Less than two weeks after Binance co-founder Changpeng Zhao (CZ) removed the “ex-Binance” from his social media bio and replaced it with just “Binance,” activity across the BNB Chain (BSC) ecosystem is soaring, with monthly active users (MAU) reaching their highest levels ever.

Between new token launches, such as STBL and ASTER, as well as a whirlwind airdrop campaign on the Aster DEX, BSC is booming as traders pour onto the chain, pushing BSC’s MAU up to 56.4 million, a 9.5% increase from its previous high of 51.8 million in September 2024.

BSC MAU – TokenTerminal

DEX volumes are surging as well, and reached as high as $24 billion between Sept. 15 and Sept. 21, on track to surpass $35 billion by the end of this week. If accomplished, it would become BSC DEXs’ biggest week of 2025, surpassing the first week of June when over $26 billion was traded on the chain.

Spot DEX volumes over the last two weeks can be attributed to the rise of Aster, which has processed just over $4 billion in volume since CZ promoted it last week.

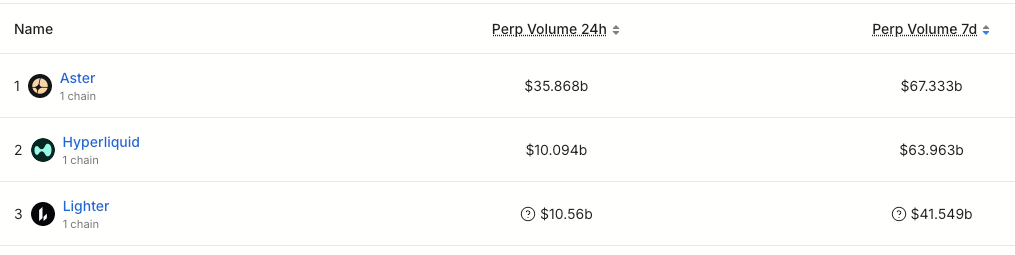

The DEX has also taken a stranglehold of the perp DEX space, flipping Hyperliquid’s total perpetual derivatives volume over the last seven days with $67 billion, compared to Hyperliquid’s $64 billion. However, it is worth noting that Hyperliquid is still significantly ahead of Aster in terms of open interest (OI), with $12 billion in OI compared to Aster’s $1.3 billion.

Perp DEXs by Volume – DeFiLlama