- Bitcoin -Dominance showed Beerarish divergence while the market is shifting to alternative assets.

- Signal This signal investors who leave BTC?

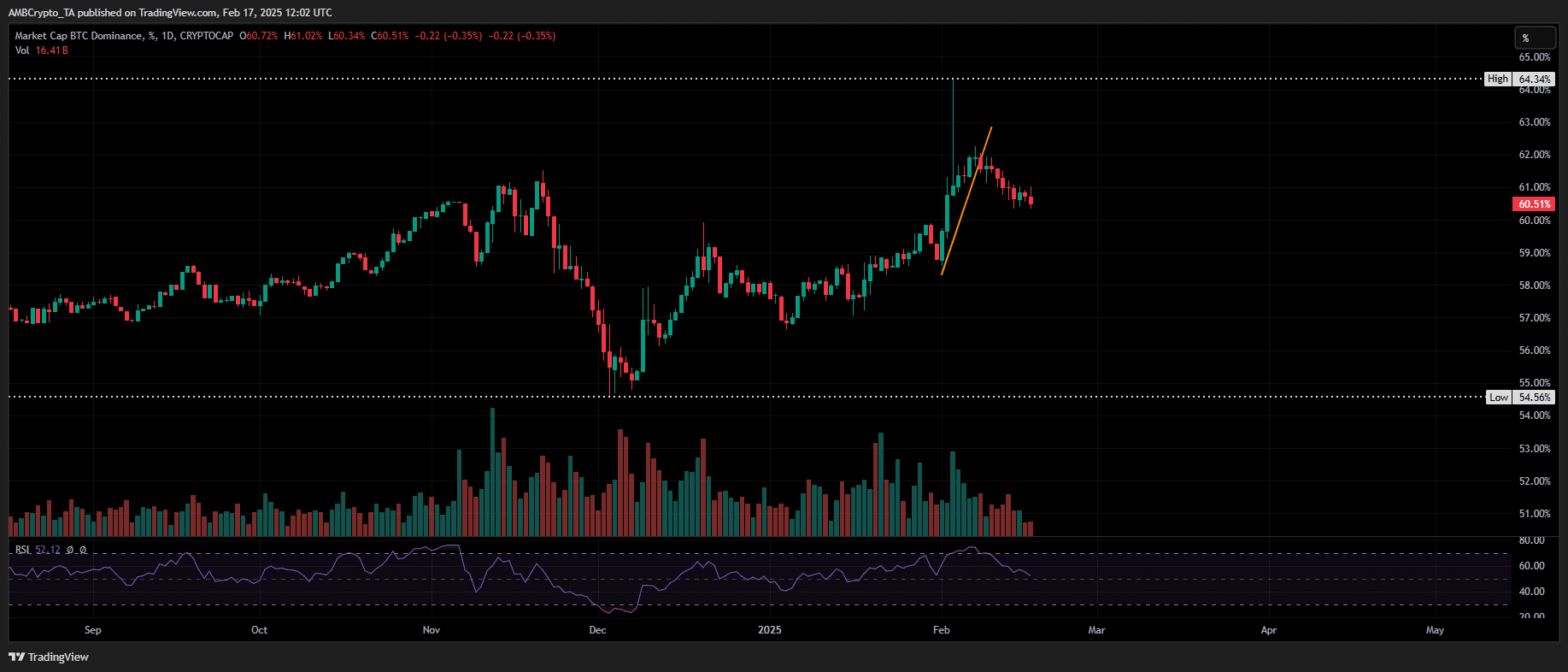

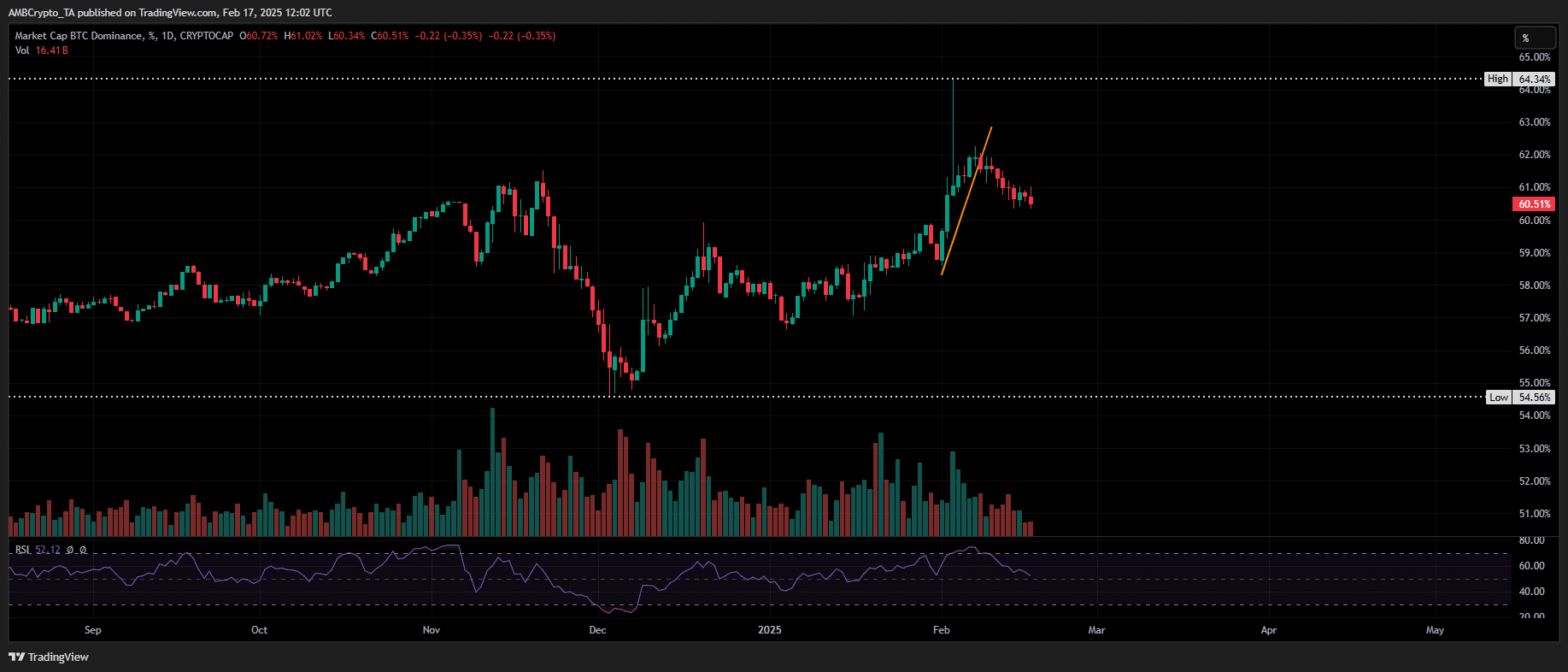

Bitcoin [BTC] Dominance (BTC.D) showed a bearish divergence, suggesting that its market share is weakened compared to the total crypto market capitalization.

The relative strength index (RSI), however, does not yet provide a sales signal that the momentum has not yet completely shifted – not yet.

Bitcoin is preparing for a retreat, or is this just a temporary cooling -off period?

A critical week for Bitcoin

BTC.D shot up by 5% at the beginning of February after a market-wide stir was caused by the tariff position of Trump, which has wiped out more than $ 420 billion in crypto-market capitalization.

Source: TradingView (BTC.D)

While panic spread, Bitcoin kept strong while Altcoins crumbled, with most High-Cap Altcoins who touched new lows against BTC.

History shows that Bitcoin consolidation often evokes Altcoin meetings. In the second quarter last year, when BTC floated between $ 60k and $ 70k, Ethereum’s [ETH] Steed with his longest green candlestick and achieved a daily profit of 19%.

With High-Cap Altcoins that already show weekly profits, this trend might be ready to play again. Bitcoin Futures traders must remain careful. Sentiment is bullishWith more long positions that accumulate.

With a bearish divergence in the game, billions will run the risk of liquidation in the coming days, making it a stage for a potential long squeeze.

Is this shakeup just a temporary cooldown?

This month Bitcoin has dropped more than $ 1 trillion in market capitalization and fell from a peak of $ 2.10 trillion at the end of January.

Now that sentiment sinks in fear, a BTC -Rebound still feels far away.

If the dominance continues, we could see the fear index diving into ‘extreme’ territory, making it the scene for potential panic sales. This is something to keep an eye on in the coming days.

Source: Coinmarketcap

However, there is a slight increase in the index, with momentum now neutral. The RSI has not yet completely reversed, which means that space is left for a possible turn.

Altcoins see a correction of 5% in the daily price promotion, which suggests that the recent increase can be nothing more than a cooldown phase-in place of the start of a full Altcoin season.

Nevertheless, to prevent the RSI from getting a low, it is closely monitoring on the Futures market is the key, because this could pose the biggest threat to Bitcoin’s dominance.