On-chain data shows that Bitcoin HODLers are currently exhibiting net accumulation behavior as they grow their holdings by 15,000 BTC per month.

Bitcoin’s long-term holders have been accumulating lately

This is evident from data from the on-chain analytics company Glasnode, these investors were rather aggressively allocating during the bear market lows. The HODLers, or more formally, the “long-term holders” (LTHs), are a Bitcoin cohort that includes all investors who have held their coins since at least 155 days ago.

The LTHs are one of the two main groups of containers on the market; the other cohort is called the “short-term holders” (STH) group and, of course, only includes investors who bought their BTC less than 155 days ago.

Statistically, the longer a holder owns a coin, the less likely they are to ever sell it. This means that the LTHs are the more determined group of the two groups, which is why they are referred to as the “HODLers” or the diamond hands of the market.

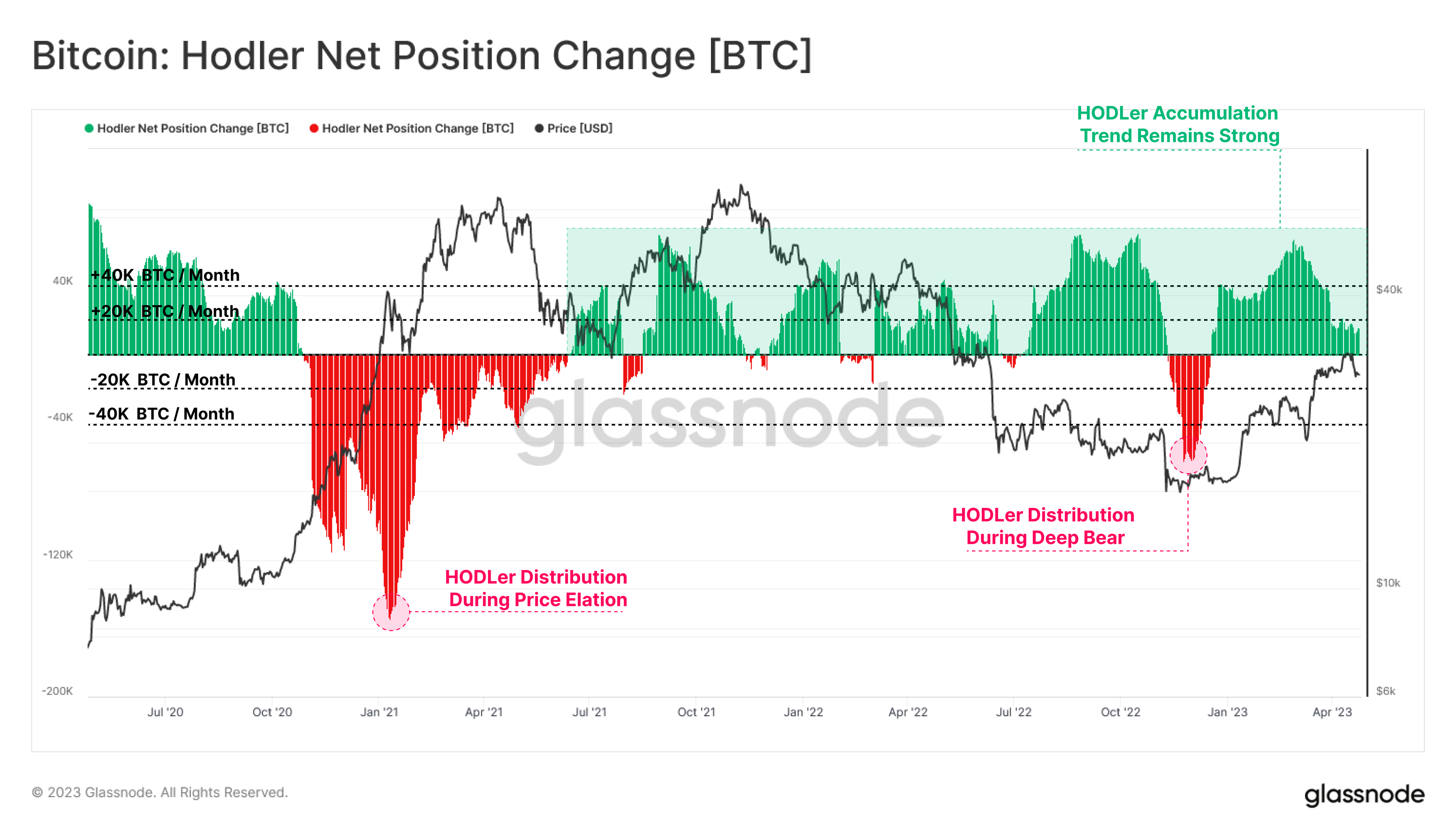

Since these investors are an important part of the industry, their movements may be worth following. An indicator called the “HODLer Net Position Change” measures the monthly rate at which these investors are currently buying or selling a net amount of Bitcoin.

The graph below shows the trend in this statistic over the past few years:

The value of the metric seems to have been green in recent months | Source: Glassnode on Twitter

When the HODLer net position change has a positive value, it means that these investors are currently receiving inflows into their positions. On the other hand, negative values suggest that a net number of coins are leaving the LTHs supply.

As shown in the chart, Bitcoin HODLer’s net position change had a deep red value during the bear market lows that followed the November 2022 FTX crash. This means that LTHs had sold off during this period.

However, this sharp negative peak was an exception to the long-term trend, as HODLers have generally shown strong accumulation behavior in recent years. The last time these investors participated in consistent distribution was during the bull rally in the first half of 2021.

The chart shows that after the aforementioned short period of distribution at the bear market lows, LTHs switched back to accumulation just before the current rally started.

These diamond hands have continued to grow in their holdings throughout the rally so far, demonstrating that they are not lured by the opportunity to take profits. This could be a bullish sign for the rally’s long-term sustainability.

Although, very recently, the monthly amount they have added to their holdings has been on a decreasing trend. Nevertheless, the value of the indicator remains positive as Bitcoin LTHs are currently accumulating at a rate of 15,000 BTC per month.

BTC price

At the time of writing, Bitcoin is trading around $29,100, up 1% over the past week.

BTC has seen some heavy fluctuations during the past day | Source: BTCUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com