The spot ETF market has revealed the recent high demand for altcoins by institutional investors. The United States Securities and Exchange Commission (SEC) has received dozens of spot crypto ETF applications, with the final deadlines beginning this month.

U.S. SEC Receives More Spot Crypto ETF Applications

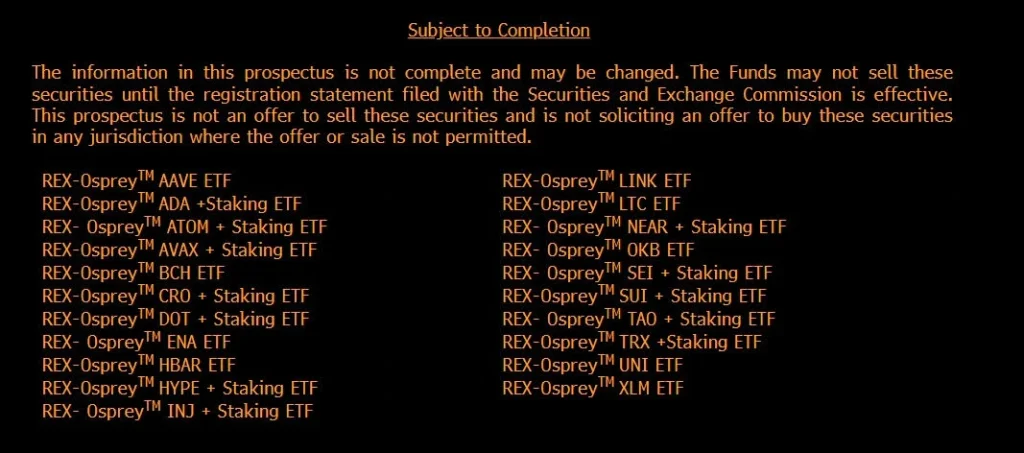

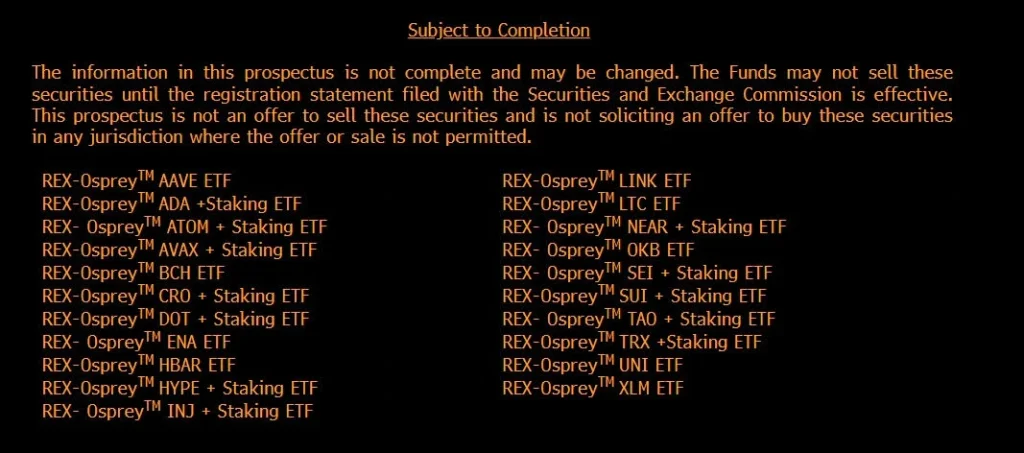

REX-Osprey 21 Filings

On Friday, REX Shares, in collaboration with Osprey Funds, filed applications with the U.S. SEC for a record 21 spot crypto ETFs. The majority of the 21 spot altcoin ETFs included staking options, including NEAR, SUI, CRO, ADA, and TRX, among others.

The 21 REX-Osprey crypto ETF filing builds on their existing applications with the U.S. SEC. As such, the fund manager will become a spot ETF powerhouse once the U.S. SEC approves the latest applications in addition to the prior list.

Defiance ETFs

Defiance, a crypto ETF-focused company founded in 2018, filed nearly 50 3x leveraged ETFs, with some including crypto. Some of the notable spot crypto ETF filings by Defiance include Ethereum and Bitcoin.

Generic Listings Delayed

The expected trading of spot crypto ETFs has been delayed following the ongoing U.S. government shutdown. As Coinpedia reported, the U.S. SEC missed its final deadline on the Canary Litecoin ETF on October 2 due to the ongoing government shutdown.

Late last month, the U.S. SEC requested fund managers to withdraw their Form 19b-4 to facilitate their approval process via generic listing standards. As such, ETF analysts, led by James Seyffart, believe the approval of spot crypto ETFs is imminent and on the horizon.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.