Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, has experienced a volatile market in recent days, with its price fluctuating between highs and lows. However, BTC recently recovered from a key trendline at USD 27,000 and is currently trading at USD 29,600, representing a gain of more than 8% in the past 24 hours.

This latest BTC price hike comes after the collapse of a major US bank, First Republic Bank. The news of this collapse may have contributed to the rise in the price of BTC as investors look for alternative investment opportunities following the bank’s bankruptcy.

Another bank failure linked to BTC price hike

Theto, the trader and analyst, who goes by the pseudonym “CJ”, has identified what they believe are the current parameters for the market. According to CJ, the market is likely to hit the 33,000 liquidity level if Bitcoin’s price closes above 30,000 and breaks through the US Dollar Index (DXY) to a range of 97-100. However, if Bitcoin’s price rejects this level and closes below 29250, it could be a bearish retest.

It is worth noting that Bitcoin has recently bounced back from a major critical support level of $27,000, which is good news for bulls in the near term. However, the market is still uncertain whether Bitcoin will again break above the USD 30,000 resistance or experience another slump.

On the other hand, the recent bank failure, such as described by Nick Gerli, CEO and founder of Reventure Consulting, has highlighted the potential risks of traditional banking and finance. This has led investors to question the stability of the traditional financial system and to seek alternative options.

Contrary to this situation, Bitcoin has been on the rise since early 2023, and some analysts believe that the current economic climate could be a contributing factor. The recent contraction in the money supply in the US has led to a reduction in available capital, which could lead investors to look for alternative investment opportunities.

With its decentralized nature and limited supply, Bitcoin has become an attractive option for investors looking to diversify their portfolios. Moreover, Bitcoin’s recent price increase can be attributed to several factors, including greater institutional adoption and growing mainstream adoption. However, the current economic climate has undoubtedly played a role in Bitcoin’s recent appreciation.

As the economic outlook remains uncertain, many investors are turning to Bitcoin as a safe haven. The cryptocurrency has been touted as a hedge against inflation and economic instability, and its recent price increase could reflect these beliefs.

Bitcoin Highs already made for the year?

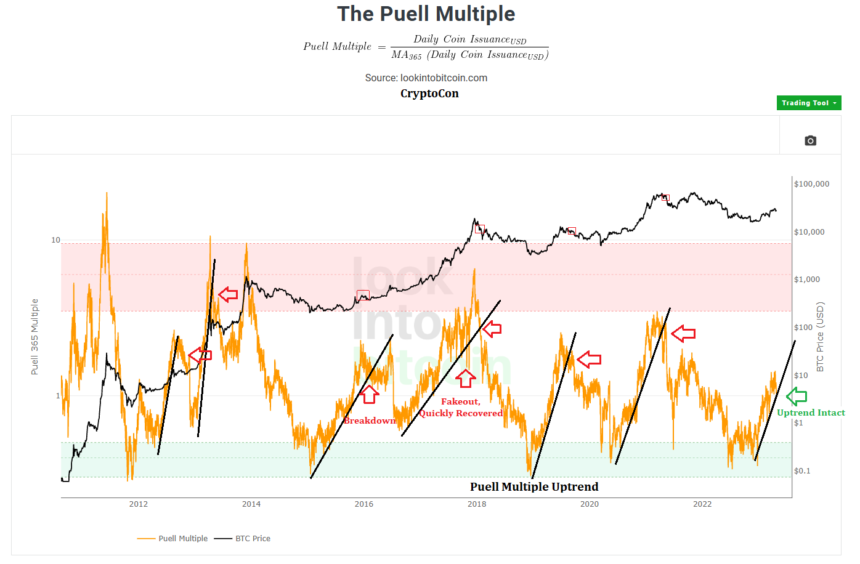

The Puell Multiple, a metric used by cryptocurrency traders and analysts to measure Bitcoin’s value, has recently made a perfect retest of its uptrend, according to to CryptoCon, a trader and analyst of the crypto market. This retest suggests that Bitcoin’s uptrend remains intact and could potentially lead to much higher valuations in the future.

The Puell Multiple is calculated by dividing Bitcoin’s daily issue value by the 365-day rolling average of the daily issue value. It is a useful metric for understanding the current state of Bitcoin’s mining ecosystem and can provide insight into the possible future direction of Bitcoin’s price.

With Puell Multiple’s recent retests of the uptrend, CryptoCon suggests that Bitcoin’s upside momentum remains strong and could lead to even higher valuations in the future. This is welcome news for bulls eagerly awaiting a continued rise in Bitcoin’s price.

Featured image of Unsplash, chart from TradingView.com