A Bloomberg Exchange Traded Fund (ETF) analyst says the market could be flooded with Ethereum (ETH) futures ETFs starting October 2.

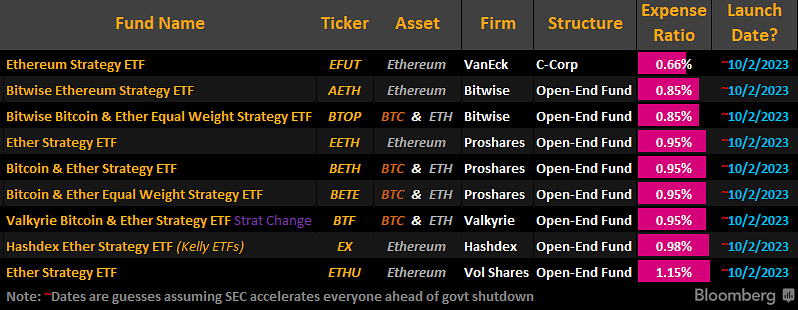

In a new thread on social media platform X, Bloomberg ETF analyst James Seyffart says notes that nine different ETH-based futures ETFs may launch on Monday, adding that it will be a “crazy day.”

The financial firms on Seyffart’s list that are preparing to issue Ethereum futures ETFs are VanEck, Bitwise, Proshares, Vol Shares, Hashdex and Valkyrie.

The analyst continues participation that other companies interested in issuing Ethereum ETFs, such as Grayscale, have yet to file updated documents and are unlikely to do so.

“The only potential issuers that have not yet submitted updated documents are Direxion, Roundhill and Grayscale. It’s likely that some, or all, will simply have no problem with it.”

According to Seyffart, the reason is that the ETFs are likely launch This is due to the fear of an impending government shutdown.

Last month, global investment manager VanEck announced that it is preparing to roll out its ETH futures ETF, which the company stated would not invest in Ethereum itself, but rather in standardized, cash-settled ETH futures contracts traded on registered commodity exchanges.

VanEck said at the time that the fund – which will be listed on the Chicago Board Options Exchange (CBOE) – only plans to invest in ETH futures traded on the Chicago Mercantile Exchange.

Also in September VanEck issued a statement saying they expect “effectiveness to occur on October 3, 2023, or at such time as the U.S. Securities and Exchange Commission (SEC) expedites [the] effectiveness of the registration statement.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney