- Bitcoin’s bullish price action highlighted whale activity and network growth, targeting $110,000.

- Mixed market signals, including the price whale ratio, reflected cautious optimism amid a potential breakout.

Bitcoin [BTC] whales have purchased more than 22,000 BTC worth a whopping $2.24 billion in the past 72 hours, creating bullish momentum in the market.

With Bitcoin trading at $105,275.37 at the time of writing and up 3.78%, the rise in whale activity underlines the growing confidence among large holders.

However, can this uptrend push Bitcoin past $110,000 and confirm a new bullish cycle?

Bitcoin price action indicates bullish potential

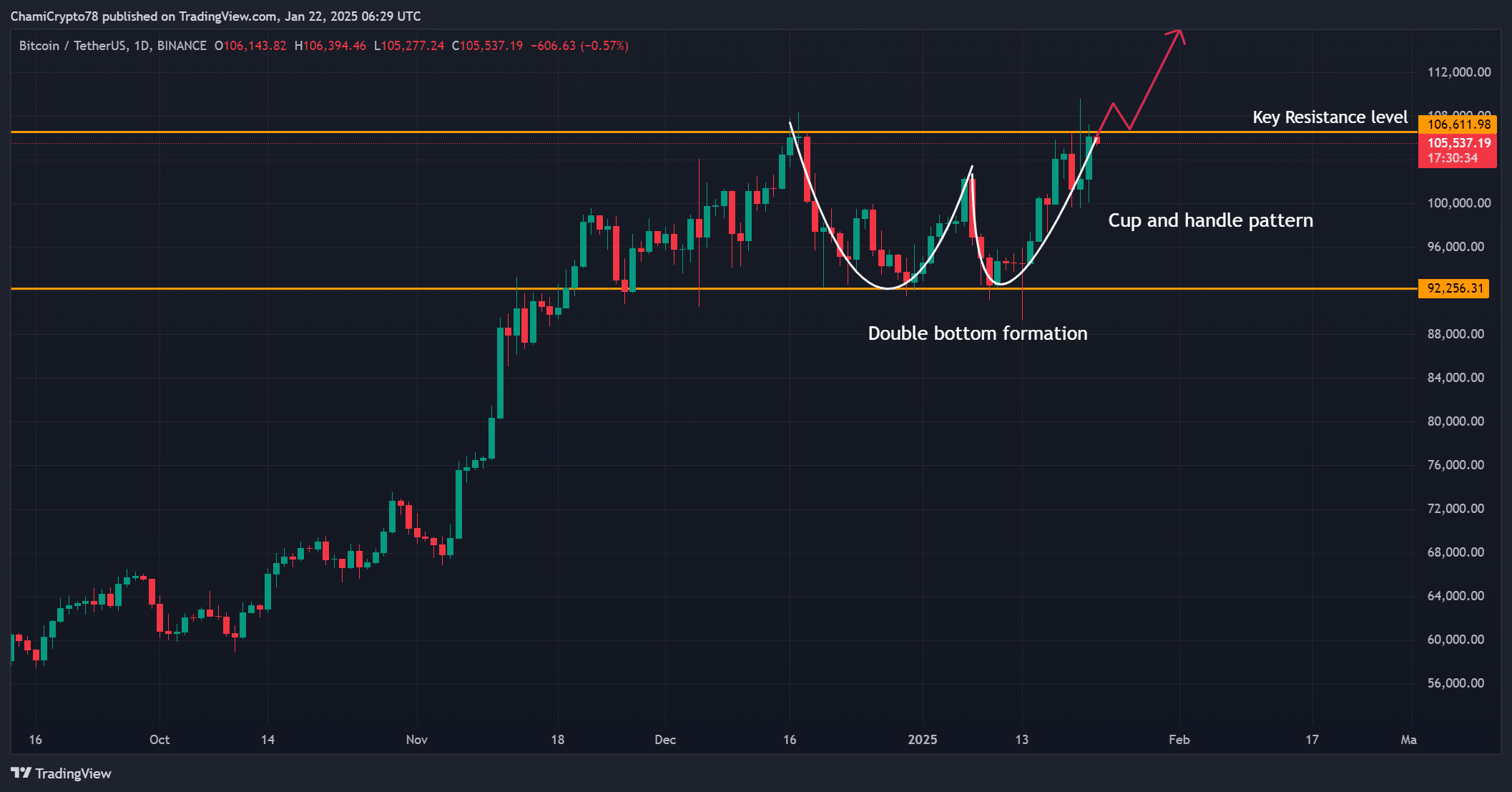

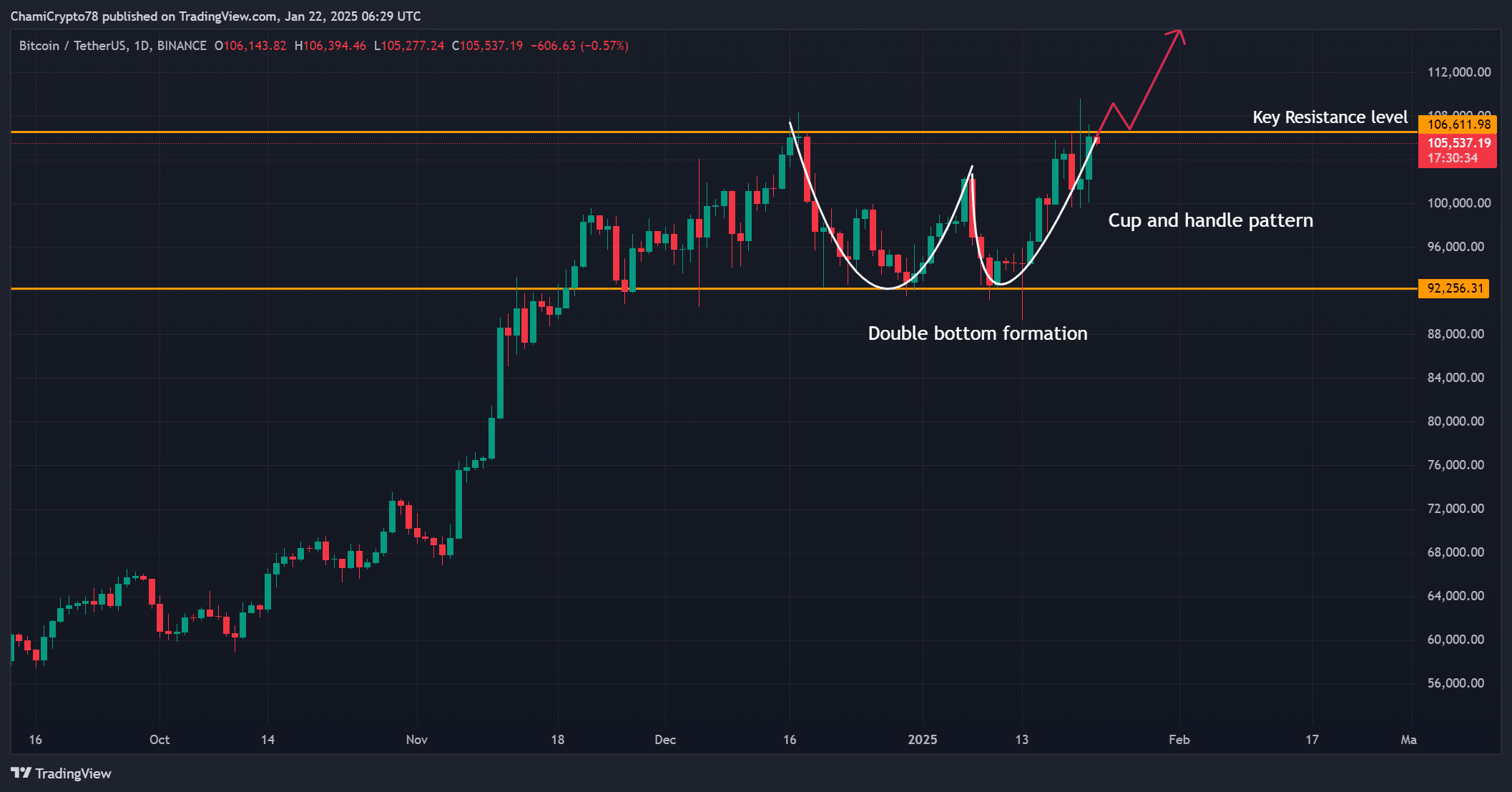

Bitcoin’s price chart showed an instructive cup-and-handle formation, often indicating bullish continuation.

The pattern developed after BTC built strong support around $92,256, followed by a breakout above $106,600, a critical resistance level.

The double bottom structure further strengthens the bullish case, as this technical indicator historically leads to price recovery.

BTC’s recent rally appears to have enough momentum to reach the next significant level at $110,000.

However, if the price fails to hold above $106,600, a pullback could occur in the near term, testing lower support levels. Sustained volume and further buying pressure are essential for Bitcoin to continue its upward trajectory.

Source: TradingView

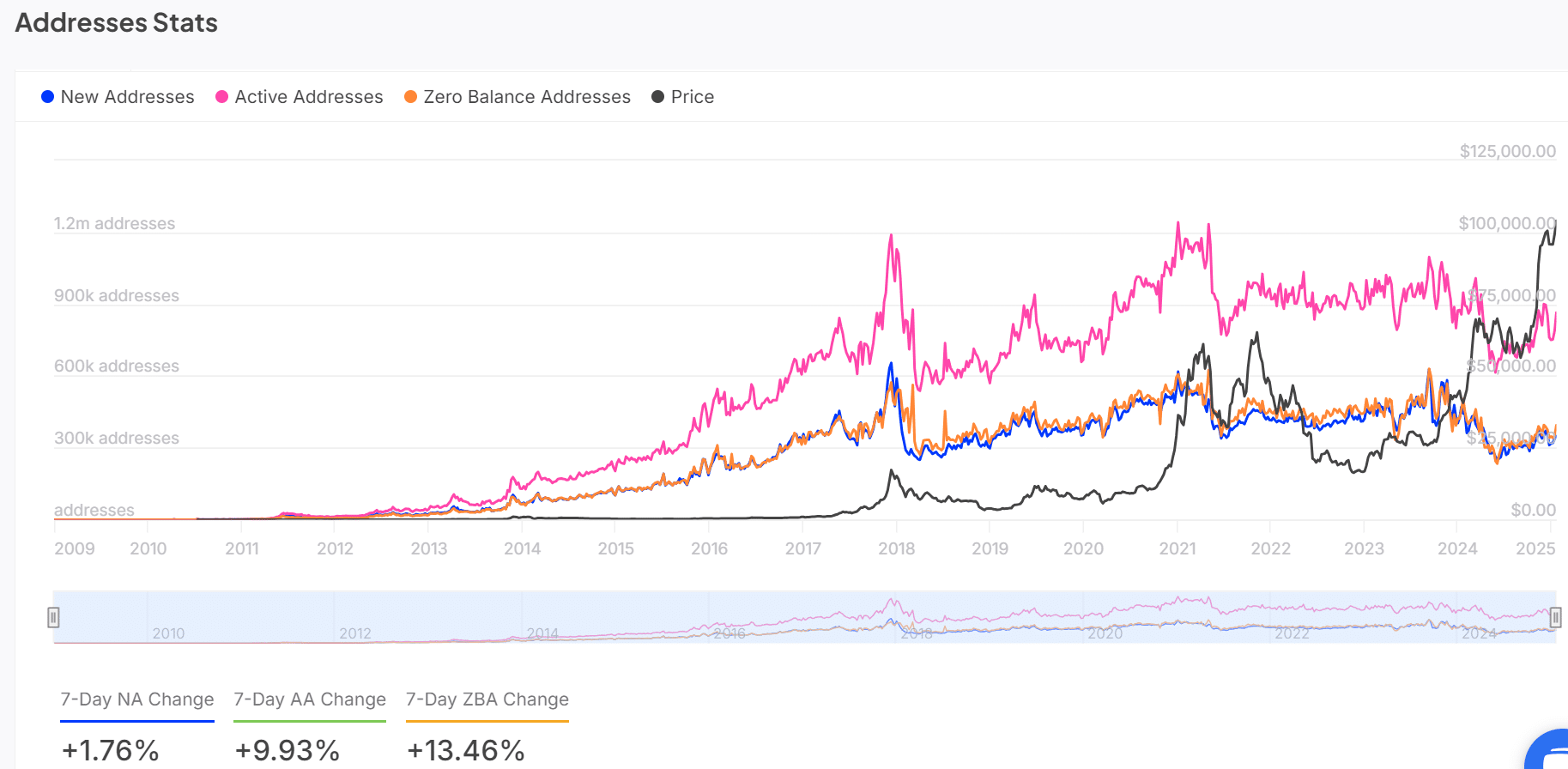

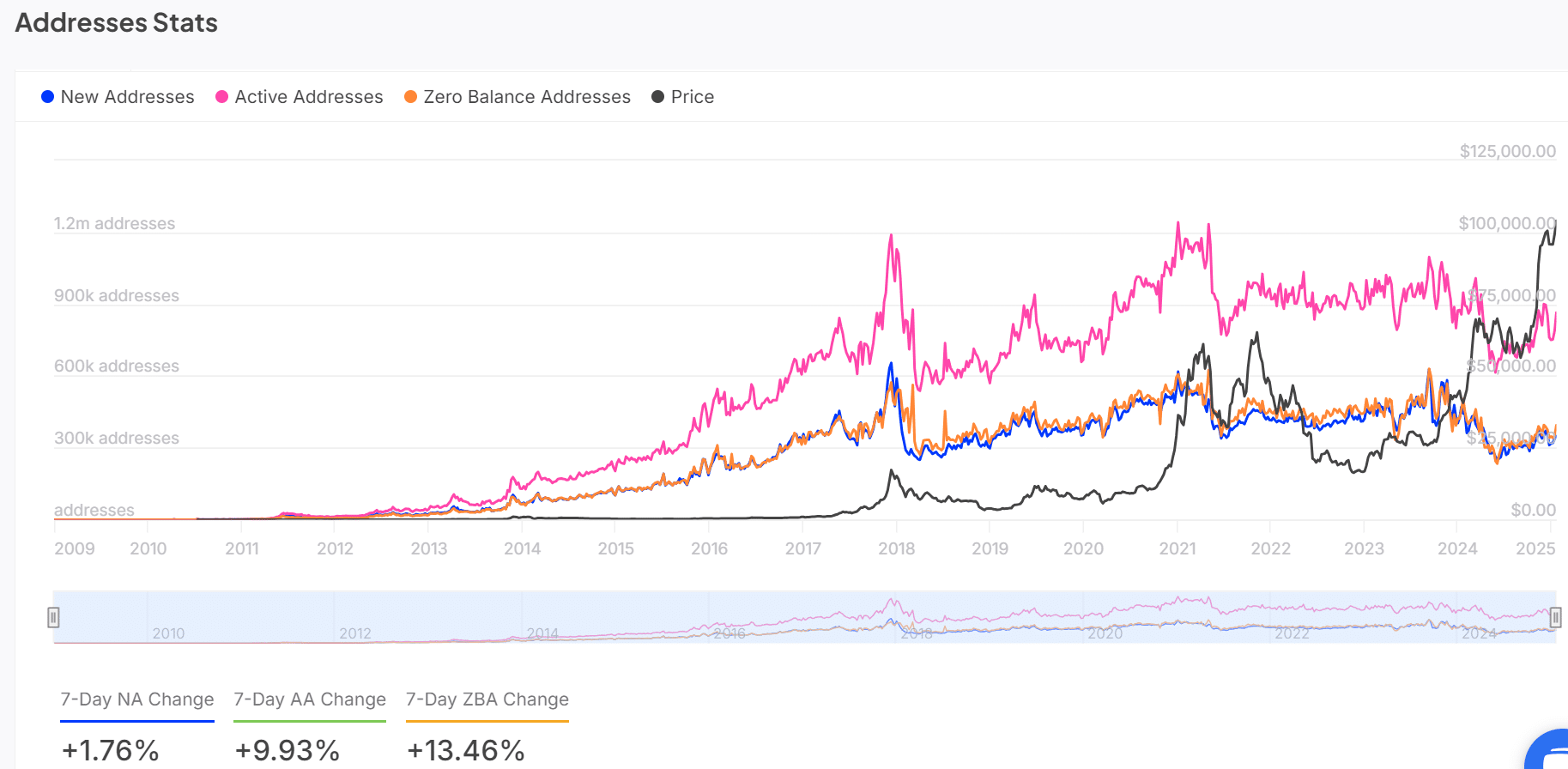

BTC’s active addresses show growing network demand

Bitcoin’s network is witnessing increased activity, which supports the bullish outlook. Over the past week, active addresses have increased by 9.93%, indicating greater participation from existing holders.

Additionally, new addresses grew by 1.76%, signaling new demand as new users entered the ecosystem. This increase in network activity matches the recent price action and reinforces the story of increased interest in BTC.

Source: CryptoQuant

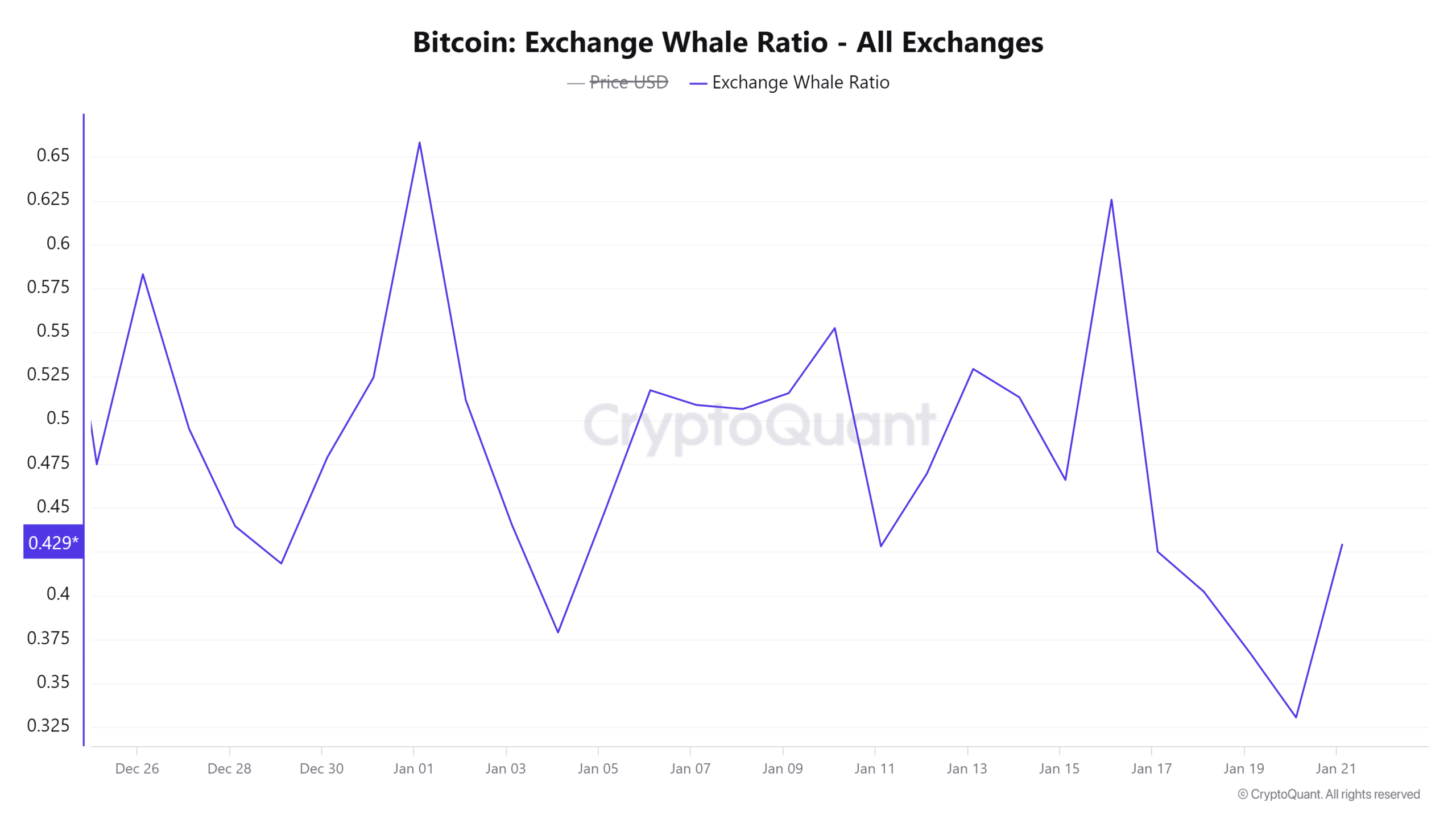

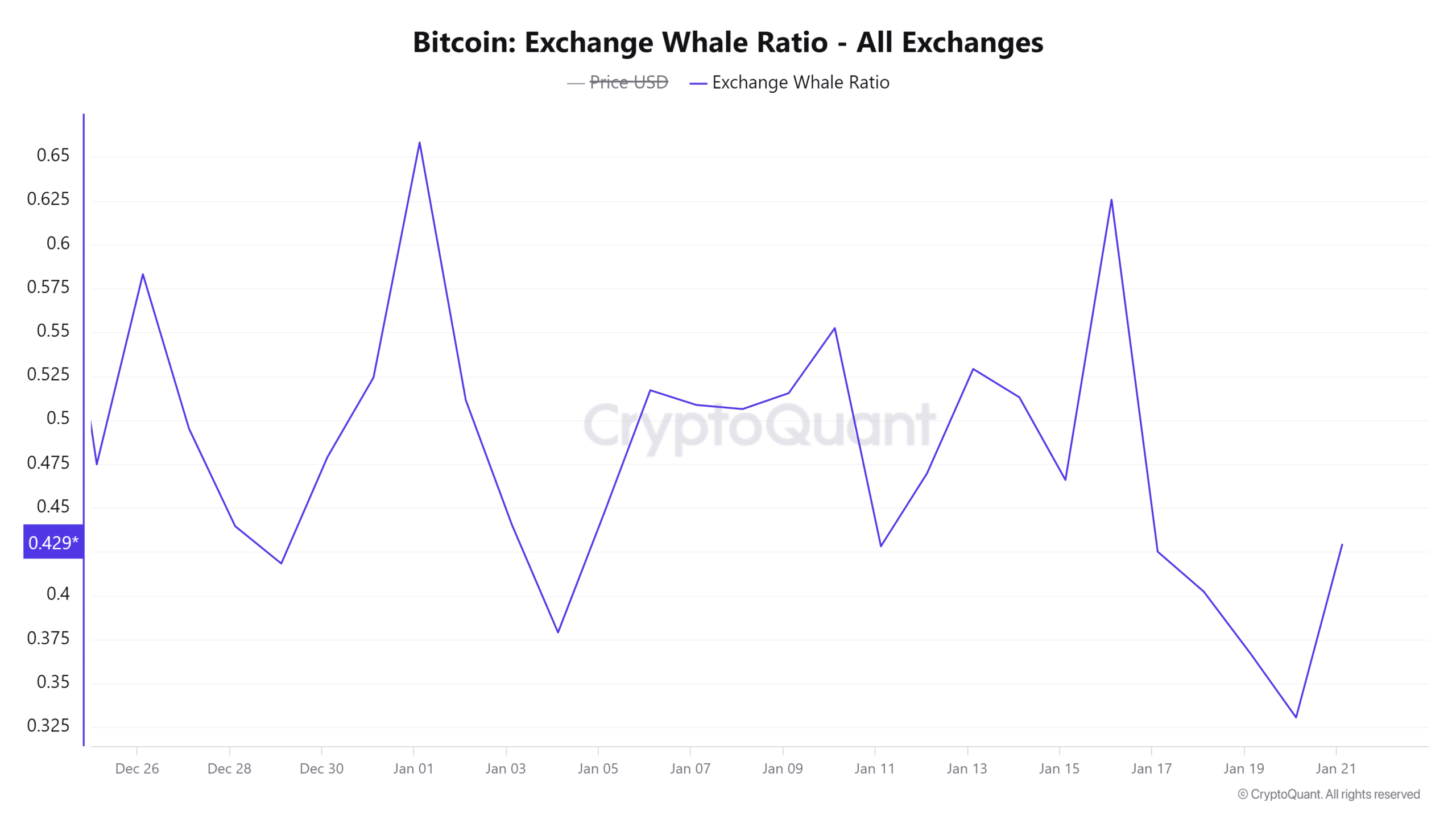

The Exchange Whale Ratio emphasizes cautious optimism

The price whale ratio is 0.96, which represents a slight increase of 1.03%. This ratio reflects the share of the largest inflows of whales into the trade relative to total inflows.

As whales accumulate BTC, the increase in trading activity indicates that some are preparing to take profits or limit risk. These data suggest a mix of optimism and caution.

A further decline in the ratio could strengthen bullish sentiment, indicating a reduced likelihood of selling pressure.

Source: CryptoQuant

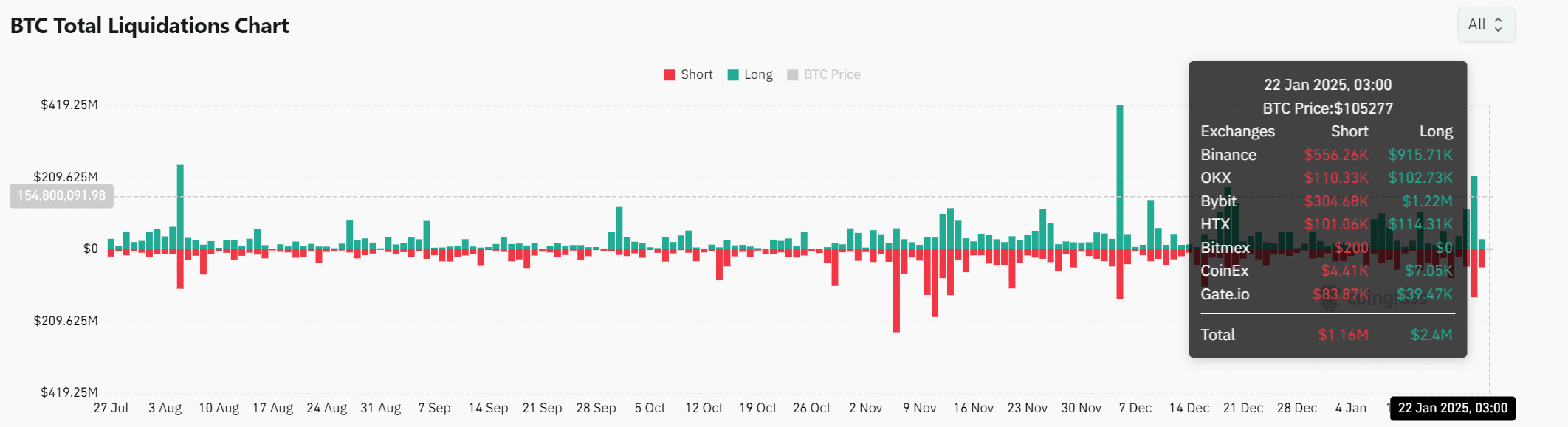

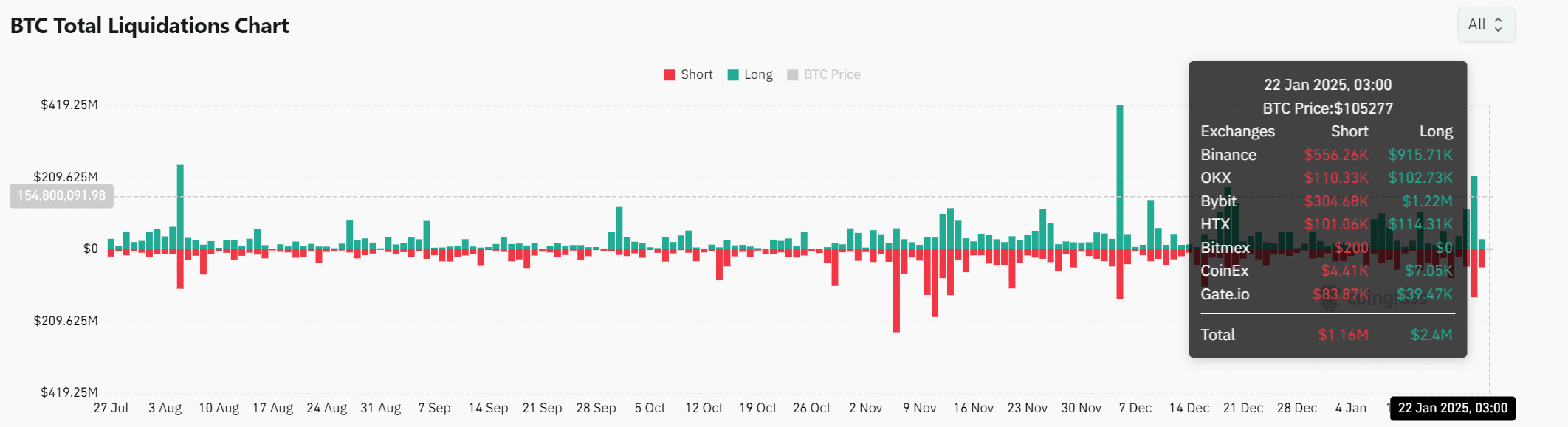

BTC liquidations reveal market indecision

Bitcoin liquidations in the past 24 hours provide insight into current market sentiment. Long positions worth $2.4 million were liquidated, compared to $1.16 million in shorts, underscoring an even battle between bulls and bears.

This equilibrium reflects the market’s indecisiveness as traders wait for confirmation of BTC’s next major move.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2025–2026

Bitcoin’s technical patterns, rising network activity, and whale accumulation point to a potential breakout above $110,000. However, cautious currency activity and liquidation trends indicate some hesitation in the market.

If BTC can maintain its bullish momentum and maintain levels above key resistance, a move past $110,000 seems likely in the near term.