- Bitcoin’s January rally faces a possible pullback due to the Fed’s impending move.

- Institutional interest and stablecoin activity continue to support BTC’s bullish outlook despite near-term volatility.

Amid the excitement surrounding Donald Trump’s return as the 47th US president, the crypto market saw a notable rise.

Still, concerns loom as forecasts point to a possible pullback as the Federal Reserve prepares to announce its first interest rate decision of the year.

What can you expect in the first quarter?

According to Markus Thielen, founder of 10x Research, a “positive start” in early January could mean a slight decline ahead of key economic data, followed by another rally ahead of Trump’s inauguration on January 20.

This dynamic creates an intriguing landscape for Bitcoin [BTC] and the broader crypto market in the coming weeks.

I’m noticing the same thing, Thielen marked a potentially positive CPI result and said:

“Favorable inflationary pressures could boost optimism and fuel a rally heading into Trump’s inauguration,”

He added:

“However, this momentum could fade as the market is likely to retreat somewhat ahead of the January 29 FOMC meeting.”

For those unaware, CME Group’s FedWatch tool indicates an 88.8% probability that the US federal target rate will remain between 425 and 450 basis points after the upcoming FOMC meeting on January 29.

What is the price status of Bitcoin?

This comes after Bitcoin suffered a nearly 15% drop to around $92,800 following the December 18 FOMC meeting, where the Federal Reserve cut its projected interest rate cuts for 2025 from five to two.

According to Thielen, the Federal Reserve’s upcoming announcements pose significant risk to a potential BTC rally in 2025, adding a layer of uncertainty to the market’s bullish outlook.

“We expect lower inflation this year, although it may take some time for the Federal Reserve to formally recognize and respond to this shift.”

Despite the near-term volatility, the broader outlook for Bitcoin remains bullish, driven by institutional interest in minting stablecoins and spot inflows from BTC ETFs.

Thielen predicts that Bitcoin could reach the $97,000 to $98,000 range by the end of January.

Meanwhile, John Glover, Chief Investment Officer at Ledn, expects a potential recovery to $125,000 by the end of the first quarter. He also suggests the possibility of making $160,000 by the end of 2025 or early 2026.

This is what the indicators say

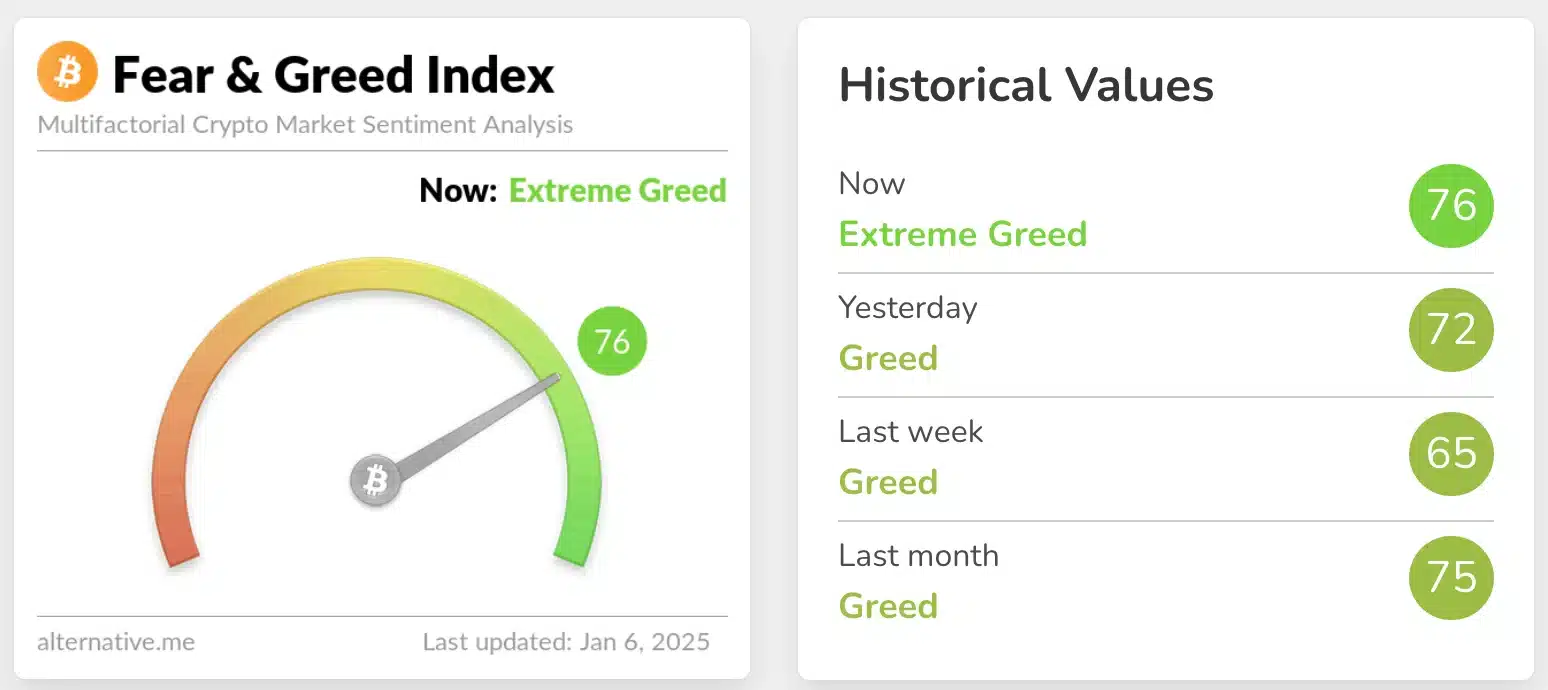

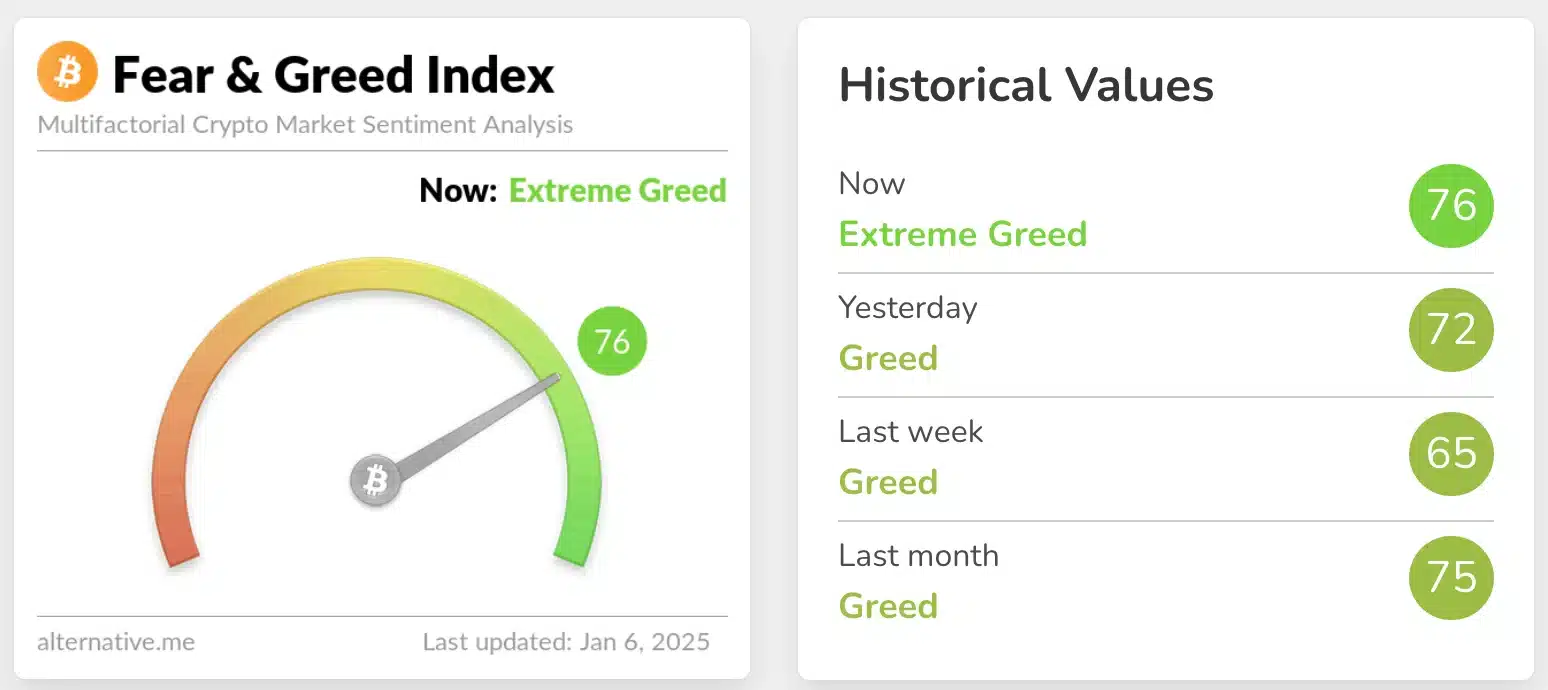

Interestingly, the King Coin’s Crypto Fear and Greed Index rose to ‘Extreme Greed’, signaling strong confidence in Bitcoin’s long-term potential despite short-term fluctuations.

Source: Alternative.me

Moreover, the Relative Strength Index (RSI), which stood at 57 at the time of writing, further strengthened Bitcoin’s long-term bullish trajectory.

So while Bitcoin’s January rally is promising, the Federal Reserve’s monetary policy and broader macroeconomic conditions are key factors that could significantly shape its future trajectory.