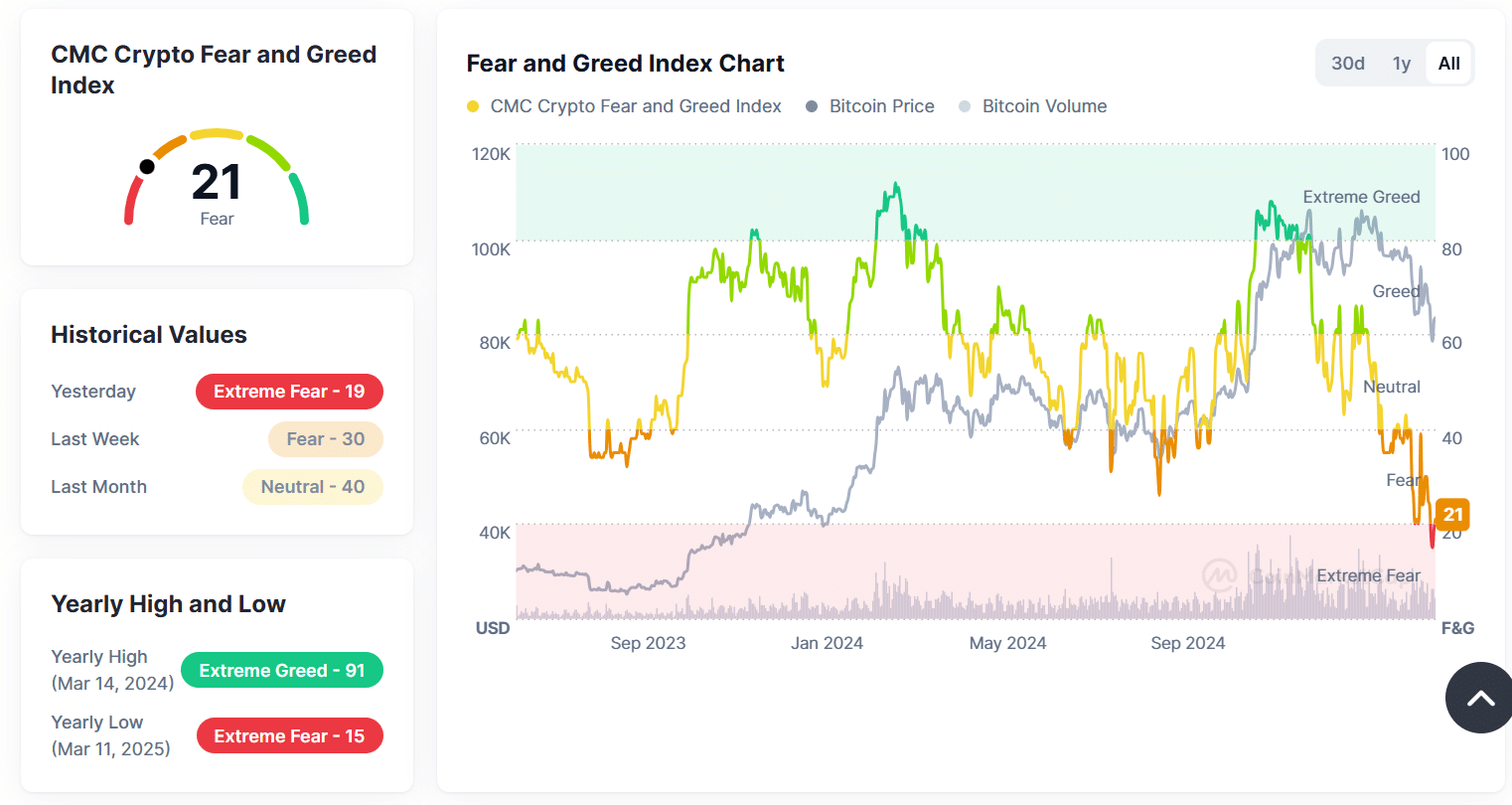

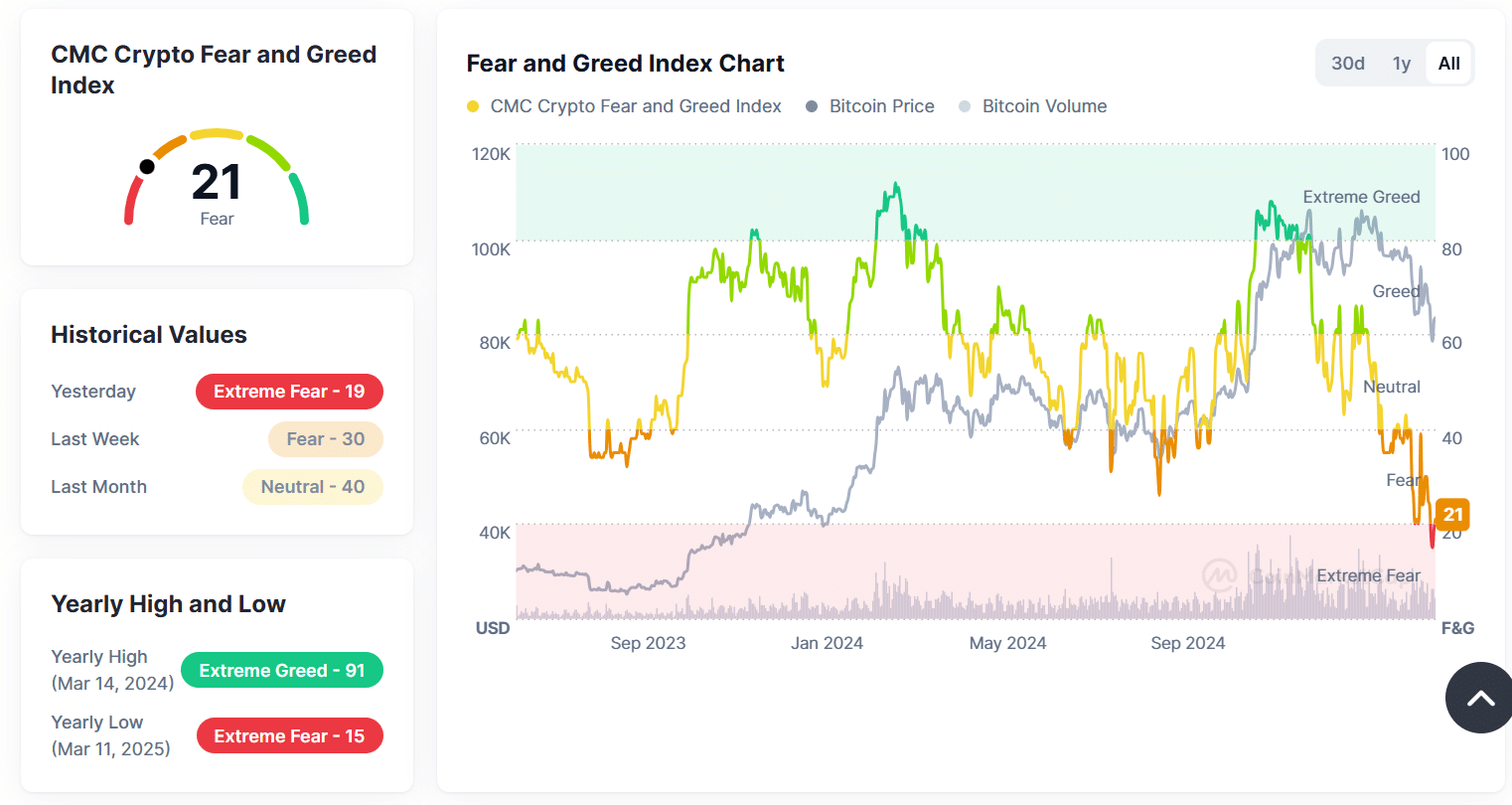

- The fear and greed index has plummeted to 21, so that increased fear is marked in the market.

- ETF -network flows show a mixed trend, where BTC sees small inflow while ETH is struggling with continuous outflow.

The cryptocurrency market experiences increased fear, with the crypto fear and the index of greed.

This sharp decline reflects the growing uncertainty, driven by significant outflows of ETFs, falling market capitalization and wider macro -economic care.

Crypto -fear and greed index falls

The crypto Market sentiment taken an important hit when the fear and greed index dropped to 21, which indicates extreme fear of investors.

Last month the index stood on a neutral 40, with a sharp fall in confidence as market conditions deteriorated.

Source: Coinmarketcap

This drop is in line with a broader market correction, reflected in the crypto market capitalization and ETF -Netto flow trends in the last 30 days.

Market hood is suffering from large decreases

The total crypto market capitalization is now around $ 3 trillion, with Bitcoin [BTC] and Ethereum [ETH] take significant hits.

The market capitalization of Bitcoin was $ 1.65 trillion at the time of the press, which marked a decrease of 15.11%, while Ethereum has seen a more drastic decrease and 30.53% dropped to $ 227.41 billion.

In the meantime, Stablecoins remained relatively stable at $ 216.23 billion, which reflects a shift to risk -aging assets in a time of increased uncertainty.

Source: Coinmarketcap

Other altcoins have also had to deal with major sale, with their collective market capitalization with 19.76%.

ETF Netflows reflect mixed sentiment

ETF -Netflows offer further insight into investor behavior.

While Bitcoin saw a modest $ 13 million in positive inflow, Ethereum registered $ 10 million, which emphasized the diverging investor sentiment between the two leading cryptocurrencies.

Source: Coinmarketcap

In the past month, several days of negative flows have contributed to the bearish sentiment, which reflects the extreme fear in the index.

The persistent outflows suggest that investors are still hesitating to use capital and further weigh on market recovery.

Implications for crypto markets

A fear and greed index on these levels usually indicates a sold -up market, but it also indicates a lack of merchant confidence among investors.

Historically, such extreme fear levels preceded the recovery phases, because opportunistic traders want to benefit from lower prices.

However, with continuous decreases in market capitalization and persistent ETF outflows, the road to recovery can still experience resistance.

If Bitcoin does not keep its market dominance and the outflow of Ethereum continues, the Bearish trend could continue to exist, forcing more liquidations and the market correction deepens.

On the other hand, any shift to positive ETF intake and stabilization of market capitalization can mark the start of a sentimenta save.

Conclusion

The current market sentiment suggests a cautious approach for traders and investors. Although extreme anxiety can offer purchasing options, macro -economic factors and capital outflows remain important risks.

Monitoring of ETF trends, stablecoin -dominance and the market strength of Bitcoin will be crucial in determining the next big step.