According to an analyst, crypto whales spend most of the year dividing their massive Ethereum (ETH) stacks.

Analyst Ali Martinez tells With its 31,000 followers on the social media platform

The crypto analyst emphasizes that so far there are no signs that Ethereum whales will change their behavior anytime soon.

“Since February 2023, Ethereum whales have taken advantage of rising prices, offloading or redistributing more than 5 million ETH – equivalent to approximately $8.5 billion.

Notably, this selling trend continues with no evidence of a shift towards ETH accumulation at this time.”

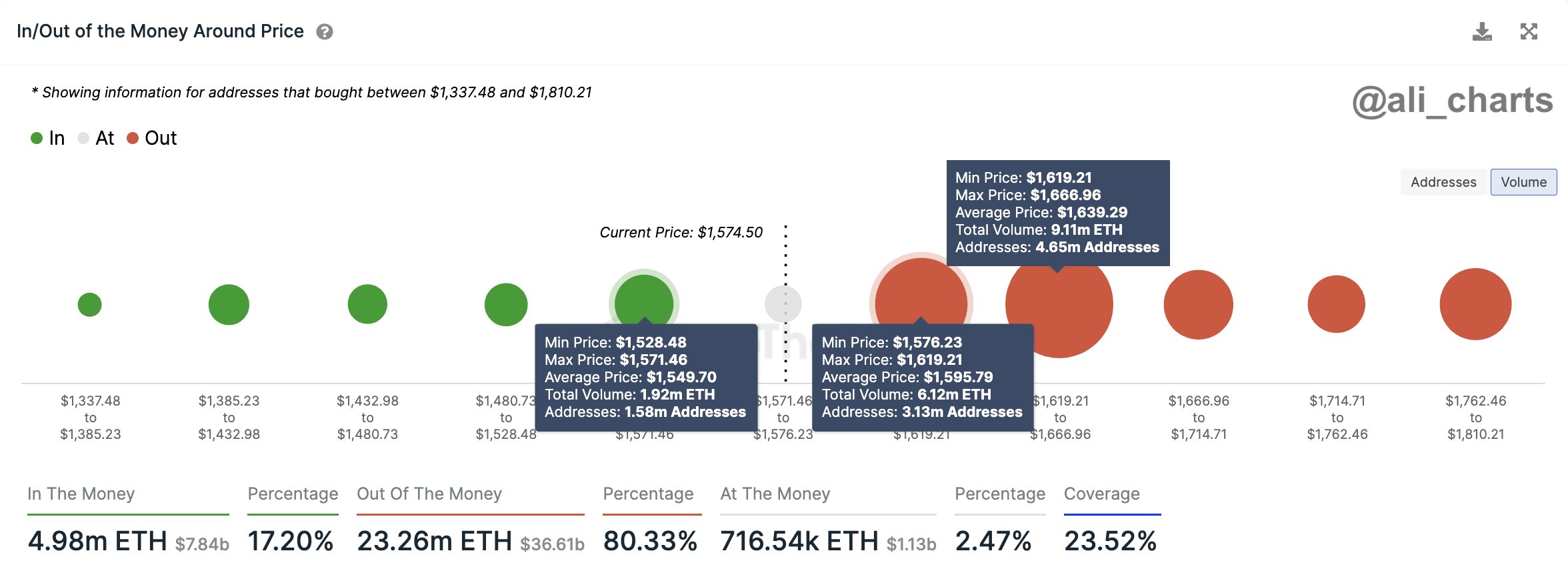

Martinez also looks at the cluster addresses that bought Ethereum above $1,528. According to the analyst, 1.58 million addresses bought 1.92 million ETH between $1,528 and $1,571, indicating that a move below the lower bounds of the price range could mean a deep corrective move for Ethereum.

“Ethereum is hovering over a critical demand zone. Keep a close eye on it as a daily close below $1,530 could signal a steep correction for ETH.”

At the time of writing, ETH is trading at $1,568.

As for Bitcoin (BTC), Martinez thinks the crypto king is heading for lower levels after exiting the symmetrical triangle pattern on the two-hour chart.

“Given the height of the triangle’s y-axis, we can expect a 5% correction in BTC, possibly heading towards $26,200.”

At the time of writing, BTC is trading at $27,472.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney