Be taught Crypto Jun 17 · 13 min learn

One of many key options of cryptocurrencies is that they’re open supply. Which means combination person information, just like the variety of distinctive addresses or the amount of every day transactions, is freely out there on-line. However cryptocurrencies are additionally designed to prioritise privateness, so breaking that information down to know demographics, or use by nation, is difficult, however not unattainable. We’ll clarify why that’s, the frequent workarounds and summarise the very best out there figures on which nations have adopted crypto probably the most.

Bitcoin, the primary cryptocurrency, was designed to work as a brand new type of cash, prioritising these key options:

- No central authority

- Open to anybody

- No geographic restrictions

- Personal & pseudonymous

- Immune to any type of censorship

In observe, which means that you don’t should create an account to ship or obtain bitcoin, within the sense that you simply may with a financial institution or fee supplier. The truth is, you don’t have to offer any private info.

All transactions are saved in a database that’s shared throughout a distributed laptop community – the Bitcoin blockchain. Transactions include no personal info and no IP addresses. That is arduous for newcomers to know in a web2.0 world the place we quit some a lot private info so commonly and freely enable on-line companies to know a lot about us together with our nation of origin.

The various 1000’s of cryptocurrencies that Bitcoin impressed work in a really related method. This makes it difficult to know the place most transactions are happening; however not unattainable. That is due to the idea of pseudonymity.

Pseudonymity is among the least understood elements of cryptocurrency. A pseudonym is a constant identifier that’s not your actual identify however may reveal your actual identify by affiliation.

As already talked about, you don’t have to create an account to make use of Bitcoin. You simply want a Bitcoin pockets that can generate an tackle – like an electronic mail tackle – that may ship and obtain funds.

That tackle has no figuring out info. It’s only a lengthy string of letters and numbers. However in the event you, for instance, embody your Bitcoin tackle inside your Twitter profile, as many individuals do, and your Twitter account identifies you, then it’s easy to attach the 2 bits of data, revealing you because the proprietor of that Bitcoin tackle.

The identical is true with the companies that serve the crypto ecosystem, crucial being exchanges. Although you don’t have to create an account to make use of Bitcoin, the most typical path to buying some is thru a centralised cryptocurrency trade, the place you do have to create an account and supply figuring out info.

Exchanges act because the custodian of cryptocurrency on behalf of their prospects. They’ve final management of the addresses that maintain the funds however give prospects entry to their funds by way of an internet site or app and a private account.

Exchanges publicly share particulars of these deposit/withdrawal addresses, so it isn’t troublesome to attach an trade to a spread of addresses, the exercise for which is freely out there as a result of crypto is open supply.

A complete trade has grown as much as derive these patterns and behaviours from blockchain utilization. Blockchain evaluation makes use of information science to make the connections between identified entities – like exchanges – and the quantity of crypto held within the addresses they are often publicly linked to.

Exchanges are companies that shield their customers’ information, so for blockchain analysts to interrupt down the amount of knowledge from an trade by nation or demographic, they should mix it with different sources of data and make some assumptions.

Right here’s how one blockchain evaluation agency, Chainalysis, goes about connecting the dots. They take the identified crypto exercise and mix it with a Net Site visitors Methodology.

An index is used as a result of in any other case the information would merely mirror populace nations with excessive GDP and wouldn’t inform us something we didn’t already know. To deal with that these three elements of the trackable crypto exercise are mixed to create the general index.

- the whole worth of crypto acquired by nation

- crypto exchanged by non-professional crypto traders (transactions <$10,000)

- P2P exchange-traded quantity

These three metrics are then weighted by buying energy parity (PPP) per capita, which measures the flexibility of a person in a given nation to buy a set “basket” of products.

The Net Site visitors Methodology takes the geographic breakdown of internet visitors to every trade from public web site monitoring sources like Similar Web, and combines it with different identified components:

- Time zone of the crypto exercise

- The fiat buying and selling pairs supplied

- The vary of languages supplied

- The place the trade is headquartered

- Data offered in labels given to crypto addresses

If this seems like plenty of guesswork, it’s. The method utilized by Related Net to establish the place the visitors to a given web site comes from isn’t a precise science both. The method doesn’t think about using VPNs, and it offers all visitors to the trade equal weight when in actuality solely a small proportion shall be energetic customers and lots of bots.

What Chainalysis find yourself with is the very best guess for an index of world grassroots crypto adoption based mostly on their mannequin and all its assumptions.

Primarily based on their methodology, Chainalysis’s ‘Geography of Cryptocurrency Report for 2020’ ranked nations as follows:

On the face of it, the listing is a little bit of a shock, however bear in mind this isn’t measuring absolute numbers of customers – which might mirror GDP per capita and inhabitants – however an index of adoption.

The highest nation for crypto adoption based mostly on the Chainalysis Index is Vietnam, a younger and tech-savvy nation, with a speculative tradition that favours playing and funding and the place remittance is a crucial element of GDP (just over 6% in 2020 according to World Bank data). This gives a fertile floor for cryptocurrency adoption.

India and Pakistan’s look in positions two and three of the worldwide crypto adoption index shouldn’t be a shock both. Remittance is once more necessary in each nations which boast youthful demographics, rising cellular penetration, and rising center lessons who’re well-educated, and financially astute but missing in alternatives to spend money on options to nationwide currencies.

4 of the nations throughout the prime 10 – Nigeria, Venezuela, Argentina and Kenya – underline crypto’s energy as a hedge in opposition to the hyperinflation every is struggling to various levels.

For all of the nations within the listing – barring the US – remittance makes up a big a part of GDP, for which crypto is an rising answer competing with comparatively costly current choices like Western Union or Moneygram.

Of the three parts of crypto exercise that the Chainalysis analysis makes use of, the final, P2P exchange-traded quantity, is the one one that enables for breakdown by nation. P2P stands for peer-to-peer.

The web site Coin Dance pulls in information from three main P2P exchanges – Localbitcoins, Paxful and Bisq – and charts buying and selling quantity by nation. That information isn’t aggregated throughout the three P2P exchanges listed and doesn’t embody Binance P2P, which has important quantity, but it surely gives dependable information exhibiting a special side of crypto adoption.

A P2P trade facilitates buying and selling instantly between customers and could be very widespread in nations the place face-to-face buying and selling continues to be how most commerce occurs, and belief in centralised monetary establishments is low.

P2P exchanges additionally provide a greater diversity of fee strategies, once more useful in nations the place the vast majority of the inhabitants doesn’t have a conventional checking account.

The info from Coin Dance and Chainalysis factors to the significance of P2P Trade in Africa, Asia and South/Central America, and exhibits how the adoption of a completely new type of digital cash is partly being pushed by some very conventional values.

Outdoors of the Chainalysis methodology the most typical method to gauging adoption is thru surveys. However there are quite a few issues with survey information:

- conclusions are drawn on small/biased samples

- survey methodologies are notoriously weak

- it is rather arduous to confirm claims from respondents to proof of possession

- survey outcomes are sometimes used as a method to draw an viewers suggesting methodologies aren’t notably sturdy

That stated, there may be survey information that independently reaches related conclusions to Chainalysis, lending some weight to their information.

Nevertheless, survey findings aren’t in keeping with Pew Research in November 2021 suggesting 16% of Individuals have invested in or traded some type of cryptocurrency, (which quantities to over 50million folks) whereas Finder.com had that quantity at 9.5%.

The Monetary Conduct Authority, which is answerable for regulating monetary establishments within the UK, conducted a survey in January 2021 which confirmed that 4.4% of adults owned cryptocurrency (round 2,3 million folks). This once more contradicts Finder,com which put adoption within the UK at 7%.

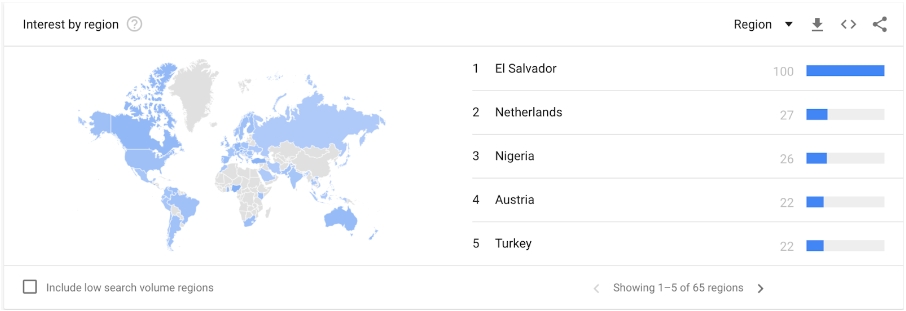

If you would like a easy proxy for international crypto adoption you’ll be able to at all times base it on the variety of Google searches. Google Tendencies exhibits that international combination curiosity within the time period ‘Bitcoin’ is nicely beneath its peak of 2017, and over the past 12 months is comparatively flat.

It is going to be attention-grabbing to see when Chainalysis replace their information for 2021 and whether or not precise exercise in El Salvador matches the demand to search out out extra by way of a Google Search.

Nayib Bukele, El Salvador’s President, is performing as a Bitcoin ambassador on the worldwide stage as illustrated by his welcoming representatives from 44 nations in Might 2022 to share his experiences.

The present Bear Market will make it a lot tougher for Bukele to convey extra nations into the Bitcoin fold, and can even put stress on his personal choices to repeatedly ‘purchase the dip’ however El Salvador is just not alone in making Bitcoin authorized tender. The Central African Republic followed in their footsteps in April 2022.

The information acquired a much more muted response with the motivation for the transfer unclear. CAR is among the world’s poorest nations with very low web penetration and a legacy of inner battle a lot of which centres round management of its pure sources – diamonds, gold and uranium.

CAR is in a tug of struggle with France and Russia each of whom need better affect. Together with many different ex-colonies, the Central African Republic’s official foreign money is the French-backed CAF franc so this transfer has been seen by some as a problem to that historic hyperlink.

The one different nation that seems in each Google Tendencies information for ‘Bitcoin’ searches over the past 12 months and Chainalysis bespoke index information for 2020, is Nigeria which Be taught Crypto has written about in separate weblog articles.

Nigeria has a weak nationwide foreign money – the Naira – struggling a number of latest devaluations and struggles with political instability. However, it’s a youthful and entrepreneurial nation desirous to embrace monetary options. That is backed up by the Statista information already talked about the place 42% of respondents from Nigeria indicated that they owned or had used a digital coin.

Google’s information may simply spotlight a disconnect between a need to know – by way of a key phrase search – and precise use. It is usually troublesome to know whether or not it’s a ‘main’ indicator telling is the place adoption is coming, or a ‘lagging’ indicator confirming current developments.

We merely aren’t going to know with any certainty as a result of crypto was designed to make understanding demographic or geographic developments in use arduous.

There isn’t any 100% correct option to assess the place cryptocurrency adoption is rising quickest. Any try to mix on-chain information with internet bases metrics requires an enormous variety of assumptions which might result in inaccurate information.

Surveys are notoriously unreliable as a result of the samples are sometimes too small, aren’t consultant of the broader inhabitants and are sometimes administered in a method that promotes bias.

The crypto trade is immature and based mostly on rules that prioritise privateness so you’re most unlikely to see a commerce physique emerge which may attempt to anonymously combination information from licensed exchanges to know international adoption.

Although it might be attention-grabbing to totally perceive the place utilization is rising quickest, cryptocurrencies like Bitcoin are designed to work throughout borders however retain privateness. This ought to be seen as a function, not a bug. The truth is, this censorship resistance is itself a driver of world adoption although the precise numbers utilizing it for that objective alone are arduous to gauge.

There are advocacy teams which might be motivated towards addressing misconceptions and reinforcing the use case for Bitcoin – such because the Bitcoin Mining Council and Bitcoin Coverage Institute. They’re producing credible studies of Bitcoin serving to with financial inclusion and reinforcing human rights however they aren’t sharing easy adoption metrics.

“When foreign money catastrophes struck Cuba, Afghanistan, and Venezuela, Bitcoin gave our compatriots refuge. When crackdowns on civil liberties befell Nigeria, Belarus, and Hong Kong, Bitcoin helped hold the battle in opposition to authoritarianism afloat. After Russia invaded Ukraine, these applied sciences (which the critics allege are “not constructed for objective”) performed a task in sustaining democratic resistance.”

https://www.financialinclusion.tech/

Regardless of the censorship-resistant nature of crypto there are some organisations who’re going to nice lengths to be taught extra about adoption patterns – governments.

The Anti Cash Laundering laws that centralised exchanges should comply with and the studies of suspicious exercise they compile which is able to embody account info (names, addresses, IDs, telephone numbers) enable governments and crime companies to construct up complicated photos of crypto exercise.

Most nations are attempting to ramp up crypto regulation to make the duty of surveillance simpler. Simply don’t count on this information to be printed wherever.

This highly effective functionality is among the predominant the reason why Central Financial institution Digital Currencies are seen with such suspicion by these throughout the crypto neighborhood. CBDCs would give governments nearly complete visibility on our monetary actions, one motive why China has banned cryptocurrencies and is full steam forward to implementing a digital Yuan.

It ought to now be clear that establishing dependable international crypto adoption information could be very arduous, primarily as a result of crypto is designed to obfuscate geographic evaluation and the out there workarounds all have important shortcomings.

What is evident, nonetheless, from the totally different information sources are common patterns of crypto adoption by nation exhibiting that necessity is a extra necessary driver than hypothesis.

- Adoption is best in nations the place the nationwide foreign money is weak and inflation is excessive, remittance is necessary and monetary inclusion is low.

- Hypothesis drives adoption in nations the place these components are much less necessary.

Given the present state of the worldwide economic system hit by Covid and the Struggle in Ukraine a a lot larger proportion of the world inhabitants is being pushed into the need class.

Inflation is now everybody’s downside however cryptocurrency markets are nonetheless strongly correlated to conventional monetary markets so paradoxically adoption in excessive GDP western nations is more likely to be negatively impacted. As monetary markets ‘risk-off’ within the face of inflation and recession, adoption could decline simply when the use case for crypto ought to be at its strongest.

The speculative dynamic is performed out by means of punishing bull/bear cycles which feed again into patterns of world adoption. In some nations, there’s a dire want for various types of cash, whereas in others a rejection due to its volatility.

On prime of this cocktail of competing forces, you need to graft the affect of elevated regulation which looks as if a certainty given high-profile collapses like Terra-Luna.

The complicated interaction of things that drive crypto adoption world wide, together with crypto’s pseudonymity, makes understanding which nations are utilizing it arduous to know but when historical past has taught us something it’s that cash evolves.

Pushed by necessity, nations like Vietnam, India and Pakistan are main that revolution, it stays to be seen how a lot additional it is going to unfold.