- Bitcoin Investors choose to risk in the midst of uncertainty

- If history is a guide, volatility can be an engine

Bitcoin’s [BTC] Volatility is the greatest strength and the deepest mistake. Even with institutions that purchase, companies that keep strong and collected smart money, it is 120 days since BTC came almost $ 110k.

So what does it stop? While ambcrypto marked, investors have held profit to avoid deeper drawings.

Although that may seem Bearish, it has not been without a strategic advantage. In that sense, Bitcoin’s volatility can build up the momentum for the next leg.

Distribution and volatility signals in the long term

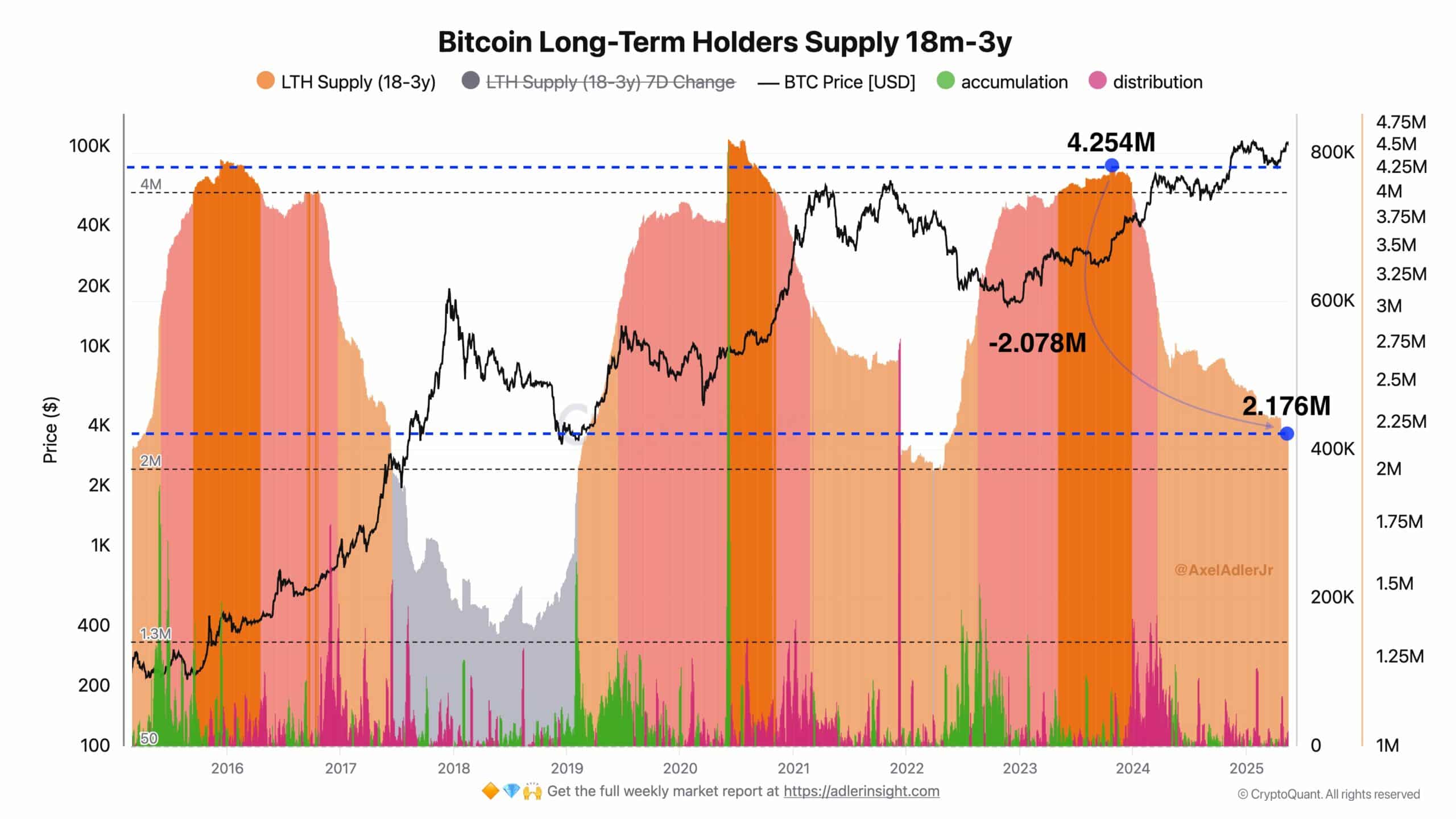

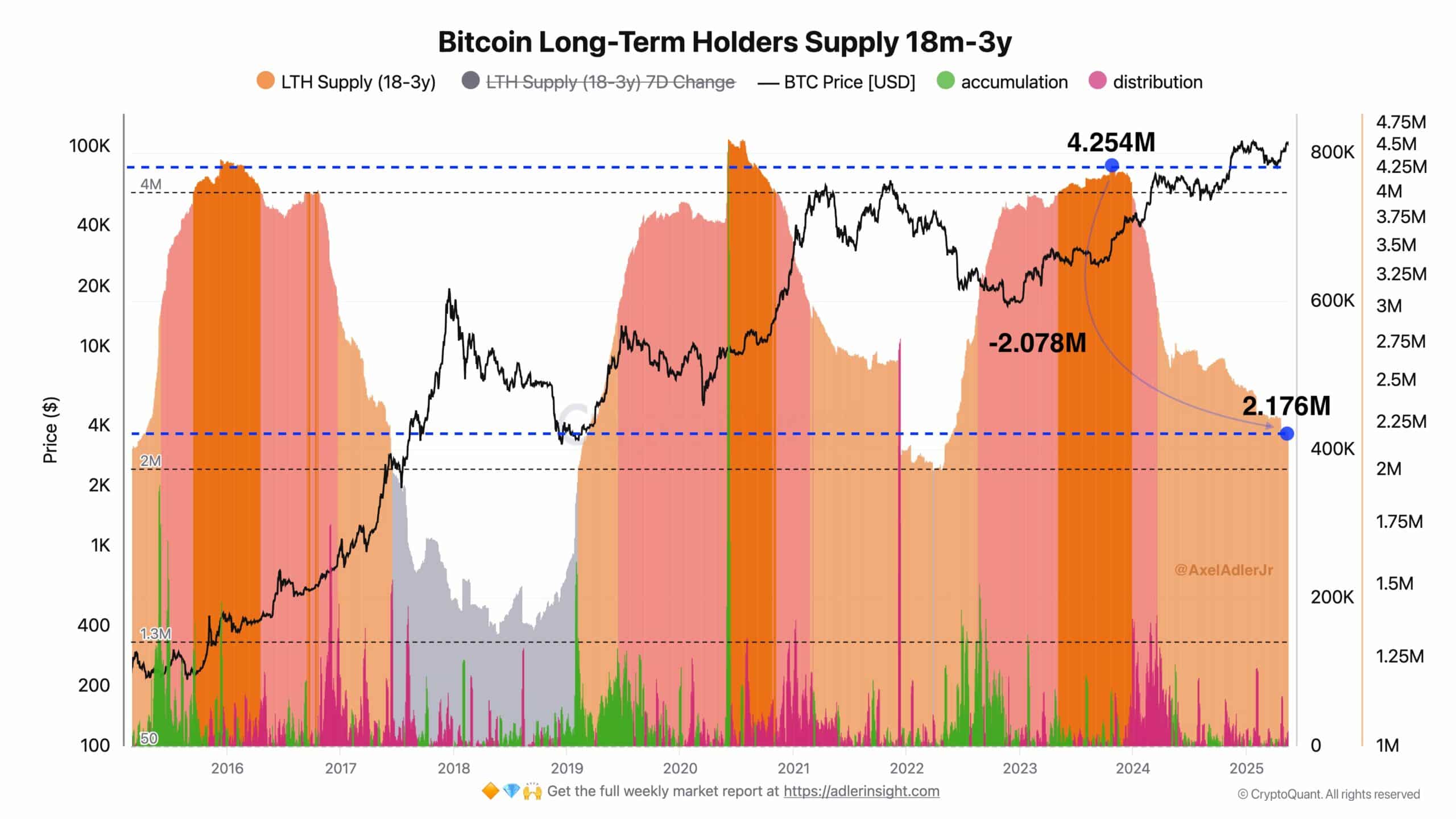

The attached graph revealed an important trend.

Since November 2023, long-term holders (LTHS) have discharged that with BTC from 18 months to 3 years than 2 million coins. They have yielded around $ 138 billion in realized profits.

Source: Cryptuquant

This steady decrease in LTH food, from a peak from 4,254 million to 2,176 million BTC, is a sign of a clear distribution phase. It even looks a lot like what we have seen during earlier bear markets.

Especially in 2022, when a similar pattern preceded an annual decrease of 63% of Bitcoin’s opening of $ 46,017.

What makes the current cycle different is the outcome. Despite similar levels of long -term distribution and profitable, Bitcoin is to continue to trends. It has risen almost 200% in the same phase.

That tells us that something has changed. Instead of causing a crash, all this sale and volatility can shake things and form the stage for a stronger, smarter accumulation.

Bitcoin’s next big chance

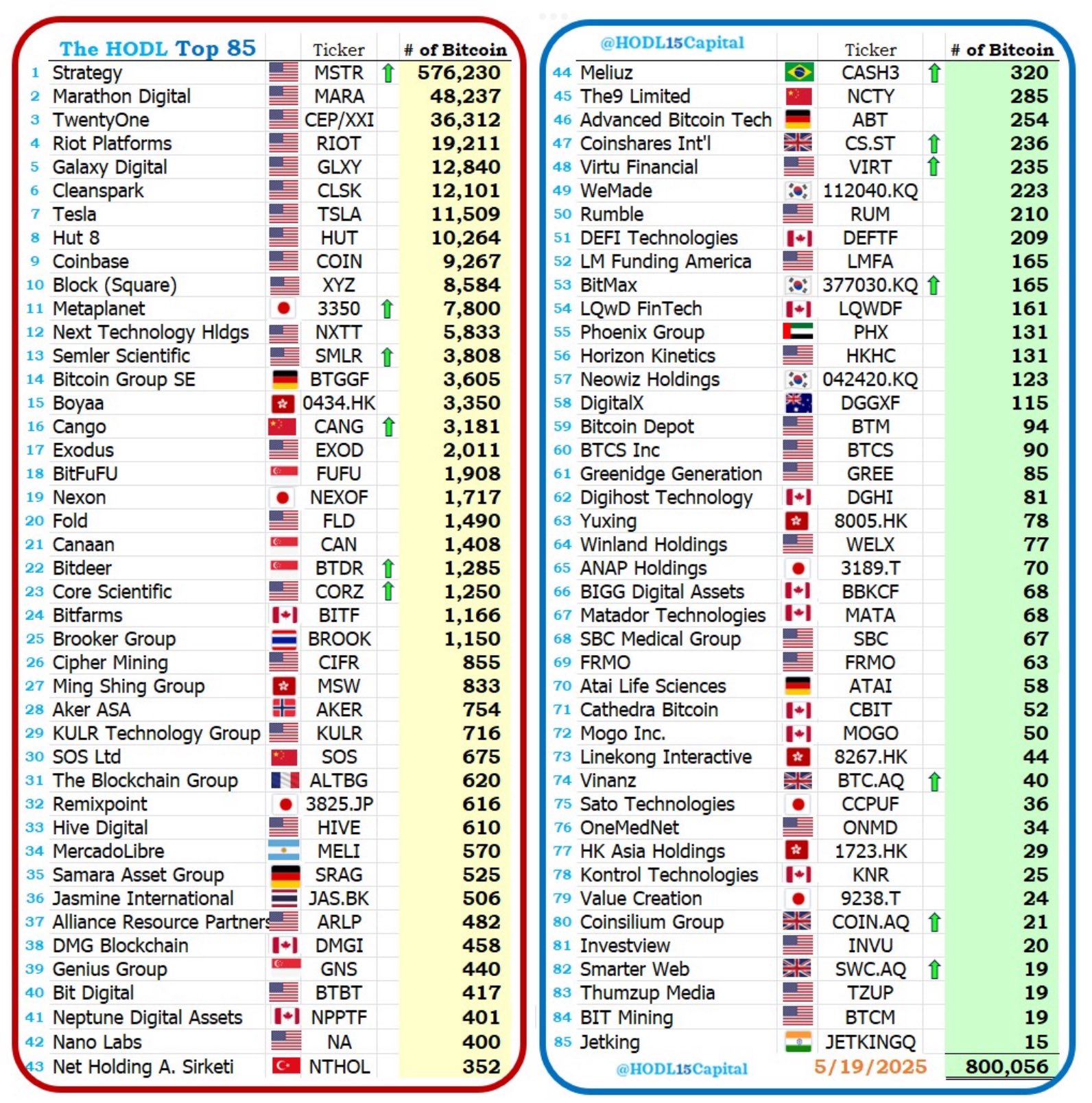

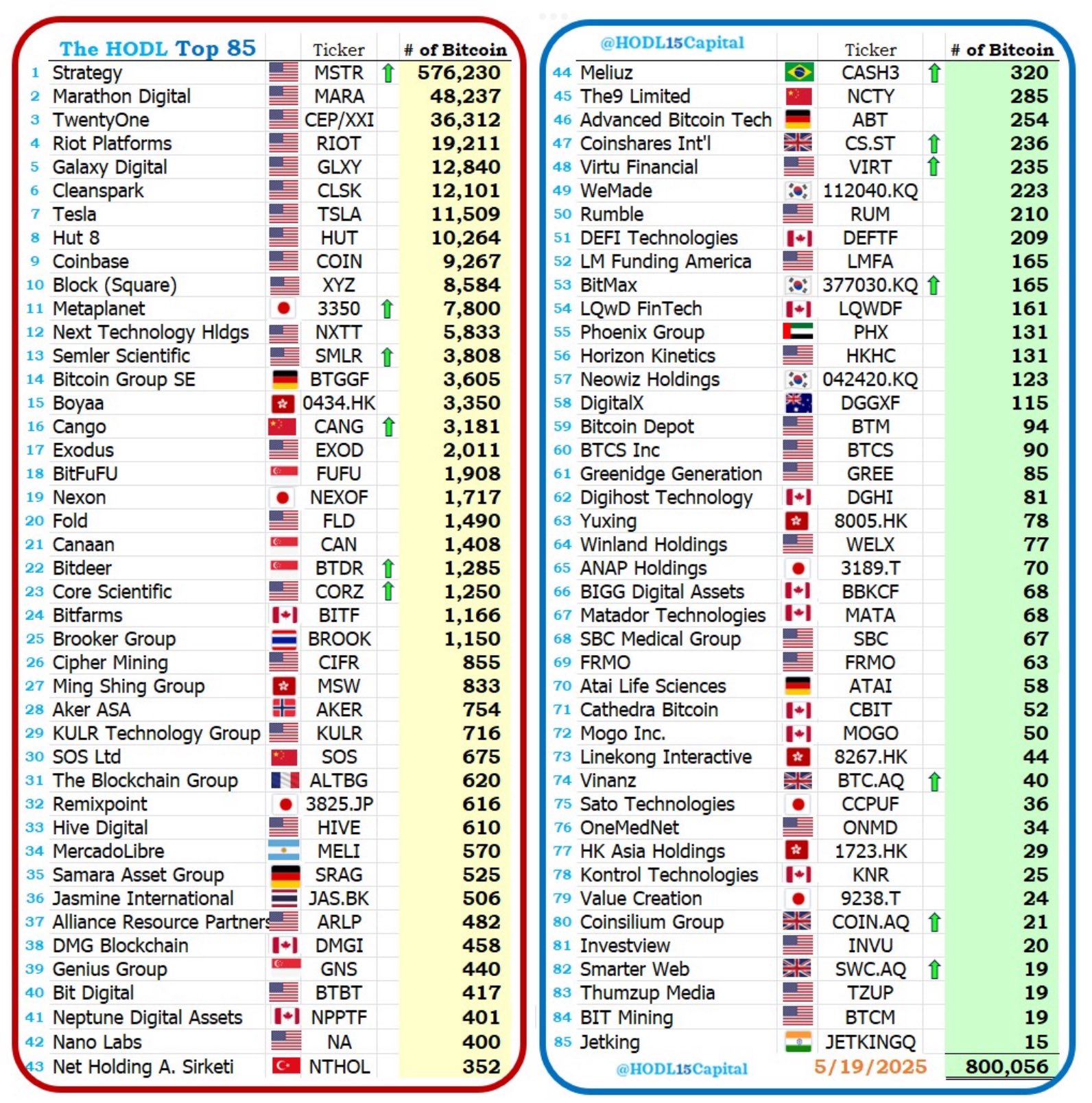

Following this cohort closely is essential. Based on their current BTC treasure box, data-driven analysis of a Leading expert projects That Bitcoin of a maximum of 500K could come on the market towards the end of the year.

This can mean the build -up of a significant wave of exit -liquidity below the surface.

According to Ambcrypto, such a release will inevitably put the volatility of Bitcoin under renewed pressure. That is why the ability of the market to absorb large -scale distribution to test without disturbing the wider uprising.

However, with institutional and business interest in Bitcoin that now surpass levels that are seen in the 2023–24 cycle, this volatility can be less than a threat. Instead, it may look more like a different chance.

Source: X

If history is a guide, Bitcoin could again demonstrate his resilience, bulls offer strategic access and form the stage for further price discovery.