- There has been an increase in liquidity inflow in Berachain in the last 24 hours and other chains surpassed.

- The market remains slow, but the pressure refers to an upward chance for a large tree.

In the last 24 hours, Berachain [BERA] Has fallen by 4.58% because it became Beerarish market sentiment. This continues its downward trend of the past week, with it acting by 10.65%.

This price decrease comes in the midst of massive liquidity inflow in the chain. However, other important market statistics indicate intense sales pressure of market participants.

Liquidity inflow cannot cause a price increase

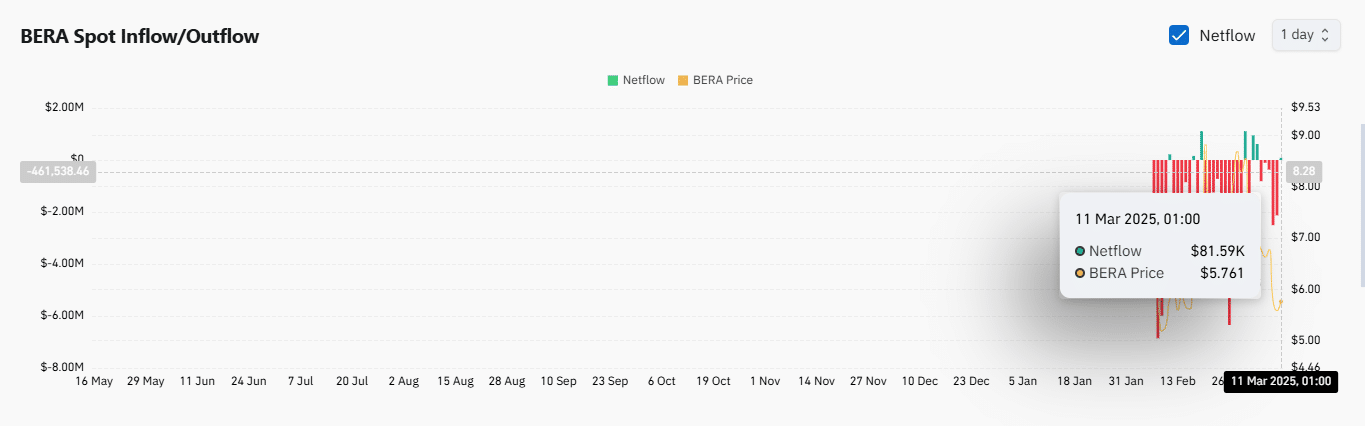

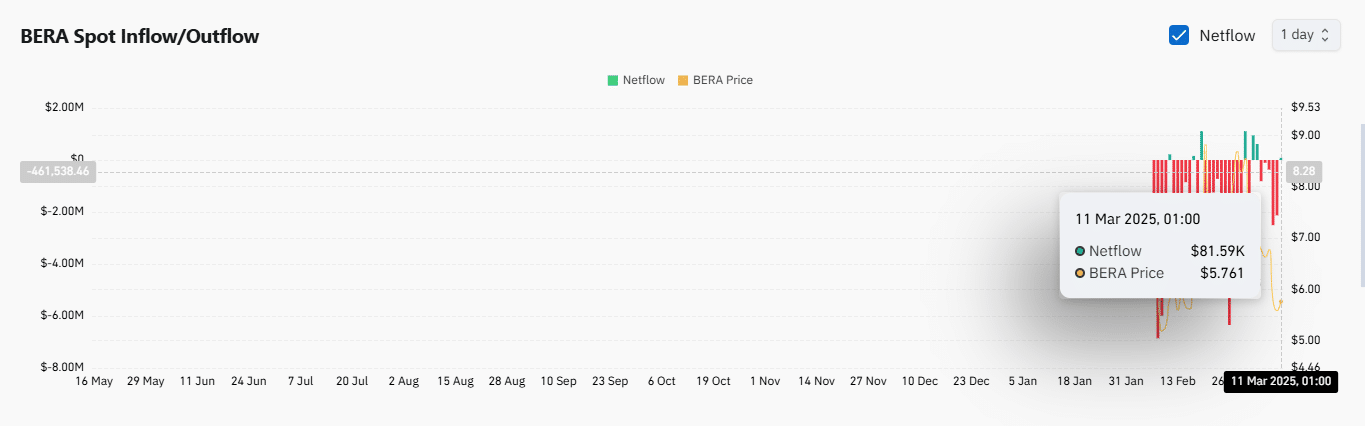

Massive liquidity inflow in Berachain has been admitted for the past 24 hours, according to Artemis.

During this period, $ 112.8 million was purchased from Bera, as indicated by chain Netflows, who placed it for the base, Solana [SOL]and Sei Network [SEI].

Source: Artemis

A major liquidity inflow is usually followed by a major price increase. However, the opposite is done with Bera, because it is still struggling and investors stay in a drawing during this period.

An investigation into the total value locked (TVL) shows that investors start selling their locked or deposited Bera about protocols on Berachain.

This trend started on March 6, when TVL was $ 3,495 billion. From the moment of the press, TVL has fallen to $ 3,187 billion, which means that Bera has flooded the market for $ 308 million, which contributes to the downward pressure.

The sales pressure is growing on the spot and derivative markets

The sales pressure is not limited to Defi protocols -Trade also sells both in the place and in the Futures markets.

Coinglass Exchange Netflow data shows that this cohort started selling Bera after five consecutive days of buying spot traders.

From the moment of the press, $ 81,570 has been sold to the active – a number that will probably increase as other segments of the market follow.

Source: Coinglass

Derived traders also tackle the pace.

According to the analysis of Ambcrypto, the financing figure is used to determine market trends on the basis of or long or short traders pay the premium -that short traders dominate, with a lecture of -0.0834.

In simple terms there are probably more short contracts in the market than long. It is important that traders who hold these short contracts pay a periodic fee to maintain their positions.

Events as these indicate Beerarish sentiment, which tends to weigh on price action.

Is there still hope for a price rebound?

Although the market remains in broad lines, there are signs of potential recovery.

A closer look at the 4-hour graph of 4 hours showed it actively perfectly from an important level of support at $ 5,538 and formed three consecutive bullish candles.

If Bearish Momentum slows down and this level of support acts as a catalyst, Bera has two potential goal levels: first at $ 7.20, whereby it would actively win 30% and then at $ 8.89, which represents an increase of 60%.

Source: TradingView

However, this scenario depends on bullish trends that rise and withdraw. If that happens, Bera could see a big price increase and achieve these goals.