- Bitcoin’s pullback of $ 90 billion remained small in the light of the macro delay cycle.

- The next leg can arrive earlier than the market expected.

In contrast to the consensus of the marketBitcoin’s path to $ 100k seems increasingly likely in the aftermath of the ‘trade dump’.

Since February 19, the US stock market has paid $ 11 trillion in market capitalization, with 54.55% of that drawing that accelerates the day after ‘liberation.’

Yet this can only be the beginning. Gold (XAU) marked a Q2 peak at $ 3,143 per ounce before a retracement of almost 3%, with $ 520 billion in market capitalization erased since 2 April. Bitcoin [BTC]In the meantime, 5.17% have corrected of the rating of $ 1.74 trillion.

A dip of $ 90 billion is small compared to the wider market flushing. Consequently, the increasing divergence of Bitcoin against risk assets and macro swings has been strengthened.

Proper holders accumulate, strengthen conviction

The supply of holders in the short term (<155 days) has fallen to a lowest point in two months of 3.7 million BTC, which reflects around 3 million BTC in realized losses in the midst of Bitcoin's retracement of his $ 109k of all time.

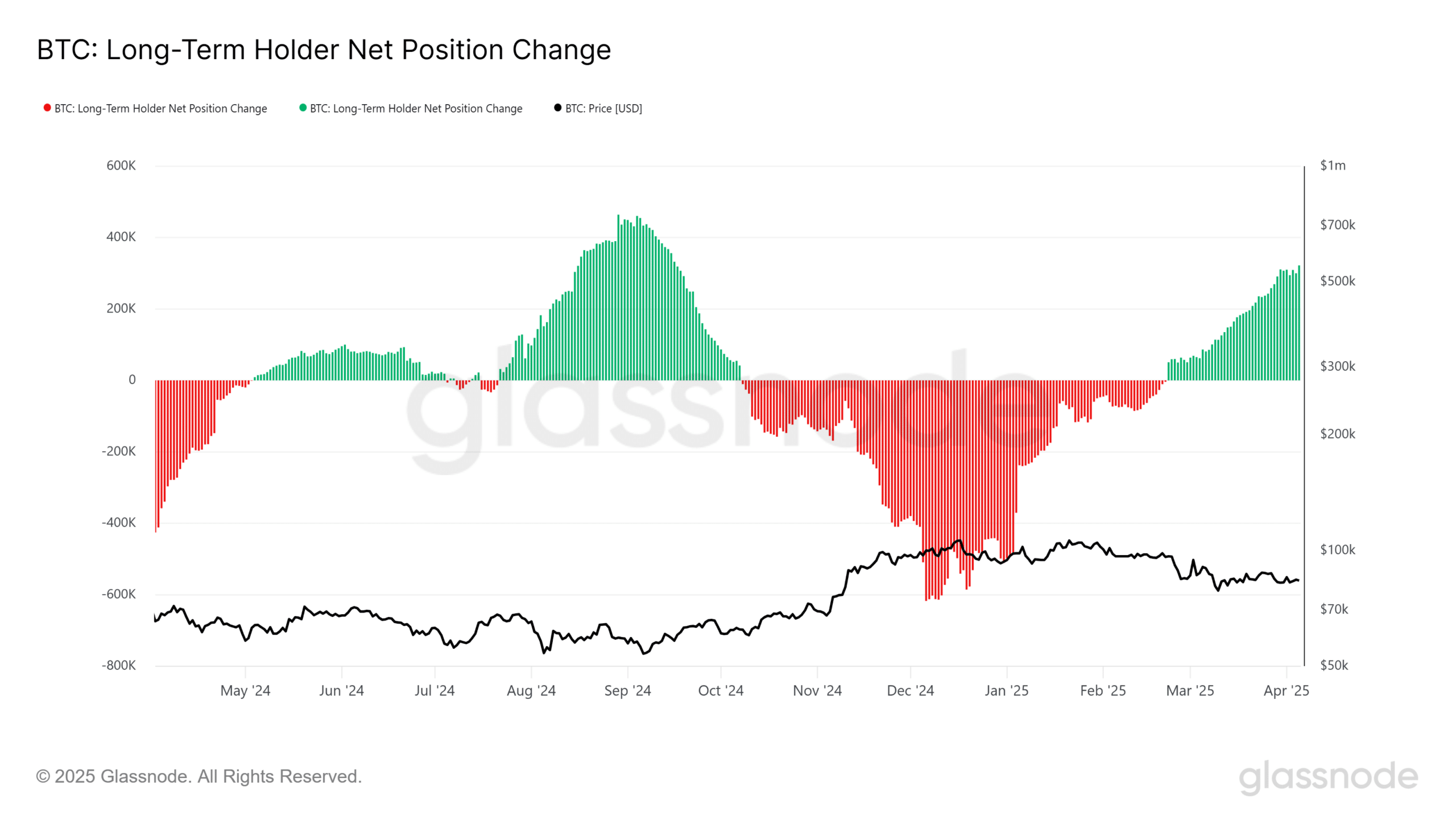

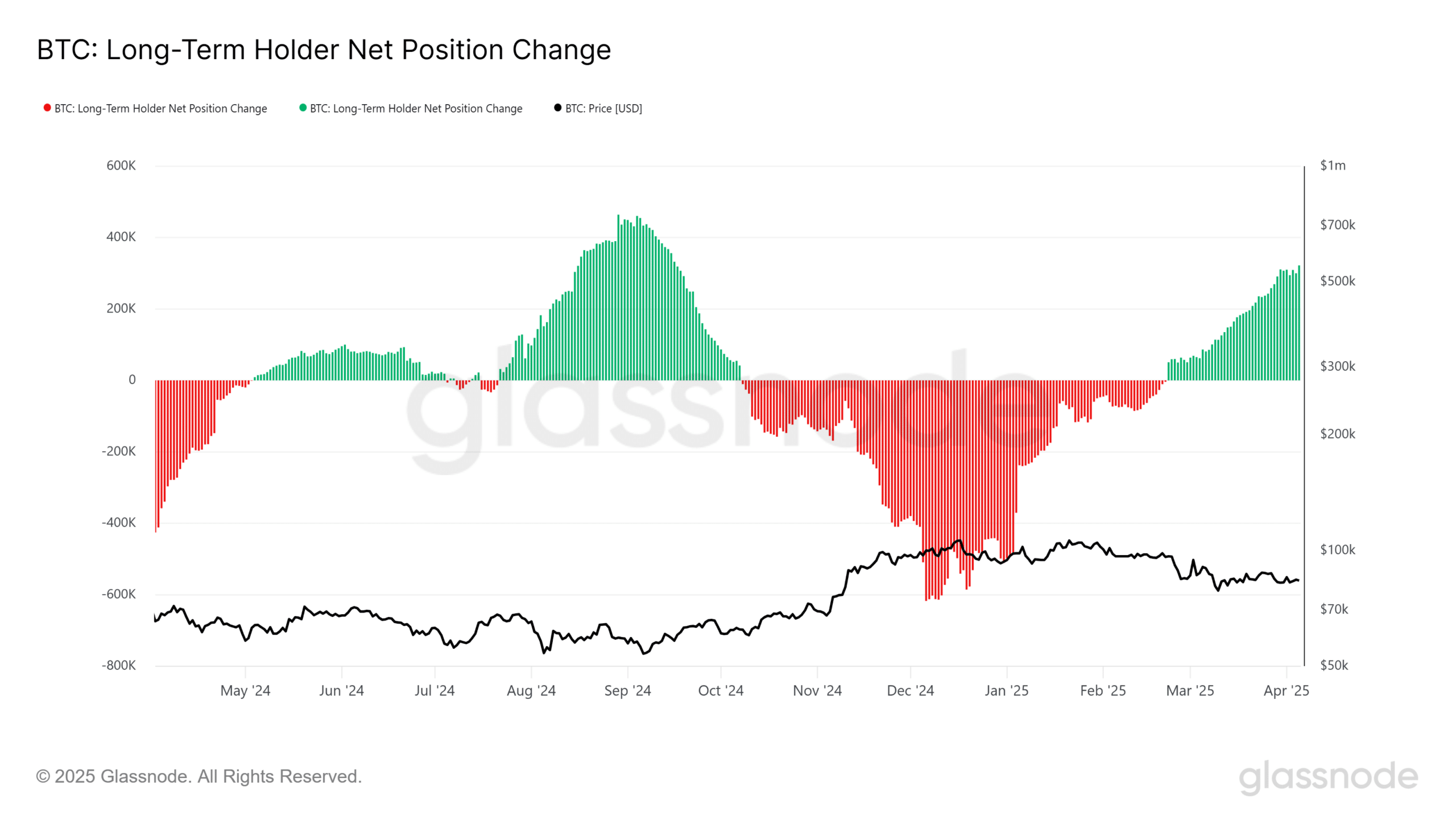

Conversely, the long -term holder (LTH) stock has been expanded in the same period.

The net position change statistics signals aggressive accumulation at an average cost basis of $ 84k per BTC, which underlined a strong conviction.

Source: Glassnode

At the time of the press, Bitcoin remained under $ 85k, a critical break life threshold for weak hands.

Persistent LTH accumulation and the growing decoupling of BTC of US shares, however, indicate a critical bending point That could be the scene for BTC to reclaim $ 100k.

The most important driver? Capital flows from risk activa – and even safe ports – in BTC.

Germany Recently initiated A pullback of 1200 tons of gold worth $ 124 billion from the New York reserves. If more countries follow, this could weaken the role of Gold as a worldwide port.

With Bitcoin that is strong, while the S&P500 $ 4 trillion throws the biggest drop since the COVID-19-Crash and Gold that loses steam, BTC is in an excellent position to attract capital of governments, institutions and retail investors.

Bitcoin’s Haven status back in Focus

In the short term, to activate FOMO, Bitcoin has to break resistance to $ 85k $ 87k, a key zone where taking a profit goes then. It was a month since these levels were last tested.

That is why the creation of a strong bidding wall within this reach is crucial for bullish continuation. Yet a breakdown below $ 80k remains an event with little probability.

Since March 12, Walviscohorten (> 1K BTC) have collected aggressively, so that companies have been brought to a three -month high. With deep pocket entities that absorb the range, a retest of support of $ 77k seems increasingly unlikely.

Source: Glassnode

The ability of BTC to keep strong despite the macro uncertainty continues to feed its case as a cover against the market turbulence.

As long as the question remains firm, the path from Bitcoin to the discovery of six digits remains well positioned. Capital inflow could pick up even more, especially with US shares that are confronted with a greater risk of rising rate pressure.