- The Bitcoin price crash was sudden and caught many investors off guard.

- As the market braces for the future, stablecoins could be ready to step in.

The recent Bitcoin [BTC] The crash has divided the market. Bulls claim it is a bear trap, relying on a liquidity operation to effect a recovery.

Meanwhile, fear creeps in and greed hangs by a thread.

With volatility rising in the first quarter, will the “Trump pump” kick in again to save the day, or is a deeper Bitcoin price crash inevitable?

Fears of a Bitcoin price crash are increasing

Bitcoin has fallen 9% in the past three days, leaving many wondering if this is the start of a bigger crash. And now that the Justice Department has been allowed to sell $6.5 billion worth of BTC, concerns are only growing.

It’s clear that a surge in liquidity is imminent, but with an outflow of $568 million from BTC ETFs – the second Major decline within a month – a supply shock seems far away.

Adding to the pressure, Binance’s stablecoin netflow has turned negative, with $383 million withdrawn from the platform.

Given the macro factors at play, stablecoins could become the “safe haven” by 2025 – something you’ll want to keep an eye on as things develop.

Source: CryptoQuant

So now that private and institutional investors are in an investment pattern, fear is starting to rise. If this trend continues, Bitcoin could fall even further and possibly fall below the $90,000 mark in the short term.

However, the long-term prospects are still up in the air. Remember the “Trump pump” from the fourth quarter of last year that took BTC to an all-time high of $108,000 in just 60 days?

With Trump’s inauguration just 10 days away, could a repeat of that rally spark new FOMO and revive the market?

It may be harder than it sounds

When you look at the bigger picture, there’s still a lot to unpack. The dollar index (DXY) shows no signs of easing, and government bonds are still in high demand.

With Bitcoin’s price crash stoking fear, these traditional assets are poised to benefit.

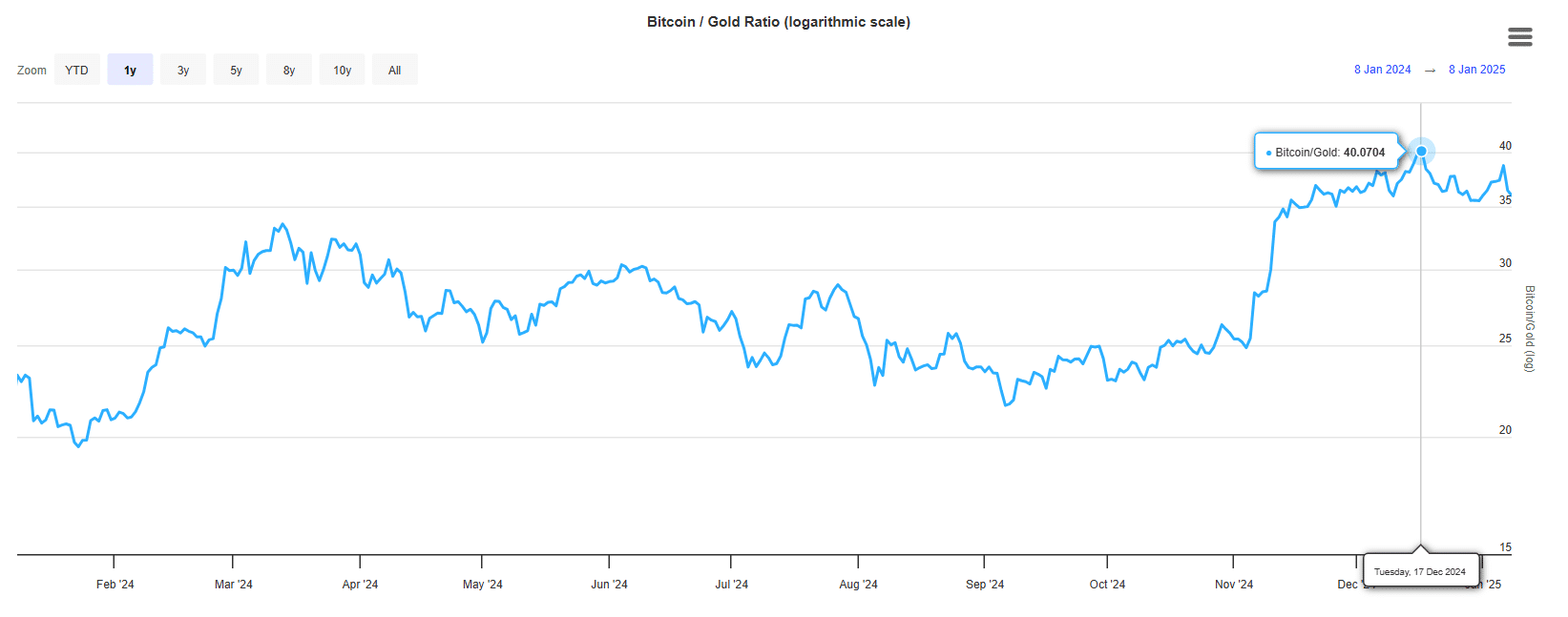

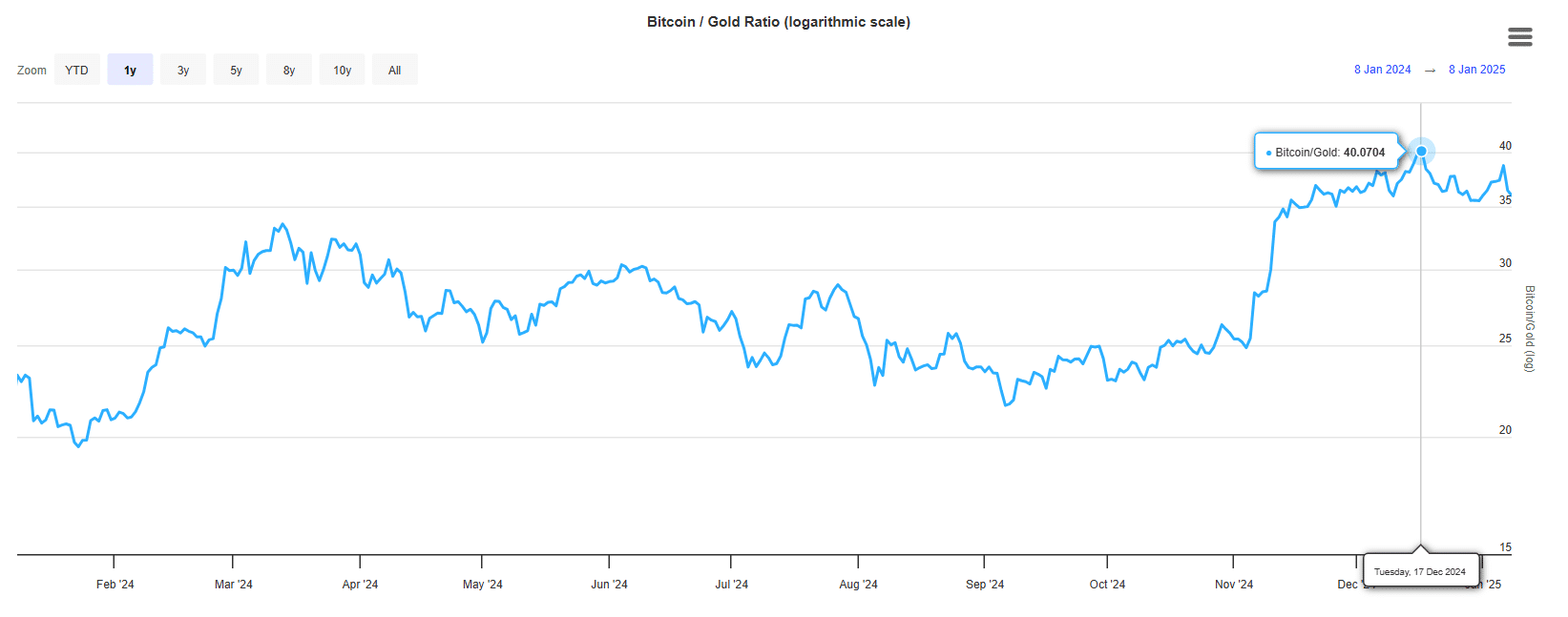

But this could be just the tip of the iceberg. The Bitcoin-to-gold ratio, which rose to a record 40 when BTC reached $108,000, has now fallen below 35.

Source: LongTermTrends

While gold (XAU) has been relatively flat lately, a deeper Bitcoin price crash below $88,000 could change everything.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Here’s why: Now the US is experiencing an upward trend debt and global inflationary pressures have increased gold’s status as a safe haven powerful than ever.

As market risks increase, investors are likely to turn to gold, potentially sidelining Bitcoin’s appeal as a store of value.