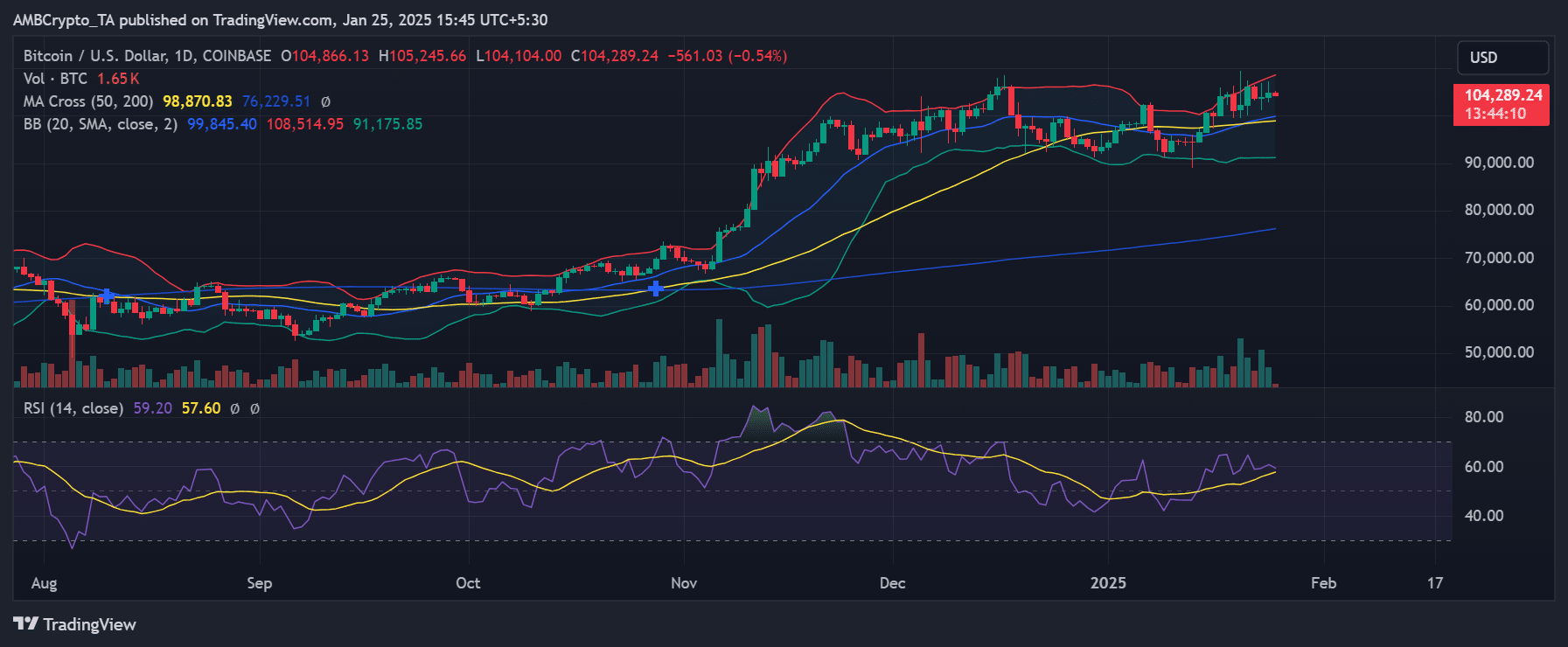

- Positive funding rates have persisted despite the consolidation, with rates hitting 0.075% in January 2025

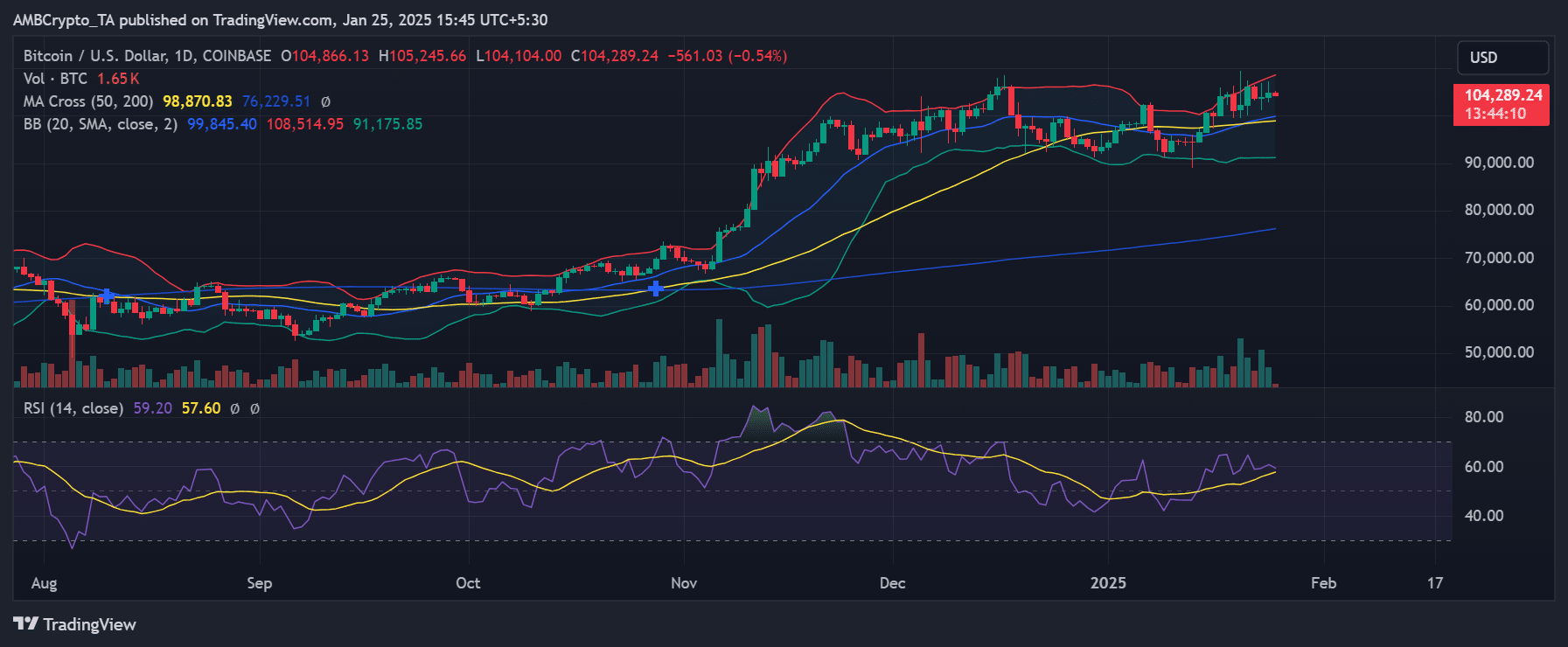

- MA Cross between 50 days (98,870.83) and 200 days (76,229.51) on average strengthens the bullish structure

Bitcoins [BTC] Recent price action around $104,000 gains deeper context when analyzed alongside perpetual futures funding rates. This is because such analysis reveals crucial insights into market sentiment and potential directional movements.

Bitcoin’s Technical Landscape and Price Action

The daily chart suggested Bitcoin consolidated nearly $104,289, with a slight decline of 0.54% at press time. The MA crossing between the 50-day (98,870.83) and 200-day (76,229.51) moving averages maintained a bullish structure for the cryptocurrency.

While the Bollinger bands (91,175.85 – 108,514.95) were at contained volatility despite the market’s recent moves.

Source: TradingView

The RSI reading of 59.20 hinted at moderate bullish momentum, without climbing into overbought territory. This seemed to imply that there is still room for upward movement in the charts.

Trading volumes of 1.65k BTC further showed continued market participation, although not at peak levels.

Funding rate analysis and implications

The eternal Futures Funding Rate chart revealed significant patterns since May 2024, with January 2025 showing a notable increase in funding rates among major exchanges. Rates have risen to 0.075% on some platforms, reinforcing bullish sentiment among futures traders.

This development took on particular importance when examining the background of historical funding movements since October 2024. The trend showed that the moving average has maintained a mostly positive trajectory, coinciding with Bitcoin’s price appreciation.

Source: Glassnode

Examining exchange-specific patterns revealed some very interesting dynamics, particularly during the volatile periods of November and December 2024. During these months, significant differences emerged between major exchanges, with BitMEX and OKX experiencing pronounced spikes that have suggested intense leverage activity.

These temporary disconnects between exchanges provided valuable insights into the behavior of market participants during periods of increased activity.

Bitcoin Market Implications and Trading Dynamics

The correlation between financing rates and price action provides a comprehensive view of market sentiment. The prevailing environment, characterized by persistent positive financing despite price consolidation, seemed to point to an advanced accumulation phase—one in which traders maintain long positions regardless of short-term price stagnation. Such divergence between stable prices and positive financing highlighted the building pressure for a potential directional move, supported by the technical indicators.

However, a continued positive funding rate environment also poses some inherent risks. The significant presence of leveraged positions, highlighted by increased funding rates, fuels vulnerability to potential long squeezes if the price is not higher.

This dynamic requires careful monitoring of Bitcoin’s key support levels, particularly around the 50-day moving average at $98,870.

-Read Bitcoin (BTC) Price Prediction 2025-26

The combination of technical indicators and funding rate patterns means this is a pivotal moment for Bitcoin, one that could see the crypto register an advantage.

This outlook remains valid as long as the market structure maintains integrity above its critical support levels, with particular attention to volume patterns and funding pathways between major exchanges.