- Bitcoin’s STH offer is confronted with increasing pressure, since macro uncertainty deposits the market volatility of the market

- If BTC breaks below $ 72k, the capitulation risks can escalate

On April 9, US President Donald Trump announced a 90 -day break about rates, which activated an increase of 8.27% in Bitcoin [BTC] – The longest green candlesticks in almost a month. Then, on 10 April, the American Core CPI inflation fell below 3.0%for the first time since March 2021. In response, Bitcoin rose at the time of 3.36% to $ 82,532.

With this back-to-back macro-boosts, the market seemed to be gaining strength. However, a real test can be for us.

Short-term holders (STHs) felt the pressure because their price realized on the $ 93k press was above the level of BTC.

So, if the Federal Reserve slows down the rate reduction, will STHs hold? Or will the confirmation resistance force them to capitulate?

Bitcoin’s StH Supply Signals Capitulation Risk

The range of Bitcoin’s short -term holder (STH) is approaching a crucial bending point.

On February 10, STH-BTC peaked at a highlight of four years of 400K. Since then it has fallen to 360K, which signals the net distribution.

This coincided with the world’s largest cryptocurrency that violate three important support levels and a sign of the persistent sales of this cohort.

Source: Glassnode

Data on chains From Glassnode it revealed that the majority of these companies were collected around $ 93k. With BTC trading under this realized price, around 360K BTC remains in a non -realized loss status, which increases the risk of capitulation.

More critical, the STH realized price was at $ 131k and $ 72k, which defined the critical liquidity zones.

If Bitcoin brings itself back to the lower tire at $ 72k, the profit margins for these holders would erode with 22%, so that extra stress is placed in the short term. Historically, a violation of the lower band has catalyzed forced liquidations.

If Bitcoin maintains a movement under $ 72k, a step -by -step sales pressure could come out, which reinforces the drawdowns.

Conversely, the recovery of $ 93k STH’s positioning would turn back in profit, so that the risk on the supply side can be sent and the Bullish Momentum revived.

Shaking macro-volatility in the short term

From a macro-structural position, the price action of Bitcoin continues to consolidate under the crucial $ 85k resistance level. Repeated rejections at this threshold indicate a liquidity zone that, if violated, could activate a cascade of short liquidations.

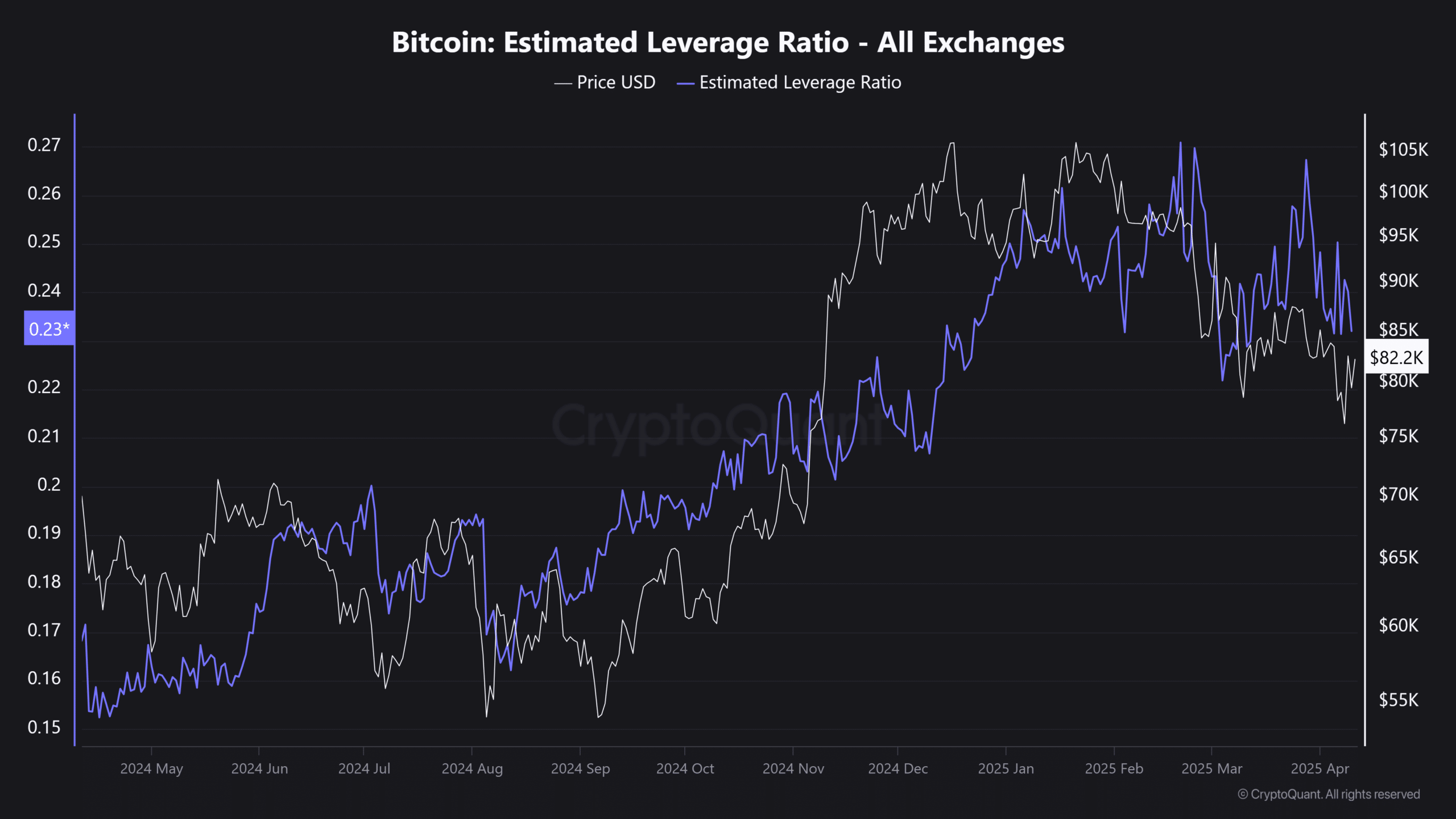

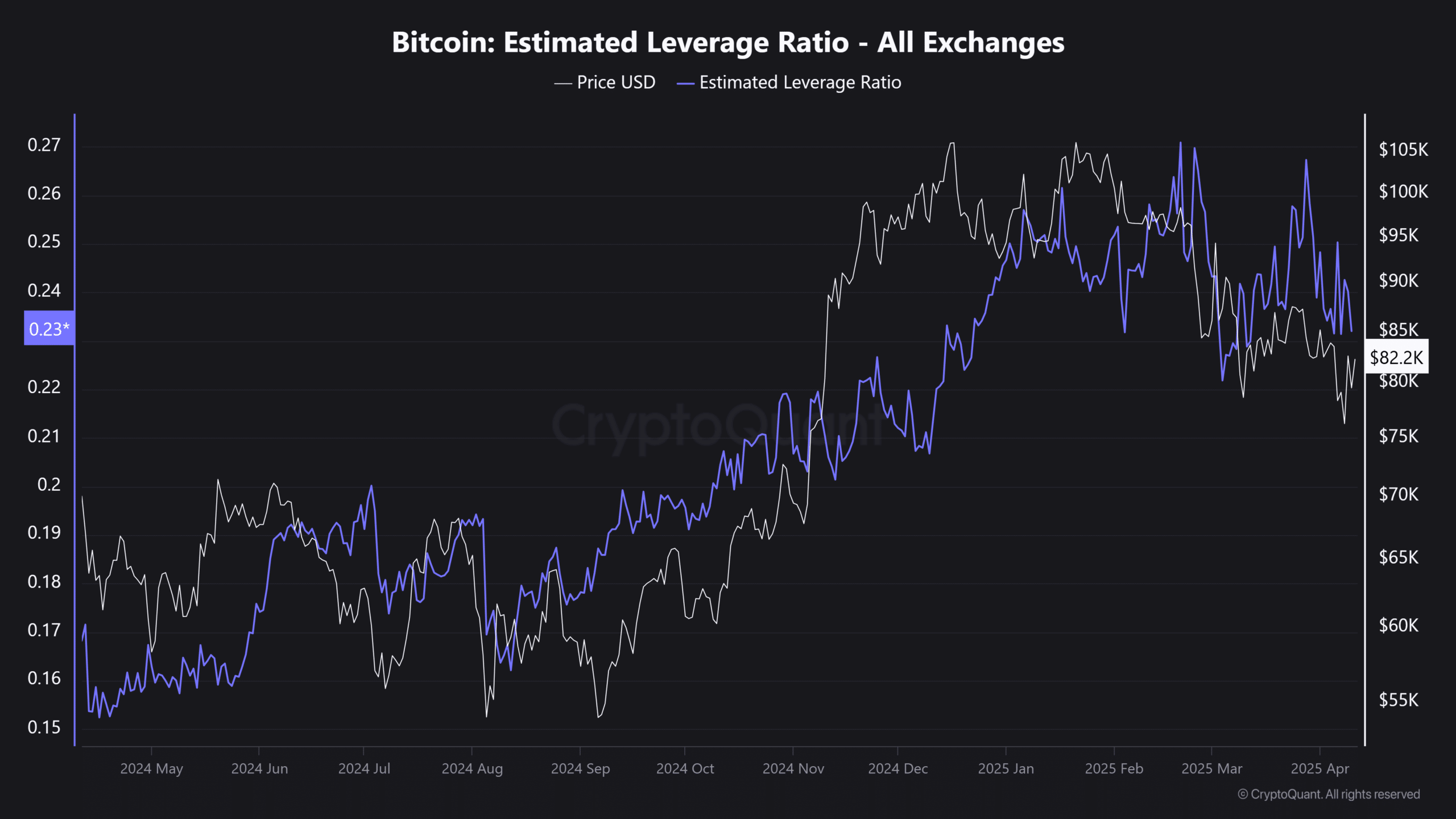

At the same time, the estimated lever ratio of Bitcoin (ELR) slid under the basic line of the beginning of March – which indicates a persistent delevering phase. Futures traders remain risk-suffering, with a noticeable reduction in positioning with a high leverage.

Source: Cryptuquant

Despite these challenges, Bitcoin has shown some resilience.

After the turbulence with tariff-related market, the market capitalization of BTC saw only $ 90 billion-a relatively modest leaching compared to other risk activa.

However, because the Federal Reserve has less chance of rapidly reducing interest rates, macro illness could push holders in the short term to leave. Many of them bought around $ 93k. And if the price does not recover quickly, they can sell to prevent deeper losses.

With the fear still high, speculative demand low and the most important resistance levels overhead, a dip up to $ 72k remains a real possibility before Bitcoin can try a persistent outbreak.