of active NFT traders: Dune

NFTs are sometimes traded on Solana and Bitcoin blockchains, but the volume is negligible compared to Ethereum, the chain used by top collections like CryptoPunks, Bored Ape Yacht Club, and Azuki.

The impact of Blur’s strategy of providing traders with lucrative incentives to overtake OpenSea as the leading marketplace by trading volume is unprecedented, Kay said.

“Driven by Blur Marketplace’s aggressive airdrop and bidding incentives, liquidity farming has surged,” he said. “While this has boosted short-term liquidity, it has also led to downward pressure on the market floor. Farmers pursuing Blur’s rewards accept short-term trade losses, driving prices lower.”

“Liquidity farmers” are essentially traders who want to take advantage of Blur’s incentives by “artificially inflating the price or volume of an NFT before it sells quickly,” Kay said, adding that this discourages “real” trading while at the same time threatens liquidity.