USDC, the flagship product of Boston-based Circle, is currently seeing the most demand of any regulated stablecoin, says crypto intelligence firm Kaiko.

In a new report, Kaiko says that following Circle’s announcement that its USDC and EURC products would now comply with the European Markets in Crypto-assets Regulation (MiCA), both stablecoins have seen a strong increase in volume.

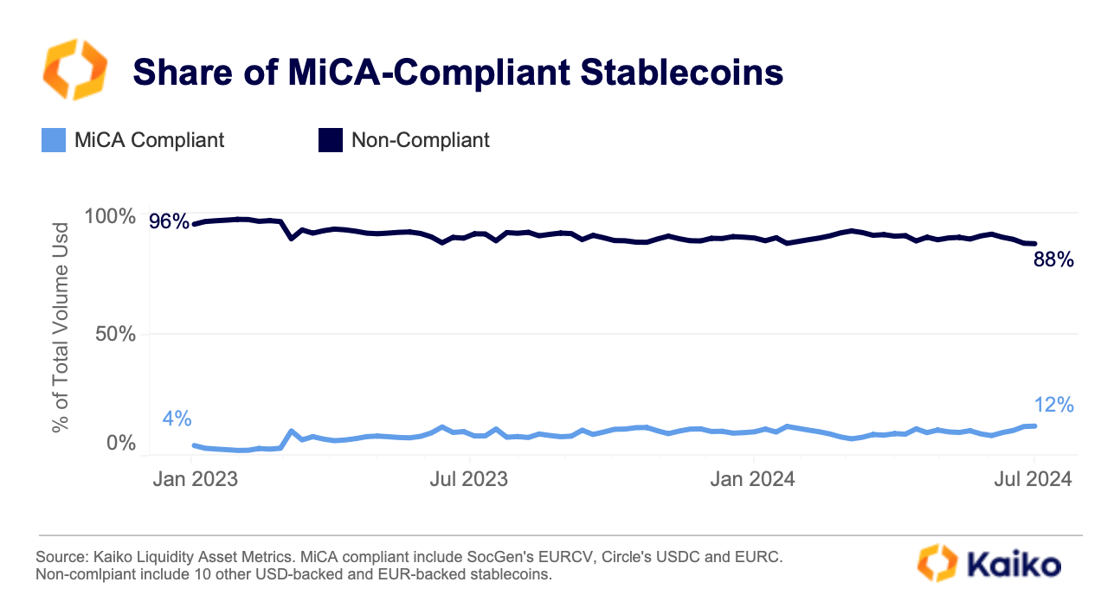

While ‘non-compliant’ stablecoins still rule the markets, Kaiko says the volume of regulated products has increased over the past year, possibly due to a desire for transparency.

“Currently, non-compliant stablecoins dominate the market, accounting for 88% of total stablecoin volume. MiCA could shift this balance as exchanges and market makers favor compliant stablecoins over non-compliant alternatives. Major crypto exchanges such as Binance, Bitstamp, Kraken and OKX have already introduced restrictions, removing non-compliant stablecoins for their European customers.

On the other hand, the share of compliant stablecoins has increased over the past year, indicating an increased demand for transparency and regulated alternatives. So far, this trend has mainly benefited USDC.”

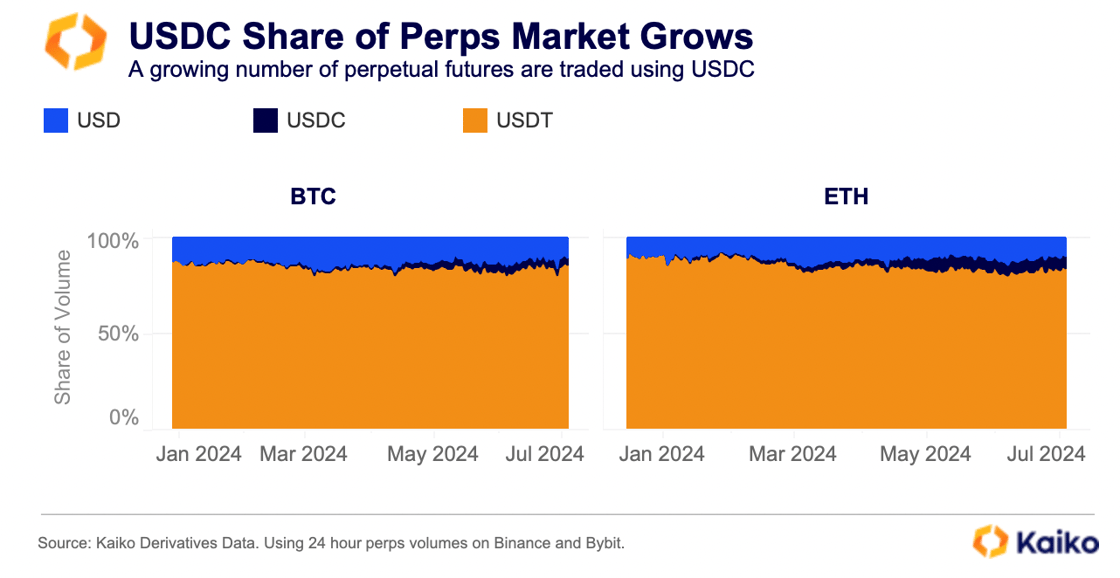

Kaiko also reports that another factor contributing to USDC’s growth is the fact that its use for perpetual futures settlement is increasing – although it is still minuscule compared to Tether’s USDT.

“Another factor contributing to this trend is the increased use of USDC for perpetual futures settlement. The share of BTC perpetuals denominated in USDC, traded on Binance and Bybit, rose to 3.6% from 0.3% in January.

The use of USDC in ETH perpetuals trading was even higher, with trading volume between ETH and USDC increasing from 1% at the start of the year to over 6.8%. While USDC’s market share in these perpetual markets is only a fraction of USDT’s, the growing use of USDC for perpetual settlement speaks to the changing preferences of investors as stablecoin regulations take effect.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on XFacebook and Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Natalia Siiatovskaia/Tithi Luadthong