This article is available in Spanish.

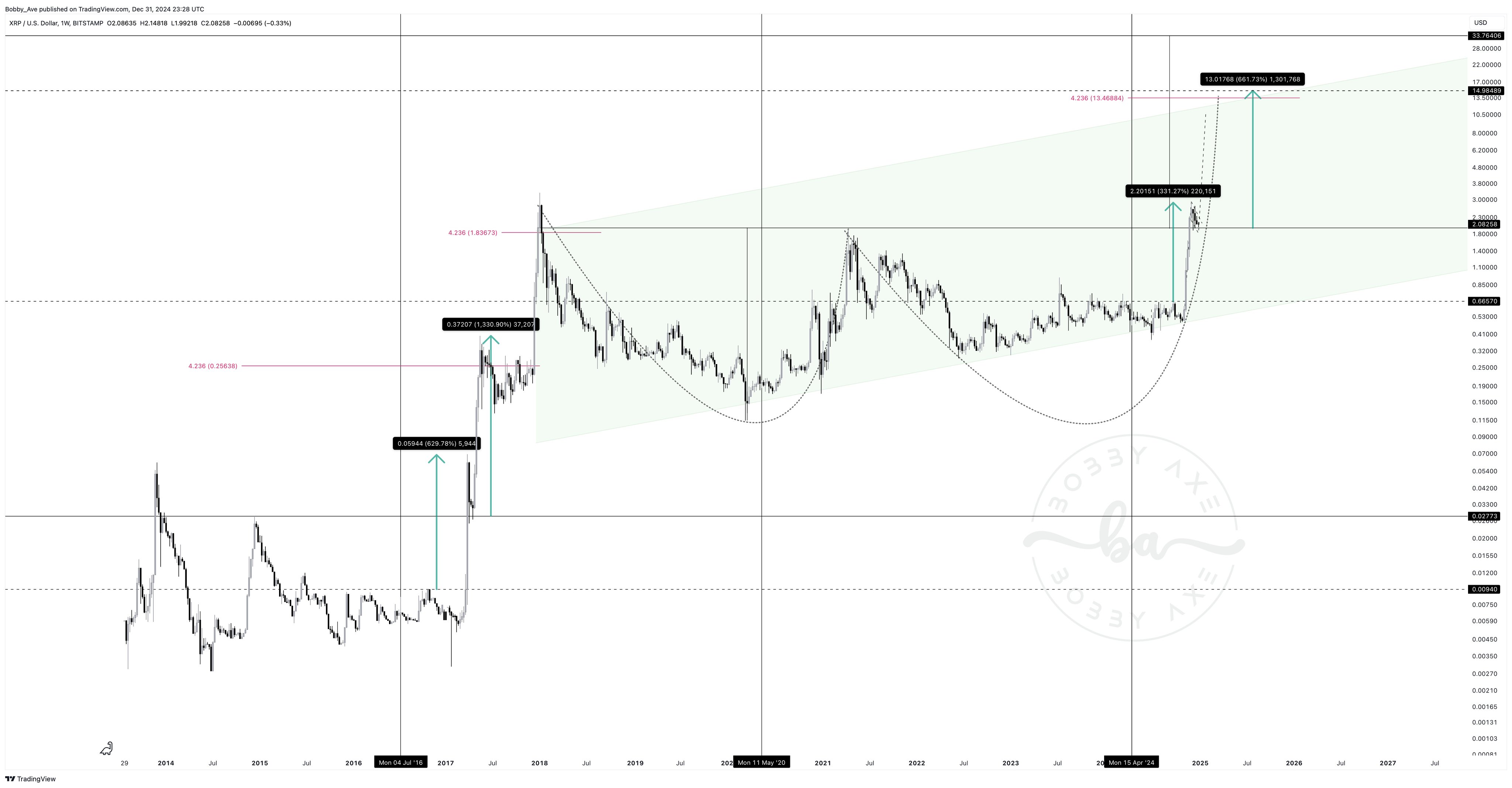

In a technical analysis shared by crypto analyst Bobby A (@Bobby_1111888) on The analysis delves into XRP’s past market cycles, applying percentage-based extrapolations and chart pattern assessments to predict future price trajectories.

Is an XRP price of $15 realistic?

Bobby A’s analysis pits XRP’s performance during the 2017 market cycle against its current 2024 trajectory. From the 2017 range breakout, marked by a horizontal black dotted line on the chart, XRP experienced an initial appreciation of 629%.

By comparison, the asset has risen in value by around 331% since breaking through the 2024 high. Going back even further, from the December 2014 high to the May 2017 peak – approaching the Fibonacci expansion of 4,236 – XRP experienced a staggering 1,330% increase.

Related reading

Applying the principle of halving percentage point increases observed from the first surge in 2017, Bobby A argues that XRP’s next boost could result in a 665% increase. This calculation positions XRP at approximately $15.00 near the 4.236 Fibonacci extension level.

” of the 4,236 extension, after a possible increase of 665%,” explains Bobby A.

Notably, the analyst also notices a developing bull flag pattern, a continuation pattern that typically signals the potential for further upward movement. This bull flag targets the upper limit of XRP’s macro-parallel channel, estimated around the $10.50 price level. “The asset’s current bull flag is targeting the top of its parallel macro channel around $10.50,” notes Bobby A.

Related reading

Another analyst, bassii (@cryptobassii), responded with a contrasting view, focusing on fractal analysis. Bassii states that the ongoing run could be shortened by 42%, predicting that the price of XRP will approach $9, followed by a significant downturn.

Expanding on the fractal patterns, he states: “This run looks to be cut to 42%, would get us close to $9, and then a big drop. But you will miss the last part of the 2017 run. IF (big if) that happens, and we keep the same percentage, we will get about $30 after months of accumulation.”

Or even $35?

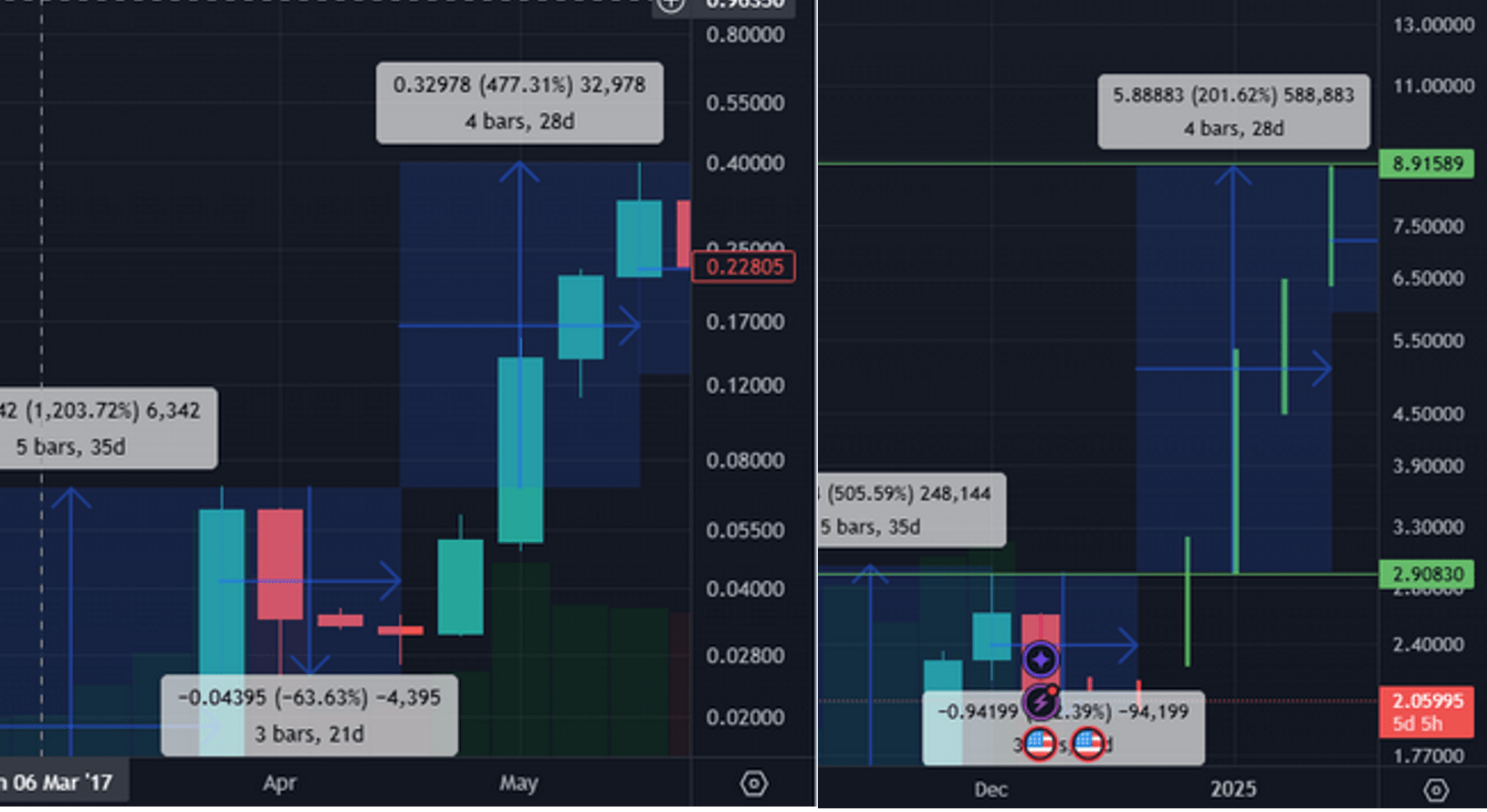

Bassii referred to a previous one analysis of himself, where he highlighted the similarities between the 2024 run and the 2017 cycle. It is striking that both periods show green candles for five weeks in a row, albeit with different sizes: around 500% in 2024 compared to 1,200% in 2017.

He points out: “2017: 5-week green candles at ~1,200%^, followed by 3-week red candles down 63%. 2024: Also 5 weeks of green candles up ~500% (~1/2 of the 2017 run), followed by… (so far) 1 week of red candles by how much? You guessed it… 30% lower.” The subsequent correction phases also mirror each other, with XRP experiencing a 30% decline in 2024, compared to a 63% decline in 2017, each roughly halved in size.

Based on this, Bassii outlines potential future moves based on historical patterns, suggesting that if XRP continues to follow these fractal patterns without significant disruptions, it could accumulate over several months and potentially rise to $30 by September 2025.

Responding to Bassii’s analysis, Bobby A expresses his cautious optimism, saying: “Yes, but I’m not sure the final push will come. I have much more confidence in the next one.” Bassii complements this by emphasizing the importance of sticking to fractal patterns and real-time map developments, adding: “I think it will depend on how closely we follow the fractals and what the map tells us during the upcoming run. So far it is being monitored very closely. The weekly candles for the past 8 weeks followed beat by beat. I’m not a moon boy, I know how crazy $30-35 sounds. But if we still follow the 2017 run.”

At the time of writing, XRP was trading at $2.1581.

Featured image created with DALL.E, chart from TradingView.com